California

California’s ‘affordability crisis’ attracts breakthrough ratemaking and regulatory innovation proposals

Groundbreaking new affordability analysis standards and metrics to handle California’s skyrocketing electrical energy charges are a step ahead however not sufficient, regulators and stakeholders agreed on the state’s second annual electrical energy charges affordability convention Feb. 28.

Regardless of the falling prices of wind and photo voltaic era, California’s electrical energy charges are rising because of prices associated to wildfires, legacy property, and public goal applications, the California Public Utility Fee’s 2019 Annual Affordability Report, revealed in April 2021, concluded. In consequence, a “substantial variety of households” face “a double burden of pricy service and a low skill to pay for it,” the report stated.

The severity of California’s “affordability disaster” for low-income prospects has but to be measured, but it surely “is starting to impression middle-class households,” Senior Coverage Knowledgeable Jennifer Dowdell of ratepayer advocacy group The Utility Reform Community informed Utility Dive. She applauded the brand new CPUC standards and metrics and different convention enter as a result of “the state wants all events’ proposals.”

There may be “no panacea” for electrical energy affordability, and a “portfolio” of options will likely be wanted, particularly as a result of “some price drivers, like world gasoline costs, are exterior our management,” CPUC Commissioner Darcie Houck cautioned. The fee is learning the convention’s many proposals for actions the state can take “for controlling prices and mitigating charges,” she added.

The Feb. 28 California affordability convention started with a dialogue of the brand new analysis standards and metrics. However a lot of the content material was about electrical energy ratemaking reforms, new methods to fund public applications, improvements in regulatory oversight, and a possible breakthrough in fairness with redesigned mounted expenses for low-income prospects.

The standards and metrics

With U.S. electrical energy charges rising within the final decade from the vitality transition, and particularly from the disruptions created by Covid-19, regulators in lots of states, together with Pennsylvania, New York, Connecticut and Nevada, have been trying to find methods to enhance affordability and lengthen fairness to low-income prospects.

However California’s skyrocketing charges and excessive variable renewables penetrations make its work a guidepost for managing transition prices, convention members informed Utility Dive. Ordered by California’s 2018 affordability continuing (R.18-07-006), the convention provided essentially the most affordability innovation but thought-about in any state, they stated.

The CPUC’s six proposed analysis standards for managing rising electrical energy charges supply steerage on regulatory reforms associated to affordability, fairness, environmental and social justice, and utility income necessities and charges, CPUC Power Division Regulatory Analyst for Electrical Charges Jack Chang informed the convention. In addition they contemplate the economics and feasibility of affordability proposals.

The fee’s three affordability analysis metrics, based mostly on its recently-approved Environmental and Social Justice Motion Plan 2.0, begin with the “Affordability Ratio,” which reveals vitality’s portion of a family’s earnings. “Hours at Minimal Wage” measures the labor wanted to pay for vitality. The “Socioeconomic Vulnerability Index – Deprived Communities” is a multi-factorial measure of neighborhood impacts.

Over 11% of California’s low-income households have Affordability Ratio values over 35%, which suggests vitality prices over one-third of their discretionary earnings, the CPUC report discovered. “Median-income households can rather more simply afford utility providers” and this “stark disparity” could also be “a warning signal” of low-income households’ want for help, it added.

Some Californians at the moment are compelled “to decide on between utility providers and groceries,” featured speaker Abigail Solis, supervisor of sustainable vitality options for low-income housing advocacy group Self-Assist Enterprises, agreed. Regulators should forestall “catastrophic results on weak communities,” she stated. And the California Various Charges for Power, or CARE, and Household Electrical Price Help, or FERA, applications will not be enough, she added.

Permission granted by U.S. Chamber of Commerce

Reactions

Many convention members endorsed the fee’s standards and metrics with reservations. They’re “actually simply good ratemaking and public coverage that many states may benefit from,” stated Regulatory Help Venture Affiliate Mark LeBel. However as a result of some proposed mounted expenses and non-rate income sources may have unintended penalties, there have to be a “real looking dialogue of the downsides of every proposal, together with my very own,” he added.

