Business

How Do You Deal With a Windfall in Your 20s?

Mattea Roach still gets around Toronto by subway. In a city where tear-down bungalows can sell for $1 million, Mx. Roach, who uses they/them pronouns, still shares an apartment with their brother despite having more than enough money to buy a house.

For Mx. Roach, 24, the youngest ever “Jeopardy” super-champion, the $560,983 in winnings has done little to change how they live their daily life. They haven’t bought a car or splurged on anything more than some new clothes and a few more trips to the record store.

Despite the popular fantasy that a sudden financial windfall — whether a game-show win, an inheritance or a lawsuit settlement — will radically change a young person’s life, it’s not a guarantee. It does, of course, for some, allowing them to buy a house or adventure around the world at a young age. But for those who receive money after losing a loved one or who are learning to manage large sums of money for the first time, a windfall can feel overwhelming.

Mx. Roach, who grew up in Halifax, Nova Scotia, had planned to attend law school, but is doing public speaking and podcasting for now. “School’s not going anywhere, and these other things won’t be around forever,” they said. “I once had a very good idea what I was going to do with my life.”

Now, perhaps surprisingly, Mx. Roach has less clarity than before their win. “There’s a sense of uncertainty and unease,” they said. “I have it more than ever.”

For Mx. Roach, the “Jeopardy” money offers a sort of relieved exhalation, the knowledge of having a cushion to make new, different and possibly more interesting choices with their life.

“I feel very much the same as I did before,” they said. “I always feel guilty spending money.” Having six figures in the bank, though, offers them a welcome safety net in case they ever get sick, become unable to work or need to help their mother. Mx. Roach’s father died unexpectedly when they were competing on the show.

“I don’t know yet what my lifestyle will be,” they said.

For Alexandra Merullo Steffgen, a 25-year-old writer in Fort Collins, Colo., a $10,000 fellowship changed her life for good. She was a scholarship student during her final two years at Phillips Exeter Academy, a prestigious preparatory school, with peers who were wealthy enough to fly to Europe on a private plane for a weekend and who had campus buildings named for family members.

“A lot of time I couldn’t keep up with my friends who had stipends,” Ms. Merullo Steffgen said. “I had a minimum-wage job two days a week at the library.”

She watched fellow seniors worry about which college they would get into and knew that wasn’t the path she wanted. She instead applied for two fellowships, each of which would give her the financial freedom to take a gap year and travel. At 18, she won a Phillips Exeter Academy fellowship worth $10,000 that allowed her to do just that.

“It was so exciting,” Ms. Merullo Steffgen said. “It was a sum of money I could barely fathom at that age. It felt really special.” She volunteered in Naples, Italy; hiked the Camino de Compostela in Spain; spent time in Berlin, Ireland and Florence, Italy; and went on a Buddhist retreat. She spent the last of her funds on a trip to Cambodia.

“I spent the money just indulging myself, which I don’t do anymore,” she said. “I let myself enjoy myself more than any other time. I’ve always felt like an overly responsible person making sure no one suffers because of me. That was the greatest gift it gave me.”

The irony to getting a windfall in your 20s or 30s? It can offer new freedom, but it can also feel disorienting, especially if your peers are still in early-stage careers, burdened by student debt and simply can’t relate to the sudden challenge of managing five or six figures.

Nicholas Freda, a tech worker in Seattle, was 26 when he received a $100,000 inheritance from his grandmother. The gift brought pangs of grief because his father had already died, which meant the money would be passed directly to him.

“I’d heard people talk about inheritance in old-timey movies,” Mr. Freda said. “It was something other people did.” When he was told to expect a payment, “I thought it would not be very much at all,” he said.

Mr. Freda said he was initially uncomfortable with the inheritance. He ultimately decided the money should go toward buying a house rather than unnecessary splurges and went in search of advice. He was surrounded by older and much higher-earning workers in his industry who owned multimillion-dollar homes.

“It was hard to discuss since we weren’t really using the same unit of measurement,” Mr. Freda said of the differences in buying power.

Yet it was also an odd feeling, he said, to be able to “have a conversation with people five, 10 or 15 years further along” in their careers. Two years after receiving the money, Mr. Freda put two-thirds of his inheritance into buying a house, where he now lives with his fiancée.

