CNN

—

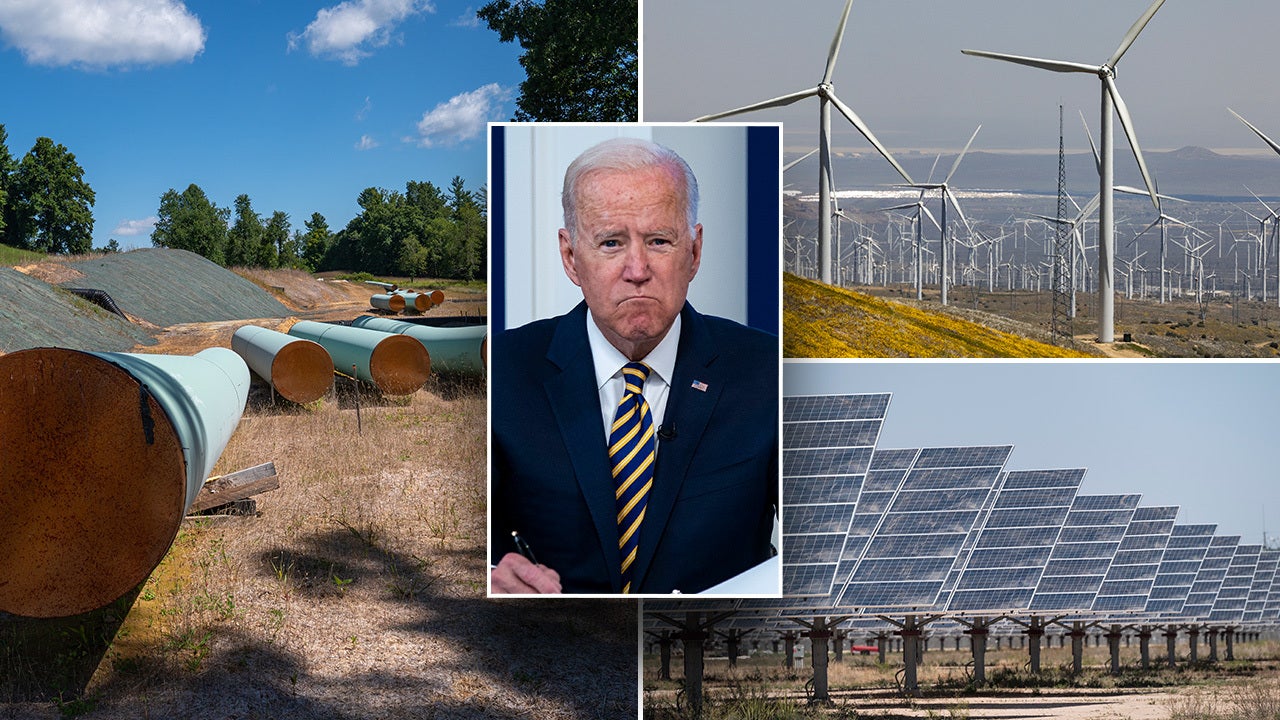

For the primary time since Russia’s invasion of Ukraine, the US is offering Kyiv with the varieties of high-power capabilities some Biden administration officers considered as an excessive amount of of an escalation threat a couple of brief weeks in the past.

The $800 million checklist is pushed not solely by direct requests from Ukraine, but additionally in preparation for a brand new kind of struggle on the open plains of southeast Ukraine proper subsequent to Russia, terrain that performs into Russia’s pure navy benefits.

The brand new weapons package deal represents the starkest signal so far that the battle in Ukraine is shifting – and with it the weapons Ukraine will want if it hopes to proceed to stymie a Russian navy that has regrouped and resupplied after its preliminary failures within the opening weeks of the battle.

The Biden administration introduced the brand new package deal included 11 Mi-17 helicopters that had initially been earmarked for Afghanistan, 18 155 mm Howitzer cannons and 300 extra Switchblade drones, along with radar programs able to monitoring incoming hearth and pinpointing its origin.

This package deal stands out from earlier safety help partially as a result of this tranche consists of extra refined and heavier-duty weaponry than earlier shipments. A US official tells CNN that’s by design, arguing that as a result of Russia, which was unable to seize Kyiv, has shifted its technique to pay attention forces in japanese Ukraine, the US is shifting its personal technique in what it provides Ukraine.

“The contours of what they want could be very completely different,” the US official stated.

The newly approved package deal was introduced days after nationwide safety adviser Jake Sullivan and Chairman of the Joint Chiefs of Employees Gen. Mark Milley spent greater than two hours on the cellphone with their Ukrainian counterparts reviewing requests. Protection Secretary Lloyd Austin additionally spoke with Ukrainian Minister of Protection Oleksii Reznikov twice within the final week. Reznikov gave an replace of the state of affairs on the bottom, which allowed Austin to find out what weapons Ukraine most wanted.

