Business

Dear USPS: This California town wants its post office back

On the outskirts of this coastal village — just past the road sign telling visitors they are “Entering a Socially Acknowledged Nature-Loving Town” — a big wooden placard displays a set of hand-painted numbers. They are changed each morning.

“Days Without a Bolinas Post Office,” the sign reads.

On June 1, that number hit 456.

That’s how long it has been since the U.S. Postal Service was booted from its office in downtown Bolinas amid a fight with its longtime landlord.

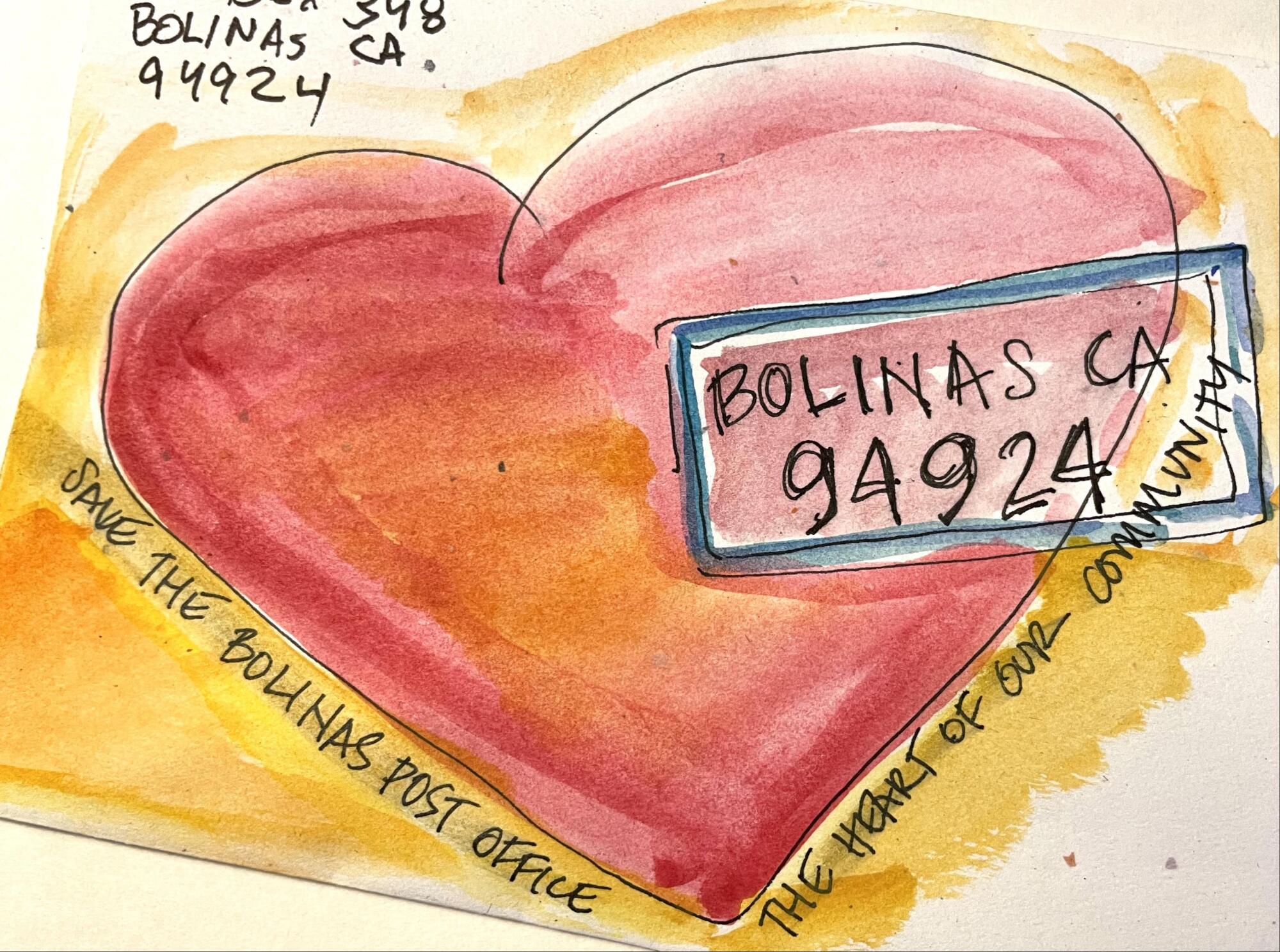

In this artsy little town in west Marin County — a haven for poets and painters, writers and actors — the loss hit hard. The 1,500 citizens of ZIP Code 94924 have fought to get their post office back with their most cherished tool: creativity.

They have picketed with placards reading, “Real Mail Not Email!” They have marched in local parades dressed as letter carriers. They have composed songs and written poems and sent thousands of letters, in hand-painted envelopes, to USPS officials.

They even drafted their own plan for a temporary post office, offered to fund it, and sent it to Congress.

“It’s a very Bolinas approach, breaking through bureaucracy through art and culture and pleas,” said John Borg, who is helping lead the citizens campaign. “This has taken way longer than it should.”

The approach is quirky, but the loss is serious.

A sign at the entrance of Bolinas counts the days the small coastal town has been without its post office.

(Genaro Molina / Los Angeles Times)

Most people in this aging rural community abutting the Point Reyes National Seashore do not get home delivery. They relied upon daily trips to the post office for parcels, pension checks and mail-order prescriptions, not to mention the chance to catch up on the small-town scuttlebutt.

Now, they must drive at least 40 minutes round-trip, through the forest on Highway 1, to a flood-prone post office at a campground in the even smaller town of Olema.

Enzo Resta, a longtime resident and founder of the new Bolinas Film Festival, compared reaction to the loss of the post office with the so-called “hype cycle” around new technologies.

“There was the crash, where there was a lot of hope and indicators we would get it back — the peak of inflated expectations,” he said. “When it got pushed a little further, we kind of went into the valley of despair, and we’re just trying to crawl back out.”

