Business

Bad Bunny Anchors a Year of Explosive Growth for Latin Music

The highest nominee on the twenty third annual Latin Grammy Awards on Thursday is the Puerto Rican famous person Unhealthy Bunny, with 10 nods for “Un Verano Sin Ti,” his chart-topping, streaming-dominating launch that’s the 12 months’s hottest LP.

However for the broader Latin music enterprise, Unhealthy Bunny is the cherry on prime of a unprecedented 12 months on streaming providers and on tour, by artists together with the singers Karol G, from Colombia, and Anitta, from Brazil; genre-crossing innovators just like the Spanish pop disrupter Rosalía; and regional Mexican bands like Grupo Firme.

Lengthy seen as a distinct segment discipline, Latin music is continuous to penetrate recent markets, with streaming platforms serving to artists attain broad new audiences, who in flip are shopping for up a whole bunch of thousands and thousands of {dollars} in live performance tickets.

“Latin music is having a second,” mentioned Gary Gersh, a longtime music govt who’s the president of world touring and expertise for the live performance firm AEG Presents. “Nevertheless it’s not going away. The doorways have been blown off.”

Within the first half of 2022, gross sales of Latin music recordings reached $510 million in america, a brand new peak, in line with the Recording Business Affiliation of America, and will go $1 billion by the top of the 12 months. Of that complete, 97 p.c got here from streaming — indicating an viewers that’s younger and technologically linked. In response to Spotify, half its customers world wide stream at the very least one Latin tune every month.

Previously, Latin artists have been few and much between among the many business’s prime excursions, however that’s altering. In response to information from the commerce publication Pollstar, the highest 100 excursions world wide for the primary three quarters of 2022 consists of 13 Latin artists who collectively offered $436 million in tickets — up from 9 with $205 million in gross sales for a similar interval in 2019, the final comparable 12 months earlier than the pandemic. (Pollstar’s monitoring interval annually begins in late November.)

Unhealthy Bunny, 28, is the chief of Latin’s present wave, with gross sales and tour numbers that routinely rival and beat English-language pop titans like Taylor Swift and Beyoncé. His newest album notched 13 weeks at No. 1 on the Billboard 200 chart, greater than some other title this 12 months. In response to business estimates, his two excursions in 2022 — one hitting arenas, the opposite stadiums — will prime the year-end world touring record with round $400 million in mixed gross sales, placing him within the league of giants like Swift and U2.

Born Benito Antonio Martínez Ocasio, Unhealthy Bunny — his stage title comes from a childhood costume — represents a brand new form of pop star, with an eclectic model and broad, world enchantment. After rising in 2016, he constructed his profession as a featured visitor, rapping and singing on songs by artists like J Balvin and Cardi B, earlier than releasing his first album, “X100PRE,” in 2018.

Since then he has turn into inescapable, interesting not solely to Spanish-speaking listeners however to followers whose private playlists might also be dotted with hip-hop, Okay-pop and every little thing else. In the meantime, Unhealthy Bunny has expanded into a world model. He has an Adidas sneaker partnership, has wrestled within the W.W.E. and is ready to star within the new Marvel superhero film “El Muerto,” from Sony Footage — whereas additionally being outspoken about political and social struggles in Puerto Rico.

“I don’t assume that popular culture actually has borders or language limitations anymore,” mentioned Jbeau Lewis of United Expertise Company, who books Unhealthy Bunny’s excursions. “I don’t know {that a} fan essentially attracts a distinction between BTS, Taylor Swift or Unhealthy Bunny.”

When tickets to his enviornment outing, El Último Tour del Mundo, have been placed on sale in April 2021, it turned one of many fastest-selling excursions in Ticketmaster’s historical past, and a key information level displaying the business that followers have been desirous to return to live shows amid the pandemic.

