Business

Warner nixes Paramount’s bid (again), citing proposed debt load

Paramount’s campaign to acquire Warner Bros. Discovery was dealt another blow Wednesday after Warner’s board rejected a revised bid from the company.

The board cited the enormous debt load that Paramount would need to finance its proposed $108-billion takeover.

Warner’s board this week unanimously voted against Paramount’s most recent hostile offer — despite tech billionaire Larry Ellison agreeing in late December to personally guarantee the equity portion of Paramount’s bid. Members were not swayed, concluding the bid backed by Ellison and Middle Eastern royal families was not in the best interest of the company or its shareholders.

Warner’s board pointed to its signed agreement with Netflix, saying the streaming giant’s offer to buy the Warner studios and HBO was solid.

The move marked the sixth time Warner’s board has said no to Paramount since Ellison’s son, Paramount Chief Executive David Ellison, first expressed interest in buying the larger entertainment company in September.

In a Wednesday letter to investors, Warner board members wrote that Paramount Skydance has a market value of $14 billion. However, the firm is “attempting an acquisition requiring $94.65 billion of [debt and equity] financing, nearly seven times its total market capitalization.”

The structure of Paramount’s proposal was akin to a leveraged buyout, Warner said, adding that if Paramount was to pull it off, the deal would rank as the largest leveraged buyout in U.S. history.

“The extraordinary amount of debt financing as well as other terms of the PSKY offer heighten the risk of failure to close, particularly when compared to the certainty of the Netflix merger,” the Warner board said, reiterating a stance that its shareholders should stick to its preferred alternative to sell much of the company to Netflix.

The move puts pressure on Paramount to shore up its financing or boost its cash offer above $30 a share.

However, raising its bid without increasing the equity component would only add to the amount of debt that Paramount would need to buy HBO, CNN, TBS, Animal Planet and the Burbank-based Warner Bros. movie and television studios.

Paramount representatives were not immediately available for comment.

“There is still a path for Paramount to outbid Netflix with a substantially higher bid, but it will require an overhaul of their current bid,” Lightshed Partners media analyst Rich Greenfield wrote in a Wednesday note to investors. Paramount would need “a dramatic increase in the cash invested from the Ellison family and/or their friends and financing partners.”

Warner Bros. Discovery’s shares held steady around $28.55. Paramount Skydance ticked down less than 1% to $12.44.

Netflix has fallen 17% to about $90 a share since early December, when it submitted its winning bid.

The jostling comes a month after Warner’s board unanimously agreed to sell much of the company to Netflix for $72 billion. The Warner board on Wednesday reaffirmed its support for the Netflix deal, which would hand a treasured Hollywood collection, including HBO, DC Comics and the Warner Bros. film studio, to the streaming giant. Netflix has offered $27.75 a share.

“By joining forces, we will offer audiences even more of the series and films they love — at home and in theaters — expand opportunities for creators, and help foster a dynamic, competitive, and thriving entertainment industry,” Netflix co-Chief Executives Ted Sarandos and Greg Peters said in a joint statement Wednesday.

After Warner struck the deal with Netflix on Dec. 4, Paramount turned hostile — making its appeal directly to Warner shareholders.

Paramount has asked Warner investors to sell their shares to Paramount, setting a Jan. 21 deadline for the tender offer.

Warner again recommended its shareholders disregard Paramount’s overtures.

Warner Bros.’ sale comes amid widespread retrenchment in the entertainment industry and could lead to further industry downsizing.

The Ellison family acquired Paramount’s controlling stake in August and quickly set out to place big bets, including striking a $7.7-billion deal for UFC fights. The company, which owns the CBS network, also cut more than 2,000 jobs.

Warner Bros. Discovery was formed in 2022 following phone giant AT&T’s sale of the company, then known as WarnerMedia, to the smaller cable programming company, Discovery.

To finance that $43-billion acquisition, Discovery took on considerable debt. Its leadership, including Chief Executive David Zaslav, spent nearly three years cutting staff and pulling the plug on projects to pay down debt.

Paramount would need to take on even more debt — more than $60 billion — to buy all of Warner Bros. Discovery, Warner said.

Warner has argued that it would incur nearly $5 billion in costs if it were to terminate its Netflix deal. The amount includes a $2.8-billion breakup fee that Warner would have to fork over to Netflix. Paramount hasn’t agreed to cover that amount.

