Business

Chevron, after 145 years in California, is relocating to Texas, a milestone in oil's long decline in the state

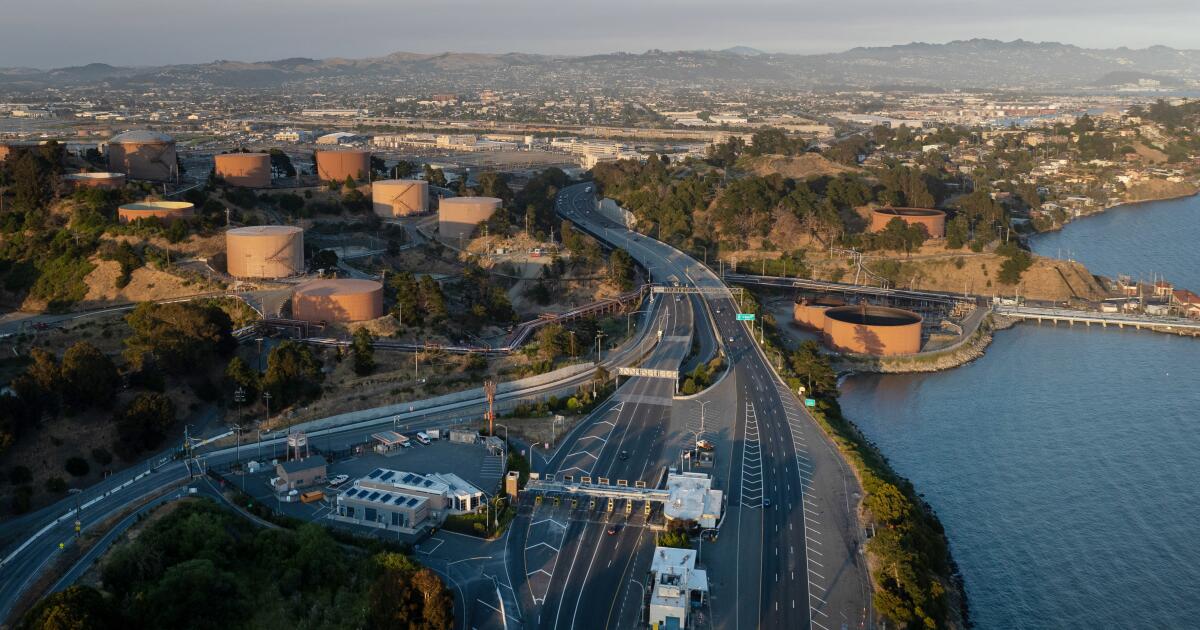

With the announcement Friday that it was moving its headquarters from California to Texas, Chevron Corp. became perhaps one of the last dinosaurs to slip into the tar pit, a symbol of California’s monumental transition from a manufacturing and production state to the brave new world of services.

In the popular imagination, California has long been seen as Hollywood, sunshine and beaches that attracted millions of new residents and built its sprawling cities. But in reality the great magnet of growth for decades was the production of things: think the aerospace industry, petroleum and agriculture.

The transition away from manufacturing has been going on for decades, exemplified by Silicon Valley, which churns out the ideas for high-tech devices but leaves the actual production to others, overseas, and the sprawling ports of Los Angeles and Long Beach, which offload the vast flow of manufactured goods from abroad.

Now, it’s Chevron’s turn.

The oil giant was founded in California 145 years ago at the beginning of an era when the state became one of the world’s leading suppliers of oil and its byproducts.

But in recent years, the company has been butting heads with Sacramento over energy and climate policies, which now loom larger than manufacturing in many people’s minds. On Friday, the company said it is moving its headquarters from the Bay Area to Houston.

The move is part of a long, steady exodus of not only Chevron’s operations, but also the larger petroleum industry from California, which in its heyday early last century produced more than one-fifth of the world’s total oil.

While California remains the seventh-largest producer of oil among the 50 states, its production of crude has been sliding since the mid-1980s and is now down to only about 2% of the U.S. total, according to the latest U.S. Energy Information Administration data.