Lewis mentioned that whereas these tickets have been being offered, he may see in Ticketmaster’s back-end system that, for some exhibits, as much as 300,000 followers have been ready to purchase extra — an indication of big demand. That day, Lewis mentioned, he referred to as Noah Assad, Unhealthy Bunny’s supervisor, and advised him, “Oh man, we have to maintain some stadiums for subsequent 12 months.”

The current Latin touring powerhouses embody a large spectrum of aesthetics and traditions. Karol G, identified for neon-colored wigs and her Caribbean-flavored hit “Provenza,” made a splash at Coachella in April — the place she paid tribute to previous Latin crossovers like “Macarena” and Daddy Yankee’s “Gasolina” — after which offered $70 million in tickets for her North American tour. That could be the largest haul in historical past for a Latin feminine act.

Maná, a veteran Mexican rock band, performed 12 instances on the Kia Discussion board in Inglewood, Calif., as a part of a residency this 12 months, and simply introduced a North American enviornment tour for 2023. Grupo Firme, a Mexican banda group that has collaborated with pan-Latin pop stars like Camilo and Maluma, has offered $57 million in tickets in 2022, in line with Pollstar.

Traditionally, artists singing primarily in Spanish — or any language apart from English — confronted an enormous barrier to success when it got here to radio. However streaming has supplied a path round that impediment, and lots of Latin acts have flourished consequently. An early indication of this shift was “Despacito,” the 2017 tune by Luis Fonsi and Daddy Yankee, which turned an enormous hit on YouTube — although its success was partly attributable to a radio-friendly remix that includes Justin Bieber.

“The barrier just isn’t the identical because it was once, that you just needed to have a tune at radio so you’ll be able to promote a lot of tickets,” mentioned Gersh, of AEG. “I believe we’re going to see extra music that isn’t sung in English reaching English-speaking youngsters, and we’re most likely going to see extra English-language music attain into different nations the place English isn’t the primary language.”

“That, to me, is the true different music — it’s the choice to the mainstream,” added Gersh, who was one of many figures who kicked off the choice rock explosion within the Nineteen Nineties by signing Nirvana to DGC Information.

Radio continues to be lagging behind this wave. Whereas Unhealthy Bunny is the king of streaming — he was the most-streamed act on Spotify in 2020 and 2021, and stands likelihood of retaining the title this 12 months — he’s solely the 119th most performed artist on High 40 radio stations to this point this 12 months, in line with the monitoring service Mediabase.

To some extent, demographic shifts will help clarify the expansion of Spanish-language music. As of 2021, 19 p.c of the whole United States inhabitants recognized as Hispanic, up from 16 p.c in 2010 and simply 5 p.c in 1970, in line with Census information and the Pew Analysis Heart.

These followers can straddle a number of genres and cultural areas, mentioned AJ Ramos, a longtime radio and streaming programmer who’s the pinnacle of artist partnerships for Latin music at YouTube. Utilizing himself for instance — born in america, talking Spanish at house in a Salvadorean household, however rising up a hip-hop fan — he describes these culture-straddling followers as representing “the 200 p.c.”

“You might have Mexican artists like Yahritza y Su Esencia and Fuerza Regida, who embrace American tradition and embrace Latin tradition, residing in each areas,” Ramos mentioned. “That viewers will go from a Kendrick Lamar report to a Fuerza Regida report.” (Yahritza y Su Esencia, a trio of siblings whose Mexican household migrated to an agricultural space of Washington State, is up for 2 Latin Grammys, together with finest new artist.)

That success — enabled by streaming and social media, and now amply seen on tour — will solely proceed sooner or later, mentioned Maykol Sanchez, an govt at Spotify who handles Latin artist and label partnerships.

“Previously, it was more durable,” Sanchez mentioned. “In the present day, you’ll be able to have an artist from Chile that has successful, and it occurs globally on Spotify, creating an area for that artist develop greater.”

Business

Eight arrested in multimillion-dollar retail theft operation, Los Angeles County sheriff officials say

Eight people were arrested on suspicion of organized retail theft after authorities discovered several million dollars’ worth of stolen medicines, cosmetics and other merchandise at multiple Los Angeles locations, sheriff officials said.