Gina Knox, a 30-year-old financial coach in San Antonio, has received two windfalls at an early age: $15,000 at the age of 22 and $100,000 at 28. The first was money from her parents left in her college account after graduation, which came as a shock.

Ms. Knox took $5,000 and traveled for a month through South America, riding horses in Argentina, savoring hot springs in Chile and taking a bus ride over the Andes. “I had a blast,” she said.

But she was stymied by what to do with the rest of it. “I sat on it for months not knowing what to do,” she said. “I was completely petrified I would mess it up or spend it.” She felt awkward and overwhelmed thinking, “this is too much money to have.”

By the time Ms. Knox received a $100,000 family inheritance, she had more confidence thanks to her father, who taught her about money management. “I had already saved and invested $100,000 on my own, so this was not the first time I’d managed six figures,” she said.

Ms. Knox now counsels others about managing their money. “If you don’t know what to do with it, it is vitally important to do nothing,” she said. “Ask a family member or financial adviser when you have large sums of money you are strategically or emotionally not prepared to deal with. Spend some time imagining what you want your life to be.”

Her splurge is driving a Mercedes station wagon, a purchase that gives her daily pleasure.

Those from lower-income families are even less equipped to smoothly integrate a windfall into their lives because managing large sums of money is a new skill they need to master. Steven M. Hughes, 36, a financial therapist based in Atlanta, is a first-generation American and knows the welter of emotions a sudden influx of cash can evoke. Fear, shame and guilt are three common ones he encounters with his clients.

“There are a lot of emotions tied into money, and there’s a rush of endorphins with an inheritance, but you may also feel a survivor’s remorse having more money than your family or your neighborhood ever had,” he said.

A windfall can also attract new pleas for aid. “You may now feel like a faucet for your family,” Mr. Hughes said.

Your first phone call should be to “the person you admire most in how they manage their money,” he said. “Ask who’s their accountant.” Your second phone call should be to a fee-based financial planner. “Once you have those people on your team, you can get some ideas from them,” he said.

If family or friends come asking for money, Mr. Hughes suggests giving yourself some guardrails. “Sometimes our heart and our eyes are bigger than our wallets,” he said. Lower-income recipients and people of color are often already financially supporting both younger and older relatives at the same time and can be seen as the savior, or the financial anchor of the family.

“Establish yourself financially first,” Mr. Hughes said.

Business

Paramount chair Shari Redstone has been diagnosed with thyroid cancer

Paramount Global chairwoman and controlling shareholder Shari Redstone is battling cancer as she tries to steer the media company through a turbulent sales process.

“Shari Redstone was diagnosed with thyroid cancer earlier this spring,” her spokeswoman Molly Morse said late Thursday. “While it has been a challenging period, she is maintaining all professional and philanthropic activities throughout her treatment, which is ongoing.

“She and her family are grateful that her prognosis is excellent,” Morse said.

The news comes nearly 11 months after Redstone agreed to sell Paramount to David Ellison’s Skydance Media in a deal that would end the family’s tenure as major Hollywood moguls.

However, the government’s review of the Skydance sale hit a snag amid President Trump’s $20-billion lawsuit against Paramount subsidiary CBS over edits to an October “60 Minutes” broadcast.

Redstone, 71, told the New York Times that she underwent surgery last month after receiving the diagnosis about two months ago. Surgeons removed her thyroid gland but did not fully eradicate the cancer, which had spread to her vocal cords, the paper said.

She continues to be treated with radiation, the paper reported.

The Redstone family controls 77% of the voting shares of Paramount. Her father, the late Sumner Redstone, built the company into a juggernaut but it has seen its standing slip in recent years. There have been management missteps and pressures brought on by consumers’ shift to streaming. The trend has crimped revenue to companies that own cable channels, including Paramount.

Redstone has wanted to settle the lawsuit Trump filed in October, weeks after “60 Minutes” interviewed then-Vice President Kamala Harris. Trump accused CBS of deceptively editing the interview to make Harris look smarter and improve her election chances, a charge that CBS has denied.

The dispute over the edits has sparked unrest within the company, prompted high-level departures and triggered a Federal Communications Commission examination of alleged news distortion.

The FCC’s review of the Skydance deal has become bogged down. If the agency does not approve the transfer of CBS television station licenses to the Ellison family, the deal could collapse.

