Colorado

Inflation hits Colorado farmers hard; prices increase on diesel, fertilizer

KEENESBURG, Colo. (KDVR) — Inflation is impacting farmers throughout Colorado and America. As shoppers navigate greater costs on items, farmers are additionally feeling the pinch. Costs on fertilizer and diesel are driving elements shrinking revenue margins within the agricultural trade.

On 3,000 acres close to Keenesburg, farmer Marc Arnusch and his son, Brett Arnusch, a fourth-generation farmer, are grappling with greater costs.

“It’s actually powerful on us in agriculture proper now,” Marc mentioned.

Brett echoed that sentiment.

“This yr is actually exhausting,” Brett mentioned.

The daddy-son duo runs a various operation that features grains for craft beer and spirits in addition to feed for livestock. They depend upon diesel, fertilizer and crop safety merchandise for a profitable season.

“A number of the scenario with fertilizer costs and vitality costs is coming from international locations banning imports from Belarus in addition to Russia,” mentioned Chris Hughen, College of Denver finance professor.

Inflation forces farmers to place crops ‘on a eating regimen’

Farmers in Colorado have seen dramatic will increase.

“Yr over yr, we’re seeing a couple of 300% enhance in fertilizer and about 150% enhance in farm diesel gas proper now,” Marc advised FOX31.

The upper prices impression revenue margins, forcing farmers to do extra with much less.

“We’re mainly going to place our crop on a eating regimen this yr,” Marc mentioned. “We’re going to spend money on the quantity of fertilizer we will afford and hope for the very best.”

That technique is much more tough amid present drought circumstances.

“We’ve got to take a look at much more information this yr to essentially perceive what our circumstances are going to be,” Brett defined.

Inflation started impacting the Arnusch farm about six months in the past, Marc mentioned. Aid is required.

“We’ve most likely seen peak inflation, which is actually excellent news,” Hughen mentioned.

Colorado

Colorado weather: Wintry mix on the way for Christmas

Watch CBS News

Be the first to know

Get browser notifications for breaking news, live events, and exclusive reporting.

Colorado

Toyota Game Recap: 12/22/2024 | Colorado Avalanche

ColoradoAvalanche.com is the official Web site of the Colorado Avalanche. Colorado Avalanche and ColoradoAvalanche.com are trademarks of Colorado Avalanche, LLC. NHL, the NHL Shield, the word mark and image of the Stanley Cup and NHL Conference logos are registered trademarks of the National Hockey League. All NHL logos and marks and NHL team logos and marks as well as all other proprietary materials depicted herein are the property of the NHL and the respective NHL teams and may not be reproduced without the prior written consent of NHL Enterprises, L.P. Copyright © 1999-2024 Colorado Avalanche Hockey Team, Inc. and the National Hockey League. All Rights Reserved. NHL Stadium Series name and logo are trademarks of the National Hockey League.

Colorado

Colorado authorities shut down low-income housing developer

The Colorado Division of Securities is pursuing legal action against a man whom it claims deceived investors and used the ownership of federally supported low-income housing projects to line his own pockets.

