Politics

In another pandemic fallout, used car prices are way up, and the repo man is back

Healthcare employee Cleveland Wishop landed at Baltimore-Washington Worldwide Airport final fall anticipating to retrieve his automotive from long-term parking and drive residence.

It by no means crossed Wishop’s thoughts that he had fallen into one of many financial traps stemming from the COVID-19 pandemic.

His blue Camaro had vanished. The vendor who bought him the 2010 automotive a yr earlier seized it after Wishop fell simply 19 days behind in making his August fee.

“I used to be pissed, extraordinarily,” Wishop stated.

In occasions previous, auto sellers and lenders had been slower to retake vehicles when debtors fell behind. Discovering and repossessing automobiles was usually tough, sometimes even dangerous. And recouping prices on seized automobiles was a dropping recreation.

However the pandemic modified that.

World provide chain snarls proceed to trigger continual shortages in lots of very important merchandise, together with the pc chips on the coronary heart of contemporary vehicles.

And that’s led to an unprecedented rise in used-car costs as manufacturing of latest automobiles stays constrained.

Primarily based on authorities surveys, costs for used vehicles and vans rose 43% in June from August 2020, once they first began to leap. For brand spanking new automobiles, costs rose 17% over the identical interval.

This pandemic-related surge within the demand for used vehicles and vans has turned the repo recreation on its head.

Now a vendor who strikes quick to repossess a car can anticipate to resell it rapidly, typically at a far larger worth.

And because of the prevalence of monitoring expertise, discovering automobiles is pretty easy.

Auto repos had been down throughout earlier phases of the pandemic as lenders gave extra breaks to debtors. Though statistics for this yr aren’t but out there, title corporations, authorities regulators and many individuals concerned in auto assortment and auctions say that repossessions are rising notably, notably for used vehicles.

“There was a interval for lots of collectors, they had been deferring earlier in COVID,” stated Colin Welsh, a Woodland Hills lawyer who works with debtors and has been fielding many extra repo calls. “That has waned, and now they’re seizing the second.”

Mark Lacek, a Florida repo man who’s recovered greater than 10,000 automobiles because the Seventies, predicts the pattern will solely develop.

“I anticipate to be tremendous, tremendous busy,” he stated, including that expertise has streamlined assigning and discovering repo automobiles. Like beachcombers with steel detectors, Lacek stated, a small military of individuals with license-plate-reading cameras mounted on their vehicles cruise the streets, ready for a ping to alert them once they move a car within the repo database.

Within the case of Wishop’s Camaro, Caspian Auto Motors of Stafford, Va., resold the automotive inside two weeks and is now suing Wishop, of Petersburg, Va., to repay the steadiness due on the four-year, high-interest mortgage.

Wishop, whereas acknowledging his checkered credit score historical past, says he’s pursuing his personal authorized motion towards the vendor.

“They obtained paid twice for a similar automotive,” he stated. “That was their intention. That’s their recreation.”

Caspian managers didn’t return calls.

Automobile costs have soared so excessive that Robert W. Murphy, a Fort Lauderdale, Fla., lawyer who represents debtors, stated he even had two shoppers receives a commission a number of thousand {dollars} every after their vehicles had been repossessed and bought at an public sale.

That’s as a result of, by legislation, proceeds exceeding the mortgage restoration quantity have to be returned to the borrower.

“Neither put any cash down, no fairness, no pores and skin within the recreation, they usually each obtained checks,” Murphy stated.

Automobiles have been a significant component within the nation’s surge in inflation total, which is at a four-decade excessive. Within the years simply previous to the pandemic, used-vehicle costs hardly noticed any change.

On the similar time, growing numbers of customers are starting to fall behind on their automotive funds.

Not solely is inflation straining family budgets, however authorities pandemic assist checks have stopped flowing, and many individuals who bolstered their financial savings accounts in the course of the earlier phases of COVID are seeing these balances begin to dwindle.

Shopper automotive mortgage delinquencies have began to tick larger, notably for younger and subprime debtors. Auto loans greater than 60 days late had been up 30% in Could from a yr earlier, though defaults up to now stay under pre-pandemic ranges, Cox Automotive stated.

American customers presently have auto loans totaling $1.4 trillion, double the quantity from 10 years in the past and now bigger than bank card debt, in keeping with the Federal Reserve Financial institution of New York.

If the economic system falls into recession and extra folks lose jobs and incomes, households will really feel growing monetary stress.

The typical month-to-month fee on a used-car mortgage in the present day exceeds $500, says Bankrate.com. It’s about $650 for brand new automobiles, with one out of eight debtors on the hook for $1,000 or extra a month.