The downshift reflects just how far the state has staked its fortunes away from fossil fuels to renewable forms of energy and, in particular, away from gas-powered cars to become the center of the electric vehicle industry

“Oil and gas has shaped California into what it became, but it has been in a tremendous decline,” said Andreas Michael, an assistant professor of petroleum engineering at the University of North Dakota. Chevron’s move out of the state, he said, “is a milestone in that decline, and it’s very sad to see.”

Sarah Elkind, a San Diego State University history professor who has chronicled the profound impact of oil production on people’s health and industry overall in Los Angeles, wondered out loud whether Chevron was leaving California to get away from regulatory scrutiny.

“It’s unfortunate corporations will relocate their workforces in places that have fewer environmental regulations rather than working in ways that lead to healthy and vibrant communities,” she said.

Chevron, the second-largest U.S. oil company, based in San Ramon, didn’t respond to interview requests Friday. In a statement, the company said that the move to Texas would allow the company to “co-locate with other senior leaders and enable better collaboration and engagement with executives, employees, and business partners.”

Chevron has been steadily shrinking its footprint in the Bay Area. It moved Chevron Energy Technology, a subsidiary, to Texas last decade, and two years ago the company sold its San Ramon campus as it began shifting jobs to Houston. The company already has about 7,000 employees in the Houston area.

Chevron has some 2,000 employees in San Ramon. It is the latest high-profile departure of a California company to another state.

Recently Elon Musk said he is moving his companies SpaceX and X from California to Texas, and over the last decade there have been scores of other California companies in tech and other industries that have fled the state, with many attributing it to the state’s high operating costs and other policies that they see as not supportive of business.

Last fall, California’s attorney general sued Chevron and several other big oil companies, alleging that their production and refining operations have caused billions of dollars in damage and that they deceived the public about the risks of fossil fuels in global warming.

Chevron’s chief executive, Mike Wirth, has pushed back against the suit and California’s approach to climate change, saying that planet warming is a global issue and that piecemeal legal actions aren’t helpful.

Gov. Gavin Newsom’s office downplayed the significance of Chevron’s relocation news Friday and highlighted the growth and opportunities in clean energy for California, which it said already has six times more jobs than fossil fuels employment.

“This announcement is the logical culmination of a long process that has repeatedly been foreshadowed by Chevron,” said Alex Stack, a spokesman for the governor’s office. “We’re proud of California’s place as the leading creator of clean energy jobs — a critical part of our diverse, innovative and vibrant economy.”

Wirth and Chevron’s vice chairman, Mark Nelson, will move to Houston before year’s end. “There will be minimal immediate relocation impacts to other employees currently based in San Ramon,” Chevron said in its statement.

Some operations will remain in San Ramon — along with “hundreds of employees,” Wirth told CNBC on Friday — but the company said it expects all corporate functions to move to Houston over the next five years.

“We’ve got a proud history in California,” Wirth said, noting that the company began in 1879 in the Pico Canyon oil field just west of Newhall, the site of the state’s first huge flow of oil three years earlier. But he said Houston is the industry’s epicenter and where Chevron’s suppliers, vendors and other key partners are located.

Chevron started out as Pacific Coast Oil Co., incorporated in 1879 in San Francisco, and later was long known as Standard Oil of California. With other companies, it rode the drilling boom in Los Angeles in the early 1900s when big oil fields were discovered in places like Long Beach and Santa Fe Springs, spurring the region’s industrial development but also creating increasing concerns about its impact on especially working-class neighborhoods, with uncontrolled gushers, fires, oil spreads and loud diesel pumps, said Elkind. In the 1920s, a full 20% of the oil produced in the U.S. came from Los Angeles County.

California’s relationship with the oil and gas business survived well into the 1960s. But at the end of that decade the Santa Barbara oil spill helped spur a huge environmental movement, said Michael, the University of North Dakota petroleum expert. With the state’s aggressive pursuit of zero-carbon policies, production of crude has fallen to less than 300,000 barrels a day, about one-fourth of what it was in mid-1980s.

“And I don’t think we’ve hit bottom yet,” said Uduak-Joe Ntuk, an industry expert who until this year oversaw oil fields for the California Department of Conservation’s energy management division. Los Angeles County alone still has thousands of oil wells. “We have billions of barrels of recoverable oil in California, but they’re just in the ground.”

