Business

Former Ace Hotel in downtown L.A. reopens as 'Airbnb on steroids'

The former Ace Hotel in downtown Los Angeles, which helped lead an economic revival on a historic stretch of Broadway a decade ago, has reopened as a minimal-service operation akin to Airbnb, following a strategy that has become increasingly common for struggling hotels in recent years

Now called Stile Downtown Los Angeles by Kasa, the 1920s-vintage hotel tower has resumed limited operations after shutting down nearly six months ago. Downtown hotels were particularly hard-hit by the pandemic, and some have changed owners or operators.

Ace Hotel Group had operated the 182-room hotel near Broadway and Olympic Boulevard since it opened in 2014, even as its ownership changed twice over the years. The chic brand made the Ace a destination for travelers as well as local residents who patronized its buzzy rooftop bar and restaurants.

Korea-based AJU Continuum, which bought the hotel in 2019, announced last week that it had brought in Kasa Living Inc. to operate the property.

Kasa, which is based in San Francisco and has a national presence, “offers the consistency of a major hotel chain with the convenience and character of a modern short-term rental,” AJU Continuum said in a statement.

Ace Hotel said upon its departure that the Broadway hotel would be operated in the future as “a limited-service, rooms-only operation, managed via a tech platform.”

The limited-service model under which guests typically receive codes to get into their rooms via their phones is “basically an Airbnb on steroids,” said Donald Wise, a hotel investment banker at Turnbull Capital Group. “You’re not going to someone’s house or a condo, but to a box that has no more or less service than an Airbnb would have.”

The independent United Theater on Broadway, which is connected to the hotel, will continue to operate as an open venue hosting concerts, performances and special events, AJU Continuum said. The hotel will have a rooftop wine bar, but no restaurants.

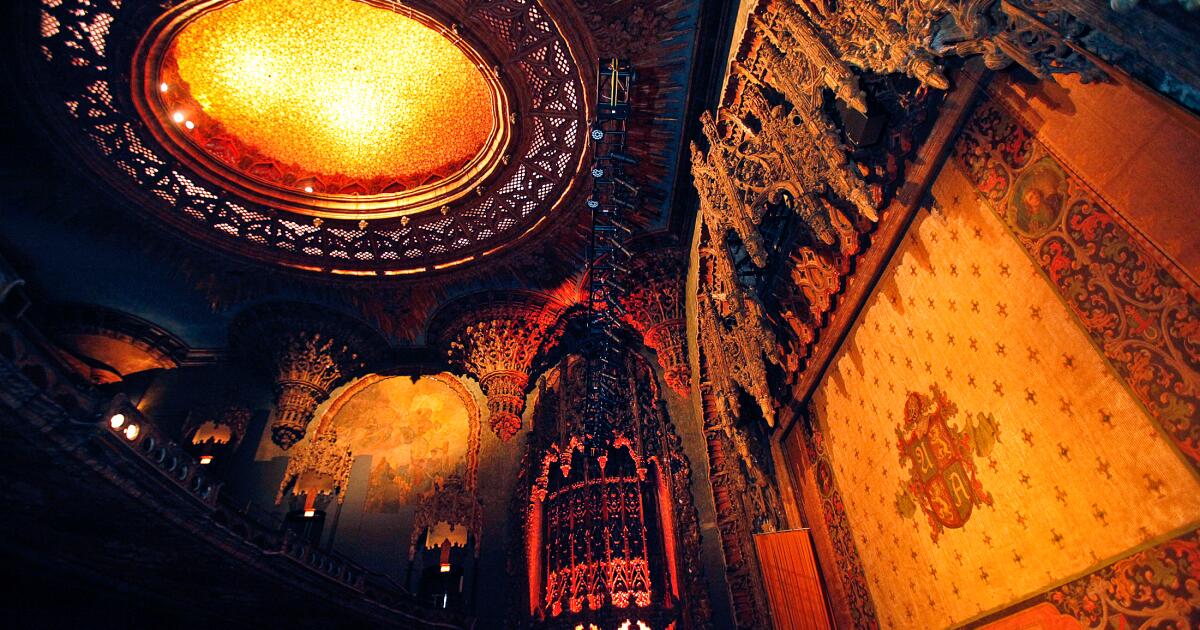

The site has had multiple identities since it was built in 1927. Constructed with backing from film luminaries Mary Pickford, Douglas Fairbanks, Charlie Chaplin and D.W. Griffith, it originally was meant in part to provide a theater for the United Artists movie production company they founded.