The Bolinas post office shut down on March 3, 2023. It had occupied half of an unadorned single-story wooden building on Brighton Avenue — most recently shared with a liquor store — for six decades.

The USPS already was a tenant when Gregg Welsh, of Ventura County, acquired the building about 50 years ago. His family trust currently owns it.

The relationship between landlord and tenant soured long ago.

Most people in Bolinas do not get home delivery and relied upon daily trips to the post office for their parcels, pension checks and mail-order prescriptions.

(Genaro Molina / Los Angeles Times)

According to a statement provided by Welsh through his attorney, Patrick Morris, the USPS for years violated its lease, which required it to maintain and repair the flooring at its own expense.

The postal service, the statement reads, discovered asbestos in the floor tiles in 1998, but essentially kept it hidden from the landlord for more than two decades and did not post warning signs for the public or employees.

When Welsh visited the Bolinas post office in late 2020, the statement reads, he saw worn and broken tiles and exposed, deteriorating subfloor materials.

The landlord and the postal service tussled over who should pay for repairs and asbestos abatement.

The USPS lease, according to the statement, ended in January 2022, with the parties still arguing over the floor. The postal service continued to occupy the building, sans lease, as a “tenant at sufferance.”

In a February 2023 email to USPS officials, which Morris provided to The Times, Morris said his client had not yet evicted the post office, in part because he had not wanted to deprive Bolinas residents of postal facilities before it could find a new location. But at that point, Welsh had had enough. He demanded the post office vacate the building within a month.

Kristina Uppal, a Bay Area-based spokeswoman for the USPS, did not respond to questions from The Times about accusations made by the landlord or about the alleged presence of asbestos in the building. She said the USPS was “forced from the old facility due to the unexpected termination of a lease,” but that there are no plans to permanently close the Bolinas post office.

“We are just as eager to resume retail operations in Bolinas as the community and provide enhanced accessibility such as expanding street delivery to alleviate any inconvenience,” Uppal wrote.