The retail goods were stolen by crews of organized shoplifters at stores in California, Arizona and Nevada, according to detectives. The stolen items were then taken to various locations in L.A. County where they were sold to various “fence” operations, officials said.

Authorities investigating retail theft refer to people who buy stolen goods and then resell them for a profit as “fences.”

The Sheriff’s Department said they had also recovered a stolen firearm and a large sum of cash, according to a release sent late Friday.

The suspects, who were not named, are being held on $60,000 bail each.

Early Thursday morning, sheriff‘s detectives performed raids at a dozen locations in Los Angeles thought to be involved in the crime ring, according to KCAL CBS.

At a small South L.A. market, they found boxes of stolen Motrin, Theraflu and other goods stacked floor to ceiling, the report said. Store tags were still affixed to much of the merchandise. The location appeared to be where the goods were relabeled for sale, officials said.

Detectives said they worked with the help of stores, including CVS and Walmart, to track the illegal operation.

The stolen merchandise is often sold online, officials said, including on Amazon.

The investigation is ongoing. Anyone with information should contact the Organized Retail Crimes Task Force at (562) 946-7270.

Business

Bob Bakish is ousted as CEO of Paramount Global as internal struggles explode into public view

Paramount Global’s months-long internal struggles spilled into full view Monday as Chief Executive Bob Bakish was ousted and pressure mounted for the company’s directors to accept — or reject — a takeover bid by David Ellison’s Skydance Media.

Moments before the company announced its first-quarter earnings, Paramount issued a statement announcing Bakish’s departure. The company said three of its top entertainment executives would run the firm: Paramount Pictures CEO Brian Robbins; CBS CEO George Cheeks; and Showtime/MTV Entertainment Studios chief Chris McCarthy.

Bakish’s firing comes during a tumultuous period for the company as its traditional TV and movie studio businesses decline amid head winds for the media industry. Bakish also was at odds with controlling shareholder Shari Redstone, who is seeking an exit.

Redstone, who has presided over the steep decline of her family’s media heirloom, is in a bind. She doesn’t want the company built by her father, the late, ferocious mogul Sumner Redstone, carved up and sold for parts at auctions. Paramount includes the CBS television network, MTV, Nickelodeon, BET and the Paramount Pictures movie studio on Melrose Avenue.

But Paramount’s common shareholders are wary of the two-phased deal with Skydance because Redstone will get a premium for her family’s shares.

Paramount is in the midst of a 30-day exclusive negotiating period with Ellison, a tech scion whose Skydance Media has teamed up with investment firms RedBird Capital and KKR to acquire Redstone’s National Amusements holding company. On Sunday, Skydance sweetened its offer by $1 billion, with money earmarked for Paramount’s B-class, or nonvoting, shareholders, according to three people familiar with the deal but not authorized to comment. National Amusements holds 77% of Paramount’s voting shares.

The exclusive negotiating period ends Friday. It is unclear whether Skydance and RedBird have given Paramount’s board a deadline to accept its revised offer. Skydance and its partners have been wrangling with Paramount’s independent board members over how much money will go to common shareholders, two knowledgeable people said. Skydance and its partners have pressed for more of the proceeds to pay down Paramount’s debt.

The company’s credit last month was downgraded to “junk” status by ratings agency S&P Global.

Bakish was opposed to the Skydance transaction, a stance that infuriated Redstone, who in 2016 handpicked Bakish to run the company, then known as Viacom. In recent weeks, senior company executives also raised questions about Bakish’s leadership and the strength of his long-range plan in their conversations with board members — a development that expedited Bakish’s departure from the company, the sources said.

Bakish was more open to another proposed deal, favored by smaller shareholders, with private equity firm Apollo Global Management, which has offered $26 billion, including the assumption of Paramount’s debt. Sony Pictures Entertainment has been negotiating with Apollo to join that effort. Most insiders expect that Apollo and Sony would break the company apart, a scenario that Redstone does not want to allow.

