Alaska

Alaska Air Stock: Still A Strong Buy Ahead Of Earnings (NYSE:ALK)

Boarding1Now

Last December, I argued that Alaska Air (NYSE:ALK) shares had tremendous upside in 2023, with the potential to rally 75% or more within a year.

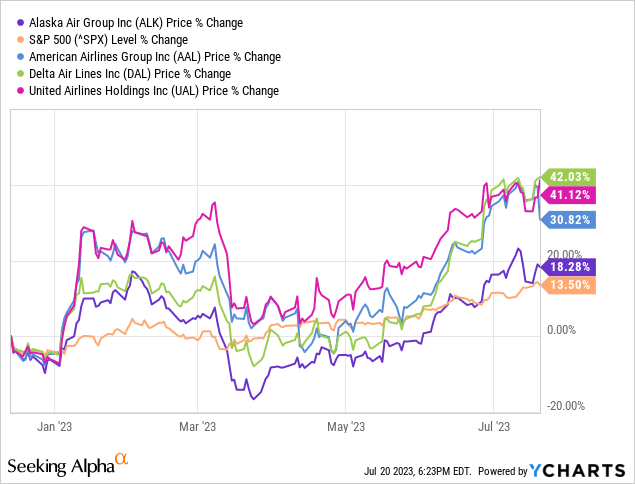

Since then, Alaska Air stock has beaten the market, but not by much, rising approximately 18%. Shares of the three big network carriers that dominate the U.S. airline industry have performed much better. American Airlines (AAL) is up more than 30%, while Delta Air Lines (DAL) and United Airlines (UAL) shares have each gained over 40%.

Despite this less-than-extraordinary start to the year, Alaska Air’s combination of strong margins, growth potential, and balance sheet strength make it the most compelling investment opportunity in the U.S. airline industry. With shares trading for just 8 times the midpoint of Alaska’s 2023 EPS guidance (which is starting to look quite conservative), Alaska Air stock could break out in the second half of 2023 and 2024 as investors begin to recognize the company’s potential.

Solid demand and lower fuel set up an earnings beat

Delta, United, and American have all released beat-and-raise earnings reports this month. I expect Alaska Air to do the same when it reports earnings on Tuesday.

Notably, air travel demand remains very strong. Despite inflationary pressures on discretionary spending, consumers (particularly higher-income consumers) remain eager to make up for lost travel opportunities during the pandemic. Meanwhile, business travel continues to return gradually, notwithstanding some belt-tightening due to recession fears.

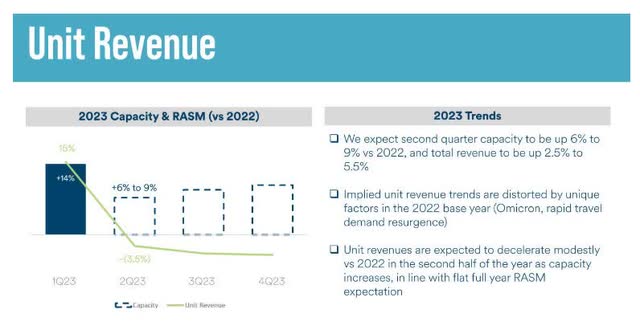

In their recent earnings reports, American, Delta, and United have reported Q2 domestic unit revenue declines ranging from 1% to 3%. Since the domestic market accounts for nearly all of Alaska’s revenue, this is the best point of comparison. Alaska’s Q2 guidance implied a unit revenue decline of approximately 3.5% at the midpoint. This suggests that Alaska Air has a good chance of delivering revenue near or even above the high end of its guidance range.

Source: Alaska Air Q1 Earnings Report and Investor Update, p. 21.

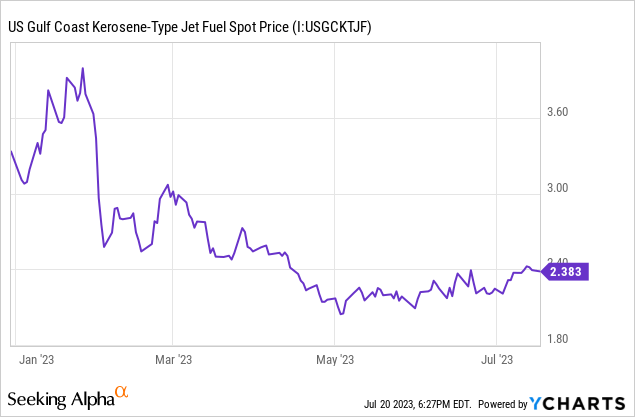

Holding all else equal, strong revenue results would support a Q2 adjusted pre-tax margin near the high end of Alaska’s 14%-17% guidance range. However, falling fuel prices have provided an incremental margin tailwind.

