California

Your questions about California’s gas rebate answered

In abstract

Readers had questions on California’s gasoline rebate funds, together with whether or not it issues what number of vehicles you may have and why it’s primarily based on 2020 tax returns. We’ve answered some right here.

To assist with the excessive value of gasoline — and the rising value of dwelling — California began sending funds starting from $200 to $1,050 to residents in October.

Every time cash is likely to be headed to individuals’s financial institution accounts, they have a tendency to have questions.

We’ve already answered the fundamentals, together with who’s eligible for the funds, when they’re getting despatched out, how individuals will obtain them, and the way a lot you’ll be able to count on to obtain.

However readers responded with extra questions through e-mail and social media. We additionally took cues from questions individuals searched for lots on-line. We’ve answered a few of these questions right here, and might be including extra questions and solutions to this web page over the approaching days.

When you’ve got a query about these funds, please tell us.

Have questions on California’s gasoline rebates? We invite you to share them with reporters right here.

Does it matter what number of vehicles I’ve, or whether or not I’ve an electrical car?

No. Whether or not or not you’re eligible for this cost — or how a lot you’re going to get — has nothing to do with whether or not you personal a automotive, what number of vehicles you personal, or what sort of automotive you personal.

The rationale individuals is likely to be confused is that again in March, Gov. Gavin Newsom proposed sending funds to Californians primarily based on what number of vehicles they personal. However that wasn’t a part of the ultimate deal.

Eligibility relies on having submitted an entire 2020 tax return by Oct. 15, 2021, in addition to different components together with earnings and residency.

Are the “gasoline rebates” the identical because the “inflation reduction” funds?

Principally, sure.

The concept of economic reduction for prime gasoline costs was floated by Newsom in March. Because the proposal developed it was generally known as a gasoline rebate or refund, and generally known as an inflation reduction cost. The official title it in the end bought was the “‘Center Class Tax Refund.” Generally, these phrases are all referring to funds that began going out in October to offset the excessive value of gasoline and different items.

One wrinkle: Within the wake of a latest uptick within the value of California gasoline, Newsom proposed a brand new tax on oil firms in late September and referred to as for a particular legislative session in December to debate the thought. His proposal is to show the funds generated from that tax right into a refund or rebate for individuals affected by excessive gasoline costs, in order that’s one other gasoline rebate you may hear about, nevertheless it hasn’t occurred but.

Are these funds taxable?

The funds gained’t be taxable for California state earnings tax functions, says Franchise Tax Board spokesperson Catalina Martinez. Martinez stated the board can be issuing 1099-MISC varieties to individuals receiving funds of greater than $600.

Whether or not the federal authorities will tax these funds is much less clear. “That’s a difficulty the place people ought to verify along with your native tax preparer,” stated H.D. Palmer, spokesperson for California’s Division of Finance.

Why can’t you file one thing now to get the cost if you happen to didn’t file a 2020 tax return?

Some individuals earn little sufficient earnings that they aren’t required to file taxes. That features some seniors and disabled individuals, in addition to some very low earnings individuals. Sadly, if you happen to didn’t file a 2020 tax return by the deadline, you aren’t eligible for this cost.

You possibly can’t file something retroactively to obtain the cost.

If the state allowed individuals to file amended tax returns, for instance, that may have taken extra time — each for individuals to file, and for the state to course of — and would have opened up “issues concerning potential fraud,” stated Palmer.

Basing the funds on beforehand submitted returns, and documentation that has “already been processed and validated by the [Franchise Tax Board] considerably eliminates the potential of fraud,” Palmer stated.

Why is your 2020 tax return vital? Why not 2021?

There are two essential the reason why the 2020 tax return was chosen, Palmer stated. One is that the 2020 tax submitting is totally performed, whereas tax submitting and processing for 2021 remains to be ongoing. (The extension deadline for 2021 tax returns was Oct. 17).