Redstone, according to one person familiar with the matter, has also been frustrated with some of Bakish’s decisions, including not selling Showtime, the premium cable network that the company folded into its television networks and streaming effort. Bakish had dismissed a recent offer of $3 billion for the channel from investors, including former Showtime head David Nevins.

Paramount, meanwhile, has lost more than $2 billion on its streaming service, Paramount+.

“Paramount Global includes exceptional assets and we believe strongly in the future value creation potential of the Company,” Redstone said in a statement. “I have tremendous confidence in George, Chris and Brian. They have both the ability to develop and execute on a new strategic plan and to work together as true partners. I am extremely excited for what their combined leadership means for Paramount Global and for the opportunities that lie ahead.”

In addition, the company faces a crucial Wednesday deadline to strike a new deal with cable distribution giant Charter Communications, which runs the Spectrum TV service.

Paramount entered the Charter negotiations with a weak hand — its cable television channels have suffered from falling ratings amid consumers’ shift to streaming. Paramount relies heavily on the revenue it receives from Charter, Comcast, DirecTV and other distributors.

“Paramount still has a popular network, an esteemed studio, and solid streaming services, but its business prospects look tenuous as it looks to sell,” EMarketer senior analyst Ross Benes wrote Monday in an emailed statement. “Arranging a new quixotic leadership structure may appease those looking for new blood. But the dramatic removal evokes a feeling of rearranging deck chairs on the Titanic.”

Less than two minutes after Paramount announced Bakish’s departure, the company reported its earnings results.

At the beginning of a call with analysts, company executives said they would not take questions after reporting their financial results. The call lasted slightly less than 10 minutes.

After Cheeks thanked Bakish for “his many years of leadership and steadfast support for all Paramount Global businesses, brands and people,” McCarthy tried to calm concerns about the new triumvirate leadership structure, saying that he, Cheeks and Robbins have worked together for years.

“It’s a true partnership,” McCarthy said. “We have a deep respect for one another, we’re going to lead and manage this company together.”

He said the company’s long-term strategic plan would be focused around three pillars — making the most of the company’s popular content, strengthening its balance sheet and optimizing its streaming strategy.

Paramount reported $7.68 billion in revenue for the three-month period that ended March 31, up almost 6% compared with the same period a year earlier. Paramount reported a net loss of $554 million, but that was less than its loss of more than $1 billion from a year earlier.

The company’s streaming division saw increased revenue of nearly $1.88 billion, up 24% compared with a year earlier. The segment’s quarterly loss was $287 million.

The company’s TV media revenue was aided by CBS’ February broadcast of the Super Bowl, which drew a massive audience. Revenue for the television networks division totaled $5.23 billion, up 1% compared with a year earlier. Paramount’s film division revenue totaled $605 million, up almost 3% compared with a year earlier.

The media empire now known as Paramount Global was formed in 2019 from the merger of Viacom Inc. and CBS Corp. But the combination never convinced Wall Street of its promise. In the last year alone, Paramount Global’s stock has lost nearly half of its value.

“While the mighty Viacom empire declined tremendously under Bakish, who profited handsomely personally, it isn’t clear that another appointed leader would have changed Paramount’s fortune,” Benes of EMarketer wrote in a note to investors. “With a mountain of debt and its primary assets, namely TV, continually losing value, the deep problems facing the company extend beyond any single executive.”

Bakish, who joined Viacom in 1997, was named CEO of Viacom in 2016, after the company’s stock had fallen 45% in two years due to falling ratings at some of its key networks, including Comedy Central and MTV, as well as struggles at its Paramount Pictures film studio.

After Redstone orchestrated the merger of Viacom with CBS, Bakish became CEO of the combined enterprise.

“The Board and I thank Bob for his many contributions over his long career, including in the formation of the combined company as well as his successful efforts to rebuild the great culture Paramount has long been known for,” Redstone said in her statement.