Southern California Edison is “typically supportive” of the standards and metrics, however affordability should not compromise security, reliability and state local weather, clear air and electrification objectives, SCE Director of Pricing Design and Analysis, Robert A. Thomas emailed Utility Dive. Modifications should additionally keep away from doubtlessly costly “operational complexity,” he added.

The metrics will “require additional testing and refinement previous to broad scale implementation” as a result of understanding some might require a “steep studying curve,” San Diego Gasoline and Electrical spokesperson Anthony Wagner emailed Utility Dive.

The standards and metrics “might be helpful,” however “conventional ratemaking rules” defend utility income necessities and appeal to very important funding capital, Pacific Gasoline and Electrical Senior Vice President of Regulatory and Exterior Affairs Robert S. Kenney additionally emailed.

It’s cheap to attempt to develop goal standards and repeatable metrics, and fairness is important, California Power Fee Commissioner J. Andrew McAllister informed Utility Dive. However “one-size-fits-all ratemaking” might not swimsuit California utilities’ income necessities and the state’s various geographies, ethnicities, climates and buyer lessons, he added.

That is “a singular time,” he cautioned. On April 3, California briefly reached a 97.3% renewables penetration and, because the state expands on that and on its economy-wide electrification objectives, low-cost renewables will make era “a smaller a part of the general invoice and infrastructure a much bigger half,” he stated.

Affordability can, although, be addressed with conventional cost-based charges if they’re proactively designed to guard weak prospects and to optimize using electrification, McAllister added.

There are three primary methods for rising affordability in California, in line with Pure Sources Protection Council work introduced to the convention by NRDC Senior Scientist, Local weather & Clear Power Program, Mohit Chhabra.

First, utilities’ complete income necessities may very well be lowered by transferring coverage objectives and public goal applications out of charges, Chhabra stated. California’s tax-supported Normal Fund would possibly pay for wildfire mitigations and restoration and the CARE and FERA applications, and gasoline taxes may assist new transmission and distribution to fulfill transportation electrification objectives, he stated.

“It’s most likely time to make some disciplined selections among the many many ratepayer-funded applications,” Commissioner McAllister agreed. However that can’t be an excuse to finish cost-effective applications, he harassed.

The purpose is to maintain electrical energy charges low sufficient to encourage constructing and transportation electrification and permit renewables-generated electrical energy to switch fossil fuels for heating and driving, each East Bay Group Power VP of Public Coverage and Deputy Normal Counsel Melissa Brandt and SDG&E Senior VP of Buyer Companies and Exterior Affairs Scott Crider agreed.

Funding public goal program prices by state taxes as an alternative of by electrical energy charges wouldn’t remedy the affordability drawback fully, however it could alleviate some charge stress, Brandt informed the convention.

Legislative motion is required to take away public goal program prices, which have “elevated 130% within the final 10 years,” from “the backs of our prospects,” Crider added.

Funding coverage goals from non-ratepayer sources, although attainable, would possibly make them “topic to legislative and political uncertainties,” Chhabra stated. However a multiple-source hybrid strategy that includes funding from taxes, securitized debt, shareholder capital, public infrastructure investments, or lowered utility returns might be efficient, he added.

A “holistic strategy to ratemaking” is what the fee is broadly working towards, CPUC Commissioner Houck stated.

Affordability also can come by extra electrification, which might unfold mounted infrastructure prices in charges over extra kWh with out rising peak demand prices, Chhabra stated, laying out the group’s second technique for rising affordability. And if prices for system upgrades to handle electrification’s increased kWh volumes are stored low sufficient, falling charges can begin a “virtuous cycle” of affordability, he added.

NRDC discovered present California charges will not be low sufficient to speed up buyer investments in, or assist utility incentives for, issues like warmth pumps and electrical car chargers, Chhabra stated.

Good charge designs can drive electrification and “strategically develop utility revenues sufficient to place downward stress on charges,” CEC Commissioner McAllister added with out particularly endorsing the NRDC proposal.