The two companies must complete the merger by early October. If not, Paramount will owe a $400-million breakup fee to Skydance. Redstone, through the family’s National Amusements Inc., also owes nearly $400 million to a Chicago banker and tech titan Larry Ellison, who is helping bankroll the buyout of Paramount and National Amusements.

Business

How Hard It Is to Make Trade Deals

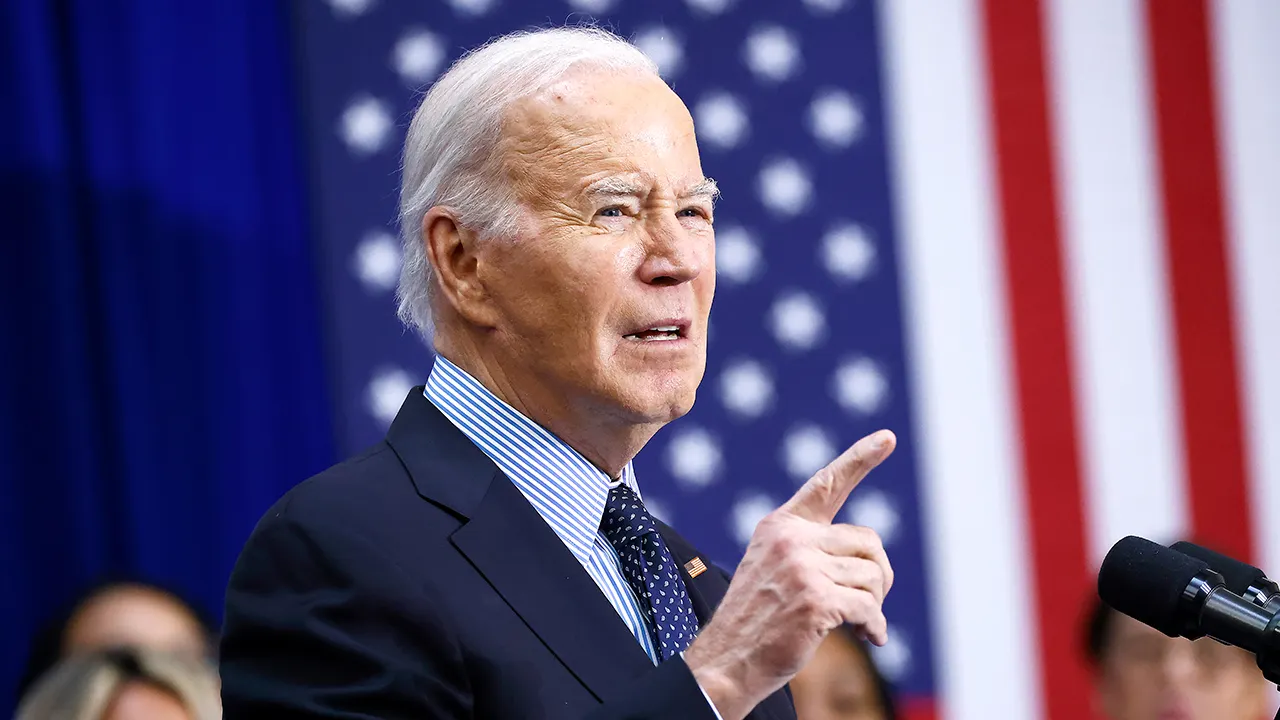

President Trump has announced wave after wave of tariffs since taking office in January, part of a sweeping effort that he has argued would secure better trade terms with other countries. “It’s called negotiation,” he recently said.

In April, administration officials vowed to sign trade deals with as many as 90 countries in 90 days. The ambitious target came after Mr. Trump announced, and then rolled back a portion of, steep tariffs that in some cases meant import taxes cost more than the wholesale price of a good itself.

The 90-day goal, however, is a tenth of the time it usually takes to reach a trade deal, according to a New York Times analysis of major agreements with the United States currently in effect, raising questions about how realistic the administration’s target may be. It typically takes 917 days, or roughly two and a half years, for a trade deal to go from initial talks to the president’s desk for signature, the analysis shows.

Roughly 60 days into the current process, Mr. Trump has so far announced only one deal: a pact with Britain, which is not one of America’s biggest trading partners.

