Business

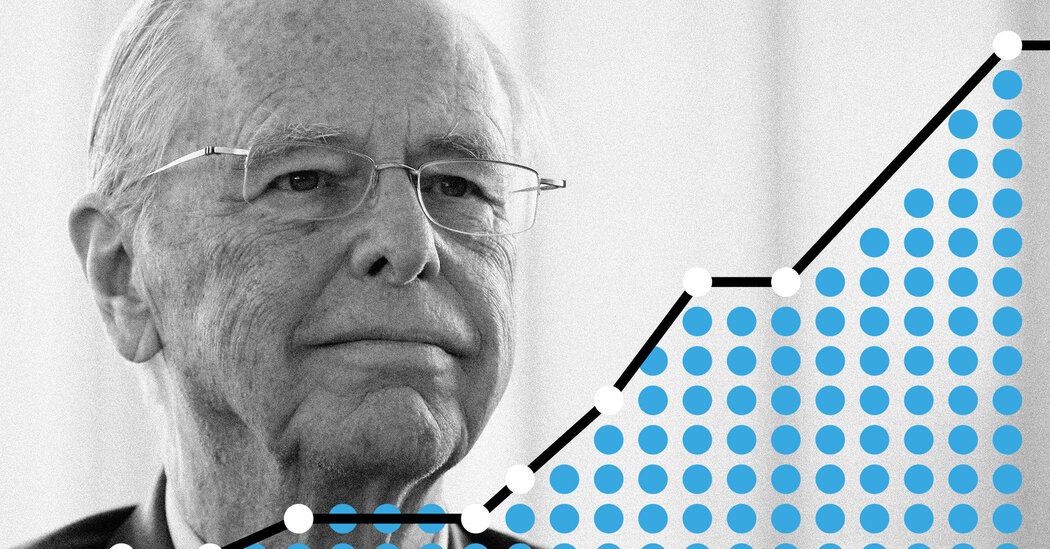

How One Man Helped Create a Nation of Investors

The DealBook e-newsletter delves right into a single matter or theme each weekend, offering reporting and evaluation that provides a greater understanding of an essential subject in enterprise. For those who don’t already obtain the each day e-newsletter, join right here.

Among the many trailblazers who made finance extra accessible to the lots beginning within the Seventies — John Bogle of Vanguard along with his index fund, Charles Schwab along with his low cost brokerage and Louis Rukeyser along with his weekly interrogation of 1 Wall Road sage or one other — Edward C. Johnson III, the longtime chief of Constancy Investments, was the least well-known but arguably an important.

The others have been all public figures, however Mr. Johnson, who died final week on the age of 91, was a Boston patrician with a patrician’s aversion to the highlight. Regardless of his upper-class background, he’s credited with serving to to vary the way in which the center class considered its cash, remodeling Individuals from savers to buyers. That’s why he issues.

Mr. Johnson, extensively often called Ned, was 42 when he took over Constancy, a small mutual fund firm his father had run for 3 a long time. The yr was 1972: The market was within the doldrums, inflation was on the rise and Constancy’s belongings have been in decline.

Like different monetary executives, Johnson realized {that a} new funding car not too long ago permitted by the Securities and Change Fee would possibly provide a strategy to appeal to extra money. This car was known as a cash market fund; by investing in ultrasafe bonds, it might generate returns that matched real-world rates of interest. At a time when financial institution curiosity was regulated — fastened by regulation at 5.25 p.c — these higher-yielding funds have been bought as a substitute for financial savings accounts.

They weren’t, nevertheless, client pleasant. Whereas it was simple to maneuver cash out and in of a checking account, it usually took weeks to redeem cash market fund shares, requiring onerous paperwork. That was a turnoff to individuals who have been used to having easy accessibility to their cash.

As his obituaries have all famous, Mr. Johnson threw that enterprise mannequin overboard by permitting Constancy prospects to put in writing checks towards the corporate’s cash market fund. In a single stroke, he made it as simple to take cash out of a fund as to place cash in. His pondering was that individuals can be extra keen to entrust their cash to Constancy in the event that they knew they might simply withdraw it. He would deal with buyers like customers.