The Spanish Gothic theater was designed by C. Howard Crane and the tower by Walker & Eisen, the team behind other local landmarks including the Fine Arts Building downtown and the Beverly Wilshire hotel in Beverly Hills. It held offices for rent and a theater where United Artists pictures premiered, starting with Pickford’s film “My Best Girl.”

Other prominent occupants of the property through the years include California Petroleum Corp., Texaco and flamboyant preacher Gene Scott, whose broadcasts were heard nationally. He died in 2005.

The opening of the Ace in 2014 was a pivotal point in the residential renaissance of downtown that helped spur growth nearby, said Nick Griffin, executive vice president of DTLA Alliance, formerly the Downtown Center Business Improvement District.

“It was evocative of that particular moment in downtown, arriving as a kind of a hipster paradise,” he said. “That area of Ninth and Broadway was a particularly hip area with fashion and hotels at the intersection of the Historic Core, the fashion district and the downtown center.”

Two other boutique hotels created in historic buildings followed the Ace to the neighborhood: the Hoxton Downtown LA and Downtown L.A. Proper. Both are also on Broadway.

Short-term rentals in former traditional hotels and apartment buildings have been popping up downtown as business owners work to find financial equilibrium, Griffin said.

“The new model of short-term rentals is sort of indicative of this moment in downtown as we continue to evolve and innovate coming out of the pandemic.”

Griffin’s improvement district reported that average downtown hotel occupancy, which plunged during the pandemic, has reached nearly 69%, up a percentage point from a year ago. That’s close to what is usually considered a healthy rate but down from late 2019 when occupancy was closer to 80% and average room rates were higher.

“The downtown Los Angeles market is still lagging, hasn’t recovered fully to the numbers that were pre-COVID,” said consultant Alan Reay of Atlas Hospitality Group. “We are definitely starting to see more distress among owners.”

Challenges for hotel owners include a reduction in business travelers to downtown offices as more people work from home resulting in lower revenue. They also face high interest rates on their loans and rising labor costs.

Limited service hotels such as Stile may produce more profit for their owners while also lowering rates for guests who don’t mind having fewer services, Reay said.

Business

Trump orders federal agencies to stop using Anthropic’s AI after clash with Pentagon

President Trump on Friday directed federal agencies to stop using technology from San Francisco artificial intelligence company Anthropic, escalating a high-profile clash between the AI startup and the Pentagon over safety.

In a Friday post on the social media site Truth Social, Trump described the company as “radical left” and “woke.”

“We don’t need it, we don’t want it, and will not do business with them again!” Trump said.

The president’s harsh words mark a major escalation in the ongoing battle between some in the Trump administration and several technology companies over the use of artificial intelligence in defense tech.

Anthropic has been sparring with the Pentagon, which had threatened to end its $200-million contract with the company on Friday if it didn’t loosen restrictions on its AI model so it could be used for more military purposes. Anthropic had been asking for more guarantees that its tech wouldn’t be used for surveillance of Americans or autonomous weapons.

The tussle could hobble Anthropic’s business with the government. The Trump administration said the company was added to a sweeping national security blacklist, ordering federal agencies to immediately discontinue use of its products and barring any government contractors from maintaining ties with it.

Defense Secretary Pete Hegseth, who met with Anthropic’s Chief Executive Dario Amodei this week, criticized the tech company after Trump’s Truth Social post.

“Anthropic delivered a master class in arrogance and betrayal as well as a textbook case of how not to do business with the United States Government or the Pentagon,” he wrote Friday on social media site X.

Anthropic didn’t immediately respond to a request for comment.

Anthropic announced a two-year agreement with the Department of Defense in July to “prototype frontier AI capabilities that advance U.S. national security.”

The company has an AI chatbot called Claude, but it also built a custom AI system for U.S. national security customers.

On Thursday, Amodei signaled the company wouldn’t cave to the Department of Defense’s demands to loosen safety restrictions on its AI models.

The government has emphasized in negotiations that it wants to use Anthropic’s technology only for legal purposes, and the safeguards Anthropic wants are already covered by the law.

Still, Amodei was worried about Washington’s commitment.

“We have never raised objections to particular military operations nor attempted to limit use of our technology in an ad hoc manner,” he said in a blog post. “However, in a narrow set of cases, we believe AI can undermine, rather than defend, democratic values.”

Tech workers have backed Anthropic’s stance.