The opposite purpose, Palmer stated, is that the tax board “acquired roughly half 1,000,000 extra low-income tax returns than typical in 2020, since extra households filed tax returns to make the most of pandemic-related help.” So, through the use of the 2020 return, California will be capable of attain a number of hundred thousand extra individuals with these funds, in response to Palmer.

What occurs if you happen to have been married whenever you filed your 2020 tax return and filed it collectively, however have since gotten divorced?

Your tax return for 2020 is vital for these funds — with out one, you aren’t eligible. Plus, the adjusted gross earnings reported in your 2020 return will issue into how a lot cash you get. The funds are being despatched out both as direct deposits or debit playing cards.

For those who have been a part of a pair that filed a 2020 tax return collectively, however have since separated or gotten divorced, you’ll nonetheless be issued one debit card collectively along with your former partner or accomplice, with each names on it, stated Martinez. That card can be despatched to the latest deal with the tax board has on file for the primary particular person named on the 2020 return.

In case your deal with has modified because you final filed California taxes, you’ll be able to replace your deal with by MyFTB or by cellphone, dialing 1-800-542-9332 in response to Martinez.

Identical goes for direct deposit: For those who filed a 2020 tax return with a accomplice or partner you’ve since separated from, the deposit will go to the checking account of the primary particular person named on the 2020 tax return, Martinez stated.

On this state of affairs the previously coupled taxpayers “ought to work collectively to make sure correct dealing with of the (Center Class Tax Refund) cost,” stated Martinez in an announcement.

California

Northern California 6-year-old, parents hailed as heroes for saving woman who crashed into canal

LIVE OAK — A six-year-old and her parents are being called heroes by a Northern California community for jumping into a canal to save a 75-year-old woman who drove off the road.

It happened on Larkin Road near Paseo Avenue in the Sutter County community of Live Oak on Monday.

“I just about lost her, but I didn’t,” said Terry Carpenter, husband of the woman who was rescued. “We got more chances.”

Terry said his wife of 33 years, Robin Carpenter, is the love of his life and soulmate. He is grateful he has been granted more time to spend with her after she survived her car crashing off a two-lane road and overturning into a canal.

“She’s doing really well,” Terry said. “No broken bones, praise the Lord.”

It is what some call a miracle that could have had a much different outcome without a family of good Samaritans.

“Her lips were purple,” said Ashley Martin, who helped rescue the woman. “There wasn’t a breath at all. I was scared.”

Martin and her husband, Cyle Johnson, are being hailed heroes by the Live Oak community for jumping into the canal, cutting Robin out of her seat belt and pulling her head above water until first responders arrived.

“She was literally submerged underwater,” Martin said. “She had a back brace on. Apparently, she just had back surgery. So, I grabbed her brace from down below and I flipped her upward just in a quick motion to get her out of that water.”

The couple said the real hero was their six-year-old daughter, Cayleigh Johnson.

“It was scary,” Cayleigh said. “So the car was going like this, and it just went boom, right into the ditch.”

Cayleigh was playing outside and screamed for her parents who were inside the house near the canal.

I spoke with Robin from her hospital bed over the phone who told us she is in a lot of pain but grateful.

“The thing I can remember is I started falling asleep and then I was going over the bump and I went into the ditch and that’s all I remember,” Robin said.

It was a split-second decision for a family who firefighters said helped save a stranger’s life.

“It’s pretty unique that someone would jump in and help somebody that they don’t even know,” said Battalion Chief for Sutter County Fire Richard Epperson.

Robin is hopeful that she will be released from the hospital on Wednesday in time to be home for Thanksgiving.

“She gets Thanksgiving and Christmas now with her family and grandkids,” Martin said.

Terry and Robin are looking forward to eventually meeting the family who helped save Robin’s life. The family expressed the same feelings about meeting the woman they helped when she is out of the hospital.

“I can’t wait for my baby to get home,” Terry said.

California

California may exclude Tesla from EV rebate program

Spear Invest founder and Chief Investment Officer Ivana Delevska discusses the value of A.I. data centers and the future of driverless cars on ‘Making Money.’

