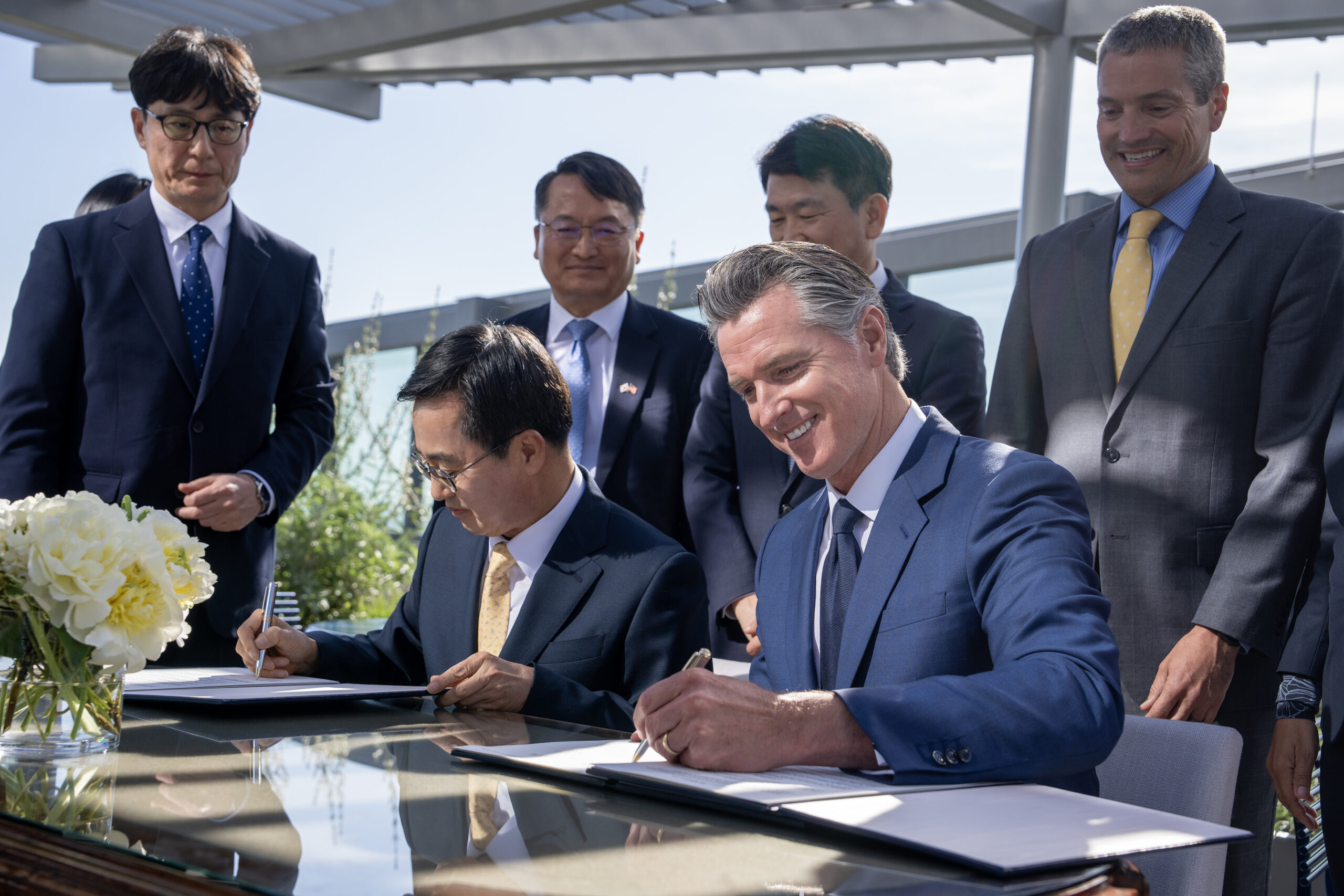

SACRAMENTO – California has a new international partnership – this time with South Korea’s Gyeonggi Province, California’s kindred subnational partner in terms of population, innovation, and economy. Gyeonggi surrounds Seoul, the capital and largest city of South Korea.

The MOU signed today between California and Gyeonggi Province outlines three years of collaboration to foster trade relations, advance climate goals, and promote people-to-people exchanges among the two regions’ academics, entrepreneurs, and innovators alike. The text of the MOU signed today is available here.

“California is forging new partnerships around the globe to advance climate action and grow our economy. Like California, Gyeonggi is the tentpole of its nation’s economy and a driving force for innovation.

Working together, we can help lift communities on both sides of the Pacific.”

Governor Gavin Newsom

What Governor Dong Yeon KIM said: “Gyeonggi and California share a common vision of building global partnerships to respond to the climate crisis. We look forward to collaborating on innovative technologies and future high-tech industries for sustainable development along with our climate efforts.”

BIG PICTURE:

- California and Gyeonggi are the most populous subnationals in their respective countries – and are both known for being economic engines and centers of innovation for their national economies.

- California and Gyeonggi have both committed to achieving carbon neutrality by 2045 and 2050, respectively.

HOW WE GOT HERE: California’s world-leading climate policies have led the state to exceed its 2020 climate target six years ahead of schedule, and formed partnerships across the U.S. and around the world.

- Earlier this year, Governor Newsom welcomed delegations from Sweden and Norway and signed renewed climate partnerships with the two governments.

- Last year, Governor Newsom led a California delegation to China, where California signed five MOUs – with China’s National Development and Reform Commission, the provinces of Guangdong and Jiangsu, and the municipalities of Beijing, and Shanghai. The trip also resulted in a first-of-its-kind declaration by China and California to cooperate on climate action like aggressively cutting greenhouse gas emissions, transitioning away from fossil fuels, and developing clean energy.

- Also in 2023, California signed a MOU with the Chinese province of Hainan, as well as with Australia.

- In 2022 alone, California signed Memorandums of Cooperation with Canada, New Zealand and Japan, as well as Memorandums of Understanding with China and the Netherlands, to tackle the climate crisis. The Governor also joined with Washington, Oregon, and British Columbia to recommit the region to climate action.