If used-car values soften within the months forward — and the will increase are already starting to reasonable — many customers may very well be left with upside-down auto loans.

Some analysts say the scenario appears to be like frighteningly much like the subprime mortgage disaster that led to the Nice Recession in 2007-09.

Although most economists don’t foresee something just like the monetary crater again then, they fear nonetheless that the imbalances within the auto business and financing will trigger vital hassle for customers and lenders alike, particularly these heavy within the subprime market.

Credit score unions, with their repute for decrease rates of interest and lending to numerous communities, have seen booming development in used-car loans. Credit score unions now account for a few third of the car credit score market within the nation.

Mike Schenk, chief economist on the Credit score Union Nationwide Assn., says information counsel that a few quarter of credit score union debtors have below-prime scores, that means they’re extra prone to get into monetary difficulties and fall behind on automotive funds.

Schenk dismissed worries as overblown, saying auto mortgage delinquencies of larger than 60 days are up solely barely for credit score unions and stay traditionally at very low ranges.

However some lenders are beginning to really feel extra strain.

Pentagon Federal Credit score Union has one of many largest portfolios of used-auto loans, about $3.6 billion as of March. That’s up a whopping 80% from a yr earlier. As of March, the greenback quantity of delinquent accounts 60 days or larger has greater than doubled from a yr in the past to about $45 million, in keeping with quarterly filings.

Different lenders could face larger threat due to their giant publicity. In Orange County at Westminster-based LBS Monetary Credit score Union, for instance, autos make up 70% of its whole loans. Neither Pentagon Federal nor LBS Monetary would remark.

“You do see some monetary establishments, together with credit score unions, fairly deep in subprime autos, and will that market flip out of the blue and viciously, they’ll discover themselves on the mistaken aspect of a speculative wager,” stated Aaron Klein, a senior fellow on the Brookings Establishment.

He famous that the pandemic, by inducing large quantities of federal stimulus cash and an irregular surge in automotive values, masked the underlying issues within the used-car market, notably within the fast-growing subprime section that’s lengthy been troubled by discrimination and unsavory practices.

Massachusetts and some different states have been cracking down on subprime auto sellers and financiers.

Although lenders can legally seize automobiles from debtors who’re greater than 10 days late on fee — and in lots of states with out prior notification — it’s illegal to “breach the peace” in doing so, stated John Gayle Jr., a Richmond, Va., client rights lawyer and co-author of the state’s lemon legal guidelines.

He stated variations in state legal guidelines can create grey areas for repossessing operations, however nearly in every single place it will break the legislation if it would result in any sort of violence or if repossession occurred in a automotive proprietor’s yard or non-public property.

Iieska Packard of Fresno, a 43-year-old licensed vocational nurse, was at her firm workplace final yr when a colleague requested, “Isn’t that your automotive getting towed?” Packard raced down the steps and out the door, but it surely was too late. Her 2017 Lincoln MKX was gone.

“I didn’t know what was occurring. At first I believed it was theft,” she stated. Later, Packard realized her SUV, which she had bought solely a month earlier, had been towed by an unmarked truck.

She stated the dealership, LA Auto Trade in Montebello, informed her that the financing had been canceled as a result of it couldn’t affirm her employment.

LA Auto Trade managers didn’t return calls. The dealership is in arbitration with Packard’s lawyer, Welsh of Woodland Hills.

When Packard purchased the car, she put down $2,000 on a purchase order worth of $21,285, together with gross sales tax and charges. She financed the remainder by means of the vendor with a six-year mortgage bearing an annual rate of interest of 26.2% — even larger than the common 9% to twenty% price that subprime automotive consumers face, in keeping with the Shopper Monetary Safety Bureau.

The gross sales contract confirmed Packard’s financing expenses over the time period of the mortgage totaling $19,561 — greater than the unique principal borrowed.

Packard, a mom of two, says her credit score was damage after she fell behind on pupil loans and medical payments. However having her automotive repossessed like that “was irritating and embarrassing,” she stated. “Everybody within the workplace was there.”

Politics

Video: Mourners Honor Minnesota Lawmaker and Husband at Funeral

new video loaded: Mourners Honor Minnesota Lawmaker and Husband at Funeral

transcript

transcript

Mourners Honor Minnesota Lawmaker and Husband at Funeral

Gov. Tim Walz of Minnesota delivered a eulogy praising Melissa Hortman as a consequential and compassionate political leader, and her husband, Mark, as her proudest supporter.