For those who’re as previous as I’m, you’ll bear in mind what occurred subsequent. Inflation surged and rates of interest adopted. The typical 30-year mortgage fee peaked at near 17 p.c by 1981. Tens of thousands and thousands of Individuals, seeing their financial savings eroded by inflation, made the leap from a checking account to a cash market fund. This was step one of their transition from savers to buyers.

By the autumn of 1982, the Federal Reserve chair Paul Volcker had introduced the inflation fee down sharply, triggering a strong bull market. Mr. Johnson was prepared for the second.

Constancy had lengthy earlier than lower its ties with brokers, giving the corporate a direct relationship with prospects. As their cash market fund returns diminished, they appeared for different autos that might present the yields that they had turn into accustomed to. What Mr. Johnson might provide them was Constancy’s Magellan fund — or, extra particularly, the genius of its supervisor, Peter Lynch, whom he had put in 5 years earlier.

It’s laborious to overstate how essential Mr. Lynch was in bringing the center class to the inventory market. It wasn’t simply that his report was off the charts — the Magellan Fund recorded a 29 p.c common annual return within the 13 years he ran it, between 1977 and 1990, with nary a down yr. It was additionally that Mr. Lynch did it whereas making stock-picking look like one thing anybody might do if they simply used frequent sense. He demystified the marketplace for thousands and thousands.

Mr. Lynch, now 78, famously invested in Hanes as a result of he noticed his spouse shopping for the corporate’s L’eggs pantyhose on the grocery store. He known as his massive winners “ten-baggers.” He used to say, “I like to purchase a enterprise that any idiot can run as a result of finally one will.”

Mr. Lynch’s reputation begot the period of the famous person fund supervisor, who grew to become heroes for the brand new breed of middle-class buyers. The Magellan fund’s belongings underneath administration grew from $18 million to $14 billion throughout Mr. Lynch’s tenure.

There was one other issue pushing folks into the inventory market round that point, and Mr. Lynch and Mr. Johnson seized the chance.

In 1982, Congress created the Particular person Retirement Account, or I.R.A., which allowed folks to defer taxes on $2,000 a yr in the event that they put it apart for retirement. By 1984, Constancy’s entrepreneurs have been touring the nation, speaking up I.R.A.s as a terrific middle-class tax break — and mutual funds as the way in which to benefit from it. Constancy by then provided quite a lot of funds; Mr. Johnson was additionally among the many first to make it simple for patrons to modify from one fund to a different, additional enhancing the agency’s attraction.

The mutual fund period ended, roughly, on Aug. 9, 1995. That was the date of Netscape’s blockbuster I.P.O. — its inventory greater than doubled on its first day as a public firm — and the start of the dot-com growth.

The subsequent few years proved that Mr. Johnson’s objective of bringing the center class into the market had succeeded. Partly, folks needed to: How else might they afford to retire or ship their youngsters to school? For higher or worse, they embraced these ever-rising tech shares in the identical approach that they had as soon as embraced Mr. Lynch and the Magellan fund.

I used to be residing in a small city in Massachusetts on the time, and I’ll always remember my neighbors — folks I’d by no means considered buyers — crowing concerning the returns they have been getting on shares like Cisco or Juniper Networks or, sure, eToys.

Constancy had a reduction brokerage by then however, extra essential, it had switched the emphasis of its mutual fund enterprise from people to firms providing 401(ok) plans to their staff. There are those that consider that staff have been higher off when corporations provided outlined profit pension plans (I’m considered one of them) however, when confronted with an array of mutual funds to select from for self-directed retirement plans, folks took it in stride. It was no massive deal anymore. Individuals had really turn into buyers.

Mr. Johnson retired as chairman of Constancy in 2014, turning it over to his daughter Abigail. In the present day, it holds over $4 trillion in belongings and has greater than 30 million prospects. However Mr. Johnson’s actual legacy isn’t simply that he turned a small agency in Boston right into a monetary behemoth, however how he did it — by making investing part of on a regular basis middle-class life.

What do you assume? Tell us: dealbook@nytimes.com.

