World

In New York, Taiwan leader says ties with US ‘closer than ever’

Beijing has condemned Tawain President Tsai Ing-wen’s cease within the US, with a Chinese language official pledging to ‘struggle again’.

Taiwan’s President Tsai Ing-wen has hailed the island’s relations with the US throughout a stopover on her approach to Central America, a “transit” that has been condemned by Beijing.

Throughout a closed-door speech in New York on Wednesday evening, Tsai stated the connection between Washington and Taipei was “nearer than ever” and touted “vital progress” in financial and safety cooperation, based on an announcement from her workplace.

She hailed Taiwan as a “beacon of democracy in Asia” and stated the island wouldn’t be remoted regardless of the “monumental challenges” it confronted.

“Now we have demonstrated a agency will and resolve to defend ourselves, that we’re able to managing dangers with calm and composure and that we’ve the flexibility to keep up regional peace and stability,” Tsai stated.

Among the many attendees on the occasion had been New Jersey Governor Phil Murphy and Laura Rosenberger, chair of the American Institute in Taiwan (AIT), which operates the de facto US embassy in Taiwan.

Tsai can also be on account of communicate at a Hudson Institute assume tank occasion on Thursday, sources instructed the Reuters information company, however all occasions are set to be closed to the press and public.

The stopover comes as Tsai travels to Central America, the place she’s going to try to shore up help in Guatemala and Belize, a part of a shrinking group of nations that recognise Taipei’s sovereignty from Beijing.

She can also be scheduled to cross via Los Angeles, California, on her manner dwelling subsequent week, the place she is rumoured to be assembly with US Home of Representatives Speaker Kevin McCarthy.

Tsai’s journey comes days after Honduras established ties with Beijing and ended its recognition of Taiwan, leaving the island with solely 13 allies that preserve formal diplomatic ties.

Beijing maintains Taiwan belongs to “one China” and that, as a Chinese language province, it has no proper to state-to-state ties. Taiwan is the place the nationalist Republic of China authorities fled in 1949, following its defeat by the Chinese language Communist Celebration on the finish of the nation’s civil warfare.

Washington has not formally recognised Taiwan because it normalised ties with Beijing in 1979. Nonetheless, the US stays an necessary ally, offering army coaching and tools to the island.

Within the lead-up to Tsai’s journey via the US, White Home nationwide safety spokesperson John Kirby sought to downplay the transit’s significance to keep away from tensions with China. He billed her journey as “in keeping with our longstanding unofficial relationship with Taiwan”.

On Wednesday, Kirby stated: “There isn’t a purpose — none — for the Chinese language to overreact right here”.

Daniel Kritenbrink, the highest US diplomat for East Asia, additionally famous that Tsai had transited via the US six instances beforehand “with out incident”.

Nonetheless, Beijing has condemned Tsai’s cease within the US. China’s Taiwan Affairs Workplace spokesperson Zhu Fenglian stated on Wednesday that, if Tsai met with McCarthy, China would “positively take measures to resolutely struggle again”.

Xu Xueyuan, the cost d’affaires of China’s embassy to Washington, additionally instructed reporters on Wednesday that the US risked “severe confrontation” ought to its leaders meet with Tsai.

Referencing a go to then-Home Speaker Nancy Pelosi made to Taiwan in 2022, Xu warned in opposition to different US politicians following her instance and assembly with Tsai.

“The US retains saying that transit is just not a go to and that there are precedents, however we should always not use previous errors as excuses for repeating them at this time,” she stated.

Pelosi’s Taiwan journey final yr prompted Beijing to stage a number of days of army workout routines and hearth missiles into the Taiwan Strait. She was the highest-ranking US official to go to Taiwan in 25 years.

The anticipated assembly between McCarthy and Tsai in California has been framed as much less diplomatically fraught than Pelosi’s journey to Taiwan. Nonetheless, such a gathering would signify the primary time a Taiwanese chief has met with a Home Speaker on US soil.