Warner also has groused that other terms in Paramount’s proposal were problematic, making it difficult to refinance some of its debt while the transaction was pending.

Warner leaders say their shareholders should see greater value if the company is able to move forward with its planned spinoff of its cable channels, including CNN, into a separate company called Discovery Global later this year. That step is needed to set the stage for the Netflix transaction because the streaming giant has agreed to buy only the Warner Bros. film and television studios, HBO and the HBO Max streaming platform.

However, this month’s debut of Versant, comprising CNBC, MS NOW and other former Comcast channels, has clouded that forecast. During its first three days of trading, Versant stock has fallen more than 20%.

Warner’s board rebuffed three Paramount proposals before the board opened the bidding to other companies in late October.

Board members also rejected Paramount’s Dec. 4 all-cash offer of $30 a share. Two weeks later, it dismissed Paramount’s initial hostile proposal.

At the time, Warner registered its displeasure over the lack of clarity around Larry Ellison’s financial commitment to Paramount’s bid. Days later, Ellison agreed to personally guarantee $40.4 billion in equity financing that Paramount needs.

David Ellison has complained that Warner Bros. Discovery has not fairly considered his company’s bid, which he maintains is a more lucrative deal than Warner’s proposed sale to Netflix. Some investors may agree with Ellison’s assessment, in part, due to concerns that government regulators could thwart the Netflix deal out of concerns about the Los Gatos firm’s increasing dominance.

“Both potential mergers could severely harm the viewing public, creative industry workers, journalists, movie theaters that depend on studio content, and their surrounding main-street businesses, too,” Matt Wood, general counsel for consumer group Free Press Action, testified Wednesday during a congressional committee hearing.

“We fear either deal would reduce competition in streaming and adjacent markets, with fewer choices for consumers and fewer opportunities for writers, actors, directors, and production technicians,” Wood said. “Jobs will be lost. Stories will go untold.”

Business

Defiant independence from the Federal Reserve catches Trump off guard

WASHINGTON — White House officials were caught by surprise when a post appeared Sunday night on the Federal Reserve’s official social media channel, with Jerome Powell, its chairman, delivering a plain and clear message.

President Trump was not only weaponizing the Justice Department to intimidate him, Powell said to the camera, standing before an American flag. This time, he added, it wasn’t going to work.

The lack of any warning for officials in the West Wing, confirmed to The Times, was yet another exertion of independence from a Fed chair whose stern resistance to presidential pressure has made him an outlier in Trump’s Washington.

-

Share via

Powell was responding to grand jury subpoenas delivered to the Fed on Friday related to his congressional testimony over the summer regarding construction work at the Reserve.

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the president,” Powell said.

“This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions,” he added, “or whether instead monetary policy will be directed by political pressure or intimidation.”

For months, Trump and his aides have harshly criticized Powell for his decision-making on interest rates, which the president believes should be dropped faster. On various occasions, Trump has threatened to fire Powell — a move that legal experts, and Powell himself, have said would be illegal — before pulling back.

The Trump administration is currently arguing before the Supreme Court that the president should have the ability to fire the heads of independent agencies at will, despite prior rulings from the high court underscoring the unique independence of the central bank.

The decision by the Justice Department to subpoena the Fed over the construction — a $2.5-billion project to overhaul two Fed buildings, operating unrenovated since the 1930s — comes at a critical juncture for the U.S. economy, which has been issuing conflicting signals over its health.

Employers added only 50,000 jobs last month, fewer than in November, even as the unemployment rate dipped a tenth of a point to 4.4%, for its first decline since June. The figures indicate that businesses aren’t hiring much despite inflation slowing down and growth picking up.

The government reported last month that inflation dropped to an annual rate of 2.7% in November, down from 3% in September, while economic growth rose unexpectedly to an annual rate of 4.3% in the third quarter.

However, the long government shutdown interrupted data collection, lending doubt to the numbers. At the same time, there is uncertainty about the legality of $150 billion or more in tariffs imposed on China and dozens of countries through the International Emergency Economic Powers Act, which has been challenged and is under review by the Supreme Court.

As inflation has cooled, the Fed under Powell has incrementally cut the federal funds rate, the target interest rate at which banks lend to one another and the bank’s primary tool for influencing inflation and growth. The Fed held the rate steady at a range of 4.25% to 4.5% through August, before a series of fall cuts left it at 3.5% to 3.75%.