He has also suggested that negotiations with China have been rocky. “I like President XI of China, always have, and always will, but he is VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!” Mr. Trump wrote on Truth Social on Wednesday. China and the United States agreed last month to temporarily slash tariffs on each other’s imports in a gesture of good will to continue talks.

Part of what the president can accomplish boils down to what you can call a deal.

The pact with Britain is less of a deal than it is a framework for talking about a deal, said Wendy Cutler, the vice president of the Asia Society Policy Institute and a former U.S. trade negotiator. What was officially released by the two nations more closely resembled talking points for “what you were going to negotiate versus the actual commitment,” she said.

During his first term, Mr. Trump secured two major trade agreements, both signed in January 2020. One was the United States-Mexico-Canada Agreement, which was a reworking of the North American free trade treaty from the 1990s that had helped transform the economies of the three nations.

U.S.M.C.A. is an all-encompassing, legally binding agreement that resulted from a lengthy and formal process, according to trade analysts.

Such deals are supposed to cover all aspects of trade between the respective nations and are negotiated under specific guidelines for congressional consultation. Closing the deal involves both negotiation and ratification — modifying or making laws in each partner country. The deals are signed by trade negotiators before the president signs the legislation that puts it into effect for the United States.

Mr. Trump’s other major agreement in his first term was with China, in an echo of the current trade war. The pact, unlike previous deals, came about after Mr. Trump threatened tariffs on certain Chinese imports. This “tariff first, talk later” approach, said Inu Manak, a trade policy fellow at the Council on Foreign Relations, is part of the same playbook the administration is currently using.

The result was a nonbinding agreement between the two countries, known as “Phase One,” that did not require approval from Congress and that could be ended by either party at any time. Still, it took almost one year and nine months to complete. China ultimately fell far short of the commitments it made to purchase American goods under the agreement.

A comparison of the two first-term Trump deals shows the drawn-out and sometimes winding paths each took to completion. Fragile truces (including ones made for 90 days) were formed, only for talks to break down later, all while rounds of tariffs injected uncertainty into the diplomatic relations between countries.

The Times analysis used the date from the start of negotiations to the date when the president signed to determine the length of deal making for each major agreement dating back to 1985 that’s currently in effect. The median time it took to get to the president’s signature was just over 900 days. (A separate analysis published in 2016 by the Peterson Institute for International Economics used the date of signature by country representatives as the completion moment and found that the median deal took more than 570 days.)

With roughly one month before the administration’s self-imposed deadline, Mr. Trump’s ability to forge deals has been thrust into sudden doubt. Last week, a U.S. trade court ruled he had overstepped his authority in imposing the April tariffs.

For now, the tariffs remain in place, following a temporary stay from a federal appeals court. But in arguing its case, the federal government initially said that the ruling could upset negotiations with other nations and undercut the president’s leverage.

In a statement on Wednesday, Kush Desai, a White House spokesman, said that trade negotiators were working to secure “custom-made trade deals at lightning speed that level the playing field for American industries and workers.”

But in other recent public statements, White House officials have significantly pared back their ambitions for the deals.

In April, Scott Bessent, the Treasury secretary, hedged the number of agreements they might reach, suggesting that the United States would talk to somewhere between 50 and 70 countries. Last month he said the United States was negotiating with 17 “very important trading relationships,” not including China.

“I think when the administration first started, they thought they could actually do these binding and enforceable deals within 90 days and then quickly realized that they bit off more than they could chew,” Ms. Cutler said.

The administration told its negotiating partners to submit offers of trade concessions they were willing to make by Wednesday, in an effort to strike trade deals in the coming weeks. The deadline was earlier reported by Reuters.

The current approach to deal making may be strategic, Ms. Manak said. One of the benefits of not doing a comprehensive deal like U.S.M.C.A. is that the administration can declare small “victories” on a much faster timeline, she said.

“It means that trade agreements simply are just not what they used to be,” she added. “And you can’t really guarantee that whatever the U.S. promises is actually going to be upheld in the long run.”

Data and graphics are based on a New York Times analysis of information from the Congressional Research Service, the U.S. Trade Representative, the Organization of American States’ Foreign Trade Information System and public White House communications.

Business

Terranea Resort accused of pregnancy discrimination, retaliation in lawsuit

A former marketing executive at the Terranea Resort sued the luxury establishment on Wednesday, alleging its president had made discriminatory comments towards pregnant women working at the company.

The former marketing exercutive, Chad Bustos, alleges in the lawsuit filed on Wednesday that he was fired in retaliation after he defended several female employees.

Terranea Resort and the company’s president did not respond to a request for comment about allegations in the lawsuit, which was filed in Los Angeles County Superior Court.

Bustos said he had worked at the 560-room oceanfront resort that perches on the Palos Verdes Peninsula since 2023. He had supervised an all-female marketing team, of which three employees were young moms with children under 3, according to the complaint.

The lawsuit describes a meeting in February 2024, where the resort’s president, Ralph Grippo, became “visibly angry” after hearing a woman on the team planned to take maternity leave. Her announcement had come months after another employee had returned from maternity leave.

Grippo, who also is a defendant in the lawsuit, allegedly stood up, pushed his chair back and began questioning the other women in the room. The lawsuit said Grippo pointed at each woman in turn, asking, “Are you pregnant?” After each woman answered, he sat back down and the meeting continued.

After the meeting, Grippo allegedly began “scrutinizing the marketing team and nitpicking their performance,” using the resort’s security cameras to see what time they arrived to work and when they left. He told Bustos to write up the women for what he deemed to be minor infractions, but Bustos refused, according to the complaint.

At another meeting in May 2024, Grippo scolded female employees for not working hard enough, although the team was high-performing and employees worked long hours, the lawsuit said.

Grippo was reported to the human resources department by one of the women, and Bustos confirmed her claims to the department, the lawsuit said. Bustos also confronted Grippo around that time, telling him his comments were inappropriate, according to the complaint.

After that, Grippo refused to speak with Bustos or return his calls, the lawsuit alleged, and in August 2024, Grippo fired Bustos.

Under California law, it is illegal for employers to ask employees about medical conditions, including pregnancy.

And anti-pregnancy comments can be used as evidence of sex discrimination, said Lauren Teukolsky, the attorney representing Bustos.

Bustos, who had worked with Grippo for 11 years at another company prior to joining him at the Terranea Resort, said in an interview that he initially thought Grippo would understand his perspective because of their long-standing relationship.

Bustos said his team was “very talented and hardworking,” and the sacrifices they and others have made to raise children “should be important for everybody.”

Grippo had had a history of making other anti-pregnancy comments, the lawsuit alleged.

When a woman asked Grippo for a promotion, he allegedly questioned her about how she planned to balance the promotion while raising a child. He asked another woman with two children who applied for a marketing job if her work schedule was going to be a problem since she was a mom, the lawsuit said.

Grippo wrote up another pregnant employee because she came in 15 minutes late as a result of morning sickness, and questioned another pregnant employee why she had so many doctor’s appointments, the lawsuit said.

In 2017, former dishwasher and chef assistant Sandra Pezqueda sued the resort and a staffing agency after she allegedly experienced repeated sexual harassment and assault by her supervisor, who then retaliated against her by changing her work schedule after she rejected his advances.

Pezqueda received a $250,000 settlement with the company denying any wrongdoing, news reports said.

Then-president Terri A. Haack said in a statement to Time that the company has “a zero-tolerance policy toward harassment.”

The Terranea resort is jointly owned by JC Resorts, a company with a portfolio of resorts and golf courses based in La Jolla, and Lowe Enterprises, real estate investment firm based in Los Angeles. The companies did not immediately respond to a request for comment.

-

Politics1 week ago

Politics1 week agoTrump admin asking federal agencies to cancel remaining Harvard contracts

-

Culture1 week ago

Culture1 week agoCan You Match These Canadian Novels to Their Locations?

-

Technology1 week ago

Technology1 week agoThe Browser Company explains why it stopped developing Arc

-

News1 week ago

News1 week agoHarvard's president speaks out against Trump. And, an analysis of DEI job losses

-

News1 week ago

News1 week agoRead the Trump Administration Letter About Harvard Contracts

-

News7 days ago

News7 days agoVideo: Faizan Zaki Wins Spelling Bee

-

World1 week ago

World1 week agoDrone war, ground offensive continue despite new Russia-Ukraine peace push

-

Politics5 days ago

Politics5 days agoMichelle Obama facing backlash over claim about women's reproductive health