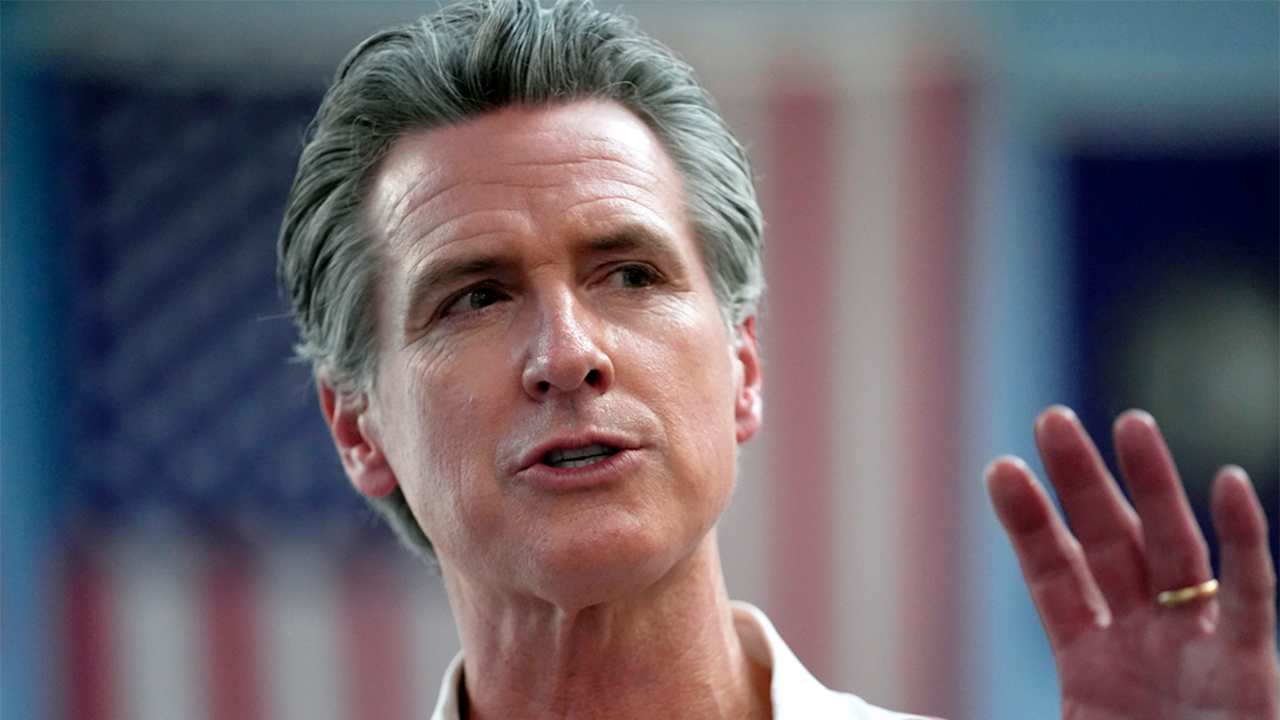

California Gov. Gavin Newsom may exclude Tesla and other automakers from an electric vehicle (EV) rebate program if the incoming Trump administration scraps a federal tax credit for electric car purchases.

Newsom proposed creating a new version of the state’s Clean Vehicle Rebate Program, which was phased out in 2023 after funding more than 594,000 vehicles and saving more than 456 million gallons of fuel, the governor’s office said in a news release on Monday.

“Consumers continue to prove the skeptics wrong – zero-emission vehicles are here to stay,” Newsom said in a statement. “We’re not turning back on a clean transportation future – we’re going to make it more affordable for people to drive vehicles that don’t pollute.”

The proposed rebates would be funded with money from the state’s Greenhouse Gas Reduction Fund, which is funded by polluters under the state’s cap-and-trade program, the governor’s office said. Officials did not say how much the program would cost or save consumers.