Alaska’s Q2 forecast assumed an average fuel price for the quarter between $2.95 and $3.15 per gallon. However, the price of Gulf Coast jet fuel fell from over $2.50/gallon on April 13 (one week before Alaska reported earnings) to an average of $2.17/gallon in May and $2.25/gallon in June. American, Delta, and United all reported average fuel prices between $2.52/gallon and $2.66/gallon for Q2.

Due to geographical differences and the cost of its fuel hedging program, Alaska’s average fuel cost will be higher than peers. During 2022, Alaska’s “raw” fuel cost per gallon (excluding hedges) was $3.64: 10 cents higher than American Airlines. A year earlier, its raw fuel cost per gallon was 7 cents higher than that of American. Furthermore, Alaska hedged 50% of its expected Q2 fuel consumption with call options, paying an average premium of $7 per barrel (see p. 34). That will add 8-9 cents/gallon to its fuel bill. Together, these factors suggest that Alaska Air likely paid an average of roughly $2.80/gallon for fuel last quarter, compared to American’s $2.62/gallon.

That savings of 25 cents per gallon compared to the midpoint of Alaska’s guidance adds nearly 2 percentage points to its pre-tax margin. Thus, I expect the company to report an industry-leading adjusted pre-tax margin of 18%-19% for the second quarter: solidly above the high end of the guidance range (17%).

Assuming revenue of $2.8 billion (just below the high end of guidance) and an effective tax rate of 25%, this implies adjusted EPS of roughly $2.90-$3.10. The analyst consensus has not caught up to reality: $2.90 is the highest estimate on Wall Street, with the average sitting at $2.70.

Cost tailwinds on the way

Alaska’s earnings power and outperformance relative to the rest of the industry is primed to expand further in the second half of 2023 and 2024, primarily due to improving cost trends.

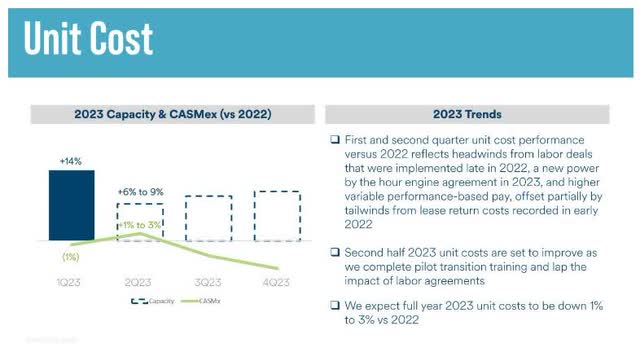

First, due to the timing of its labor negotiations, Alaska Air has experienced greater cost headwinds than many of its peers over the past few quarters. Three of the company’s labor groups (most notably its mainline pilots) ratified new multiyear agreements in the second half of 2022, creating a 4 percentage point headwind to non-fuel unit costs. That headwind partially rolls off in Q3 and fully dissipates by Q4 of this year. By contrast, American and United don’t have ratified mainline pilot agreements yet, though they are close.

In short, whereas some competitors will just start to experience labor-related margin pressure in the second half of 2023, Alaska has nearly lapped those headwinds.

Second, Alaska Airlines is on track to retire the remainder of its Airbus (OTCPK:EADSY) fleet by the end of Q3. That will allow the carrier to unlock the cost benefits of returning to a single mainline fleet type.

Additionally, Alaska incurred substantial costs to retrain Airbus pilots to fly Boeing (BA) 737s in the first half of 2023, having retired 29 Airbus A320s between last summer and January of this year. These fleet transition costs will be much smaller in the second half of the year and will drop to negligible levels in 2024.

As a result, whereas non-fuel unit costs are still rising for American and United, Alaska expects non-fuel unit costs to decline year over year in Q3 and Q4 (see p. 22). By the fourth quarter, non-fuel unit costs could be down approximately 5% year over year, putting the airline in great position to further reduce non-fuel unit costs in 2024.