That hasn’t been enough for Trump, who has called for the rate to be lowered faster and to a nearly rock bottom 1%. The last time the central bank dropped the rate so low was in the dark days of the early pandemic in March 2020. It began raising rates in 2022 as inflation took off and proved stubborn despite the bank’s efforts to rein it in.

Mark Zandi, chief economist at Moody’s Analytics, said there is room to continue lowering the federal funds rate to 3%, where it should be in a “well functioning economy, neither supporting or restraining growth.”

However, muscling the Fed to lower rates and reduce or destroy its independence is another matter.

“There’s no upside to that. It’s all downside, different shades of gray and black, depending on how things unfold,” he said. “It ends in higher inflation and ultimately a much diminished economy and potentially a financial crisis.”

Zandi said much will hinge on the Supreme Court’s decision on whether Trump can remove Federal Reserve Governor Lisa Cook, which he sought to do last year, citing allegations of mortgage fraud she denies.

While Powell’s term as chairman ends in May, his term as a governor — influencing interest-rate decisions — extends to January 2028. A criminal indictment over the construction project could provide Trump the legal justification he needs to remove him altogether.

“When he steps down in May, will he stay on the board or does he leave? That will make a difference,” Zandi said.

A key issue will be how much independence the Fed retains, he said, given the central bank’s role in establishing the U.S. as a safe haven for international bond investors who play a key role funding the federal deficit.

The investors rely on the bank to keep inflation under control, or they will demand the government pay more for its long term bonds — though the subpoenas had little effect so far Monday on bond prices.

“There are scenarios where the bond market says, ‘Oh my gosh, we’re going to see much higher inflation, and there’s a bond sell-off and a spike in long-term rates,” he said. “That’s a crisis.”

Zandi said that even if the worst-case scenarios don’t play out, it will take time for the Federal Reserve to reestablish its reputation as an independent bank not influenced by politics.

“I’m not sure investors will ever forget this,” he said. “Most importantly, it depends on who Trump nominates to be the next chair of the Federal Reserve — and how that person views his or her job.”

Lawmakers from both parties have questioned the motivation behind the investigation.

North Carolina Sen. Thom Tillis, a Republican member of the Senate Committee on Banking, Housing and Urban Affairs, has said he plans to oppose the confirmation of any nominee for the Fed until the legal matter is “fully resolved.”

“If there were any remaining doubt whether advisers within the Trump administration are actively pushing to end the independence of the Federal Reserve, there should now be none,” Tillis wrote in a social media post.

Sen. Elizabeth Warren, the top Democrat on that committee, accused Trump of trying to “install another sock puppet to complete his corrupt takeover of America’s central bank.”

“Trump is abusing the authorities of the Department of Justice like a wannabe dictator so the Fed serves his interests, along with his billionaire friends,” Warren said in a statement.

Rep. French Hill (R-Ark.), the chairman of the House Financial Services Committee, also expressed skepticism about the inquiry, which he characterized as an “unnecessary distraction.”

“The Federal Reserve is led by strong, capable individuals appointed by President Trump, and this action could undermine this and future Administrations’ ability to make sound monetary public decisions,” Hill wrote in a statement.

As Hill raised concerns about the investigation, he added he personally knew Powell to be a “person of the highest integrity.”

House Speaker Mike Johnson (R-La.), meanwhile, dismissed the idea that the Justice Department was being weaponized against Powell. When asked by a reporter if he thought that was the case, he said: “Of course not.”

Times staff writers Wilner and Ceballos reported from Washington and Darmiento from Los Angeles.

Business

Mattel introduces its first Barbie with autism, headphones on and fidget spinner in hand

Mattel is releasing its first autistic Barbie doll.

Created in partnership with the Autistic Self Advocacy Network (ASAN), the toy launched Monday is meant to represent children with autism spectrum disorder and how they experience the world.

The doll joins the Barbie Fashionistas line, which features more than 175 looks across various skin tones, body types and disabilities.

Previous additions include Barbie dolls with Type 1 diabetes, Down syndrome and blindness.

The Barbie with autism was in development for more than 18 months. ASAN, the nonprofit disability rights organization run by and for the autistic community, provided guidance as to how the doll can most accurately represent the various experiences people on the autism spectrum may relate to and celebrate the community.

The toy features elbow and wrist articulation, which allows for stimming and other gestures. Her eyes are shifted to the side to avoid eye contact.