-

Maybe it is this moment where each of us can examine the way we work together, the way we talk about each other, the way we fight for things we care about. A moment when each of us can recommit to engaging in politics and life the way Mark and Melissa did: Fiercely, enthusiastically, heartily but without ever losing sight of our common humanity.

Recent episodes in Latest Video

Whether it’s reporting on conflicts abroad and political divisions at home, or covering the latest style trends and scientific developments, Times Video journalists provide a revealing and unforgettable view of the world.

Whether it’s reporting on conflicts abroad and political divisions at home, or covering the latest style trends and scientific developments, Times Video journalists provide a revealing and unforgettable view of the world.

Politics

Schumer to force Senate reading of Trump's entire 'big, beautiful bill'

NEWYou can now listen to Fox News articles!

The top Democrat in the Senate plans to inflict maximum pain on Senate Republicans in their march to pass President Donald Trump’s “big, beautiful bill” before lawmakers even get a chance to debate the legislative behemoth.

Indeed, Senate Minority Leader Chuck Schumer, D-N.Y., plans to force clerks on the Senate floor to read the entirety of the GOP’s 940-page megabill. His move to drain as much time as possible will come after Republicans vote on a key procedural test to open debate on the legislation.

TRUMP’S ‘BIG, BEAUTIFUL BILL’ FACES REPUBLICAN FAMILY FEUD AS SENATE REVEALS ITS FINAL TEXT

Senate Minority Leader Chuck Schumer, D-N.Y., joined by Sen. Amy Klobuchar, D-Minn., right, speak to reporters following closed-door party meetings at the Capitol in Washington, Tuesday, June 17, 2025. (AP Photo/J. Scott Applewhite)

“I will object to Republicans moving forward on their Big, Ugly Bill without reading it on the Senate floor,” Schumer said on X. “Republicans won’t tell America what’s in the bill

“So Democrats are forcing it to be read start to finish on the floor,” he said. “We will be here all night if that’s what it takes to read it.”

KEY GOP SENATOR DEFECTS ON CRUCIAL VOTE, IMPERILING TRUMP’S ‘BIG, BEAUTIFUL BILL’ IN NARROW MAJORITY

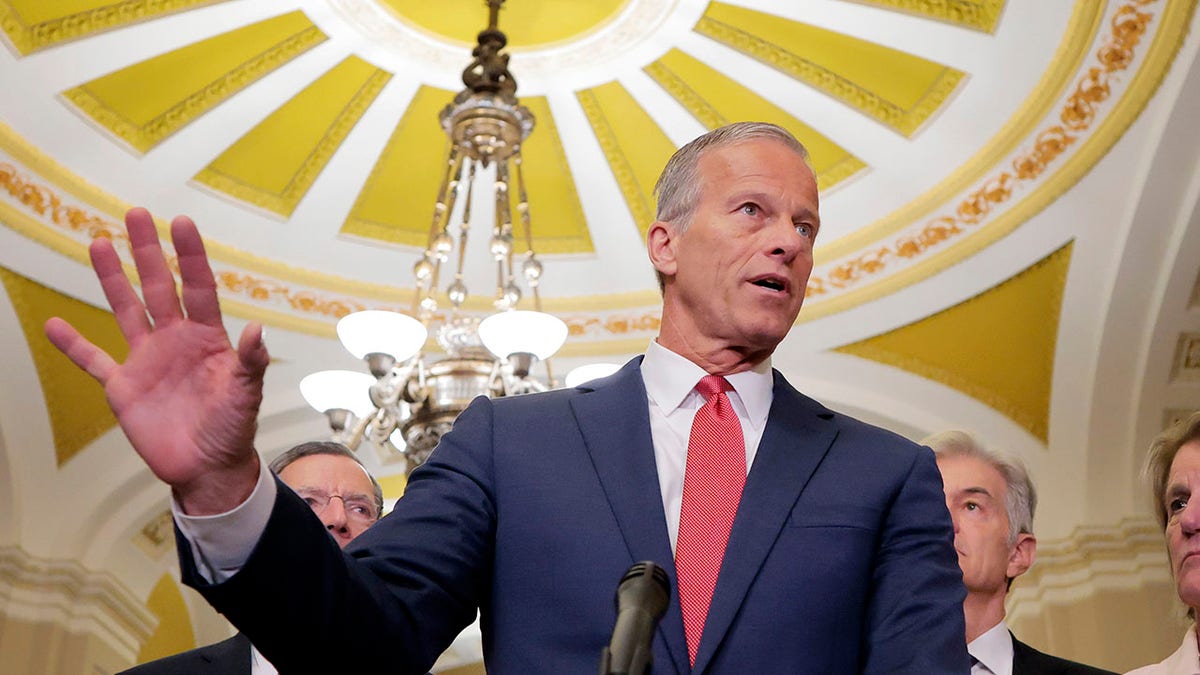

Senate Majority Leader John Thune (R-SD) speaks during a news conference following the weekly Senate Republican policy luncheon at the U.S. Capitol on June 17, 2025 in Washington. (Getty Images)

Indeed, staffers were seen carting the bill onto the Senate floor in preparation for the all-night read-a-thon.