Price parts, like time of use charges and particular mounted expenses, might be reallocated to assist affordability and fairness, the Regulatory Help Venture’s LeBel agreed. A time-of-use charge for all prospects with a really low off-peak worth is a primary easy step, and a tiered month-to-month mounted residential buyer cost of $0 for low-income prospects, $5 for middle-income prospects, and $10 for high-income prospects would add fairness, he proposed.

A hard and fast “website infrastructure cost” for distribution system prices may very well be added for increased utilization residential prospects and people with distributed vitality assets like rooftop photo voltaic and batteries, LeBel added. And a hard and fast “distribution circulate cost” may unfold prices additional by increased costs for kWh utilization than for exported kWh credit, he stated.

Such mounted expenses within the charge design, although not with out controversy, may enhance affordability and fairness in a manner that additionally protects state local weather and clear vitality objectives, many convention members acknowledged.

Permission granted by TURN

Mounted expenses

California has lengthy resisted mounted charges and imposed a statutory restrict on them as a result of they are often regressively burdensome to low-income prospects with restricted skill to handle electrical energy utilization.

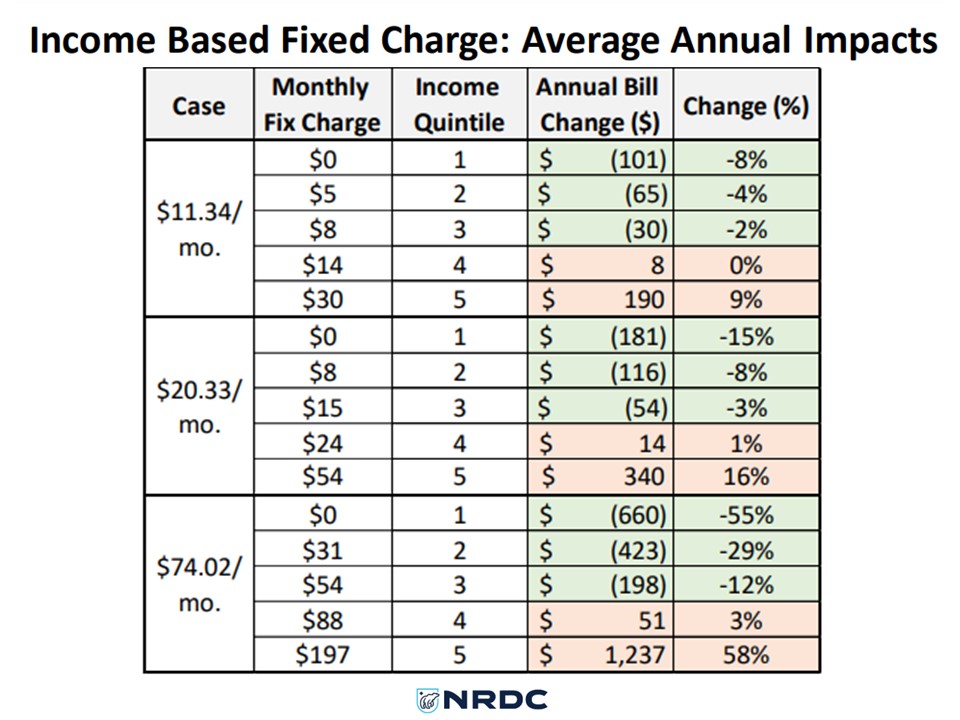

However NRDC discovered “income-based mounted expenses have the most important potential impression” on affordability, Chhabra stated. And resistance to mounted expenses might be eradicated “if the cost is income-based and designed to extend payments considerably for less than high-income prospects,” he stated.

Potential mounted cost charge reforms have been welcomed by SCE’s Thomas and PG&E’s Kenney. “It’s time to evolve charge constructions,” and the income-based mounted cost is “intriguing,” CEC Commissioner McAllister agreed.

Economists with the College of California, Berkeley, Power Institute at Haas proposed a widely-discussed income-based mounted cost in 2021.

“The price burden on lower-income households is substantial” beneath California’s present “extraordinarily regressive” charges and income-based mounted expenses can ease that burden, Haas College Director Meredith Fowlie informed the convention.

