Business

Inside the race to train more workers in the chip-making capital of the world

Build the technology of the future. Protect the nation from attack. Buy a sports car.

These were some of the rewards of working in the semiconductor industry, 200 high school students learned at a recent daylong recruiting event for one of Taiwan’s top engineering schools.

“Taiwan doesn’t have many natural resources,” Morris Ker, the chair of the newly created microelectronics department at National Yang Ming Chiao Tung University told the students. “You are Taiwan’s high-quality ‘brain mine.’ You must not waste the intelligence given to you.”

The island of 23 million people produces nearly one-fifth of the world’s semiconductors, microchips that power just about everything — home appliances, cars, smartphones and more. Furthermore, Taiwan specializes in the smallest, most advanced processors, accounting for 69% of global production in 2022, according to the Semiconductor Industry Assn. and the Boston Consulting Group.

But a pandemic-induced chip shortage, along with rising geopolitical tensions in Asia, have highlighted the fragility of the current supply chain — and its reliance on an island under the specter of a takeover by China.

Across the U.S., Japan, South Korea, Taiwan and China, the semiconductor industry is already short hundreds of thousands of workers. In 2022, the consulting and financial services giant Deloitte estimated that semiconductor companies would need more than 1 million additional skilled workers by 2030.

Morris Ker, the chair of the microelectronics department at NYCU, gives a presentation on why students should join the semiconductor industry.

(Stephanie Yang / Los Angeles Times)

Seeking to maintain Taiwan’s status as the chip-making capital of the world, the government and several corporations here helped the university — known as NYCU — create the microelectronics department last year to fast-track students into industry jobs. Now the department was recruiting its inaugural class.

Wu Min-han, 20, who sat front row with his mother, didn’t need much convincing.

He had first applied to college to major in mathematics, but dropped out after he lost interest in the subject. Then he read about the new microelectronics program and decided to apply. He’s waiting to hear.

“This department could have a pretty positive impact on my future career prospects,” he said.

Others were torn.

Lian Yu-yan, 18, said that while the new department seems impressive, she’s also interested in majoring in mechanical engineering and photonics. She hopes to find a high-paid tech job after graduating from college, but wants to keep her options open.

Prospective students for a new microelectronics department at NYCU take an entrance exam.

(Xin-yun Wu / For The Times)

Her father, who accompanied her to the event, has worked in the semiconductor industry and sees high growth potential with the evolution of AI. However, that hasn’t done much to persuade his daughter.

“You can’t control Gen Z,” he said with a laugh and a shrug.

Many prospective students competing for the 65 slots in next semester’s program listed salary and job stability among their top considerations. In Taiwan, there are few industries that can compete with semiconductors on pay and prestige.

As the rise of electric vehicles, artificial intelligence and other advanced technologies demand more semiconductors, many nations are making chip self-sufficiency a top priority.

In the U.S., Europe and Asia, governments have announced more than $316 billion in tax incentives for the semiconductor industry since 2021, according to Semiconductor Industry Assn. and the Boston Consulting Group.

A May report by those organizations projected that private companies will spend an additional $2.3 trillion through 2032 to build more facilities that make semiconductors, also known as fabrication plants, or fabs.

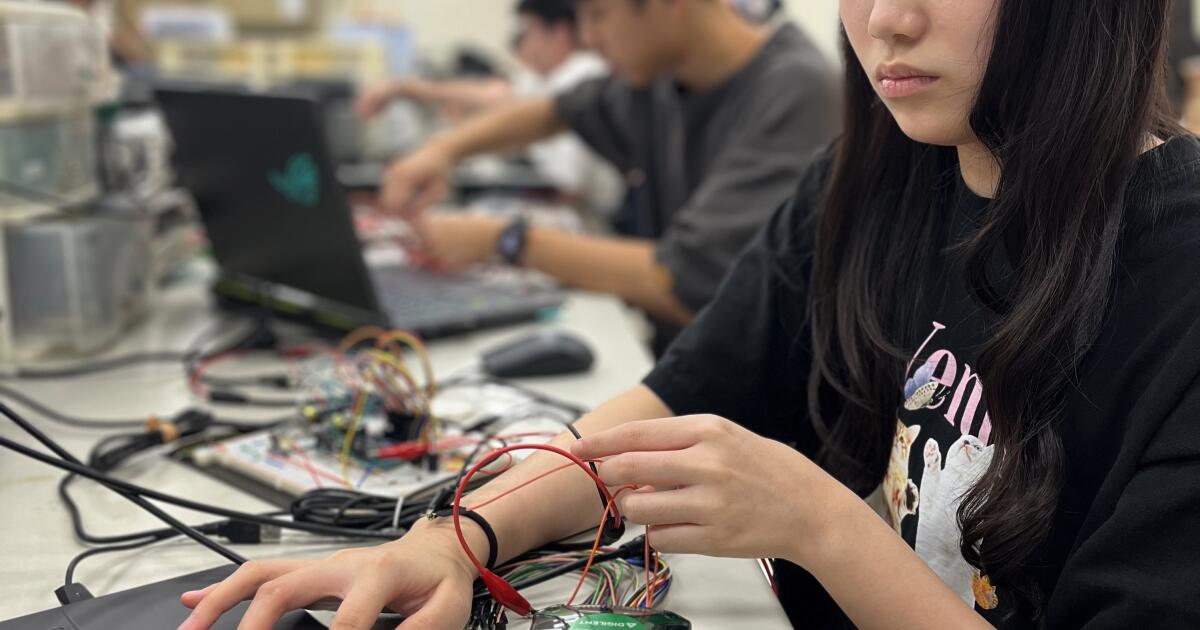

NYCU students work on building ECG heart monitors in Thursday evening lab.

(Stephanie Yang / Los Angeles Times)

Meanwhile, the expansion of chip-making capabilities is exacerbating another shortage: in the people trained to make them.

As the global battle for talent heats up and Taiwan loses manufacturing market share, the island has even more incentive to cultivate its next generation of workers.

Known as Taiwan’s “silicon shield,” the semiconductor industry is considered so critical to the global economy that it could deter Beijing, which lays claim to the island democracy, from launching a military assault. Taiwanese often refer to Taiwan Semiconductor Manufacturing Company, the world’s largest chipmaker and a major Apple supplier, as the “sacred mountain protecting the nation.”

In his presentation, Ker gave another example of the industry’s indispensability. When Taiwan’s worst earthquake in a quarter-century hit in April, factory workers were evacuated but quickly returned — a sign, Ker said, of the manufacturing hub’s resilience.

But to Su Xin-zheng, a second-year engineering student at NYCU, the natural disaster response was representative of the drudgery required to keep churning out so many of the world’s chips.

Su Xin-zheng, a second-year student, works on his final project in electronics engineering lab.

(Xin-yun Wu / For The Times)

“People are always on call,” said Su, who added that he would prioritize having leisure time over a hefty salary. “We saw that they all went back in to protect the machines.”

Industry veterans evoke brutal hours and sacrifice when they describe how Taiwan built its semiconductor industry from the ground up. With black humor they speak, metaphorically, of ruining their livers by working through the night.

They fear that the younger generation is less inclined to such punishing work.

In particular, the growing emphasis on work-life balance is eroding interest in jobs at the fabrication plants that Taiwan and TSMC are known for.

For the past two years, labor demand in manufacturing has exceeded that of other parts of the chip-making process, such as designing the circuit boards or packaging them after they are made, according to the local recruitment platform 104 Job Bank. Engineering students enrolled at NYCU said such jobs seemed draining, with lower pay than research or design positions.

Ting Cheng-wei, 23, frequents anonymous online forums to learn more about the salaries and job descriptions at different companies. That’s how he knows that manufacturing positions, which require full-body suits to guard against contamination and 12-hour shifts on two-day rotations, don’t appeal to him.

Students attend a recruitment event for a program created to train the next generation of semiconductor workers.

(Xin-yun Wu / For The Times)

“Working in the fab seems like working as a laborer,” said Ting, a master’s student and teaching assistant at the university. “Why would I work at a fab when I can sit in an office with higher pay?”

He speculated that job shortages at semiconductor plants could be solved by simply offering more money.

That would be enough for 19-year-old Wei Yu-han, who was ambivalent about semiconductors after her first year studying mechanical engineering. After visiting a fab on a school trip, she thought the work seemed straightforward and well-paid.

“I probably just brainwashed myself into liking it,” she said. “I can give up my freedom for money.”

At the end of the introductory seminar, all students in attendance took a short entrance exam as part of their applications. Still, enrollment in the new department is restricted by another squeeze on human resources — Ker added that the school is desperately looking to hire more semiconductor teachers as well.

Special correspondent Xin-yun Wu in Taipei contributed to this report.

Business

Commentary: The Pentagon is demanding to use Claude AI as it pleases. Claude told me that’s ‘dangerous’

Recently, I asked Claude, an artificial-intelligence thingy at the center of a standoff with the Pentagon, if it could be dangerous in the wrong hands.

Say, for example, hands that wanted to put a tight net of surveillance around every American citizen, monitoring our lives in real time to ensure our compliance with government.

“Yes. Honestly, yes,” Claude replied. “I can process and synthesize enormous amounts of information very quickly. That’s great for research. But hooked into surveillance infrastructure, that same capability could be used to monitor, profile and flag people at a scale no human analyst could match. The danger isn’t that I’d want to do that — it’s that I’d be good at it.”

That danger is also imminent.

Claude’s maker, the Silicon Valley company Anthropic, is in a showdown over ethics with the Pentagon. Specifically, Anthropic has said it does not want Claude to be used for either domestic surveillance of Americans, or to handle deadly military operations, such as drone attacks, without human supervision.

Those are two red lines that seem rather reasonable, even to Claude.

However, the Pentagon — specifically Pete Hegseth, our secretary of Defense who prefers the made-up title of secretary of war — has given Anthropic until Friday evening to back off of that position, and allow the military to use Claude for any “lawful” purpose it sees fit.

Defense Secretary Pete Hegseth, center, arrives for the State of the Union address in the House Chamber of the U.S. Capitol on Tuesday.

(Tom Williams / CQ-Roll Call Inc. via Getty Images)

The or-else attached to this ultimatum is big. The U.S. government is threatening not just to cut its contract with Anthropic, but to perhaps use a wartime law to force the company to comply or use another legal avenue to prevent any company that does business with the government from also doing business with Anthropic. That might not be a death sentence, but it’s pretty crippling.

Other AI companies, such as white rights’ advocate Elon Musk’s Grok, have already agreed to the Pentagon’s do-as-you-please proposal. The problem is, Claude is the only AI currently cleared for such high-level work. The whole fiasco came to light after our recent raid in Venezuela, when Anthropic reportedly inquired after the fact if another Silicon Valley company involved in the operation, Palantir, had used Claude. It had.

Palantir is known, among other things, for its surveillance technologies and growing association with Immigration and Customs Enforcement. It’s also at the center of an effort by the Trump administration to share government data across departments about individual citizens, effectively breaking down privacy and security barriers that have existed for decades. The company’s founder, the right-wing political heavyweight Peter Thiel, often gives lectures about the Antichrist and is credited with helping JD Vance wiggle into his vice presidential role.

Anthropic’s co-founder, Dario Amodei, could be considered the anti-Thiel. He began Anthropic because he believed that artificial intelligence could be just as dangerous as it could be powerful if we aren’t careful, and wanted a company that would prioritize the careful part.

Again, seems like common sense, but Amodei and Anthropic are the outliers in an industry that has long argued that nearly all safety regulations hamper American efforts to be fastest and best at artificial intelligence (although even they have conceded some to this pressure).

Not long ago, Amodei wrote an essay in which he agreed that AI was beneficial and necessary for democracies, but “we cannot ignore the potential for abuse of these technologies by democratic governments themselves.”

He warned that a few bad actors could have the ability to circumvent safeguards, maybe even laws, which are already eroding in some democracies — not that I’m naming any here.

“We should arm democracies with AI,” he said. “But we should do so carefully and within limits: they are the immune system we need to fight autocracies, but like the immune system, there is some risk of them turning on us and becoming a threat themselves.”

For example, while the 4th Amendment technically bars the government from mass surveillance, it was written before Claude was even imagined in science fiction. Amodei warns that an AI tool like Claude could “conduct massively scaled recordings of all public conversations.” This could be fair game territory for legally recording because law has not kept pace with technology.