Source: Alaska Air Q1 Earnings Report and Investor Update, p. 22.

Heading towards record earnings

Alaska Air expects unit revenue to continue declining in the second half of 2023, due to tough year-over-year comparisons. However, barring a sharp rebound in jet fuel prices, the combination of lower fuel and non-fuel unit costs will enable additional margin improvement.

Other U.S. airlines are projecting Q3 all-in fuel costs to be roughly in line with Q2 levels, despite a recent rebound in oil prices. Assuming Alaska reports an average fuel price of $2.80/gallon again in Q3, compared to $3.66 a year earlier, lower fuel prices would provide a pre-tax margin tailwind exceeding 6 percentage points. Fuel efficiency gains, better non-fuel unit costs, and higher interest earned on Alaska’s cash and investments will boost pre-tax margin by another 3 percentage points or more.

In short, Alaska’s adjusted pre-tax margin could expand by approximately 5 percentage points year over year even with unit revenue down by about 5%. That would support Q3 EPS in the vicinity of $3.50: well ahead of the analyst consensus once more.

This strong earnings trajectory has Alaska Air on pace to deliver full-year adjusted EPS around the high end of its current guidance range of $5.50-$7.50. That would beat the previous full-year record of $7.32 set in 2016. I doubt management will declare victory yet, due to the unpredictability of the airline industry, but I do expect an adjusted EPS guidance increase, perhaps to $6.50-$7.50.

A coiled spring

Looking beyond 2023, Alaska Air is on track for further earnings growth in 2024 and 2025. With the Airbus fleet transition nearly complete, Alaska will finally begin expanding its mainline fleet beyond pre-pandemic levels next year. That will allow the airline to capture pent-up demand while driving non-fuel unit costs lower through scale and efficiency benefits.

Image source: Alaska Airlines.

While margin performance will vary year to year based on short-term fluctuations in fuel prices, demand, and the timing of various expenses, Alaska Air is well positioned to grow revenue at a high-single-digit CAGR over the next few years while gradually expanding its profit margin. That would enable double-digit annual growth in net income.

Furthermore, with earnings trending towards the high end of Alaska’s guidance range and aircraft delivery delays likely pushing some CapEx from 2023 into later years, Alaska Air is also on track to produce better-than-planned free cash flow this year. This may lead the company to ramp up this year’s share buybacks well beyond the $100 million target it initially communicated, given that the stock trades for 8 times the midpoint of the 2023 EPS guidance range (and 7 times the high end). Incremental buybacks would add to future EPS growth.

Thus, I believe Alaska is still likely to deliver adjusted EPS between $8 and $10 next year: well ahead of the analyst consensus of $7.39. With shares trading at a depressed valuation relative to this earnings estimate, there is plenty of upside for Alaska Air stock as the company’s earnings potential comes into greater focus over the next year or so. The stock would have to rise nearly 50% just to trade at 10 times the low end of that range.

Obviously, the market can remain irrational for quite a while. But whereas the Big Three have reported stronger earnings momentum this year (mainly due to easier comparisons), that will change over the next few quarters as Alaska starts to push non-fuel unit costs lower. This could set the stage for an abrupt change in sentiment and a big rally in Alaska Air stock.

Alaska

As Alaska warms, Arctic geese are skipping their southern migration

Out on Izembek Lagoon, the water was flat and clear. Alison Williams, a biologist with the U.S. Fish & Wildlife Service, dipped her paddle in and steered her kayak toward the center of the lagoon, where the seagrass below runs thick.

“Everything below us is eelgrass,” she said. “It actually evolved on land and then evolved to go back into the water.”

The lagoon is the heart of the Izembek National Wildlife Refuge, a wide expanse of tundra and small lakes that stretches 310,000 acres across the Alaska peninsula, between the Pacific Ocean and the Bering Sea. It’s the smallest federal wildlife refuge in Alaska but one of the most important. It’s home to hundreds of thousands of birds: Pacific black brant, emperor geese, pintails and eiders.

This time of year, Izembek is famous as a stopover for migrating birds — a place to rest and refuel as hundreds of species move between their southern wintering grounds and the Arctic.

Refuge manager Maria Fossado underscores how central this place is for migration.

“Wildlife are very smart, and they like to capitalize on use of energy,” she said. “Their focus is feeding, resting and capitalizing on when food is available.”