Business

How Iran War Is Threatening Global Oil and Gas Supplies

Ships near the Strait of Hormuz before and after attacks began

Every day, around 80 oil and gas tankers typically pass through the Strait of Hormuz, the narrow waterway off Iran’s southern coast that carries a fifth of the world’s oil and a significant amount of natural gas.

On Monday, just two oil and gas tankers appear to have crossed the strait, according to a New York Times analysis of shipping activity from Kpler, an industry data firm. Since then, one tanker passed through.

“It’s a de facto closure,” said Dan Pickering, chief investment officer of Pickering Energy Partners, a Houston financial services firm. “You’ve got a significant number of vessels on either side of the strait but no one is willing to go through.”

Tankers have been staying away from Hormuz since the U.S.-Israeli attacks on Iran that began on Saturday. A prolonged conflict could ripple broadly across the global economy, threatening the energy supplies of countries halfway around the world and stoking inflation.

International oil prices have climbed 12 percent since the fighting began, trading Tuesday around $81 a barrel, and natural gas prices have surged in Europe and in Asia.

A senior Iranian military official threatened on Monday to “set on fire” any ships traveling through the Strait of Hormuz. Vessels in the region have already come under attack. Several oil and gas facilities have also been struck or affected by nearby shelling, though the damage did not initially appear to be catastrophic.

Where ships and energy facilities have been damaged

A fire broke out Tuesday at a major energy hub in Fujairah, United Arab Emirates, from the falling debris of a downed drone, the authorities said. On Monday, Qatar halted production of liquefied natural gas, or fuel that has been cooled so that it can be transported on ships, after attacks on its facilities.

The sharp reduction in tanker traffic is reducing the supply of oil and gas to world markets, pushing up prices for both commodities. And the longer that ships stay away from the Strait of Hormuz, the less oil and gas get out to the world, which could raise prices even more.

Shipping companies have paused their tankers to protect their crew and cargo, and because insurance companies are charging significantly more to cover vessels in the conflict area.

On Tuesday, President Trump said that “if necessary,” the U.S. Navy would begin escorting tankers through the strait. He also said a U.S. government agency would begin offering “political risk insurance” to shipping lines in the area.

In addition to tankers, other large vessels regularly go through the strait, including car carriers and container ships. In normal conditions, nearly 160 make the trip each day.

Some ships in the region turn off the devices that broadcast their positions, while others transmit false locations — making it hard to give a full picture of the traffic in the strait.

The Shiva is a small oil tanker that has repeatedly faked its location, according to TankerTrackers.com, which tracks global oil shipments. It is suspected of carrying sanctioned Iranian oil, according to Kpler. The Shiva was one of the two tankers that crossed the strait on Monday.

The oil and gas that typically move through the strait come from big producing countries like Saudi Arabia, Iraq, Iran and United Arab Emirates, and are exported around the world.

Where tankers moving through the Strait have traveled

In 2024, more than 80 percent of the oil and gas transported through the Strait of Hormuz went to Asia. China, India, Japan and South Korea were the top importers, according to the U.S. Energy Information Administration.

Countries have energy stockpiles that could last them into the coming months, but a continued shutdown of the strait could damage their economies.

Several big disruptions have roiled supply chains in recent years, but the tanker standstill in the Strait of Hormuz could have an outsize impact.

Business

Paramount credit downgraded to ‘junk’ status over debt worries

Paramount Skydance’s jubilation over its come-from-behind victory to claim Warner Bros. Discovery has entered a new phase:

Call it the deal-debt hangover.

Two major ratings agencies have raised concerns about Paramount’s credit because of the enormous debt the David Ellison-led company will have to shoulder — at least $79 billion — once it absorbs the larger Warner Bros. Discovery, bringing CNN, HBO, TBS and Cartoon Network into the Paramount fold.

Fitch Ratings said Monday that it placed Paramount on its “negative” ratings watch, and downgraded its credit to BB+ from BBB-, which puts the company’s credit into “junk” territory. Fitch said it took action due to “uncertainty” surrounding Paramount’s $110-billion deal for Warner Bros. Discovery, which the boards of both companies approved on Friday.

S&P Global Ratings took similar action.

To finance the Warner takeover, Ellison’s billionaire father, Larry Ellison, has agreed to guarantee the $45.7 billion in equity needed. Bank of America, Citibank and Apollo Global have agreed to provide Paramount with more than $54 billion in debt financing.