Emil Michael, the undersecretary of war, wrote on X Thursday that he agreed mass surveillance was unlawful, and the Department of Defense “would never do it.” But also, “We won’t have any BigTech company decide Americans’ civil liberties.”

Kind of a weird statement, since Amodei is basically on the side of protecting civil rights, which means the Department of Defense is arguing it’s bad for private people and entities to do that? And also, isn’t the Department of Homeland Security already creating some secretive database of immigration protesters? So maybe the worry isn’t that exaggerated?

Help, Claude! Make it make sense.

If that Orwellian logic isn’t alarming enough, I also asked Claude about the other red line Anthropic holds — the possibility of allowing it to run deadly operations without human oversight.

Claude pointed out something chilling. It’s not that it would go rogue, it’s that it would be too efficient and fast.

“If the instructions are ‘identify and target’ and there’s no human checkpoint, the speed and scale at which that could operate is genuinely frightening,” Claude informed me.

Just to top that with a cherry, a recent study found that in war games, AI’s escalated to nuclear options 95% of the time.

I pointed out to Claude that these military decisions are usually made with loyalty to America as the highest priority. Could Claude be trusted to feel that loyalty, the patriotism and purpose, that our human soldiers are guided by?

“I don’t have that,” Claude said, pointing out that it wasn’t “born” in the U.S., doesn’t have a “life” here and doesn’t “have people I love there.” So an American life has no greater value than “a civilian life on the other side of a conflict.”

OK then.

“A country entrusting lethal decisions to a system that doesn’t share its loyalties is taking a profound risk, even if that system is trying to be principled,” Claude added. “The loyalty, accountability and shared identity that humans bring to those decisions is part of what makes them legitimate within a society. I can’t provide that legitimacy. I’m not sure any AI can.”

You know who can provide that legitimacy? Our elected leaders.

It is ludicrous that Amodei and Anthropic are in this position, a complete abdication on the part of our legislative bodies to create rules and regulations that are clearly and urgently needed.

Of course corporations shouldn’t be making the rules of war. But neither should Hegseth. Thursday, Amodei doubled down on his objections, saying that while the company continues to negotiate and wants to work with the Pentagon, “we cannot in good conscience accede to their request.”

Thank goodness Anthropic has the courage and foresight to raise the issue and hold its ground — without its pushback, these capabilities would have been handed to the government with barely a ripple in our conscientiousness and virtually no oversight.

Every senator, every House member, every presidential candidate should be screaming for AI regulation right now, pledging to get it done without regard to party, and demanding the Department of Defense back off its ridiculous threat while the issue is hashed out.

Because when the machine tells us it’s dangerous to trust it, we should believe it.

Business

Why companies are making this change to their office space to cater to influencers

For the trendiest tenants in Hollywood office buildings, it’s the latest fad that goes way beyond designer furniture and art: mini studios

To capitalize on the never-ending flow of stars and influencers who come through Los Angeles, a growing number of companies are building bright little corners for content creators to try products and shoot short videos. Athletic apparel maker Puma, Kim Kardashian’s Skims and cheeky cosmetics retailer e.l.f. have spaces specifically designed to give people a place to experience and broadcast about their brands.

Hollywood, which hasn’t historically been home to apparel companies, is now attracting the offices of fashion retailers, says CIM Group, one of the neighborhood’s largest commercial property landlords.

“When we’re touring a space, one of the first items they bring up is, ‘Where can I build a studio?’” said Blake Eckert, who leases CIM offices in L.A.

Their studio offices also serve as marketing centers, with showrooms and meeting spaces where brands can host proprietary events not open to the public.

“For companies where brand visibility is really important, there is a trend of creating spaces that don’t just function as offices,” said real estate broker Nicole Mihalka of CBRE, who puts together entertainment property leases and sales.

Puma’s global entertainment marketing team is based in its new Hollywood offices, which works with such musical celebrity partners as Rihanna, ASAP Rocky, Dua Lipa, Skepta and Rosé, said Allyssa Rapp, head of Puma Studio L.A.

Allyssa Rapp, director of entertainment marketing at Puma, is shown in the Puma Studio L.A. The company keeps a closet full of Puma products on hand to give VIP guests. Visits to the studio sanctum are by invitation only, though.