Schumer’s move is expected to take up to 15 hours and is designed to allow Senate Democrats more time to parse through the myriad provisions within the massive legislative text. Ultimately, it will prove a smokescreen as Senate Republicans will continue to march toward a final vote.

Once the bill reading is done, 20 hours of debate evenly divided between Democrats and Republicans will begin, likely early Sunday morning. Democrats are expected to use their entire 10-hour chunk, while Republicans will go far under their allotted time.

Then comes the “vote-a-rama” process, where lawmakers can offer an unlimited number of amendments to the bill.

ANXIOUS REPUBLICANS TURN TO TRUMP AMID DIVISIONS OVER ‘BIG, BEAUTIFUL BILL’

President Donald Trump speaks as he meets with Netherlands’ Prime Minister Dick Schoof on the sidelines of a NATO summit in The Hague, Netherlands, Wednesday, June 25, 2025. (AP Photo/Alex Brandon)

Democrats will again look to extract as much pain as possible during that process, while Republicans, particularly senators that have lingering issues with key Medicaid and land sale provisions, will continue to try and shape and mold the bill.

The last time clerks were forced to read the entirety of a bill during the budget reconciliation process was in 2021, when Senate Democrats held the majority in the upper chamber.

At the time, Sen. Ron Johnson, R-Wis., demanded that the entire, over-600-page American Rescue Act be read aloud. Schumer, who was the Senate Majority Leader attempting to ram then-President Joe Biden’s agenda through the upper chamber, objected to the reading.

Politics

At Supreme Court, steady wins for conservative states and Trump's claims of executive power

WASHINGTON — The Supreme Court term that ended Friday will not be remembered for blockbuster rulings like those recent years that struck down the right to abortion and college affirmative action.

The justices scaled back their docket this year and spent much of their energy focused on deciding fast-track appeals from President Trump. His administration’s lawyers complained too many judges were standing in the way of Trump’s agenda.

On Friday, the court’s conservatives agreed to rein in district judges, a procedural victory for Trump.

What’s been missing so far, however, is a clear ruling on whether the president has abided by the law or overstepped his authority under the U.S. Constitution.

On the final two days of the term, the court’s conservative majority provided big wins for Republican-leaning states, religious parents and Trump.

The justices gave states more authority to prohibit medical treatments for transgender teens, to deny Medicaid funds to Planned Parenthood clinics and to enforce age-verification laws for online porn sites.

Each came with the familiar 6-3 split, with the Republican appointees siding with the GOP-led states, while the Democratic appointees dissented.

These rulings, while significant, were something short of nationwide landmark decisions — celebrated victories for the Republican half of the nation but having no direct or immediate effect on Democratic-led states.

California lawmakers are not likely to pass measures to restrict gender-affirming care or to prohibit women on Medicaid from obtaining birth control, pregnancy testing or medical screenings at a Planned Parenthood clinic.

The new decisions echoed the Dobbs ruling three years ago that struck down Roe vs. Wade and the constitutional right to abortion.

As the conservative justices noted, the decision in Dobbs vs. Jackson Women’s Health did not outlaw abortion nationwide. However, it did allow conservative states to do so. Since then, 17 Republican-led states in the South and Midwest have adopted new laws to prohibit most or all abortions.

On this front, the court’s decisions reflect a “federalism,” or states-rights style of conservatism, that was dominant in decades past under President Reagan and two of the court’s conservative leaders, Chief Justice William Rehnquist and Justice Sandra Day O’Connor.

Both were Arizona Republicans (and in O’Connor’s case, a former state legislator) who came to the court with that view that Washington holds too much power and wields too much control over states and local governments.

With the nation sharply divided along partisan lines, today’s conservative court could be praised or defended for freeing states to make different choices on the “culture wars.”

The other big winner so far this year has been Trump and his broad claims of executive power.

Since returning to the White House in January, Trump has asserted he has total authority to run federal agencies, cut their spending and fire most of their employees, all without the approval of Congress, which created and funded the agencies.

He has also claimed the authority to impose tariffs of any amount on any country and also change his mind a few days later.

He has dispatched National Guard troops and Marines to Los Angeles against the wishes of the governor and the mayor.