Biden delivered the information of the help package deal throughout a 58-minute cellphone name with Zelensky from the Oval Workplace on Wednesday. There was one merchandise Zelensky requested Biden for instantly: Mi-17 helicopters. In line with a supply acquainted, the helicopters had initially not been included within the package deal as of Tuesday evening as a result of US officers weren’t clear on whether or not the Ukrainians wished or wanted them right now. Zelensky made clear to the President on Wednesday that they did.

The weapons being supplied are targeted on the kind of combating that’s prone to happen within the Donbas area – open terrain slightly than the shut combating in city and wooded areas that’s occurred in areas round Kyiv and different Ukrainian cities. The area additionally borders southwest Russia, permitting Russian forces to keep away from the kinds of sustainment, logistics and communication issues that derailed their all-out invasion of the nation practically from the start.

Pentagon press secretary John Kirby stated Wednesday that the package deal was tailor-made to the struggle in Donbas, a topography he described as “slightly bit like Kansas.”

“It’s slightly bit flatter. It’s slightly bit extra open. And it’s the sort of place the place we will anticipate that the Russians will need to use tanks and long-range fires, artillery and rocket hearth to attain a few of their aims earlier than committing floor troops,” Kirby stated.

The brand new weapons package deal, Kirby added, was “very a lot an effort to offer the Ukrainians each doable benefit on this struggle that’s coming.”

The Biden administration has confronted bipartisan strain to do extra to assist Ukraine, notably in calls to ship extra highly effective weapons. However the administration resisted for weeks, cautious of how Russian President Vladimir Putin, along with his forces already deployed, would reply. Officers warned the Kremlin may even see it as escalatory or a sign that america was becoming a member of the struggle.

The difficulty was most acutely felt with the MiG-29 fighter jets Ukraine requested. The administration refused to participate in a switch of the Soviet-era jets from a 3rd nation to Ukraine through america, rejecting a proposal from Poland.

The US anxious, Kirby stated on March 9, that “the switch of fight plane proper now might be mistaken by Mr. Putin and the Russians as an escalatory step.” A big a part of the priority internally was over the proposal to fly them into Ukraine from a NATO air base.

Now the rhetoric of the Biden administration seems to have shifted together with the scope of the battle. Because the US prepares to ship within the varieties of weapons it has not despatched for the reason that invasion started, the Pentagon insisted this was a part of the US dedication “from the very starting” to assist Ukraine defend itself.

“How that will get interpreted by the Russians – you possibly can ask Mr. Putin and the Kremlin,” Kirby stated Wednesday.

For weeks, Zelensky pleaded with world leaders for extra arms and tools. In March, he spoke with the parliaments of 17 international locations, in addition to three worldwide organizations. He by no means strayed removed from his core message: Ukraine wants extra weapons.

He requested Congress for brand new air protection programs to assist defend Ukraine’s skies. He requested 1% of NATO’s tanks and planes to struggle again towards Russian forces. And he sought extra weapons from Belgium, warning that if Ukraine loses, the European Union loses.

However his requires heavier firepower went largely unanswered. For essentially the most half, international locations despatched extra small arms ammunition, anti-armor missiles and anti-aircraft missiles, in addition to protecting and medical tools.

Now, with Russian forces making ready for an enormous assault on the Donbas area, the tide is popping.

“The envelope of what individuals are ready to supply has grown significantly within the final couple of weeks,” the US official stated. As soon as Ukrainian forces have been capable of maintain off the Russian invasion for the primary few days, it put the choices for safety help “in a short time in a unique place.”

Slovakia supplied Ukraine with S-300 anti-aircraft missiles. The Czech Republic despatched in T-72 tanks. The UK introduced that it will ship 120 armored automobiles to Ukraine. And now america has approved a spread of latest and extra highly effective weapons.

As an indication of the coordination on help to Ukraine, the European Union introduced it will present one other $544 million in help on the identical day the White Home approved its personal $800 million.

The package deal introduced Wednesday marked the primary time the US was offering Ukraine with howitzer cannons. Kirby stated that a number of programs would require extra coaching for the Ukrainians to make use of them, together with the howitzers and counter-artillery radars.

Lots of the weapons which are being directed towards Ukraine are heavier, making them tougher to move throughout the nation. Ukraine has collected the weapons supplied so far from the US and different international locations at its western border earlier than transferring them to forces across the nation.

Kirby stated the Pentagon is aware of “time will not be our pal” as Russia prepares its subsequent offensive however that it’s working to maneuver tools into Ukraine’s fingers as rapidly as doable:

“Even earlier than this was introduced, we had been transferring at very, very quick pace all the opposite safety help that we’ve been offering, frankly at an unprecedented charge.”

The Pentagon hosted the CEOs of the navy’s eight largest prime contractors Wednesday to determine easy methods to arm Ukraine sooner, in accordance with a readout of the categorized assembly. The roundtable dialogue, led by Deputy Protection Secretary Kathleen Hicks, targeted on the Pentagon’s aims to maintain supplying Ukraine with arms whereas with the ability to preserve the readiness of US forces and assist the protection of allies.

This story has been up to date with extra developments Wednesday.