Unions and worker groups representing 700,000 employees at Amazon, Google and Microsoft said this week in a joint statement that they’re urging their employers to reject these demands as well if they have additional contracts with the Pentagon.

“Our employers are already complicit in providing their technologies to power mass atrocities and war crimes; capitulating to the Pentagon’s intimidation will only further implicate our labor in violence and repression,” the statement said.

Anthropic’s standoff with the U.S. government could benefit its competitors, such as Elon Musk’s xAI or OpenAI.

Sam Altman, chief executive of OpenAI, the company behind ChatGPT and one of Anthropic’s biggest competitors, told CNBC in an interview that he trusts Anthropic.

“I think they really do care about safety, and I’ve been happy that they’ve been supporting our war fighters,” he said. “I’m not sure where this is going to go.”

Anthropic has distinguished itself from its rivals by touting its concern about AI safety.

The company, valued at roughly $380 billion, is legally required to balance making money with advancing the company’s public benefit of “responsible development and maintenance of advanced AI for the long-term benefit of humanity.”

Developers, businesses, government agencies and other organizations use Anthropic’s tools. Its chatbot can generate code, write text and perform other tasks. Anthropic also offers an AI assistant for consumers and makes money from paid subscriptions as well as contracts. Unlike OpenAI, which is testing ads in ChatGPT, Anthropic has pledged not to show ads in its chatbot Claude.

The company has roughly 2,000 employees and has revenue equivalent to about $14 billion a year.

Business

Video: The Web of Companies Owned by Elon Musk

new video loaded: The Web of Companies Owned by Elon Musk

By Kirsten Grind, Melanie Bencosme, James Surdam and Sean Havey

February 27, 2026

Business

Commentary: How Trump helped foreign markets outperform U.S. stocks during his first year in office

Trump has crowed about the gains in the U.S. stock market during his term, but in 2025 investors saw more opportunity in the rest of the world.

If you’re a stock market investor you might be feeling pretty good about how your portfolio of U.S. equities fared in the first year of President Trump’s term.

All the major market indices seemed to be firing on all cylinders, with the Standard & Poor’s 500 index gaining 17.9% through the full year.

But if you’re the type of investor who looks for things to regret, pay no attention to the rest of the world’s stock markets. That’s because overseas markets did better than the U.S. market in 2025 — a lot better. The MSCI World ex-USA index — that is, all the stock markets except the U.S. — gained more than 32% last year, nearly double the percentage gains of U.S. markets.

That’s a major departure from recent trends. Since 2013, the MSCI US index had bested the non-U.S. index every year except 2017 and 2022, sometimes by a wide margin — in 2024, for instance, the U.S. index gained 24.6%, while non-U.S. markets gained only 4.7%.

The Trump trade is dead. Long live the anti-Trump trade.

— Katie Martin, Financial Times

Broken down into individual country markets (also by MSCI indices), in 2025 the U.S. ranked 21st out of 23 developed markets, with only New Zealand and Denmark doing worse. Leading the pack were Austria and Spain, with 86% gains, but superior records were turned in by Finland, Ireland and Hong Kong, with gains of 50% or more; and the Netherlands, Norway, Britain and Japan, with gains of 40% or more.

Investment analysts cite several factors to explain this trend. Judging by traditional metrics such as price/earnings multiples, the U.S. markets have been much more expensive than those in the rest of the world. Indeed, they’re historically expensive. The Standard & Poor’s 500 index traded in 2025 at about 23 times expected corporate earnings; the historical average is 18 times earnings.

Investment managers also have become nervous about the concentration of market gains within the U.S. technology sector, especially in companies associated with artificial intelligence R&D. Fears that AI is an investment bubble that could take down the S&P’s highest fliers have investors looking elsewhere for returns.

But one factor recurs in almost all the market analyses tracking relative performance by U.S. and non-U.S. markets: Donald Trump.

Investors started 2025 with optimism about Trump’s influence on trading opportunities, given his apparent commitment to deregulation and his braggadocio about America’s dominant position in the world and his determination to preserve, even increase it.

That hasn’t been the case for months.

”The Trump trade is dead. Long live the anti-Trump trade,” Katie Martin of the Financial Times wrote this week. “Wherever you look in financial markets, you see signs that global investors are going out of their way to avoid Donald Trump’s America.”