As of Thursday, Taipei stated the New York stopover had not triggered any uncommon army actions by China.

World

The Dow just crossed 40,000 for the first time. The number is big but means little for your 401(k)

NEW YORK (AP) — The Dow Jones Industrial Average just topped 40,000 for the first time, the latest pop in what’s been a surprisingly good year for Wall Street.

But just like New Year’s represents an arbitrary point in time in the Earth’s revolution around the sun, such milestones for the Dow don’t mean that much inherently.

For one, with just 30 companies, the Dow represents a tiny slice of Corporate America. For another, almost no one’s 401(k) account sees its performance depend on the Dow, which has become more of a relic used for historical comparisons.

Here’s a look at what the Dow is, how it got here and how its use among investors is on the wane:

WHAT IS THE DOW?

It’s a measure of 30 established, well-known companies. These stocks are sometimes known as “blue chips,” which are supposed to be on the steadier and safer side of Wall Street.

WHAT’S IN THE DOW?

Not just industrial companies like Caterpillar and Honeywell, despite the name.

The roster has changed many times since the Dow began in 1896 as the U.S. economy has transformed. Out, for example, was Standard Rope & Twine, and in recently have been big technology companies.

Apple, Intel and Microsoft are some of the newer-economy names currently in the Dow. The financial industry also has a healthy representation with American Express, Goldman Sachs, JPMorgan Chase and Travelers. So does health care with Amgen, Johnson & Johnson, Merck and UnitedHealth Group.

WHAT’S ALL THE HUBBUB NOW?

The Dow just crossed its latest 10,000 point threshold to top 40,000 briefly in midday trading on Thursday. It took about three and a half years to make the leap from 30,000 points, which it first crossed in November 2020.

It’s kept chugging mostly higher despite the worst inflation in decades, painfully high interest rates meant to get inflation under control and worries that high rates would make a recession inevitable for the U.S. economy.

Companies are now in the midst of reporting their best profit growth in nearly two years, and the economy has managed to avoid a recession, at least so far.

IS THE DOW THE MAIN MEASURE OF WALL STREET?

No. The Dow represents only a narrow slice of the economy. Professional investors tend to look at broader measures of the market, such as the S&P 500 index, which has nearly 17 times the number of companies within it.

More than $11.2 trillion in investments were benchmarked to the S&P 500 at the end of 2019, according to estimates from S&P Dow Jones Indices. That’s 350 times more than the $32 billion benchmarked to the Dow Jones Industrial Average.

Investors’ 401(k) accounts are much more likely to include an S&P 500 index fund than anything tied to the Dow. The S&P 500 crossed above its own milestone Wednesday, topping 5,300 points for the first time.

That’s what more investors care about. Well, 100-point milestones matter for the S&P 500 as little as others, but the fact that the S&P 500 is higher than ever matters a lot.

HOW DIFFERENT ARE THE DOW AND THE S&P 500?

Their performances have historically tracked relatively closely with each other, but the S&P 500 has been better recently. Its 29.3% rise for the last 12 months easily tops the 21.1% gain for the Dow.

That’s in part because the S&P 500 has more of an emphasis on Big Tech stocks, which were responsible for most of the S&P 500’s gains last year. Hopes for an easing of interest rates by the Federal Reserve and a frenzy around artificial-intelligence technology have pushed them to dizzying heights.

The Dow reflects none of the movements of such marquee stocks as Alphabet, Meta Platforms or Nvidia.

IS THAT IT?

No, the Dow and S&P 500 also take different approaches to measuring how an index should move.

The Dow gives more weight to stocks with higher price tags. That means stocks that add or subtract more dollars to their stock price push and pull it the most, such as UnitedHealth Group and its $523 stock price. A 1% move for that stock, which is about $5, packs a radically harder punch than a 1% move for Walmart, which is about 63 cents

The S&P 500, meanwhile, gives more weight to stocks depending on their overall size. That means a 1% move for Walmart carries more weight than a 1% move for UnitedHealth Group because Walmart is a slightly bigger company by total market value.