The Haas idea is sound, however its three tiers of expenses, which go as much as $74 monthly for some prospects, “elevate the feasibility query,” Chhabra stated. With NRDC’s 5 mounted cost tiers, “low-income earners profit most,” and “the center three tiers both profit or are impartial,” Chhabra stated.

There are challenges to implementing an income-based mounted cost, each Chhabra and Fowlie acknowledged. Utilities would seemingly want cooperation from the state’s Franchise Tax Board to forestall folks from abusing the system, however which may current data privateness points or result in bureaucratic complexities, they stated.

Two revolutionary modifications to regulatory oversight exterior of NRDC’s three methods for rising affordability have been proposed by different convention members.

Permission granted by NRDC

Regulatory oversight innovation

A doubtlessly easy oversight change would require every utility’s Normal Price Case to incorporate a second spending plan for less than what the utility would prioritize if spending was restricted to the speed of inflation, TURN’s Jennifer Dowdell stated.

This hypothetical inflation-limited spending “is just not a cap on utility spending, it’s a context,” Dowdell informed the Feb. 28 convention.

Utilities are required to make use of a commission-ordered Threat-Spend Effectivity metric to prioritize program proposals, Dowdell informed Utility Dive. If these priorities and prices are clear within the Normal Price Case report, a regulatory assessment can examine outcomes from accredited spending with what inflation-constrained spending would have supplied, she stated.

Like different members, TURN’s intent is to not restrict or discourage utility investments in security and reliability, Dowdell added. All of the proposals have advantage and deserve analysis, “even when some don’t meet the fee’s feasibility criterion.”

However reforms to different regulatory processes are wanted to “comprise utility prices,” California Photo voltaic and Storage Affiliation Coverage Director Brad Heavner insisted throughout the convention. The fee ought to order a “Focused Power Dispatch” program requiring higher utility dispatch of native distributed assets to cut back infrastructure investments that drive charge will increase, he stated.

It must also make use of its new feasibility criterion to judge the convention proposals, Heavner informed Utility Dive. Most of the charge reform proposals are “politically unrealistic” and won’t be accepted by lawmakers or shoppers, he stated.

Each the CEC’s McAllister and the CPUC’s Houck applauded the convention members for taking over the controversial subject. “It was an important dialog,” McAllister stated.

“Crucial takeaway is the huge settlement that charges can’t preserve rising at latest years’ double-digit percentages,” added Houck. There’s a rising urgency for “concrete measures to constrain utility prices and their impacts on ratepayers.”

The convention enter will result in a Q1 2023 CPUC workers proposal for enhancing affordability that would be the foundation of the CPUC’s affordability rulemaking report back to Governor Gavin Newsom, Houck stated.

California

Where are mandatory evacuation orders in place for California wildfires? See maps

Winds fuel devastating Los Angeles wildfires growth

Firefighters are battling multiple blazes across Los Angeles, with some not contained at all.