NEBRASKA AG LAUNCHES ASSAULT AGAINST CALIFORNIA’S ELECTRIC VEHICLE PUSH

California Gov. Gavin Newsom on Monday proposed creating a new version of the state’s Clean Vehicle Rebate Program if the incoming Trump administration scraps a federal tax credit for electric car purchases. (Photo by Justin Sullivan/Getty Images, File / Getty Images)

They would also include changes to promote innovation and competition in the zero-emission vehicles market – changes that could prevent automakers like Tesla from qualifying for the rebates.

Tesla CEO Elon Musk, who relocated Tesla’s corporate headquarters from California to Texas in 2021, responded to the possibility of having Tesla EVs left out of the program.

Tesla and other automakers may not qualify for the proposed tax credits, according to the governor’s office. (Getty Images, File / Getty Images)

“Even though Tesla is the only company who manufactures their EVs in California! This is insane,” Musk wrote on X, which he also owns.

BENTLEY PUSHES BACK ALL-EV LINEUP TIMELINE TO 2035

Those buying or leasing Tesla vehicles accounted for about 42% of the state’s rebates, The Associated Press reported, citing data from the California Air Resources Board.

Newsom’s office told Fox Business Digital that the proposal is intended to foster market competition, and any potential market cap is subject to negotiation with the state Legislature.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TSLA | TESLA INC. | 338.59 | -13.97 | -3.96% |

“Under a potential market cap, and depending on what the cap is, there’s a possibility that Tesla and other automakers could be excluded,” the governor’s office said. “But that’s again subject to negotiations with the legislature.”

Newsom’s office noted that such market caps have been part of rebate programs since George W. Bush’s administration in 2005.

Newsom has pushed Californians to replace gas-powered vehicles with zero-emission vehicles. (Chip Somodevilla/Getty Images / Getty Images)

Federal tax credits for EVs are currently worth up to $7,500 for new zero-emission vehicles. President-elect Trump has previously vowed to end the credit.

CLICK HERE TO GET THE FOX NEWS APP

California has surpassed 2 million zero-emission vehicles sold, according to the governor’s office. The state, however, could face a $2 billion budget deficit next year, Reuters reported, citing a non-partisan legislative estimate released last week.

California

STEVE HILTON: Five things California Democrats still don't get

NEWYou can now listen to Fox News articles!

Along with most other Democratic politicians in California, Gov. Gavin Newsom still doesn’t seem to understand what happened in the 2024 election.

For years, Newsom, along with California cronies like former House Speaker Nancy Pelosi and, of course, Vice President Kamala Harris, bragged about their state being a “model for the nation.”

In one sense–not the one they intended, of course–that’s true. California became a model of what not to do.

CALIFORNIA VOTERS NARROWLY REJECT $18 MINIMUM WAGE; FIRST SUCH NO-VOTE NATIONWIDE SINCE 1996

The terrible combination of elitism and extremism that has defined Democratic policymaking in my home state for at least the last decade has delivered failure on every front.

Despite having the highest taxes in the nation, despite the state’s budget nearly doubling in the last ten years (even as our population has been falling, in the exodus from blue state misrule), California has the highest rate of poverty in America. We have the highest housing costs, the lowest homeownership, highest gas and utility bills, and the worst business climate–ten years in a row.

This record of failure is exactly why Democrats lost so badly on November 5th. Voters had a clear choice: between more of the same Democrat policies that raised the cost of living and lowered their quality of life, or a return to the peace and prosperity of the Trump years.

GAVIN NEWSOM TO MEET WITH BIDEN AFTER VOWING TO PROTECT STATE’S PROGRESSIVE POLICIES AGAINST TRUMP ADMIN

In many ways, the contest between Donald Trump and Kamala Harris represented a battle between the ‘blue state model’ championed by Gavin Newsom in California, and the ‘red state model’ that has driven people and businesses out of California and into the arms of more welcoming states like Texas, Tennessee and Florida.