Business

In Los Angeles, Hotels Become a Refuge for Fire Evacuees

The lobby of Shutters on the Beach, the luxury oceanfront hotel in Santa Monica that is usually abuzz with tourists and entertainment professionals, had by Thursday transformed into a refuge for Los Angeles residents displaced by the raging wildfires that have ripped through thousands of acres and leveled entire neighborhoods to ash.

In the middle of one table sat something that has probably never been in the lobby of Shutters before: a portable plastic goldfish tank. “It’s my daughter’s,” said Kevin Fossee, 48. Mr. Fossee and his wife, Olivia Barth, 45, had evacuated to the hotel on Tuesday evening shortly after the fire in the Los Angeles Pacific Palisades area flared up near their home in Malibu.

Suddenly, an evacuation alert came in. Every phone in the lobby wailed at once, scaring young children who began to cry inconsolably. People put away their phones a second later when they realized it was a false alarm.

Similar scenes have been unfolding across other Los Angeles hotels as the fires spread and the number of people under evacuation orders soars above 100,000. IHG, which includes the Intercontinental, Regent and Holiday Inn chains, said 19 of its hotels across the Los Angeles and Pasadena areas were accommodating evacuees.

The Palisades fire, which has been raging since Tuesday and has become the most destructive in the history of Los Angeles, struck neighborhoods filled with mansions owned by the wealthy, as well as the homes of middle-class families who have owned them for generations. Now they all need places to stay.

Many evacuees turned to a Palisades WhatsApp group that in just a few days has grown from a few hundred to over 1,000 members. Photos, news, tips on where to evacuate, hotel discount codes and pet policies were being posted with increasing rapidity as the fires spread.

At the midcentury modern Beverly Hilton hotel, which looms over the lawns and gardens of Beverly Hills, seven miles and a world away from the ash-strewed Pacific Palisades, parking ran out on Wednesday as evacuees piled in. Guests had to park in another lot a mile south and take a shuttle back.

In the lobby of the hotel, which regularly hosts glamorous events like the recent Golden Globe Awards, guests in workout clothes wrestled with children, pets and hastily packed roll-aboards.

Many of the guests were already familiar with each other from their neighborhoods, and there was a resigned intimacy as they traded stories. “You can tell right away if someone is a fire evacuee by whether they are wearing sweats or have a dog with them,” said Sasha Young, 34, a photographer. “Everyone I’ve spoken with says the same thing: We didn’t take enough.”

The Hotel June, a boutique hotel with a 1950s hipster vibe a mile north of Los Angeles International Airport, was offering evacuees rooms for $125 per night.

“We were heading home to the Palisades from the airport when we found out about the evacuations,” said Julia Morandi, 73, a retired science educator who lives in the Palisades Highlands neighborhood. “When we checked in, they could see we were stressed, so the manager gave us drinks tickets and told us, ‘We take care of our neighbors.’”

Hotels are also assisting tourists caught up in the chaos, helping them make arrangements to fly home (as of Friday, the airport was operating normally) and waiving cancellation fees. A spokeswoman for Shutters said its guests included domestic and international tourists, but on Thursday, few could be spotted among the displaced Angelenos. The heated outdoor pool that overlooks the ocean and is usually surrounded by sunbathers was completely deserted because of the dangerous air quality.

“I think I’m one of the only tourists here,” said Pavel Francouz, 34, a hockey scout who came to Los Angeles from the Czech Republic for a meeting on Tuesday before the fires ignited.

“It’s weird to be a tourist,” he said, describing the eerily empty beaches and the hotel lobby packed with crying children, families, dogs and suitcases. “I can’t imagine what it would feel like to be these people,” he said, adding, “I’m ready to go home.”

Follow New York Times Travel on Instagram and sign up for our weekly Travel Dispatch newsletter to get expert tips on traveling smarter and inspiration for your next vacation. Dreaming up a future getaway or just armchair traveling? Check out our 52 Places to Go in 2025.