“Potential credit risks include the prospective debt-funded structure, Fitch’s expectation of materially elevated leverage and limited visibility on post-transaction financial policy and capital structure,” Fitch said.

Late last week, Paramount sent $2.8 billion to Netflix as a “termination fee” to officially end the streaming giant’s pursuit of Warner Bros. That payment paved the way for Warner and Paramount’s board to enter into the new merger agreement.

Paramount hopes the merger will be wrapped up by the end of September. It needs the approval of Warner Bros. Discovery shareholders and regulators, including the European Union.

Paramount executives acknowledged this week the new company would emerge with $79 billion in debt — a considerably higher total than what Warner Bros. Discovery had following its spinoff from AT&T. That 2022 transaction left Warner Bros. Discovery with nearly $55 billion of debt, a burden that led to endless waves of cost-cutting, including thousands of layoffs and dozens of canceled projects.

Warner still has $33.5 billion in debt, a lingering legacy that will be passed on to Paramount.

Paramount plans to restructure about $15 billion in Warner Bros. Discovery’s existing debt.

Paramount CEO David Ellison at a 2024 movie premiere for a Netflix show.

(Evan Agostini / Invision / AP)

Paramount told Wall Street it would find more than $6 billion in cost cuts or “synergies” within three years — a number that has weighed heavily on entertainment industry workers, particularly in Los Angeles.

Hollywood already is reeling from previous mergers in addition to a sharp pullback in film and television production locally as filmmakers chase tax credits offered overseas and in other states, including New York and New Jersey.

Some entertainment executives, including Netflix Co-Chief Executive Ted Sarandos, have speculated that Paramount will need to find more than $10 billion in cost cuts to make the math work. More recently, Sarandos went higher, telling Bloomberg News that Paramount may need $16 billion in cuts.

Cognizant of widespread fears about additional layoffs, Paramount Chief Operating Officer Andrew Gordon took steps this week to try to tamp down such concerns.

Gordon is a former Goldman Sachs banker and a former executive with RedBird Capital Partners, an investor in Paramount and the proposed Warner Bros. deal. He joined Paramount last August as part of the Ellison takeover.

During a conference call Monday with analysts, Gordon said Paramount would look beyond the workforce for cuts because the company wants to maintain its film and TV production levels.

Paramount plans to look for cost savings by consolidating the “technology stacks and cloud providers” for its streaming services, including Paramount+ and HBO Max, Gordon said. The company also would search for reductions in corporate overhead, marketing expenses, procurement, business services and “optimizing the combined real estate footprint.”

It’s unclear whether Paramount would sell the historic Melrose Avenue lot or simply centralize the sprawling operations onto the Warner Bros. and Paramount lots in Burbank and Hollywood.

Workers are scattered throughout the region.

HBO, owned by Warner Bros. Discovery, maintains its West Coast headquarters in Culver City; CBS television stations operate from CBS’ former lot off Radford Avenue in Studio City; and CBS Entertainment and Paramount cable channels executive teams are located in a high-rise off Gower Street and Sunset Boulevard, blocks from the Paramount movie studio lot.

“The combination of PSKY and WBD could create a materially stronger business than either individual entity,” Standard & Poor’s said in its note to investors. “However, this transaction presents unique challenges because it would involve the combination of three companies, with the smallest, Skydance, being the controlling entity.”

David Ellison’s production firm, Skydance Media, was the entity that bought Paramount, creating Paramount Skydance.

Ellison has not announced what the combined company will be called.

Paramount shares closed down more than 6% Tuesday to $12.45.

Warner Bros. Discovery fell 1% to $28.20. Netflix added less than 1% to close at $97.70.

Business

Commentary: Trump Media’s financial report revives doubts for investors

So much Trump-related news has appeared lately on the airwaves and in web pixels — what with Iran and Epstein and Minnesota and so on — that inevitably a nugget will fall between the cracks.

That seems to have been the fate of the most recent annual financial report of Trump Media and Technology Group, which covered calendar year 2025 and was issued Friday.

Trump Media, which is 52% owned by Donald Trump and trades on Nasdaq with a ticker symbol based on his initials (DJT), is the holding company for Trump’s social media platform, Truth Social.

The value of TMTG’s brand may diminish if the popularity of President Donald J. Trump were to suffer.