Paramount’s B-class stock rose 3% to $12.25 a share Monday before Bakish’s departure was officially announced. The shares continued to gain slightly in after-hours trading.

Business

Granderson: Here's one way to bring college costs back in line with reality

It took me by surprise when my son initially floated the idea of not going to college. His mother and I attended undergrad together. He was an infant on campus when I was in grad school. She went on to earn a PhD.

“What do you mean by ‘not go to college’?” I pretended to ask.

My tone said: “You’re going.” (He did.)

Opinion Columnist

LZ Granderson

LZ Granderson writes about culture, politics, sports and navigating life in America.

The children of first-generation college graduates are not supposed to go backpacking across (insert destination here). They’re supposed to continue the climb — especially given that higher education was unattainable for so many for so long. The thought of not sending my son to college felt like regression for our family. In retrospect, our conversation said more about the future.

A 2023 study of nearly 6,000 human resources professionals and leaders in corporate America found only 22% required applicants to have a college degree.

The labor shortage is one aspect of the conversation. The shift in academia’s place in society is more significant.

I’m sure that sounds like a good thing for young people joining the workforce. As an educator, my concern is what happens to a society if only the wealthy pursued higher education. Oh, that’s right: We did that already, back before there was a middle class … and paid vacations.

Though it must be said the lowering of hiring requirements isn’t the only threat to the college experience.

Academia has publicly mishandled the campus tensions and student protests that began after the Hamas attack against Israel on Oct. 7, and that certainly hasn’t been good for academia either. Neither has canceling commencement speakers … or commencement itself. Add in the rising costs — up nearly 400% in 30 years compared with 1990 rates — and, well, the college bubble hasn’t quite burst, but it’s hemorrhaging.

Forgiving student loan debt — whether you agree with the idea or not — addresses the past.

The future of colleges depends on the future of labor. If employers are making it easier to enter corporate America without a degree, then universities must adjust how much cash they try to extract from students and their families, because the return on investment will be falling.

College enrollment has already been declining for a decade, and it’s not because Americans have become less ambitious or less willing to invest in their children’s futures. It’s because of eroding confidence that a degree guarantees a higher quality of life.

Imagine that your high school senior is interested in going to college and wants to major in education or communication or the arts. The sticker price for tuition, even at a state school, is going to look pretty steep. If your child were headed toward a degree in engineering or business, that same tuition might feel like a better bet.

There’s no reason tuition rates couldn’t vary to reflect this reality. Colleges and universities should set tuition rates for classes based on the earning potential of the discipline studied.

If our groceries stores can figure out a way to charge us more for organic produce, then surely this great nation can devise a system to set college costs that accounts for future earnings.

For example, according to the National Education Assn., the starting salary for a teacher in California is about $55,000, the fourth highest in the nation. For California residents, the cost to attend UCLA comes to almost $35,000 a year, without financial aid. That math just doesn’t work.

It’s easy to see why 20% of the nation’s teachers work a second job during the school year to make ends meet. Between 2020 and 2022, the nation lost about 300,000 educators, and we’re facing a teacher shortage. To address the issue, a number of states have loosened the teacher certification rules to make it easier to get more bodies in the classroom, which sounds … less than ideal.

Instead, why not lower the cost of credit hours for college students pursuing a degree in education? Wouldn’t parents feel more comfortable knowing the people in the classroom set out to teach and earned the credentials?

If colleges don’t find ways like this to lower costs for at least some students, higher education will become a relic. Just as cable cutting reshaped the economics of the TV industry, the trend of corporate America moving away from degree requirements is going to put pressure on universities to make some big changes.

There have already been tectonic shifts in a short period of time. Because of the COVID-19 pandemic, colleges lost international students, who once propped up many institutions by paying higher rates than Americans.