SO WHY CARE ABOUT THE DOW?

Because it’s so old, it has a longer track record than other measures of the market.

For a while, a triple-digit move for the Dow also offered an easy shorthand way to show the stock market was having a big day. Now, though, it means much less. A 100 point swing for the Dow means a move of less than 0.3%.

World

Russian metals tycoon says US Treasury sanctions against him are 'balderdash'

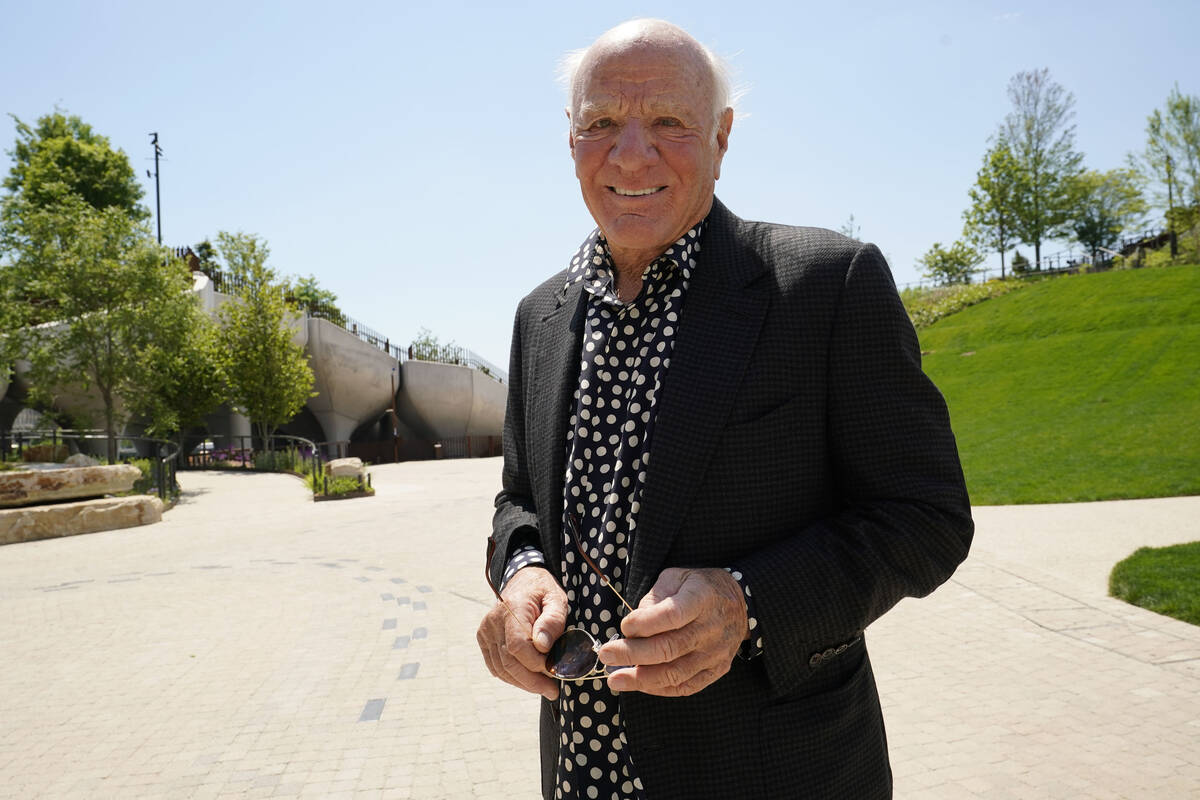

Russian tycoon Oleg Deripaska dismissed the latest U.S. sanctions on a series of companies that the U.S. Treasury said were connected to a scheme to evade sanctions and unlock frozen shares as nonsense.

“This balderdash isn’t worth the time,” Deripaska said by message via a spokesperson in response to a Reuters request for comment about the latest U.S. sanctions.