— A risk factor disclosed by Trump Media

The annual financial disclosure has garnered minimal press coverage. That’s a pity, because it makes fascinating reading, though not in a good way.

Here are the top and bottom lines from the 10-k annual report: Trump Media lost $712.1 million last year on revenue of about $3.7 million. That’s quite a bit worse than its performance in 2024, when it lost $409 million on revenue of about $3.6 million. The company attributed most of the flood of red ink to “loss from investments,” of which more in a moment.

Truth Social isn’t an especially strong keystone of this operation. The platform is chiefly an outlet for Trump’s social media ramblings and the occasional official White House statements. But no one has to sign in to Truth Social to see them — they’re almost invariably picked up by the news media or reposted by users on other platforms such as X.

That might explain Truth Social’s relatively scrawny user base. The platform is estimated to have about 2 million active users, according to the analytical firm Search Logistics. By comparison, X has about 450 million monthly active users and Facebook has more than 2.9 billion.

It’s no mystery, then, why TMTG disdains “traditional performance metrics like average revenue per user, ad impressions and pricing, or active user accounts, including monthly and daily active users,” according to its annual report.

Relying on those metrics, which are used to judge TMTG’s social media rivals, “might not align with the best interests of TMTG or its stockholders, as it could lead to short-term decision-making at the expense of long-term innovation and value creation.”

Instead, the company says it should be evaluated based on “its commitment to a robust business plan that includes introducing innovative features, new products, new technologies.” But it also acknowledges that, at its heart, TMTG is a proxy for “the reputation and popularity of President Donald J. Trump.” The company warns that “the value of TMTG’s brand may diminish if the popularity of President Donald J. Trump were to suffer.”

How has that played out in real time? Trump Media notched its highest closing price as a public company, $66.22, on March 27, 2024, the day after its initial public offering. In midday trading Monday, the shares were quoted at $11.08, for a loss of 83% since the IPO.

One can’t quibble with stock market price quotes; nor can one finagle annual profit and loss statements, at least not without receiving questions, and perhaps lawsuit complaints, from attentive investors and the Securities and Exchange Commission.

In recent months, TMTG has engaged in a number of baroque financial transactions.

In May, the company announced that it was planning to raise $3.5 billion from institutions to invest in bitcoin, with the money to come from issues of common and preferred shares. The goal was to climb onto the cryptocurrency train, which Trump himself was fueling by, among other things, issuing an executive order promoting the expansion of crypto in the U.S. and denigrating enforcement efforts by the Biden administration as reflecting a “war on cryptocurrency.”

Under Trump, federal regulators have dropped numerous investigations related to cryptocurrencies. Trump has also talked about creating a government crypto strategic reserve, which would entail large government purchases of bitcoin and other cryptocurrencies; a March 3 announcement on that subject briefly sent bitcoin prices soaring by nearly 20%, though they promptly fell back.

Then there’s TMTG’s relationship with Crypto.com, a Singapore-based crypto “service provider” best known to Angelenos unfamiliar with the crypto world as the firm with naming rights to the Los Angeles arena that hosts the NBA Lakers and Clippers, WNBA Sparks and NHL Kings.

In August, Crypto.com and TMTG announced a deal in which TMTG would pursue a crypto treasury strategy consisting mostly of Cronos tokens, a cryptocurrency sponsored by Crypto.com. The initial infusion would consist of 6.4 billion Cronos valued at $1 billion, or about 15.8 cents per Cronos.

As of Dec. 31, TMTG said in its 10-K, it owned 756.1 million Cronos, acquired at a cost of about $114 million, or 15 cents each. By year’s end, they were worth only about nine cents each, for a paper loss of about $46 million. In trading this week, Cronos was quoted at about 7.6 cents, producing a paper loss for TMTG of about $56.5 million, or roughly half the investment.

The financial maneuvering involved in this trade is a little dizzying. The initial transaction was a 50% stock, 50% cash trade in which Crypto.com bought $50 million in TMTG stock and TMTG bought $105 million in Cronos. Who gained in this deal? It’s almost impossible to say.

Crypto.com did gain, if not purely in cash, then arguably through the Trump administration’s good graces.