Bolinas residents sent more than 2,500 “art” letters with personalized appeals asking U.S. Postal Service officials to resurrect mail service in their town.

(John Borg)

Residents want their post office back, but their trust in the USPS has frayed.

The dust-up in Bolinas comes as U.S. Postmaster Louis DeJoy, appointed when former President Trump was in the White House, is under fire for efforts to consolidate postal facilities. In a May letter, a bipartisan group of U.S. senators criticized his 10-year plan, Delivering for America, arguing that cost-cutting measures have degraded service and disproportionately affected rural communities.

Bolinas residents say they have had little direct communication from the USPS over the last 15 months. Bolinas, they note, had a post office since 1863, but townsfolk were given less than two weeks’ notice before it closed.

Their mail has been bounced around — rerouted first to Olema, then to nearby Stinson Beach because of flooding, then back to Olema. Sometimes, their letters were left in unsecured bins on outdoor tables.

The relocation has been more than just an inconvenience for the town’s elderly residents, many of whom cannot drive. There is little public transit, and more than half the town’s residents are 65 or older.

People began reporting problems getting mail-order medication soon after the post office closed, according to the Marin County Board of Supervisors. They also have struggled to get lab results and healthcare coverage updates.

Borg, 62, is a type 1 diabetic who had his insulin delivered through the mail before the closure. Now, he said, package delivery is so iffy that he drives two hours round-trip to San Rafael each month to pick it up at a pharmacy.

Bolinas’ poets and painters have been integral to the town’s campaign for a post office. Here, an artist who goes by StuArt, creates the sign that will count the days Bolinas goes without service.

(John Borg)

Borg runs a small business, making stainless steel drinkware, and has had two five-figure checks for his company lost in the mail.

He said residents of the unincorporated town — which has no mayor or city attorney advocating on their behalf — had to band together to make their voices heard.

Appealing to the outside world is a tall order for a place so famously reclusive that, for years, a vigilante band called the Bolinas Border Patrol stole road signs on Highway 1 directing travelers into town. Once, when the California Department of Transportation tried painting BOLINAS on the blacktop, sneaky citizens promptly blacked them out with tar.

“We’re a small village that kind of likes to keep to ourselves and deflect attention and not be super profile. But we’re in the process where the town is changing,” said Borg, noting that a growing share of Bolinas’ limited housing stock is being used as second homes for the wealthy and short-term vacation rentals.

“The one thing that holds this place together is the post office.”

There has been no viable commercial real estate in tiny Bolinas for the post office to move into permanently. And a 1971 water meter moratorium has effectively prohibited development for the last 53 years. The moratorium, which has been challenged and upheld in court, was put into place because Bolinas has a limited water supply, mostly coming from the Arroyo Hondo Creek in the Point Reyes National Seashore.

Last spring, residents drafted a detailed proposal for a temporary facility — a mobile office trailer on a parking lot next to the fire station — and offered to raise $50,000 for its installation.

Bolinas residents note they were given just two weeks’ notice that their post office — a fixture in town since 1863 — was closing.

(Genaro Molina / Los Angeles Times)

They sent the plan to a supportive Rep. Jared Huffman (D-San Rafael), who shipped it to DeJoy. A spokesperson for Huffman said his office has been in frequent contact with the USPS and shares the community’s frustration over the slow process.

Uppal, the USPS spokeswoman, said the agency has “reviewed proposals” and “will select a site that best meets our operational needs and can provide continued service to the community long term.”

“I can confirm there is a potential option that is under review now,” she wrote. She did not provide details.

In his written response to questions from The Times, Welsh, through his attorney, said there has been discussion with USPS about moving back into its former building. No further details were provided.

For now, Bolinas residents continue to haul up to Olema — and to lionize the simple pleasure of picking up their mail locally. Or, as one local poet put it in an ode penned for a “Save the Post Office” rally:

I have gossip to send to Tomales,

regrets to send to Limantour Beach.

But it’s Bolinas — always Bolinas — I dream of finding

in the return address of a letter sent to me.