She carries a fidget spinner and a tablet. She also wears noise-canceling headphones and a loose-fitting dress that allows for less fabric-to-skin contact.

To celebrate the new doll, Mattel is donating more than 1,000 autistic Barbies to pediatric hospitals across the country that offer specialized services for children on the spectrum. According to the autism nonprofit, Autism Speaks, one in 31 children and one in 45 adults in the U.S. has autism.

“Barbie has always strived to reflect the world kids see and the possibilities they imagine, and we’re proud to introduce our first autistic Barbie as part of that ongoing work,” said Jamie Cygielman, global head of dolls at Mattel, in a press release.

She added that the doll “helps to expand what inclusion looks like in the toy aisle and beyond because every child deserves to see themselves in Barbie.”

The toymaker’s investments in diversity and representation have proved commercially successful.

The Fashionistas line launched in 2009 and has provided the opportunity to create dolls beyond Barbie’s original look. In 2024, the most popular Fashionistas dolls globally included the blind Barbie and the Barbie with Down syndrome. The wheelchair-using doll has also consistently been a top performer since its debut in 2019.

Founded in 1945, Mattel started out of a Los Angeles garage. Over the last 80 years, the El Segundo-based company cemented itself as a multibillion-dollar toy company with products and brands like Fisher-Price, Hot Wheels cars and American Girl.

The new autistic Barbie is available starting Monday through Mattel Shop and retailers nationwide.

Business

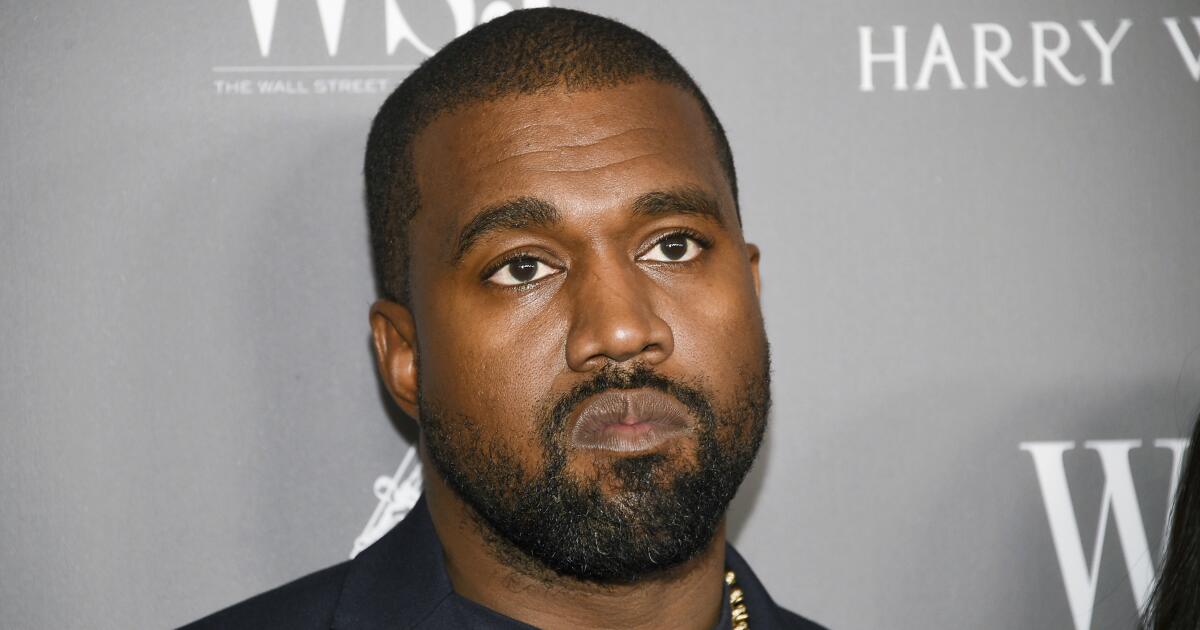

Kanye West sues ex-employee over Malibu mansion lien

Kanye West, the rapper now known as Ye, is suing his former project manager and his lawyers, alleging they wrongfully put a $1.8-million lien on his former Malibu mansion.