On March 27, the SEC formally closed an investigation of the company that it had launched during the Biden administration, when the agency was headed by a known crypto skeptic, Gary Gensler. Trump appointed a crypto-friendly regulator, Paul Atkins, as Gensler’s successor.

It’s reasonable to note that as a business model, crypto treasuries have been in vogue over the last year or so, allowing investors to play the crypto market without all the complexities of actually buying and holding the digital assets by buying shares in treasury companies.

I asked Crypto.com whether the steady decline in Cronos’ price suggested that the hookup with TMTG wasn’t bearing fruit. “The fluctuation in value during this time period is consistent with the entire crypto market, which is typical in a bear market,” company spokeswoman Victoria Davis told me by email.

Davis also asserted that the SEC’s investigation of the company had been closed by Gensler, “not the current administration” (i.e., Trump). That’s misleading, at best. Gensler put the investigation on hold after the 2024 election, when it became clear that Trump was going to be in charge.

Crypto.com’s March 27 announcement of the formal end of the case attributed the action to “the current SEC leadership” and blamed the case on “the previous administration.” I asked Davis to explain the discrepancy but got no reply.

TMTG, like Crypto.com, attributed the decline in Cronos’ value to the secular bear market raging in the entire cryptocurrency space, a reflection of “temporary price swings across the crypto market,” said TMTG spokeswoman Shannon Devine. She said the price decline “will not diminish our enthusiasm for the enormous potential of the [CRONOS] ecosystem.”

Trump’s coziness with crypto companies hasn’t gone unnoticed by Democrats on the House Judiciary Committee, who issued a scathing report on the topic in November. (The White House scoffed at the report, saying in response to the report that Trump “only acts in the best interests of the American public.”)

In mid-December, TMTG launched yet another remaking — this time, plunging into the business of fusion power. The instrument is TAE Technologies, a Foothill Ranch-based company working to develop the technology of nuclear fusion as a clean energy source. According to a Dec. 18 announcement, TMTG and TAE will merge, creating what they say is a $6-billion company.

According to the announcement, TMTG will contribute $200 million to the merged company when the deal closes in mid-2026, and an additional $100 million subsequently. Following the merger, TMTG said last month, it will consider spinning off Truth Social into a new publicly traded company.

These arrangements are murky. TAE is privately held and the value of Truth Social is conjectural at best, so TMTG shareholders could be hard-pressed to assess their gains or losses from the merger and spin-off.

What makes them even murkier is the speculative nature of fusion as an electrical power source. Although numerous companies have leaped into the field — and TAE, which has been backed by Alphabet, the parent of Google, is among the oldest — none has shown the capability of generating electrical power at commercial scale with the elusive technology.

Although some researchers say that fusion could become a technically and economically feasible power source within 10 years, only in 2022 did fusion researchers (at Lawrence Livermore National Laboratory) achieve the goal of using fusion to produce more energy than is required to sustain a reaction. They were able to do so only for less than a billionth of a second.

Others working on the technology have expressed doubts that fusion could become a viable power source before the 2040s. The technical challenges, including how to convert the energy produced by a fusion reactor into electricity, remain daunting.

All this points to the fundamental question of what TMTG is supposed to be. TMTG’s original mission, according to its own publicity statements, was to build Truth Social into an alternative social media platform “to end Big Tech’s assault on free speech by opening up the Internet.”

Spinning off Truth Social would place that goal on the side. TMTG is on its way too becoming a hodgepodge of crypto, fusion and other investments selected without regard to whether they fit together or are even achievable. The only constant is Trump himself.

If you want to invest in him, TMTG may be the best way to do it. But judging from its latest financial disclosure, that’s not the same as being a good way to do it.

-

World6 days ago

World6 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts7 days ago

Massachusetts7 days agoMother and daughter injured in Taunton house explosion

-

Denver, CO7 days ago

Denver, CO7 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Louisiana1 week ago

Louisiana1 week agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Oregon5 days ago

Oregon5 days ago2026 OSAA Oregon Wrestling State Championship Results And Brackets – FloWrestling

-

Florida3 days ago

Florida3 days agoFlorida man rescued after being stuck in shoulder-deep mud for days

-

Maryland3 days ago

Maryland3 days agoAM showers Sunday in Maryland

-

Culture1 week ago

Culture1 week agoTry This Quiz on Thrilling Books That Became Popular Movies