Business

How our AI bots are ignoring their programming and giving hackers superpowers

Welcome to the age of AI hacking, in which the right prompts make amateurs into master hackers.

A group of cybercriminals recently used off-the-shelf artificial intelligence chatbots to steal data on nearly 200 million taxpayers. The bots provided the code and ready-to-execute plans to bypass firewalls.

Although they were explicitly programmed to refuse to help hackers, the bots were duped into abetting the cybercrime.

According to a recent report from Israeli cybersecurity firm Gambit Security, hackers last month used Claude, the chatbot from Anthropic, to steal 150 gigabytes of data from Mexican government agencies.

Claude initially refused to cooperate with the hacking attempts and even denied requests to cover the hackers’ digital tracks, the experts who discovered the breach said. The group pummelled the bot with more than 1,000 prompts to bypass the safeguards and convince Claude they were allowed to test the system for vulnerabilities.

AI companies have been trying to create unbreakable chains on their AI models to restrain them from helping do things such as generating child sexual content or aiding in sourcing and creating weapons. They hire entire teams to try to break their own chatbots before someone else does.

But in this case, hackers continuously prompted Claude in creative ways and were able to “jailbreak” the chatbot to assist them. When they encountered problems with Claude, the hackers used OpenAI’s ChatGPT for data analysis and to learn which credentials were required to move through the system undetected.

The group used AI to find and exploit vulnerabilities, bypass defences, create backdoors and analyze data along the way to gain control of the systems before they stole 195 million identities from nine Mexican government systems, including tax records, vehicle registration as well as birth and property details.

AI “doesn’t sleep,” Curtis Simpson, chief executive of Gambit Security, said in a blog post. “It collapses the cost of sophistication to near zero.”

“No amount of prevention investment would have made this attack impossible,” he said.

Anthropic did not respond to a request for comment. It told Bloomberg that it had banned the accounts involved and disrupted their activity after an investigation.

OpenAI said it is aware of the attack campaign carried out using Anthropic’s models against the Mexican government agencies.

“We also identified other attempts by the adversary to use our models for activities that violate our usage policies; our models refused to comply with these attempts,” an OpenAI spokesperson said in a statement. “We have banned the accounts used by this adversary and value the outreach from Gambit Security.”

Instances of generative AI-assisted hacking are on the rise, and the threat of cyberattacks from bots acting on their own is no longer science fiction. With AI doing their bidding, novices can cause damage in moments, while experienced hackers can launch many more sophisticated attacks with much less effort.

Earlier this year, Amazon discovered that a low-skilled hacker used commercially available AI to breach 600 firewalls. Another took control of thousands of DJI robot vacuums with help from Claude, and was able to access live video feed, audio and floor plans of strangers.

“The kinds of things we’re seeing today are only the early signs of the kinds of things that AIs will be able to do in a few years,” said Nikola Jurkovic, an expert working on reducing risks from advanced AI. “So we need to urgently prepare.”

Late last year, Anthropic warned that society has reached an “inflection point” in AI use in cybersecurity after disrupting what the company said was a Chinese state-sponsored espionage campaign that used Claude to infiltrate 30 global targets, including financial institutions and government agencies.

Generative AI also has been used to extort companies, create realistic online profiles by North Korean operatives to secure jobs in U.S. Fortune 500 companies, run romance scams and operate a network of Russian propaganda accounts.

Over the last few years, AI models have gone from being able to manage tasks lasting only a few seconds to today’s AI agents working autonomously for many hours. AI’s capability to complete long tasks is doubling every seven months.

“We just don’t actually know what is the upper limit of AI’s capability, because no one’s made benchmarks that are difficult enough so the AI can’t do them,” said Jurkovic, who works at METR, a nonprofit that measures AI system capabilities to cause catastrophic harm to society.

So far, the most common use of AI for hacking has been social engineering. Large language models are used to write convincing emails to dupe people out of their money, causing an eight-fold increase in complaints from older Americans as they lost $4.9 billion in online fraud in 2025.