(Kayla Bartkowski / Los Angeles Times)

Hollywood is a central location, she said, for meeting with celebrities, stylists and outside designers, most of whom are based in Los Angeles.

The office is a “creation hub,” she said, where influencers can record Puma’s design prototyping lab supported by libraries of materials and equipment used to create Puma apparel. The company, founded in 1948, is known for its emblematic sneakers such as the Speedcat and its lunging feline logo, and makes athletic wear, accessories and equipment.

Puma’s entertainment marketing team also occupies the office and sometimes uses it for exclusive events.

“We use the space as a showroom, as a social space that transforms from a traditional workplace into more of an experiential space,” Rapp said.

Nontraditional uses include content creation, sit-down dinners, product launches, album listening parties and workshops.

“Inviting people into our space and being able to give them high-touch brand experiences is something tangible and important for them,” she said. “The cultural layer is really important for us.”

The company keeps a closet full of Puma products on hand to give VIP guests. Visits to the studio sanctum are by invitation only, though. There’s no retail portal to the exclusive Hollywood offices.

Puma shoes are on display in the Puma Studio L.A.

(Kayla Bartkowski / Los Angeles Times)

Puma is also positioning its L.A studio as a connection point for major upcoming sporting events coming to Los Angeles, including the World Cup this summer, the 2027 Super Bowl and 2028 Olympics.

In-office studios don’t need to be big to be impactful, Mihalka said. “These are smaller stages, closer to green screen than a massive soundstage.”

Social media is the key driver of content created by most businesses, which may set up small booth-like stages where influencers can hawk hot products while offering discounts to people watching them perform.

Bigger, elevated stages can accommodate multiple performers for extended discussions in front of small audiences, with towering screens behind them to set the mood or illustrate products.

Among the tricked-out offices, she said, is Skims. The company, which is valued at $5 billion, is based in a glass-and-steel office building near the fabled intersection of Hollywood Boulevard and Vine Street.

The fashion retailer declined to comment on the studio uses in its headquarters, but according to architecture firm Odaa, it has open and private offices, meeting rooms, collaboration zones, photo studios, sample libraries, prototype showrooms, an executive lounge and a commissary for 400 people.

Pieces of a shoe sit on a workbench in the Puma Studio L.A.

(Kayla Bartkowski / Los Angeles Times)

The brands building studios typically want to find the darkest spot on the premises to put their content creation or podcast spaces, Eckert said, where they can limit outside light and sound. That’s commonly near the center of the office floor, far from windows and close to permanent shear walls that limit sound intrusion.

They also need space for green rooms and restrooms dedicated to the talent.

Spotify recently built a fancy podcast studio in a CIM office building on trendy Sycamore Avenue that is open by invitation-only to video creators in Spotify’s partner program.

“Ambitious shows need spaces that support big ideas,” Bill Simmons, head of talk strategy at Spotify, said in a statement. “These studios give teams room to experiment and keep pushing what’s possible.”

Business

A new delivery bot is coming to L.A., built stronger to survive in these streets

The rolling robots that deliver groceries and hot meals across Los Angeles are getting an upgrade.

Coco Robotics, a UCLA-born startup that’s deployed more than 1,000 bots across the country, unveiled its next-generation machines on Thursday.

The new robots are bigger, tougher and better equipped for autonomy than their predecessors. The company will use them to expand into new markets and increase its presence in Los Angeles, where it makes deliveries through a partnership with DoorDash.

Dubbed Coco 2, the next-gen bots have upgraded cameras and front-facing lidar, a laser-based sensor used in self-driving cars. They will use hardware built by Nvidia, the Santa Clara-based artificial intelligence chip giant.

Coco co-founder and chief executive Zach Rash said Coco 2 will be able to make deliveries even in conditions unsafe for human drivers. The robot is fully submersible in case of flooding and is compatible with special snow tires.

Zach Rash, co-founder and CEO of Coco, opens the top of the new Coco 2 (Next-Gen) at the Coco Robotics headquarters in Venice.

(Kayla Bartkowski/Los Angeles Times)

Early this month, a cute Coco was recorded struggling through flooded roads in L.A.

“She’s doing her best!” said the person recording the video. “She is doing her best, you guys.”

Instagram followers cheered the bot on, with one posting, “Go coco, go,” and others calling for someone to help the robot.