Attendance by Americans is forecast to plummet starting next year. Because of low birth rates and low rates of immigration, the U.S. has fewer young people in the classes graduating from high school after 2025.

And perhaps most importantly, our confidence in college is slipping. In 2015, when my son graduated from high school, Gallup found nearly 60% of Americans had a “great deal” or “quite a lot” of confidence in our higher education system. It was under 50% in 2018. It was under 40% last year.

No telling what that number is today.

Which is sad because there is still so much to value — beyond career choices — to a liberal arts education. Given how we live, college is one of the few places we have left in America where young people from different walks of life can meet. That’s important to the health of a nation as diverse — and segregated — as we are.

Colleges will naturally shrink because of demographics, and they can use this time to adjust their business models as well and charge fairer prices. We need young people to be able to replenish all career fields, and that includes art and music and education. It’s time to rethink the economic approach so they aren’t saddled with debt that those careers can’t repay.

-

Politics1 week ago

Politics1 week agoColumbia University’s policy-making senate votes for resolution calling to investigate school’s leadership

-

News1 week ago

News1 week agoBoth sides prepare as Florida's six-week abortion ban is set to take effect Wednesday

-

World1 week ago

World1 week agoBrussels, my love? MEPs check out of Strasbourg after 5 eventful years

-

News1 week ago

News1 week agoPro-Palestinian campus protesters face looming deadlines and risk of arrest

-

Politics1 week ago

Politics1 week agoHouse Republicans brace for spring legislative sprint with one less GOP vote