Two Trump policy initiatives are commonly cited by wary investment experts. One, of course, is Trump’s on-and-off tariffs, which have left investors with little ability to assess international trade flows. The Supreme Court’s invalidation of most Trump tariffs and the bellicosity of his response, which included the immediate imposition of new 10% tariffs across the board and the threat to increase them to 15%, have done nothing to settle investors’ nerves.

Then there’s Trump’s driving down the value of the dollar through his agitation for lower interest rates, among other policies. For overseas investors, a weaker dollar makes U.S. assets more expensive relative to the outside world.

It would be one thing if trade flows and the dollar’s value reflected economic conditions that investors could themselves parse in creating a picture of investment opportunities. That’s not the case just now. “The current uncertainty is entirely man-made (largely by one orange-hued man in particular) but could well continue at least until the US mid-term elections in November,” Sam Burns of Mill Street Research wrote on Dec. 29.

Trump hasn’t been shy about trumpeting U.S. stock market gains as emblems of his policy wisdom. “The stock market has set 53 all-time record highs since the election,” he said in his State of the Union address Tuesday. “Think of that, one year, boosting pensions, 401(k)s and retirement accounts for the millions and the millions of Americans.”

Trump asserted: “Since I took office, the typical 401(k) balance is up by at least $30,000. That’s a lot of money. … Because the stock market has done so well, setting all those records, your 401(k)s are way up.”

Trump’s figure doesn’t conform to findings by retirement professionals such as the 401(k) overseers at Bank of America. They reported that the average account balance grew by only about $13,000 in 2025. I asked the White House for the source of Trump’s claim, but haven’t heard back.

Interpreting stock market returns as snapshots of the economy is a mug’s game. Despite that, at her recent appearance before a House committee, Atty. Gen. Pam Bondi tried to deflect questions about her handling of the Jeffrey Epstein records by crowing about it.

“The Dow is over 50,000 right now, she declared. “Americans’ 401(k)s and retirement savings are booming. That’s what we should be talking about.”

I predicted that the administration would use the Dow industrial average’s break above 50,000 to assert that “the overall economy is firing on all cylinders, thanks to his policies.” The Dow reached that mark on Feb. 6. But Feb. 11, the day of Bondi’s testimony, was the last day the index closed above 50,000. On Thursday, it closed at 49,499.50, or about 1.4% below its Feb. 10 peak close of 50,188.14.

To use a metric suggested by economist Justin Wolfers of the University of Michigan, if you invested $48,488 in the Dow on the day Trump took office last year, when the Dow closed at 48,448 points, you would have had $50,000 on Feb. 6. That’s a gain of about 3.2%. But if you had invested the same amount in the global stock market not including the U.S. (based on the MSCI World ex-USA index), on that same day you would have had nearly $60,000. That’s a gain of nearly 24%.

Broader market indices tell essentially the same story. From Jan. 17, 2025, the last day before Trump’s inauguration, through Thursday’s close, the MSCI US stock index gained a cumulative 16.3%. But the world index minus the U.S. gained nearly 42%.

The gulf between U.S. and non-U.S. performance has continued into the current year. The S&P 500 has gained about 0.74% this year through Wednesday, while the MSCI World ex-USA index has gained about 8.9%. That’s “the best start for a calendar year for global stocks relative to the S&P 500 going back to at least 1996,” Morningstar reports.

It wouldn’t be unusual for the discrepancy between the U.S. and global markets to shrink or even reverse itself over the course of this year.

That’s what happened in 2017, when overseas markets as tracked by MSCI beat the U.S. by more than three percentage points, and 2022, when global markets lost money but U.S. markets underperformed the rest of the world by more than five percentage points.

Economic conditions change, and often the stock markets march to their own drummers. The one thing less likely to change is that Trump is set to remain president until Jan. 20, 2029. Make your investment bets accordingly.

-

World2 days ago

World2 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts2 days ago

Massachusetts2 days agoMother and daughter injured in Taunton house explosion

-

Montana1 week ago

Montana1 week ago2026 MHSA Montana Wrestling State Championship Brackets And Results – FloWrestling

-

Louisiana5 days ago

Louisiana5 days agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Denver, CO2 days ago

Denver, CO2 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Technology7 days ago

Technology7 days agoYouTube TV billing scam emails are hitting inboxes

-

Technology7 days ago

Technology7 days agoStellantis is in a crisis of its own making

-

Politics7 days ago

Politics7 days agoOpenAI didn’t contact police despite employees flagging mass shooter’s concerning chatbot interactions: REPORT