The suit, filed in Los Angeles Superior Court on Thursday, alleges that Tony Saxon, Ye’s former project manager on the property, and the law firm West Coast Trial Lawyers, “wrongfully” placed an “invalid” lien on the property “while simultaneously launching an aggressive publicity campaign designed to pressure Ye, chill prospective transactions, and extract payment on disputed claims already being litigated in court.”

Saxon’s lawyers were not immediately available for comment.

Saxon, who was also employed as West’s security guard and caretaker at the Malibu property, sued the controversial rapper in Los Angeles Superior Court in September 2023, claiming a slate of labor violations, nonpayment of services and disability discrimination.

In January 2024, Saxon placed the $1.8-million “mechanics” lien on the property in order to secure compensation for his work as project manager and construction-related services, according to court filings.

A mechanics lien, also referred to as a contractor’s lien, is usually filed by an unpaid contractor, laborer or supplier, as a hold against the property. If the party remains unpaid, it can prompt a foreclosure sale of the property to secure compensation.

Ye has denied Saxon’s allegations. In a November 2023 response to the complaint, Ye disputed that Saxon “has sustained any injury, damage, or loss by reason of any act, omission or breach by Defendant.”

According to Ye’s recent complaint, he listed the property for sale in December 2023. A month later, he alleged, Saxon and his attorneys recorded the lien and “immediately” issued statements to the media.

The suit cites a statement Saxon’s attorney, Ronald Zambrano, made to Business Insider: “If someone wants to buy Kanye’s Malibu home, they will have to deal with us first. That sale cannot happen without Tony getting paid first.”

“These statements were designed to create public pressure and to interfere with the Plaintiffs’ ability to sell and finance the Property by falsely conveying that Defendants held an adjudicated, enforceable right to block a transaction and divert sale proceeds,” the complaint states.

The filing contends that last year the Los Angeles Superior Court granted Ye’s motion to release the lien from the bond and awarded him attorneys fees.

The Malibu property’s short existence has a long history of legal and financial drama.

In 2021, West purchased the beachfront concrete mansion — designed by Pritzker Prize-winning Japanese architect Tadao Ando — for $57.3 million. He then gutted the property on Malibu Road, reportedly saying “This is going to be my bomb shelter. This is going to be my Batcave.”

Three years later, the hip-hop star sold the unfinished mansion (he had removed the windows, doors, electricity and plumbing and broke down walls), at a significant loss to developer Steven Belmont’s Belwood Investments for $21 million.

Belmont, who spent more money to renovate the home, had spent three years in prison after being charged with attempted murder for a pitchfork attack in Napa County. He promised to restore the architectural jewel to its former glory.

However, the property has been mired in various legal and financial entanglements including foreclosure threats.

Last August, the notorious mansion was once again put on the market with a $4.1 million price cut after a previous offer reportedly fell through, according to Realtor.com.

The legal battle surrounding Ye’s former Malibu pad is the latest in a series of public and legal dramas that the music impresario has been involved in recent years.

In 2022, the mercurial superstar lost numerous lucrative partnerships with companies like Adidas and the Gap, following a raft of antisemitic statements, including declaring himself a Nazi on X (which he later recanted).

Two years later, Ye abruptly shut down Donda Academy, the troubled private school he founded in 2020.

Ye, the school and some of his affiliated businesses faced faced multiple lawsuits from former employees and educators, alleging they were victims of wrongful termination, a hostile work environment and other claims.

In court filings, Ye has denied each of the claims made against him by former employees and educators at Donda.

Several of those suits have been settled.

-

Detroit, MI1 week ago

Detroit, MI1 week ago2 hospitalized after shooting on Lodge Freeway in Detroit

-

Technology7 days ago

Technology7 days agoPower bank feature creep is out of control

-

Dallas, TX4 days ago

Dallas, TX4 days agoAnti-ICE protest outside Dallas City Hall follows deadly shooting in Minneapolis

-

Delaware4 days ago

Delaware4 days agoMERR responds to dead humpback whale washed up near Bethany Beach

-

Dallas, TX1 week ago

Dallas, TX1 week agoDefensive coordinator candidates who could improve Cowboys’ brutal secondary in 2026

-

Montana2 days ago

Montana2 days agoService door of Crans-Montana bar where 40 died in fire was locked from inside, owner says

-

Iowa6 days ago

Iowa6 days agoPat McAfee praises Audi Crooks, plays hype song for Iowa State star

-

Virginia2 days ago

Virginia2 days agoVirginia Tech gains commitment from ACC transfer QB