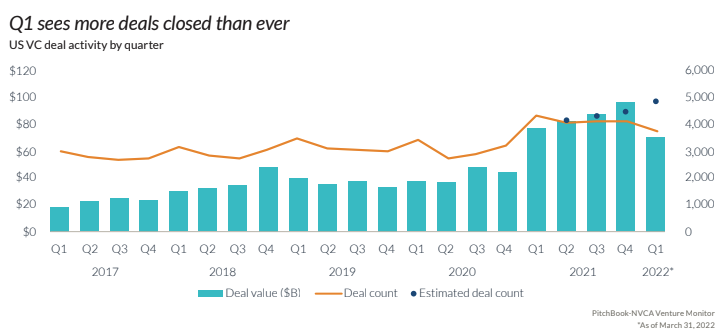

After a mind-boggling 2021 for enterprise capital investing, issues are settling down a bit by means of the primary quarter of 2022.

The newest Enterprise Monitor report from PitchBook and the Nationwide Enterprise Capital Affiliation highlighted a “wholesome recalibration interval” for dealmaking in Q1. U.S. venture-backed corporations raised practically $71 billion through the quarter, down from a whopping $95.4 billion in This fall of final yr, whereas exit worth dropped significantly to $33.6 billion.

Even with the slowdown, Q1 2022 deal worth nonetheless exceeded pre-2021 quarterly totals.

Rising rates of interest, inflation, and geopolitical uncertainty are contributing to the slowdown, the report famous. There’s additionally the pattern of newly minted VC-backed corporations seeing their market capitalizations drop in latest months, which might trickle right down to enterprise capital.

In a visitor submit for GeekWire printed in January, Seattle tech vet and angel investor Charles Fitzgerald warned founders {that a} reset in capital flows and valuations may have large implications for startups.

However there are a couple of variations between the present setting and the final tech-led downturn in 2000 and 2001. “Usually sounder enterprise fashions with better traction, and considerably extra dry powder to help portfolio corporations —roughly $230 billion of conventional VC on the sidelines within the U.S.,” Ginger Chambless, managing director at JPMorgan Chase Industrial Banking, mentioned within the report. “Each ought to cushion any pullback.”

Seattle-area startups raised $1.5 billion throughout 112 offers within the first quarter. That’s down from $2.7 billion raised over 131 offers in This fall of 2021, however up from $1.2 billion over 94 offers within the year-ago interval.

There have been a handful of megarounds for fast-growing corporations, together with a $248 million spherical for gross sales software program startup Highspot, and a $140 million spherical for e-commerce software program startup Cloth. There have been additionally new unicorns birthed, together with SeekOut and Temporal, which reached the $1 billion valuation milestone, becoming a member of a rising unicorn membership within the Seattle area.

Right here’s a take a look at the highest 10 offers in Q1 for Seattle-area corporations. See all latest offers at GeekWire’s fundings tracker.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)