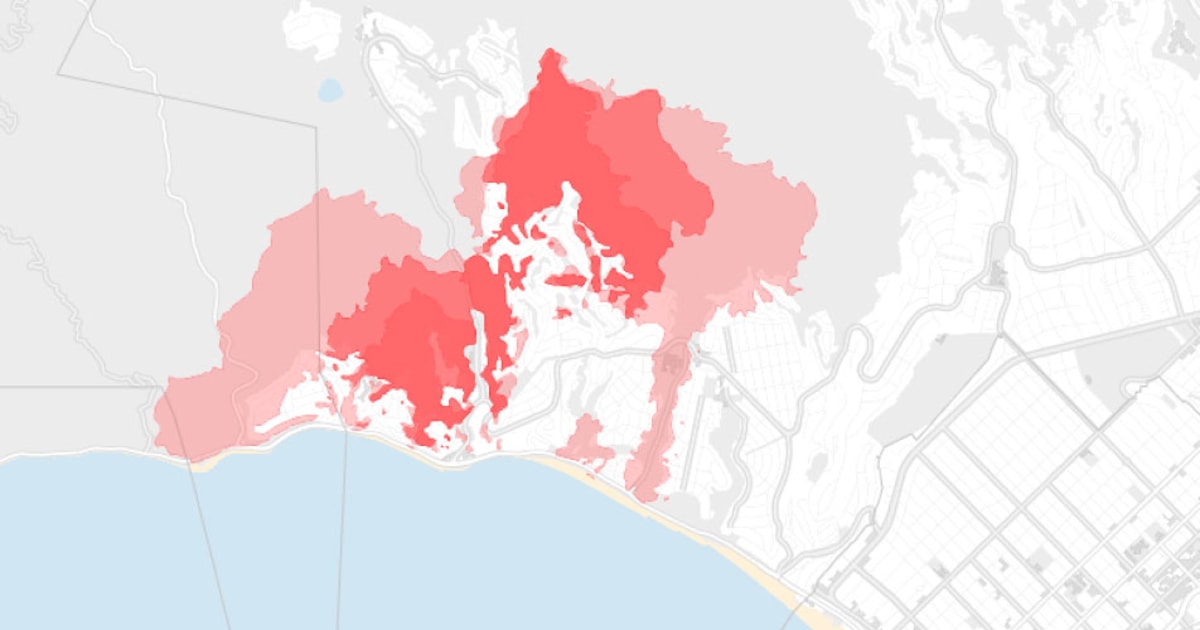

Mandatory evacuation orders remained in effect Thursday morning as wildfires continued to rage across parts of Southern California.

The deadly fires broke out this week and have destroyed more than 1,000 homes, businesses, and other structures, according to Los Angeles County Fire Chief Anthony Marrone. As of Thursday morning, at least five deaths had been confirmed, and nearly 250,000 were without power in the region, according to the USA TODAY power outage tracker.

California Gov. Gavin Newsom declared a state of emergency this week as more than 100,000 people have been forced to flee homes and evacuate the area.

The fires − Palisades, Eaton, Hurst, Lidia, and Sunset − have burned thousands of acres and continue to spread due to humidity and dry vegetation, authorities said. Before the fires started, the National Weather Service issued its highest alert for extreme fire conditions in Los Angeles and Ventura counties.

As of Thursday morning, Cal Fire reported the Palisades, Eaton, and Sunset fires were at zero containment, while firefighters had contained 10% of the Hurst Fire and 40% of the Lidia Fire.

Here’s where evacuation orders are in place for California and how to stay up-to-date on the latest.

Where are evacuation orders in place for the Palisades Fire?

Evacuation orders were in place from Malibu to Santa Monica, including Topanga State Park and stretching into the city as far south as Montana Avenue, as of just after 4:30 a.m. local time on Thursday, according to Cal Fire.

Wind gusts up to 60 miles per hour are expected to continue through Thursday in that area, CAL Fire reported online, “potentially aiding in further fire activity and suppression efforts.”

View an interactive map of Palisades Fire evacuation orders and warnings on the Cal Fire website.

Where are evacuation orders in place for the Hurst Fire?

Evacuation orders were in place for the San Fernando Valley, specifically at the Michael D. Antonovich Open Space Preserve, Stetson Ranch Park and Whitney Canyon Park, about 4:45 a.m. local time on Thursday, according to Cal Fire. Evacuation warnings were in place just north and south of the area.

View an interactive map of Hurst Fire evacuation orders and warnings on the Cal Fire website.

What are the evacuation orders in place for the Lidia Fire?

As of just after 4 a.m. local time on Thursday, no evacuation orders were in effect in connection to the Lidia Fire.

But Soledad Canyon Road between Agua Dulce Canyon Road and Crown Valley Road remained closed, CAL FIRE reported, as well as the entire Angeles National Forest for public safety and the protection of natural resources. The forest will remain closed through Jan. 15 at midnight.

View an interactive map of Lidia Fire on the Cal Fire website.

What are the evacuation orders in place for the Sunset Fire?