Theo Greenly / KSDP

/

KSDP

As the Arctic warms, some birds, like the Pacific black brant, are cutting their migrations short and spending the winter at the refuge. Williams says declining sea ice has made it easier to find the resources they need.

“It used to be, in the ’80s, a couple thousand. Increasingly, more of them are staying all winter long. Fifty to sixty thousand — the thought is, the lagoon is freezing over less, we’re getting less ice, and so the brant can access the eelgrass,” she said.

The lagoon is Izembek’s crown jewel. It hosts one of the largest eelgrass beds in the world. So why fly 2,800 miles to winter in Mexico when it’s plenty warm here?

“It might freeze up and then melt a couple times during the winter now, which is part of why people think that the brant are staying over more during the winter,” Williams said.

But overwintering has its costs. Brant don’t have to fly as far — but surviving an Alaska winter takes more energy than it does in a warmer place. Williams calls it a game of trade-offs.

A study published in March the journal Movement Ecology looked at brant over a 10-year period. It found the benefits mostly cancel out: the energy saved on the commute is about the same as the energy spent making it through the colder winters.

Theo Greenly / KSDP

/

KSDP

A fragile habitat holds on — for now

Beneath Williams’ kayak, there was a sprawling underwater meadow — the eelgrass beds that fuel the entire ecosystem.

“There’s a lot of things that live in the eelgrass,” Williams added. “It’s good habitat for a huge array of things.”

Tiny snails and clams burrow into it. Fish shelter inside it. And birds like the black brant depend on it for the energy to migrate — or overwinter.

The U.S. Geological Survey surveyed the eelgrass cover at Izembek in 2016 and 2020.

“There was some loss of eelgrass in the central part of the lagoon, where we are now,” Williams said. “And then a couple areas where we actually gained a little bit.”

Overall, the survey found a slight decline — far less than the global average. Worldwide, scientists estimate that about 30% of eelgrass habitat has vanished, hit hard by warming waters, pollution and invasive species.

Izembek remains one of the largest intact strongholds for this vital ecosystem. But in a warming world, even the most remote places are changing.

Alaska

Amid budget struggle, Alaska has little money for new construction or renovation

The Alaska House of Representatives, following in the path of the state Senate, has approved a small construction and renovation budget for the fiscal year that starts July 1.

The vote on Senate Bill 57, the annual infrastructure bill — formally known as the capital budget — was 21-19, along caucus lines.

When oil prices and production are high, the Alaska Legislature pours hundreds of millions of dollars into new construction and maintenance projects. This spring, with the Legislature anticipating low oil prices and reduced federal funding, the House version of the capital budget proposes to spend just $167.9 million in general-purpose dollars.

In comparison, the capital budget two years ago spent more than three-quarters of a billion dollars. The newly approved capital budget isn’t the smallest in recent history — in 2016, legislators approved just $107 million — but spending is very limited by historical standards, noted Rep. Calvin Schrage, I-Anchorage, who oversaw the budget on the House Finance Committee.

“This was not a fun or easy year to be the capital budget co-chair,” Schrage said, “due to our state’s dire fiscal picture. We had to say no — or at least not now — to a lot of good projects that would have benefited Alaskans. That said, we were still able to make some meaningful investments.”

A significant amount of the capital budget is being set aside for matching funds needed to unlock federal grants. For example, it allocates $57.2 million in general-purpose money to the Alaska Department of Transportation and Public Facilities, which gives the state access to more than $2 billion in transportation funding once federal money is considered.

It isn’t yet clear how federal budget cuts will affect that figure. The budget is set based on what is known as of today.

With general-purpose revenue limited, the House and Senate finance committees were mostly limited to assigning money to deferred maintenance projects at state facilities spread across Alaska.

For example, the Senate added $19 million to the major maintenance list at public schools. The House added another $19 million on top of that, enough to cover the top nine projects on the list.

“We basically had an agreement going in; we got half, they got half,” said Sen. Bert Stedman, R-Sitka and Senate Finance Committee co-chair.

When it came to discretionary funding, requests from individual legislators for things like playgrounds or streetlights, the House and Senate were again treated equally.

“Everybody got nothing,” Stedman said.

Budget documents show few exceptions to Stedman’s comment.

One of the few budget additions made by the House was $500,000 for a Blood Bank of Alaska testing lab. Gov. Mike Dunleavy requested the money, the Senate rejected it, but the House added it back in.