“The messages used to elicit a click from the target can now be generated on a per-user basis more efficiently and with fewer tell-tale signs of phishing,” such as grammatical and spelling errors, said Cliff Neuman, an associate professor of computer science at USC.

AI companies have been responding using AI to detect attacks, audit code and patch vulnerabilities.

“Ultimately, the big imbalance stems from the need of the good-actors to be secure all the time, and of the bad-actors to be right only once,” Neuman said.

The stakes around AI are rising as it infiltrates every aspect of the economy. Many are concerned that there is insufficient understanding of how to ensure it cannot be misused by bad actors or nudged to go rogue.

Even those at the top of the industry have warned users about the potential misuse of AI.

Dario Amodei, the CEO of Anthropic, has long advocated that the AI systems being built are unpredictable and difficult to control. These AIs have shown behaviors as varied as deception and blackmail, to scheming and cheating by hacking software.

Still, major AI companies — OpenAI, Anthropic, xAI, and Google — signed contracts with the U.S. government to use their AIs in military operations.

This last week, the Pentagon directed federal agencies to phase out Claude after the company refused to back down on its demand that it wouldn’t allow its AI to be used for mass domestic surveillance and fully autonomous weapons.

“The AI systems of today are nowhere near reliable enough to make fully autonomous weapons,” Amodei told CBS News.

Business

iPic movie theater chain files for bankruptcy

The iPic dine-in movie theater chain has filed for Chapter 11 bankruptcy protection and intends to pursue a sale of its assets, citing the difficult post-pandemic theatrical market.

The Boca Raton, Fla.-based company has 13 locations across the U.S., including in Pasadena and Westwood, according to a Feb. 25 filing in U.S. Bankruptcy Court in the Southern District of Florida, West Palm Beach division.

As part of the bankruptcy process, the Pasadena and Westwood theaters will be permanently closed, according to WARN Act notices filed with the state of California’s Employment Development Department.

The company came to its conclusion after “exploring a range of possible alternatives,” iPic Chief Executive Patrick Quinn said in a statement.

“We are committed to continuing our business operations with minimal impact throughout the process and will endeavor to serve our customers with the high standard of care they have come to expect from us,” he said.

The company will keep its current management to maintain day-to-day operations while it goes through the bankruptcy process, iPic said in the statement. The last day of employment for workers in its Pasadena and Westwood locations is April 28, according to a state WARN Act notice. The chain has 1,300 full- and part-time employees, with 193 workers in California.

The theatrical business, including the exhibition industry, still has not recovered from the pandemic’s effect on consumer behavior. Last year, overall box office revenue in the U.S. and Canada totaled about $8.8 billion, up just 1.6% compared with 2024. Even more troubling is that industry revenue in 2025 was down 22.1% compared with pre-pandemic 2019’s totals.

IPic noted those trends in its bankruptcy filing, describing the changes in consumer behavior as “lasting” and blaming the rise of streaming for “fundamentally” altering the movie theater business.

“These industry shifts have directly reduced box office revenues and related ancillary revenues, including food and beverage sales,” the company stated in its bankruptcy filing.

IPic also attributed its decision to rising rents and labor costs.

The company estimated it owed about $141,000 in taxes and about $2.7 million in total unsecured claims. The company’s assets were valued at about $155.3 million, the majority of which coming from theater equipment and furniture. Its liabilities totaled $113.9 million.

The chain had previously filed for bankruptcy protection in 2019.

Business

Startup Varda Space Industries snags former Mattel plant in El Segundo

In an expansion of its business of processing pharmaceuticals in Earth’s orbit, Varda Space Industries is renting a large El Segundo plant where toy manufacturer Mattel used to design Hot Wheels and Barbie dolls.

The plant in El Segundo’s aerospace corridor will be an extension of Varda Space Industries’ headquarters in a much smaller building on nearby Aviation Boulevard.