Of course, the red state model won and the blue state model was roundly rejected.

You would think that would make blue state leaders like Newsom pause and reflect. But the exact opposite has happened. Gavin Newsom immediately called a “special session” of the California legislature to “Trump-proof” his state.

What California really needs is “Newsom-proofing.”

Instead, California Democrats are doubling down on the exact same agenda that was defeated across the country – including in California, which saw the biggest shift from Democrats to the GOP in decades.

Here are the five things California Democrats still don’t get:

1. People want results, not lectures

Democrats and their media sycophants can do all the self-righteous, sanctimonious bloviating they like about “our democracy” and “equity”, but in the end people want the basics of the American Dream: a good job that pays enough to raise your family in a home of your own in a safe neighborhood with a good school so your kids can have a better life than you. No amount of moral superiority from the people in charge will make up for that if they fail to provide it.

2. Enough with the ‘climate’ extremism

“Climate” has become a religion for Democrats, and you see that especially clearly in California. But when you look at the main reason life is so unaffordable for working people, whether that’s gas prices, utility bills or housing costs, extreme climate policies are to blame. Working-class Americans can’t afford these ‘luxury beliefs.’

CLICK HERE FOR MORE FOX NEWS OPINION

3. Who cares about Hollywood?

This election destroyed forever the myth that fancy celebrities can sway votes. Oprah, Beyonce, George Clooney, Taylor Swift…nobody cares! The new cultural powerhouses are the podcast hosts, comedians…the raw power of UFC is where it’s at, not the decadent Hollywood elite who won’t even turn up to support “their” candidate without a multimillion dollar paycheck.

Producer and actress Oprah Winfrey holds up Vice President and Democratic presidential candidate Kamala Harris’ hand as she arrives onstage during a campaign rally on the Benjamin Franklin Parkway in Philadelphia, Pennsylvania, on November 4, 2024. (Getty Images)

4. ‘Little tech’ beats Big Tech

Democrats may console themselves with the knowledge that California’s Big Tech monopolies are on their side. But in this election we saw the rise of what famed Silicon Valley investor Marc Andressen calls “little tech”, the upstarts and rebels who reject leftist groupthink. They got engaged in this election in a way we’ve never seen before. It’s a massive shift and will be a huge force for the future.

5. Working class beats the elite

Back in 2016, after the Brexit vote, and then Donald Trump’s victory here, shocked the world, I predicted that the Republican Party had the opportunity to become a “multiracial working class coalition.” Trump’s 2024 victory has delivered that — a revolutionary shift in our political landscape. The other part of my prediction? Democrats will be left as the party of the “rich, white and woke.”

CLICK HERE TO GET THE FOX NEWS APP

Unless Democrats come to terms with these realities and change course, they can expect to lose elections for years to come. The reaction in California – epicenter of today’s Democrat elite — shows that there is zero sign of this happening.

They just don’t get it.

CLICK HERE TO READ MORE FROM STEVE HILTON

-

Science1 week ago

Science1 week agoTrump nominates Dr. Oz to head Medicare and Medicaid and help take on 'illness industrial complex'

-

Politics1 week ago

Politics1 week agoTrump taps FCC member Brendan Carr to lead agency: 'Warrior for Free Speech'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg) Technology1 week ago

Technology1 week agoInside Elon Musk’s messy breakup with OpenAI

-

Lifestyle1 week ago

Lifestyle1 week agoSome in the U.S. farm industry are alarmed by Trump's embrace of RFK Jr. and tariffs

-

World1 week ago

World1 week agoProtesters in Slovakia rally against Robert Fico’s populist government

-

Health4 days ago

Health4 days agoHoliday gatherings can lead to stress eating: Try these 5 tips to control it

-

News1 week ago

News1 week agoThey disagree about a lot, but these singers figure out how to stay in harmony

-

Health1 day ago

Health1 day agoCheekyMD Offers Needle-Free GLP-1s | Woman's World