“While the horrific war in Europe claims hundreds of thousands of lives every year, politicians continue to engage in their dirty games. I strongly believe that we need to do everything we can to establish peace, not serve the interests of warmongers,” he said.

NEW US SANCTIONS AGAINST RUSSIA TARGET WEAPONS DEVELOPMENT, BAN URANIUM IMPORTS FOR NUCLEAR POWER

The U.S. Treasury on Tuesday announced it had sanctioned a web of Russian companies it said were being used to disguise ownership of a $1.6 billion industrial stake controlled by Deripaska.

Russian billionaire Oleg Deripaska is seen at the St. Petersburg International Economic Forum in Saint Petersburg, Russia, on June 17, 2022. (Reuters/Maxim Shemetov/File Photo)

Austria’s Raiffeisen Bank International was planning to buy the stake and dropped the transaction following mounting U.S. pressure to abort the bid.

In its sanctions announcement, the U.S. Treasury alleged it was an “attempted sanctions evasion scheme” to unfreeze a stake using “an opaque and complex supposed divestment.”

Since Russia’s invasion of Ukraine, Deripaska has been sanctioned by Britain for his alleged ties to Putin. He has mounted a legal challenge against the sanctions which he says are based on false information and ride roughshod over the basic principles of law and justice.

Deripaska, who made his fortune by buying up stakes in aluminum factories, has also been subjected to sanctions by the United States, which in 2018 took measures against him and other influential Russians.

Those sanctions were “groundless, ridiculous and absurd”, Deripaska has previously said.

World

German police investigate AfD member Petr Bystron for money-laundering

The Munich public prosecutor’s office is conducting an investigation into Petr Bystron, a prominent figure on the German far-right party’s list for the European elections.

Petr Bysrton is under investigation for money-laundering activities, according to the Munich public prosecutor’s office.

Bystron is facing allegations that he received up to €20,000 from individuals linked to Russian President Vladimir Putin to spread Kremlin propaganda.

He is the second candidate on the AfD’s election list for theEuropean elections.

The prosecutor’s office said searches are being carried out in Berlin, Bavaria and on the Spanish island of Mayorque in pursuit of evidence.

The German parliament voted to lift Bystron’s parliamentary immunity, enabling the police to conduct their searches.

11 public prosecutors and nearly 60 Bavarian police officers have been mobilised, the Munich public prosecutor’s office said.

In response, the chairmen of the AfD parliamentary group in the German Bundestag, Alice Weidel and Tino Chrupalla, issued a statement saying: “The AfD parliamentary group therefore hopes that the investigation will be completed quickly so that there is no suspicion that authorities and public prosecutors are trying to influence the European election campaign.”

The accusations mark a fresh blow against the AfD party, which is currently under scrutiny over allegations that it has links to China and Russia.

Fellow AfD member Maximilian Krah’s assistant is under investigation for allegedly spying for China.

Krah himself is under initial investigation by prosecutors in Dresden over allegations of accepting payments from Russia and China during his time as an MEP.

-

News1 week ago

News1 week agoMan, 75, confesses to killing wife in hospital because he couldn’t afford her care, court documents say

-

World1 week ago

World1 week agoPentagon chief confirms US pause on weapons shipment to Israel

-

Politics1 week ago

Politics1 week agoRFK Jr said a worm ate part of his brain and died in his head

-

Politics1 week ago

Politics1 week ago'You need to stop': Gov. Noem lashes out during heated interview over book anecdote about killing dog

-

Politics1 week ago

Politics1 week agoBiden takes role as bystander on border and campus protests, surrenders the bully pulpit

-

Politics1 week ago

Politics1 week agoHere's what GOP rebels want from Johnson amid threats to oust him from speakership

-

World1 week ago

World1 week agoConvicted MEP's expense claims must be published: EU court

-

World1 week ago

World1 week agoPro-Palestine protests: How some universities reached deals with students