In many places, the budget attempted to use other sources of money instead of general-purpose dollars that primarily come from Permanent Fund earnings, oil taxes and royalties.

For example, Dunleavy requested $7 million for a time and attendance system to be used by state employees. The Senate cut that request to $4 million, and instead of using general-purpose dollars, lawmakers took additional money from the accounts of the Alaska Industrial Development and Export Authority. The House approved that change.

Of the budget overall, Schrage said lawmakers tried to deny projects equally, without regard to party or district.

“I know that this won’t make everyone happy, but we’ve done the best that we can,” he said.

The budget will return to the Senate for a concurrence vote, then advance to Dunleavy, who has line-item veto power and may eliminate individual budget items but cannot add new ones.

Originally published by the Alaska Beacon, an independent, nonpartisan news organization that covers Alaska state government.

Alaska

9 Best Airbnbs in Anchorage, Alaska—From Cozy Cabins to Modern Lofts

Anchorage is one of those rare cities where wild and urban live side by side. One minute, you’re passing a moose on a bike path, the next, you’re ordering a smoked salmon bagel and pour-over coffee downtown. And though Alaska’s largest city is shaped by its scale—vast landscapes, dramatic seasons—what surprises most visitors is how livable it feels. And that’s reflected in Anchorage’s best Airbnbs.

Whether you want to be downtown near the galleries, bakeries, and reindeer hot dog stands, or tucked into the mountains with views of the Cook Inlet on clear days, there’s a vacation rental in Anchorage for every type of traveler. Though I now split my time between Alaska and Colorado, I spent eight years living in Anchorage full-time—long enough to know which neighborhoods catch the best sunset light and where the trails start just beyond the backyard fence.

No matter the season, these are the Anchorage Airbnbs that make you feel like a local, even if it’s just for the weekend.

While we have not stayed in every Airbnb featured, unless otherwise stated, these listings are vetted based on Superhost status, amenities, location, previous guest reviews, and decor.

Our top picks:

FAQ

When is the best time to visit Anchorage, Alaska?

The best time to visit Anchorage depends on what kind of Alaska you’re after. Summer (mid-June through early September) offers long days, mild temperatures, and access to hiking trails, wildlife tours, and salmon runs—it’s peak season for a reason. But winter has its own magic: snow-dusted spruce trees, northern lights overhead, fewer crowds, and a festive atmosphere around events like the Fur Rendezvous and the Iditarod.

What is the best area of Anchorage to stay in?

The best place to stay in Anchorage depends on your itinerary. For walkable access to restaurants, galleries, and the Tony Knowles Coastal Trail, downtown is your go-to—compact, central, and full of character. If you’re after trailheads, parks, and mountain views, head to the Hillside or Southside neighborhoods, where cabins and modern homes back right up to Chugach State Park.

How many days do you need in Anchorage?

Anchorage isn’t one of those cities you “do” in a day, and though many travelers treat it like a stopover, I’d argue you’ll want at least two to three full days to really experience the city. That gives you time to explore Anchorage’s vibrant Indigenous art scene, bike or hike the local trails, take a day trip to nearby glaciers, and sample the local food—from king crab legs to reindeer sausage. Extend to five days so you can add in hikes in Chugach State Park, wildlife sightings in the Alaska Wildlife Conservation Center, or a scenic train ride down Turnagain Arm.

-

Austin, TX7 days ago

Austin, TX7 days agoBest Austin Salads – 15 Food Places For Good Greens!

-

Technology1 week ago

Technology1 week agoNetflix is removing Black Mirror: Bandersnatch

-

World1 week ago

World1 week agoThe Take: Can India and Pakistan avoid a fourth war over Kashmir?

-

News1 week ago

News1 week agoJefferson Griffin Concedes Defeat in N.C. Supreme Court Race

-

News1 week ago

News1 week agoReincarnated by A.I., Arizona Man Forgives His Killer at Sentencing

-

News1 week ago

News1 week agoWho is the new Pope Leo XIV and what are his views?

-

Lifestyle1 week ago

Lifestyle1 week agoAndré 3000 Drops Surprise Album After Met Gala Piano Statement

-

News1 week ago

News1 week agoEfforts Grow to Thwart mRNA Therapies as RFK Jr. Pushes Vaccine Wariness