-

Politics1 week ago

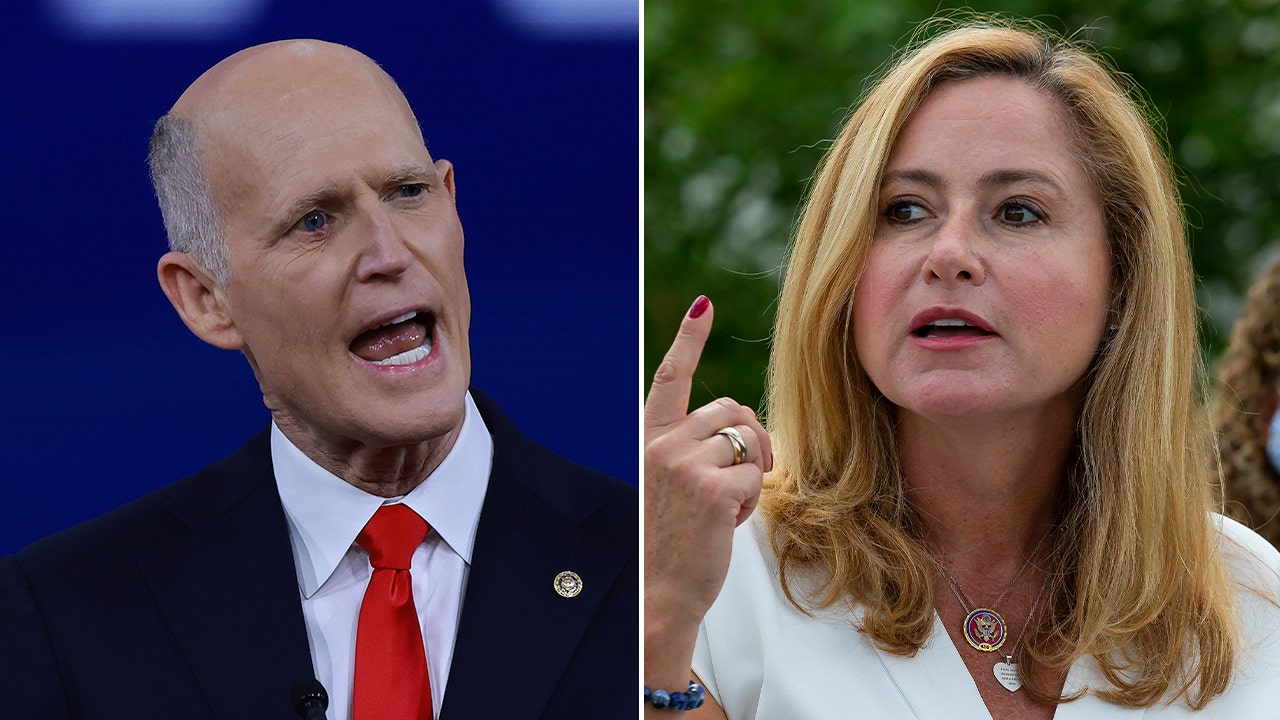

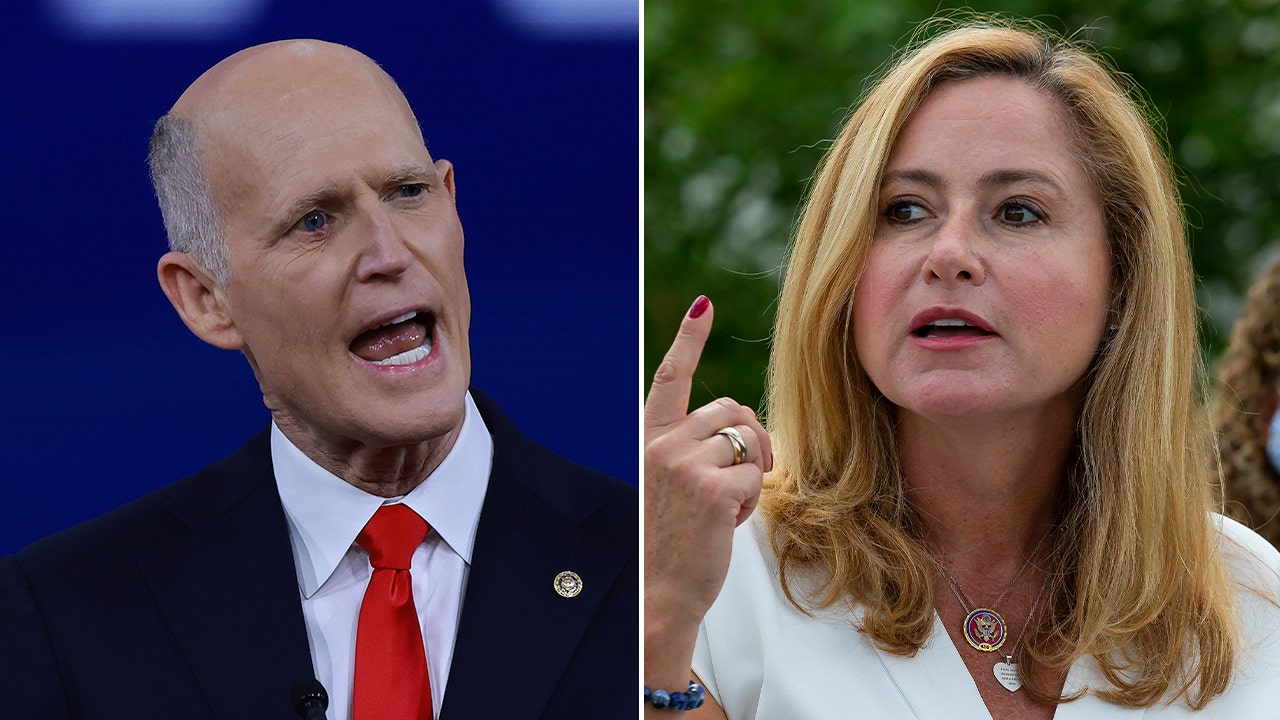

Politics1 week agoRepublican makes major announcement in push to grow GOP support from once-solid Dem voting bloc

-

Politics1 week ago

Politics1 week agoGOP Rep. Bill Posey won't seek re-election, endorses former Florida Senate President as replacement

-

World1 week ago

World1 week agoAt least four dead in US after dozens of tornadoes rip through Oklahoma