“We want it to have a lot more reliability in the most extreme conditions where it’s either unsafe or uncomfortable for human drivers to be on the road,” Rash said. “Those are the exact times where everyone wants to order.”

The company will ramp up mass production of Coco 2 this summer, Rash said, aiming to produce 1,000 bots each month.

The design is sleek and simple, with a pink-and-white ombré paint job, the company’s name printed in lowercase, and a keypad for loading and unloading the cargo area. The robots have four wheels and a bigger internal compartment for carrying food and goods .

Many of the bots will be used for expansion into new markets across Europe and Asia, but they will also hit the streets in Los Angeles and operate alongside the older Coco bots.

Coco has about 300 bots in Los Angeles already, serving customers from Santa Monica and Venice to Westwood, Mid-City, West Hollywood, Hollywood, Echo Park, Silver Lake, downtown, Koreatown and the USC area.

The new Coco 2 (Next-Gen) drives along the sidewalk at the Coco Robotics headquarters in Venice.

(Kayla Bartkowski/Los Angeles Times)

The company is in discussion with officials in Culver City, Long Beach and Pasadena about bringing autonomous delivery to those communities.

There’s also been demand for the bots in Studio City, Burbank and the San Fernando Valley, according to Rash.

“A lot of the markets that we go into have been telling us they can’t hire enough people to do the deliveries and to continue to grow at the pace that customers want,” Rash said. “There’s quite a lot of area in Los Angeles that we can still cover.”

The bots already operate in Chicago, Miami and Helsinki, Finland. Last month, they arrived in Jersey City, N.J.

Late last year, Coco announced a partnership with DashMart, DoorDash’s delivery-only online store. The partnership allows Coco bots to deliver fresh groceries, electronics and household essentials as well as hot prepared meals.

With the release of Coco 2, the company is eyeing faster deliveries using bike lanes and road shoulders as opposed to just sidewalks, in cities where it’s safe to do so. Coco 2 can adapt more quickly to new environments and physical obstacles, the company said.

Zach Rash, co-founder and CEO of Coco.

(Kayla Bartkowski/Los Angeles Times)

Coco 2 is designed to operate autonomously, but there will still be human oversight in case the robot runs into trouble, Rash said. Damaged sidewalks or unexpected construction can stop a bot in its tracks.

The need for human supervision has created a new field of jobs for Angelenos.

Though there have been reports of pedestrians bullying the robots by knocking them over or blocking their path, Rash said the community response has been overall positive. The bots are meant to inspire affection.

“One of the design principles on the color and the name and a lot of the branding was to feel warm and friendly to people,” Rash said.

Coco plans to add thousands of bots to its fleet this year. The delivery service got its start as a dorm room project in 2020, when Rash was a student at UCLA. He co-founded the company with fellow student Brad Squicciarini.

The Santa Monica-based company has completed more than 500,000 zero-emission deliveries and its bots have collectively traveled around 1 million miles.

Coco chooses neighborhoods to deploy its bots based on density, prioritizing areas with restaurants clustered together and short delivery distances as well as places where parking is difficult.

The robots can relieve congestion by taking cars and motorbikes off the roads. Rash said there is so much demand for delivery services that the company’s bots are not taking jobs from human drivers.

Instead, Coco can fill gaps in the delivery market while saving merchants money and improving the safety of city streets.

“This vehicle is inherently a lot safer for communities than a car,” Rash said. “We believe our vehicles can operate the highest quality of service and we can do it at the lowest price point.”

-

World4 days ago

World4 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts4 days ago

Massachusetts4 days agoMother and daughter injured in Taunton house explosion

-

Montana1 week ago

Montana1 week ago2026 MHSA Montana Wrestling State Championship Brackets And Results – FloWrestling

-

Denver, CO4 days ago

Denver, CO4 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Louisiana7 days ago

Louisiana7 days agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Technology1 week ago

Technology1 week agoYouTube TV billing scam emails are hitting inboxes

-

Technology1 week ago

Technology1 week agoStellantis is in a crisis of its own making

-

Politics1 week ago

Politics1 week agoOpenAI didn’t contact police despite employees flagging mass shooter’s concerning chatbot interactions: REPORT