Business

Downtown Los Angeles Macy's is among 150 locations to close

The downtown Los Angeles Macy’s department store, situated on 7th Street and a cornerstone of retail in the area, will shut down as the company prepares to close 150 underperforming locations in an effort to revamp and modernize its business.

The iconic retail center announced this week the first 66 closures, including nine in California spanning from Sacramento to San Diego. Stores will also close in Florida, New York and Georgia, among other states. The closures are part of a broader company strategy to bolster sustainability and profitability.

Macy’s is not alone in its plan to slim down and rejuvenate sales. The retailer Kohl’s announced on Friday that it would close 27 poor performing stores by April, including 10 in California and one in the Los Angeles neighborhood of Westchester. Kohl’s will also shut down its San Bernardino e-commerce distribution center in May.

“Kohl’s continues to believe in the health and strength of its profitable store base” and will have more than 1,100 stores remaining after the closures, the company said in a statement.

Macy’s announced its plan last February to end operations at roughly 30% of its stores by 2027, following disappointing quarterly results that included a $71-million loss and nearly 2% decline in sales. The company will invest in its remaining 350 stores, which have the potential to “generate more meaningful value,” according to a release.

“We are closing underproductive Macy’s stores to allow us to focus our resources and prioritize investments in our go-forward stores, where customers are already responding positively to better product offerings and elevated service,” Chief Executive Tony Spring said in a statement. “Closing any store is never easy.”

Macy’s brick-and-mortar locations also faced a setback in January 2024, when the company announced the closures of five stores, including the location at Simi Valley Town Center. At the same time, Macy’s said it would layoff 3.5% of its workforce, equal to about 2,350 jobs.

Farther north, Walgreens announced this week that it would shutter 12 stores across San Francisco due to “increased regulatory and reimbursement pressures,” CBS News reported.

Business

The justices are expected to rule quickly in the case.

When the Supreme Court hears arguments on Friday over whether protecting national security requires TikTok to be sold or closed, the justices will be working in the shadow of three First Amendment precedents, all influenced by the climate of their times and by how much the justices trusted the government.

During the Cold War and in the Vietnam era, the court refused to credit the government’s assertions that national security required limiting what newspapers could publish and what Americans could read. More recently, though, the court deferred to Congress’s judgment that combating terrorism justified making some kinds of speech a crime.

The court will most likely act quickly, as TikTok faces a Jan. 19 deadline under a law enacted in April by bipartisan majorities. The law’s sponsors said the app’s parent company, ByteDance, is controlled by China and could use it to harvest Americans’ private data and to spread covert disinformation.

The court’s decision will determine the fate of a powerful and pervasive cultural phenomenon that uses a sophisticated algorithm to feed a personalized array of short videos to its 170 million users in the United States. For many of them, and particularly younger ones, TikTok has become a leading source of information and entertainment.

As in earlier cases pitting national security against free speech, the core question for the justices is whether the government’s judgments about the threat TikTok is said to pose are sufficient to overcome the nation’s commitment to free speech.

Senator Mitch McConnell, Republican of Kentucky, told the justices that he “is second to none in his appreciation and protection of the First Amendment’s right to free speech.” But he urged them to uphold the law.

“The right to free speech enshrined in the First Amendment does not apply to a corporate agent of the Chinese Communist Party,” Mr. McConnell wrote.

Jameel Jaffer, the executive director of the Knight First Amendment Institute at Columbia University, said that stance reflected a fundamental misunderstanding.

“It is not the government’s role to tell us which ideas are worth listening to,” he said. “It’s not the government’s role to cleanse the marketplace of ideas or information that the government disagrees with.”

The Supreme Court’s last major decision in a clash between national security and free speech was in 2010, in Holder v. Humanitarian Law Project. It concerned a law that made it a crime to provide even benign assistance in the form of speech to groups said to engage in terrorism.

One plaintiff, for instance, said he wanted to help the Kurdistan Workers’ Party find peaceful ways to protect the rights of Kurds in Turkey and to bring their claims to the attention of international bodies.

When the case was argued, Elena Kagan, then the U.S. solicitor general, said courts should defer to the government’s assessments of national security threats.