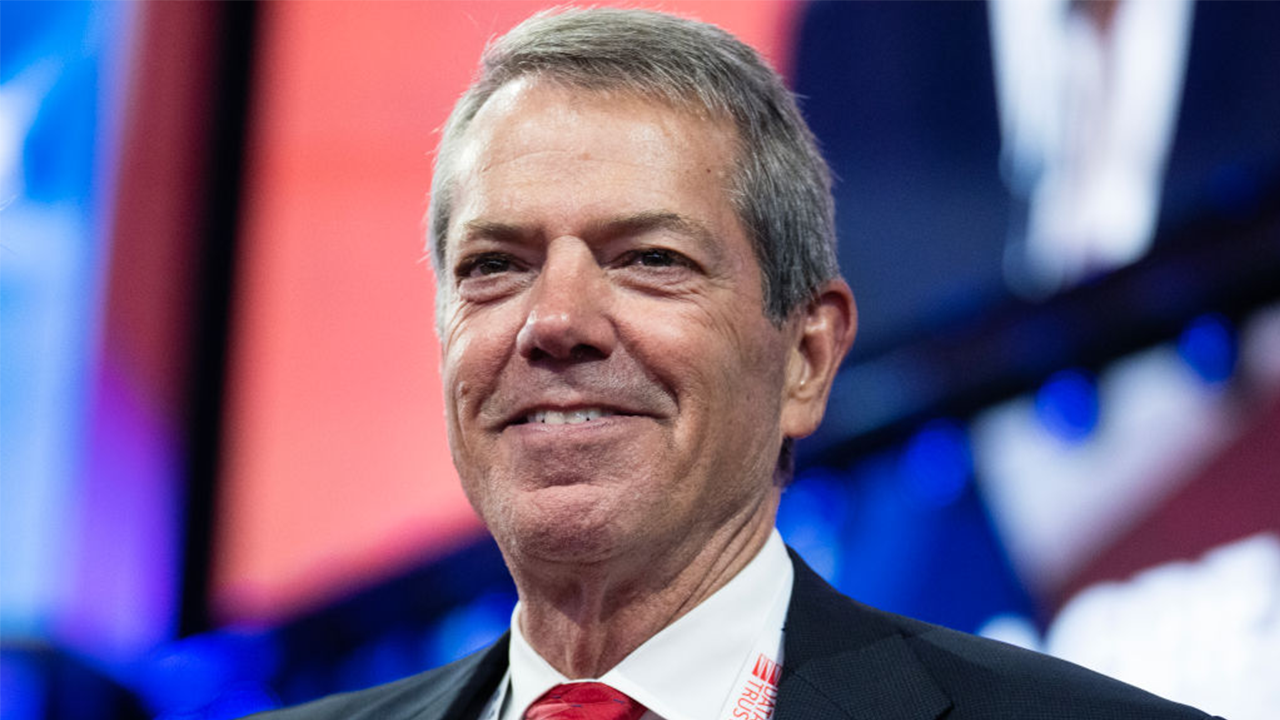

Securities Commissioner Tung Chan announced its civil court filings against Michael Dale Graham, 68, on Nov. 12.

Chan’s office filed civil fraud charges against Graham, and also asked for a temporary restraining order and freezing of Graham’s assets and his companies’. A Denver district court judge immediately granted both. Since then, two court dates to review the those orders have canceled; a third is scheduled for mid-January.

Graham operates Sebastian Partners LLC, Sebastiane Partners LLC, and Gravitas Qualified Opportunity Zone Fund I LLC (“GQOZF”), all of which were controlled by Graham during his “elaborate real estate investment scheme,” as described by the securities office in a case document.

The filing states Graham collected more than $1.1 million from eight investors to purchase three adjacent homes in Aurora. The Denver-based Gravitas fund and its investors purportedly qualified for the federal Qualified Opportunity Zone (QOZ) program with the homes. Qualified Opportunity Zones were created by the Tax Cuts and Jobs Act passed by Congress in 2017. The zones encouraged growth in low-income communities by offering tax benefits to investors, namely reductions in capital gains taxes on developed properties.

Graham formed Gravitas in early 2019 and purchased the three homes located in the 21000 block of E. 60th Avenue two years later. He quickly sold one of them with notifying investors, according to the case document. While managing the other two, Graham and Gravitas transferred the fund’s assets and never operated within QOZ guidelines to the benefit of its investors or the community, according to the state.

Gravitas also transferred the titles for the two properties to Graham privately. As their owner, Graham obtained undocumented loans from friends totaling almost $600,000. The two loans used the two properties as security.

Gravitas investors were never informed of the two loans, according to the case document. Also, Gravitas never sent its investors year-end tax reports, the securities office alleges.

Graham used the proceeds of the loans for personal use. No specific details were provided about those uses.

“Effectively, Graham used Gravitas as his personal piggy bank,” as stated in the case document, “claiming both funds and properties as his own. Graham never told investors about the risks associated with transferring title to himself. On September 1, 2023, he sent a letter to investors, stating that the properties ‘we own’ are doing well and generating growth due to record-breaking home appreciation. But Gravitas no longer owned the properties.

“Gravitas no longer had assets at all.”

Furthermore, the securities office said Graham failed to notify investors of recent court orders against him in Colorado and California. In total, Graham was ordered to pay more than $1 million in damages related to previous real estate projects.

Graham’s most recent residence is in Reno, Nev., according to an online search of public records. He evidently has previously lived in Santa Monica, Calif., and Greenwood Village.

-

Politics1 week ago

Politics1 week agoCanadian premier threatens to cut off energy imports to US if Trump imposes tariff on country

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg) Technology1 week ago

Technology1 week agoOpenAI cofounder Ilya Sutskever says the way AI is built is about to change

-

Politics1 week ago

Politics1 week agoU.S. Supreme Court will decide if oil industry may sue to block California's zero-emissions goal

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg) Technology1 week ago

Technology1 week agoMeta asks the US government to block OpenAI’s switch to a for-profit

-

Business1 week ago

Business1 week agoFreddie Freeman's World Series walk-off grand slam baseball sells at auction for $1.56 million

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg) Technology1 week ago

Technology1 week agoMeta’s Instagram boss: who posted something matters more in the AI age

-

News1 week ago

East’s wintry mix could make travel dicey. And yes, that was a tornado in Calif.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology2 days ago

Technology2 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps