California

California’s $6 gas could spread nationwide, JPMorgan warns

“There’s a actual threat the value may attain $6+ a gallon by August,” Natasha Kaneva, head of worldwide oil and commodities analysis at JPMorgan, informed CNN in an electronic mail on Tuesday.

With US gasoline inventories sitting at their lowest seasonal ranges since 2019, JPMorgan is worried will probably be troublesome to fulfill intense demand throughout this summer time’s driving season.

“With expectations of robust driving demand…US retail value may surge one other 37% by August,” JPMorgan wrote in its report, fittingly titled “Merciless Summer season.”

Actually low cost gasoline is changing into a lot harder to search out. Georgia, Kansas and Oklahoma, the final three states with a mean value beneath $4 a gallon on Monday, all crossed that threshold in Tuesday’s studying.

The common value for normal gasoline in California surpassed $6 a gallon in Tuesday’s AAA studying. The state’s common of $6.02 a gallon is up sharply from $4.13 a 12 months in the past, and $5.84 solely per week in the past. Many bigger cities are paying extra: the common stands at $6.07 in Los Angeles County, and $6.27 a gallon in San Francisco.

Even in California, 52% of stations promote gasoline for lower than $6 a gallon, and practically one station in 4 is $5.75 a gallon or much less. Stations that cost a lot greater costs inflate the common.

Excessive-priced stations which can be charging far more than common market costs should not restricted to California. Fuel is being bought for greater than $5 a gallon in 29 states, in response to OPIS, the service that collects gasoline value information for AAA. Six of them — Alaska, Hawaii, Nevada, Oregon, Washington and California — have a state common above that mark. So drivers nationwide may see some stations at or close to $6, even when the nationwide common by no means will get that top. These station homeowners are happy with promoting fewer gallons so long as they will fetch the next value.

‘Exhausting to get to $6’

It is vital to notice that this is only one forecast.

Others within the trade are skeptical that costs would get that top for the straightforward cause that some Individuals would seemingly balk at $6 gasoline and simply drive much less.

“It is laborious to get to $6,” Andy Lipow, president of Lipow Oil Associates, informed CNN. “Earlier than we get there, we’d have vital demand destruction, not solely right here, however all over the world.”

Patrick De Haan, head of petroleum evaluation at GasBuddy, echoed that sentiment, saying: “I personally assume we would see a recession earlier than we would see a nationwide common of $6.”

De Haan mentioned would not agree with JPMorgan — a minimum of, not but. Nonetheless, given the widening imbalance between provide and demand, he conceded, “I do not assume a lot is unattainable on this market.”

JPMorgan acknowledged that one caveat to its forecast is that “demand could proceed to come back in beneath our expectations.” To this point this 12 months, gasoline demand has been decrease than JPMorgan’s unique expectations by a mean of about 500,000 barrels per day.

Federal authorities forecasters count on gasoline costs to dip beneath $4 a gallon through the second half of the 12 months. The US Vitality Data Administration projected final week the nationwide common will drop to $4.81 a gallon through the third quarter and $3.59 a gallon through the closing quarter of the 12 months.

East Coast inventories at decade low

The issue is that refineries are having hassle churning out all of the gasoline wanted proper now. There may be much less US and Canadian refining capability at this time than there was earlier than the pandemic, as some refineries closed completely, and others are being transformed to refine renewable fuels somewhat than crude oil.

JPMorgan notes that East Coast gasoline inventories are at their lowest stage since 2011. The central driver behind the drawdown of inventories is higher-than-normal exports of gasoline, analysts on the financial institution mentioned.

“If exports persist at this elevated tempo and refinery runs — already close to the highest vary for affordable utilization charges — fall inside our expectations, gasoline inventories may proceed to attract to ranges beneath 2008 lows and retail gasoline costs may climb to $6/gallon and even greater,” the JPMorgan analysts wrote.

Primarily based on these assumptions, whole US gasoline inventories may fall beneath 160 million barrels by the tip of August, the bottom stage for the reason that Nineteen Fifties.

Such a decline in inventories suggests a 37% leap in costs, translating to a nationwide common of $6.20 a gallon, the financial institution mentioned. And at these ranges, gasoline costs would blow previous their inflation-adjusted peak of $5.38, set in June 2008, in response to the EIA. The value hit $4.11 at the moment, not adjusted for inflation.

JPMorgan mentioned that until refineries “instantly” reduce exports and shift manufacturing in the direction of gasoline, “US customers mustn’t count on a lot in the best way of reduction in costs on the pump till the tip of the 12 months.”

The one wild card that would increase gasoline costs is that if main hurricanes hit the US refineries and oil platforms alongside the Gulf Coast. The official authorities outlook for the upcoming hurricane season is due out subsequent week.

California

How California’s high-speed rail line will advance in 2025

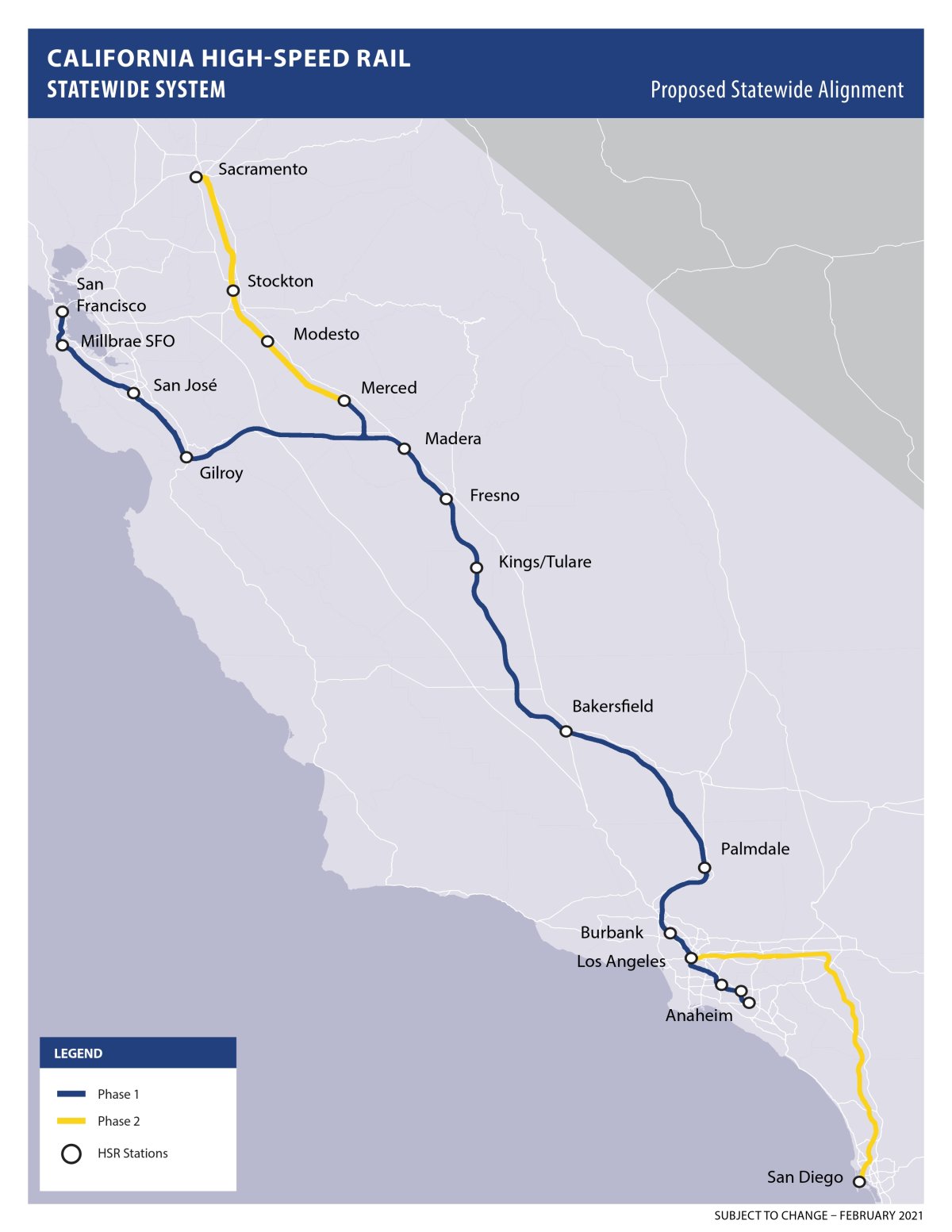

California’s high-speed rail project, which aims to connect San Francisco and Los Angeles with a 494-mile route capable of speeds up to 220 mph, aims to continue construction in 2025.

Phase 1 of the project focuses on linking San Francisco in the north to Anaheim via Los Angeles in the south, with plans to extend the line north to Sacramento and south to San Diego in Phase 2.

The California High-Speed Rail Authority, which is overseeing the project says it has already generated significant economic benefits, including creating over 14,000 construction jobs and involving 875 small businesses.

But despite its transformative goals, the project remains politically contentious, with critics questioning its costs and viability. It has been in development since voters approved funding in 2008 and has faced delays, cost increases, and shifting timelines.

Photo Illustration by Newsweek

Work Planned for 2025

In a statement to Newsweek, the California High-Speed Rail Authority outlined its planned work for 2025, which focuses on continuing construction in the Central Valley between Merced and Bakersfield.

The 171-mile segment between Merced and Bakersfield will be the first part of the line to be operational, with services expected to start between 2030 and 2033. Of that section, 119 miles are currently under construction.

Of the planned structures in the Central Valley section, 85 are underway or completed out a total of 93 on the segment. Work will continue on these structures as well as on the tracks capable of handling high-speed trains.

By the end of 2025, civil construction on the 119-mile segment currently underway is expected to be completed and construction will begin on the next stretches to Merced and Bakersfield.

In 2025, the authority also plans to advance design and begin construction on its stations in the Central Valley. It also expects to select a manufacturer for the trains.

Although the initial operating segment will only run 171 miles from Merced to Bakersfield, environmental clearances have been obtained for 463 miles of the 494-mile Phase 1 route, completing the stretch between San Francisco and Los Angeles. Only the Los Angeles-to-Anaheim section is still awaiting approval.

California High Speed Rail Authority

The Authority said it plans to publish its draft environmental impact report for the Los Angeles-to-Anaheim section in 2025, a key milestone for the eventual full-approval of Phase 1.

More than $11 billion has been invested to date, with funding sources including state bonds, federal grants, and proceeds from California’s carbon emission trading auctions.

The authority has not yet received funding to construct the segments westwards from the Central Valley to the Bay Area or southwards to Los Angeles.

Despite this, the authority said it was committed to pushing on.

“California is the first in the nation to build a true high-speed rail system with speeds capable of reaching 220 mph,” the Authority told Newsweek. “The Authority remains committed and aggressive in moving this historic project forward while actively pursuing additional funding.”

Political Opposition to the Project

Despite ongoing progress, the high-speed rail project continues to face political opposition, particularly from Republican leaders.

While President Joe Biden’s administration has invested billions in it since 2021, the incoming Republican administration, which will control the House of Representatives, the Senate, and the presidency, is unlikely to continue funding it at the same level.

Representative Sam Graves of Missouri, who chairs the House Transportation and Infrastructure Committee, has criticized the project’s costs and funding strategies.

In a statement to Newsweek, Graves described the rail line as a “highly troubled project” and raised concerns about its reliance on government subsidies.

California High Speed Rail Authority

He pointed out that the current funding supports only a limited segment between Merced and Bakersfield, which he estimated will cost $35 billion.

“Full cost estimates [for Phase 1, between San Francisco and Anaheim] now exceed $100 billion and growing,” Graves said, calling for a comprehensive review of the project before any additional funding is allocated.

“California high-speed rail must have a plan and prove that it can wisely and responsibly spend government money—something it’s failed to do so far.”

The congressman stated that over the next four years, he would oppose any further federal funding for the California high-speed rail project.

Instead, Graves advocated for efforts to redirect unspent funds and focus on improving existing transportation infrastructure, such as Amtrak.

Graves also emphasized the need for private-sector involvement in future rail projects, citing Brightline’s operations in Florida and Las Vegas as a successful example of private investment.

While Graves acknowledged the potential of high-speed rail, he argued that the California project has failed to meet the necessary criteria for viability and local demand.

The authority told Newsweek it would engage with the federal government to seek other funding sources.

“We continue to explore strategies aimed at stabilizing funding, potentially allowing the program to draw private financing and/or government loans,” it said.

California

Hawaii resident flies to California to clear name from identity theft

HONOLULU (HawaiiNewsNow) – A Honolulu man who had his identity stolen had to fly to California to clear his name. He acted quickly to stop his bank account from being completely drained.

Jamie Dahl said he’s speaking out because identity theft can happen to anyone and he’s not sure how his personal information was stolen.

“I’m still mystified how he pulled it off,” Dahl said.

In late November, Dahl found some fraudulent charges on his credit card so he ordered a replacement card.

Two weeks later, he says went to his online bank account with Bank of America and discovered his identity had been stolen. The hacker had account access for instant money transfers.

“My phone number is missing, my email is missing, my mailing address. I live in Honolulu. It’s Mililani,” Dahl said.