“The ability of Congress and of the executive branch to regulate the relationships between Americans and foreign governments or foreign organizations has long been acknowledged by this court,” she said. (She joined the court six months later.)

The court ruled for the government by a 6-to-3 vote, accepting its expertise even after ruling that the law was subject to strict scrutiny, the most demanding form of judicial review.

“The government, when seeking to prevent imminent harms in the context of international affairs and national security, is not required to conclusively link all the pieces in the puzzle before we grant weight to its empirical conclusions,” Chief Justice John G. Roberts Jr. wrote for the majority.

In its Supreme Court briefs defending the law banning TikTok, the Biden administration repeatedly cited the 2010 decision.

“Congress and the executive branch determined that ByteDance’s ownership and control of TikTok pose an unacceptable threat to national security because that relationship could permit a foreign adversary government to collect intelligence on and manipulate the content received by TikTok’s American users,” Elizabeth B. Prelogar, the U.S. solicitor general, wrote, “even if those harms had not yet materialized.”

Many federal laws, she added, limit foreign ownership of companies in sensitive fields, including broadcasting, banking, nuclear facilities, undersea cables, air carriers, dams and reservoirs.

While the court led by Chief Justice Roberts was willing to defer to the government, earlier courts were more skeptical. In 1965, during the Cold War, the court struck down a law requiring people who wanted to receive foreign mail that the government said was “communist political propaganda” to say so in writing.

That decision, Lamont v. Postmaster General, had several distinctive features. It was unanimous. It was the first time the court had ever held a federal law unconstitutional under the First Amendment’s free expression clauses.

It was the first Supreme Court opinion to feature the phrase “the marketplace of ideas.” And it was the first Supreme Court decision to recognize a constitutional right to receive information.

That last idea figures in the TikTok case. “When controversies have arisen,” a brief for users of the app said, “the court has protected Americans’ right to hear foreign-influenced ideas, allowing Congress at most to require labeling of the ideas’ origin.”

Indeed, a supporting brief from the Knight First Amendment Institute said, the law banning TikTok is far more aggressive than the one limiting access to communist propaganda. “While the law in Lamont burdened Americans’ access to specific speech from abroad,” the brief said, “the act prohibits it entirely.”

Zephyr Teachout, a law professor at Fordham, said that was the wrong analysis. “Imposing foreign ownership restrictions on communications platforms is several steps removed from free speech concerns,” she wrote in a brief supporting the government, “because the regulations are wholly concerned with the firms’ ownership, not the firms’ conduct, technology or content.”

Six years after the case on mailed propaganda, the Supreme Court again rejected the invocation of national security to justify limiting speech, ruling that the Nixon administration could not stop The New York Times and The Washington Post from publishing the Pentagon Papers, a secret history of the Vietnam War. The court did so in the face of government warnings that publishing would imperil intelligence agents and peace talks.

“The word ‘security’ is a broad, vague generality whose contours should not be invoked to abrogate the fundamental law embodied in the First Amendment,” Justice Hugo Black wrote in a concurring opinion.

The American Civil Liberties Union told the justices that the law banning TikTok “is even more sweeping” than the prior restraint sought by the government in the Pentagon Papers case.

“The government has not merely forbidden particular communications or speakers on TikTok based on their content; it has banned an entire platform,” the brief said. “It is as though, in Pentagon Papers, the lower court had shut down The New York Times entirely.”

Mr. Jaffer of the Knight Institute said the key precedents point in differing directions.

“People say, well, the court routinely defers to the government in national security cases, and there is obviously some truth to that,” he said. “But in the sphere of First Amendment rights, the record is a lot more complicated.”

-

Business1 week ago

Business1 week agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Culture1 week ago

Culture1 week agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

-

Sports1 week ago

Sports1 week agoThe top out-of-contract players available as free transfers: Kimmich, De Bruyne, Van Dijk…

-

Politics1 week ago

Politics1 week agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics1 week ago

Politics1 week agoCarter's judicial picks reshaped the federal bench across the country

-

Politics6 days ago

Politics6 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health5 days ago

Health5 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoIvory Coast says French troops to leave country after decades