He has asserted he can punish universities and law firms.

He has claimed he can revise by executive order the 14th Amendment and its birthright citizenship clause.

So far, the Supreme Court has not ruled squarely on Trump’s broad assertions of power. But the justices have granted a series of emergency appeals from Trump’s lawyers and set aside lower court orders that blocked his initiatives from taking effect.

The theme has been that judges are out of line, not the president.

Friday’s ruling limiting nationwide injunctions set out that view in a 26-page opinion. The conservatives agreed that some judges have overstepped their authority by ruling broadly based on a single lawsuit.

The justices have yet to rule on whether the president has overstepped his power.

Justice Amy Coney Barrett summed up the dispute in a revealing comment responding to a dissent from Justice Ketanji Brown Jackson. “Justice Jackson decries an imperial Executive while embracing an imperial Judiciary,” she wrote.

Missing from all this is the earlier strain of conservatism that opposed concentrated power in Washington — and in this instance, in one person.

Last year offered a hint of what was to come. A year ago, the court ended its term by declaring the president is immune from being prosecuted for his official acts while in the White House.

That decision, in Trump vs. United States, shielded the former and soon-to-be president from the criminal law.

The Constitution does not mention any such immunity for ex-presidents charged with crimes, but Chief Justice John G. Roberts Jr. said a shield of immunity was necessary to “enable the the President to carry out his constitutional duties without undue caution.”

Since returning to the White House, Trump has not been accused of exercising “undue caution.”

Instead, he appears to have viewed the court’s opinion as confirming his unchecked power as the nation’s chief executive. Trump advisors say that because the president was elected, he has a mandate and the authority to put his priorities and policies into effect.

But the Supreme Court’s conservatives did not take that view when President Biden took office promising to take action on climate change and to reduce the burden of student loan debt.

In both areas, the Roberts court ruled that the Biden administration had exceeded its authority under the laws passed by Congress.

Away from Washington, the most significant decision from this term may be Friday’s ruling empowering parents.

The six justices on the right ruled parents have a right to remove their children from certain public school classes that offend their religious beliefs. They objected to new storybooks and lessons for young children with LGBTQ+ themes.

In recent years, the court, led by Roberts, has championed the “free exercise” of religion that is protected by the 1st Amendment. In a series of decisions, the court has exempted Catholic schools and charities from laws or regulations on, for example, providing contraceptives to employees.

Friday’s ruling in a Maryland case extended that religious liberty right into the schools and ruled for Muslim and Catholic parents who objected to new LGBTQ+-themed storybooks.

At first, the school board said parents could have their young children “opt out” of those classes. But when too many parents took the offer, the school board rescinded it.

The clash between progressive educators and conservative parents reached the court when the Becket Fund for Religious Liberty appealed on behalf of the parents.

Justice Samuel A. Alito Jr. said the parents believed the books and stories offended their religious beliefs, and he ordered school authorities to “to notify them in advance whenever one of the books in question is to be used … and allow them to have their children excused from that instruction.”

This decision may have a broader impact than any from this term because it empowers parents nationwide. But it too has limits. It does not require the schools to change their curriculum and their lessons or remove any books from the shelves.

The conservatives fell one vote short in a case that could have brought about a far-reaching change in American schools. Split 4 to 4, the justices could not rule to uphold the nation’s first publicly funded, church-run charter school.

In the past, Roberts had voted to allow students to use state tuition grants in religious schools, but he appeared uncertain about using tax money to operate a church-run school.

But that question is almost certain to return to the court. Barrett stepped aside from the Oklahoma case heard in April because friends and former colleagues at the Notre Dame Law School had filed the appeal. But in a future case, she could participate and cast a deciding vote.

-

Business1 week ago

Business1 week agoDriverless disruption: Tech titans gird for robotaxi wars with new factory and territories

-

Business1 week ago

Business1 week agoProtesters are chasing federal agents out of L.A. County hotels: ‘A small victory’

-

Technology1 week ago

Technology1 week agoMeta held talks to buy Thinking Machines, Perplexity, and Safe Superintelligence

-

Technology1 week ago

Technology1 week agoSpaceX Starship explodes again, this time on the ground

-

Technology1 week ago

Technology1 week agoSamsung’s Galaxy Watch 7 has returned to its lowest-ever price

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘8 Vasantalu’ movie review: Phanindra Narsetti’s romance drama is ambitious but lacks soul

-

Politics1 week ago

Politics1 week agoTrump demands special prosecutor investigate 'stolen' 2020 election, loss to Biden

-

Education6 days ago

Education6 days agoHere Is All the Science at Risk in Trump’s Clash With Harvard