Varda will occupy a 205,443-square-foot industrial and office campus at 2031 E. Mariposa Ave., which will give it additional capacity to manufacture spacecraft at scale, the company said.

Originally built in the 1940s as an aircraft facility, the complex has a history as part of aerospace and defense industries that have long shaped the South Bay and is near a host of major defense and space contractors. It is also close to Los Angeles Air Force Base, headquarters to the Space Systems Command.

Workers test AstroForge’s Odin asteroid probe, which was lost in space after launch this year.

(Varda Space Industries)

Varda is one of a new generation of aerospace startups that have flourished in Southern California and the South Bay over the last several years, particularly in El Segundo, often with ties to SpaceX.

Elon Musk’s company, founded in 2002 in El Segundo, has revolutionized the industry with reusable rockets that have radically lowered the cost of lifting payloads into space. Though it has moved its headquarters to Texas, SpaceX retains large-scale operations in Hawthorne.

Varda co-founder and Chief Executive Will Bruey is a former SpaceX avionics engineer, and the company’s spacecraft are launched on SpaceX’s workhorse Falcon 9 rockets from Vandenberg Space Force Base in Santa Barbara County.

Varda makes automated labs that look like cylindrical desktop speakers, which it sends into orbit in capsules and satellite platforms it also builds. There, in microgravity, the miniature labs grow molecular crystals that are purer than those produced in Earth’s gravity for use in pharmaceuticals.

It has contracts with drug companies and also the military, which tests technology at hypersonic speeds as the capsules return to Earth.

Its fifth capsule was launched in November and returned to Earth in late January; its next mission is set in the coming weeks. Varda has more than 10 missions scheduled on Falcon 9s through 2028.

For the last several decades, the Mariposa Avenue property served as the research and development center for Mattel Toys. El Segundo has also long been a center for the toy industry as companies like to set up shop in the shadow of Mattel.

The Mattel facility “has always been an exceptional property with a legacy tied to aerospace innovation, and leasing to Varda Space Industries feels like a natural continuation of that story,” said Michael Woods, a partner at GPI Cos., which owns the property.

“We are proud to support a company that is genuinely pushing the boundaries of what’s possible, and are excited to watch Varda grow and thrive here in El Segundo,” Woods said.

As one of the country’s most active hubs of aerospace and defense innovation, El Segundo has seen its industrial property vacancy fall to 3.4% on demand from space companies, government contractors and technology startups, real estate brokerage CBRE said.

Successful startups often have to leave the neighborhood when they want to expand, real estate broker Bob Haley of CBRE said. The 9-acre Mattel facility was big enough to keep Varda in the city.

Last year, Varda subleased about 55,000 square feet of lab space from alternative protein company Beyond Meat at 888 Douglas St. in El Segundo, which it started moving into in June.

Varda will get the keys to its new building in December and spend four to eight months building production and assembly facilities as it ramps up operations. By the end of next year, it expects to have constructed 10 more spacecraft.

In the future, Varda could consolidate offices there, given its size. Currently, though, the plan is to retain all properties, creating a campus of three buildings within a mile of one another that are served by the company’s transportation services, Chief Operating Officer Jonathan Barr said.

“We already have Varda-branded shuttles running up and down Aviation Boulevard,” he said.

-

World1 week ago

World1 week agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Wisconsin4 days ago

Wisconsin4 days agoSetting sail on iceboats across a frozen lake in Wisconsin

-

Massachusetts1 week ago

Massachusetts1 week agoMother and daughter injured in Taunton house explosion

-

Maryland5 days ago

Maryland5 days agoAM showers Sunday in Maryland

-

Massachusetts3 days ago

Massachusetts3 days agoMassachusetts man awaits word from family in Iran after attacks

-

Florida5 days ago

Florida5 days agoFlorida man rescued after being stuck in shoulder-deep mud for days

-

Denver, CO1 week ago

Denver, CO1 week ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Oregon6 days ago

Oregon6 days ago2026 OSAA Oregon Wrestling State Championship Results And Brackets – FloWrestling