“The majority of the evacuation zone for the Sunset Fire is lifted with the exception of the area North of Franklin Ave from Camino Palmero St (East border) to North Sierra Bonita Ave. (West border)”, according to Cal Fire.

Where are evacuation orders in place for the Eaton Fire?

Evacuation orders were in place, as of about 4:30 a.m. on Thursday, for areas near Altadena Drive and Midwick Drive, Altadena and Pasadena, Cal Fire reported.

Evacuation warnings were in place for areas just west and south of the area.

View an interactive map of Eaton Fire evacuation orders and warnings on the Cal Fire website.

Contributing: Greta Cross, USA TODAY

Natalie Neysa Alund is a senior reporter for USA TODAY. Reach her at nalund@usatoday.com and follow her on X @nataliealund.

California

Jamie Lee Curtis fights back tears on ‘Tonight Show’ over California wildfire ‘catastrophe’ near her home: ‘It’s f–king gnarly, guys’

Jamie Lee Curtis fought back tears as she detailed the “catastrophe” of the Palisades Fire near her California home when she appeared on “The Tonight Show” Wednesday.

“As you know, where I live is on fire right now. Literally, the entire city of the Pacific Palisades is burning. I flew here last night. I was on the plane and started getting texts. It’s f–king gnarly, you guys,” Curtis said.

“It’s a catastrophe in Southern California. Obviously there has been horrific fires in many places. This is literally where I live. Everything.”

Curtis said she had “many, many, many” friends who have lost their homes in the devastation of the fires.

“It’s a really awful situation,” she added.

The 66-year-old added she was flying home first thing Thursday to be with her family and friends.

The Academy Award-winning actress, who lives in Los Angeles with her husband Christopher Guest, took to Instagram earlier Wednesday to share with her followers that her home was “possibly” on fire.

“My community and possibly my home is on fire,” the actress wrote in the post. “My family is safe. Many of my friends will lose their homes. Many other communities as well.”

“Take care of each other,” she told her followers. “Stay out of the way and let the firefighters do their work. Pray if you believe in it and even if you don’t, pray for those who do.”

Stay up to date with the NYP’s coverage of the terrifying LA-area fires

The Emmy winner is one of tens of thousands of people who have been forced to flee their homes in Pacific Palisades and neighboring areas.

Four fires have exploded in Los Angeles County, taking over 27,000 acres of land with zero containment in the Palisades, Eaton and Sunset fires.

The Hurst Fire is 10 percent contained, officials announced.

The fires are being fueled by strong winds, “dry fuels” and low humidity.

The “Halloween” star isn’t the only Hollywood figure whose home is under threat due to the fires.

Harrison Ford was seen talking to police as he attempted to get through to check on his $12.6 million Brentwood home he had evacuated because of the raging blaze.

Ford’s “Star Wars” co-star Mark Hamill was forced to flee his Malibu home Tuesday as the fire bore down on the area.

The 73-year-old actor detailed his hour-long “last minute” evacuation from Malibu as he experienced the most horrific fire since 1993.

Other LA-based celebrities have been forced to evacuate their homes amid the crisis, including “This Is Us” star Mandy Moore, “Schitt’s Creek” star Eugene Levy and “Once Upon a Time in America” actor James Woods.

California

Maps: See how large the California wildfires are

Multiple major wildfires are leaving a trail of destruction and death in the Los Angeles area.

A handful of wildfires kicked up Tuesday, powered by high winds and dry conditions , and have exploded in size. As of Tuesday afternoon, 2 people have been killed and more than 80,000 people have been evacuated.

Follow live coverage here.

The maps below show the size and status of the fires. They will be updated frequently.

-

Business1 week ago

Business1 week agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Culture1 week ago

Culture1 week agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

-

Sports1 week ago

Sports1 week agoThe top out-of-contract players available as free transfers: Kimmich, De Bruyne, Van Dijk…

-

Politics7 days ago

Politics7 days agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics6 days ago

Politics6 days agoCarter's judicial picks reshaped the federal bench across the country

-

Politics5 days ago

Politics5 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health4 days ago

Health4 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoIvory Coast says French troops to leave country after decades