He knew he was in trouble.

Dahl said two days after his discovered his identity had been stolen, he had to fly to California to clear his name because there are no Bank of America branches in Hawaii.

He brought several forms of ID to re-authenticate himself.

“It was just an incredible ordeal,” he said.

“The bad guys are shopping just like everybody else for Christmas,” said former HPD Deputy Chief John McCarthy, who investigated cybercrime.

McCarthy says check your bank account daily and having a local bank is helpful.

“If you don’t have a local bank, you are that much father away. I’ve had problems with banks that are on the East Coast,” he said.

“It takes a day to communicate with them, a day to get a response. That’s a lot of damage you can do in 24, 48, 72 hours,” McCarthy added.

McCarthy says most banks have streamlined their re-authentification process so you don’t have to see them in person.

Hawaii News Now contacted Bank of America to find out their process and are waiting to hear back.

Copyright 2024 Hawaii News Now. All rights reserved.

California

California high surf and flood warnings continue after pier collapse

What’s New

California’s coastal residents are facing dangerous conditions this Christmas Eve as high surf and flood warnings continue after heavy waves caused a pier to collapse on Monday.

Why It Matters

Portions of the Pacific coast are currently under hazardous seas warnings, high surf warnings and coastal flood warnings as it is shaping up to deliver some of the most severe surf conditions of the winter season, according to the National Weather Service (NWS) office in Portland.

The NWS issued a high surf warning, with waves reaching up to 35 feet, which can pose significant risks to both property and lives.

“Large waves can sweep across the beach without warning, pulling people into the sea from rocks, jetties, and beaches,” the agency warned in a Christmas Eve bulletin.

The alert remains in effect until Tuesday evening, prompting evacuations and heightened vigilance in several coastal communities.

What To Know

The NWS warnings come after a municipal wharf in Santa Cruz that was under renovation succumbed to a storm’s force. Around 150 feet of the structure collapsed into the Pacific, pulling three engineers inspecting the site into the water. All three individuals survived with two rescued by lifeguards and one swimming to safety.

Shmuel Thaler/The Santa Cruz Sentinel/ AP

Santa Cruz Mayor Fred Keeley said that section of the pier had been damaged over time, and the structure was in the middle of a $4 million renovation following destructive storms last winter.

Tony Elliot, Santa Cruz Parks & Recreation Department head, confirmed that the severed portion of the wharf, which included restrooms and a closed restaurant, drifted nearly half a mile before settling in the San Lorenzo River.

In response, coastal towns including Santa Cruz have evacuated vulnerable homes and hotels as the state braces for more damage.

What People Are Saying

Keeley said Monday: “We are anticipating that what is coming toward us is more serious than what was there this morning.”

The National Weather Service’s Bay Area office said in a post on X (formerly Twitter): “You are risking your life, and those of the people that would need to try and save you by getting in or too close to the water.”

The NWS office in Portland, Oregon, said in a post on X:“It will likely go down as some of the highest surf this winter.”

California Governor Gavin Newsom’s press office posted to X on Monday afternoon, saying that he is aware of the situation with the pier.

“@CAGovernorNewsom has been briefed on a previously damaged section of the Santa Cruz pier that broke off due to heavy surf. @Cal_OES is coordinating with local officials and is ready to provide support,” Newsom’s press office wrote. “Residents and visitors should avoid the area and follow local guidance.”

What Happens Next

As California residents grapple with these dangerous conditions, meteorologists warn that the storm’s high surf may be the most intense of the season.

With more severe weather expected, officials are urging the public to heed warnings and avoid risky coastal areas.

This article includes reporting from The Associated Press.

-

Business1 week ago

Business1 week agoFreddie Freeman's World Series walk-off grand slam baseball sells at auction for $1.56 million

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg) Technology1 week ago

Technology1 week agoMeta’s Instagram boss: who posted something matters more in the AI age

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology4 days ago

Technology4 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps

-

News1 week ago

East’s wintry mix could make travel dicey. And yes, that was a tornado in Calif.

-

News5 days ago

News5 days agoNovo Nordisk shares tumble as weight-loss drug trial data disappoints

-

Politics5 days ago

Politics5 days agoIllegal immigrant sexually abused child in the U.S. after being removed from the country five times

-

Entertainment6 days ago

Entertainment6 days ago'It's a little holiday gift': Inside the Weeknd's free Santa Monica show for his biggest fans

-

World1 week ago

World1 week agoIsrael to close its embassy in Ireland over 'anti-Israel policies'