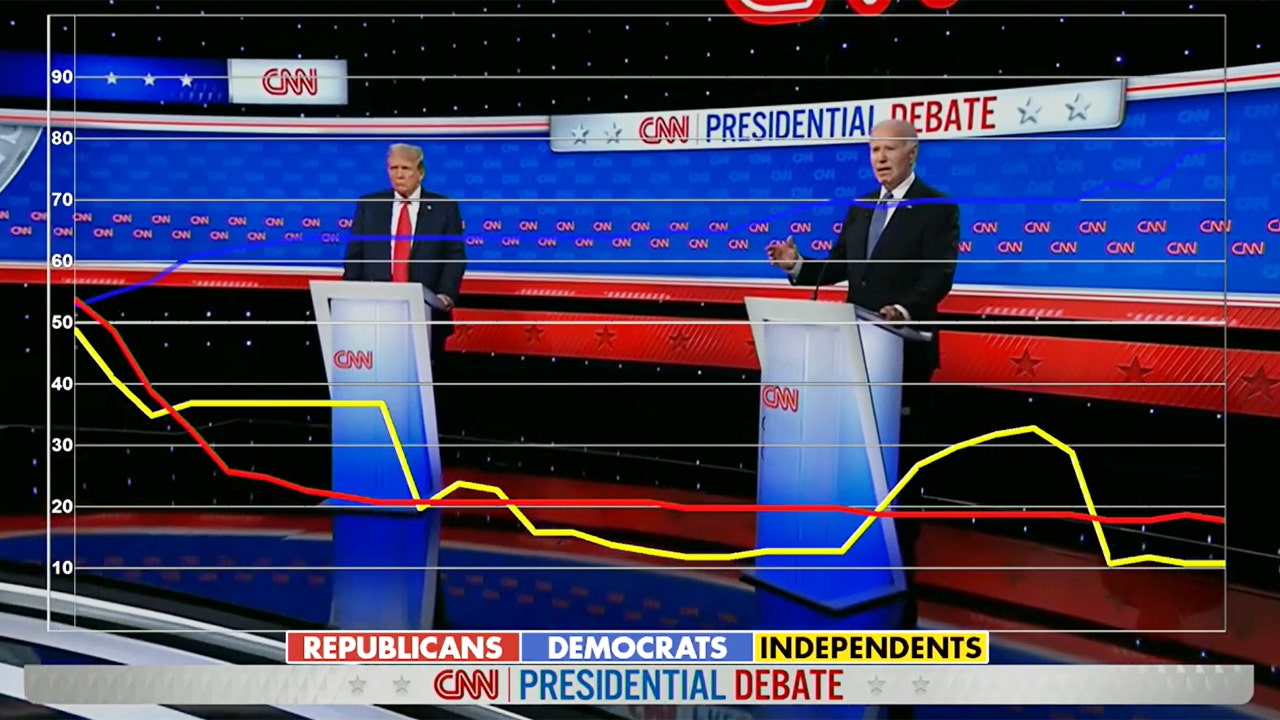

Thursday night’s US presidential debate was watched by 48mn television viewers, a sharp drop from the numbers that tuned in to the clashes between Joe Biden and Donald Trump in the 2020 campaign.

CNN, the Warner Bros Discovery-owned network which hosted the event, said just over 9mn viewers had watched on its own channels, narrowly ahead of Fox News and ABC News, with cable rival MSNBC drawing about 4mn viewers. Another 30mn people tuned in on CNN’s digital channels or YouTube, it added.

The combined television audiences were well below the totals for previous presidential debates, however, extending a pattern of US media outlets reporting less interest in their election coverage this year.

Trump and Biden drew 73mn viewers for their first debate in 2020, while Trump and Hillary Clinton pulled in an audience of 84mn for the opening showdown of their 2016 contest.

With full control over the style, content and format of the debate, CNN inserted rules that are atypical for US political events, such as foregoing a live audience and muting each candidate’s microphones unless it was their turn to speak.

Have your say

Joe Biden vs Donald Trump: tell us how the 2024 US election will affect you

The debate was also a stark departure in tone from last year’s CNN town hall event with Trump, when a studio audience filled with the former president’s supporters prompted comparisons with his raucous rallies. CNN’s own media commentator slammed the town hall as a “spectacle of lies”, and Chris Licht resigned as CNN’s chief executive just a few weeks later.

By comparison, Thursday’s night’s debate was restrained. With microphones muted, there were no shouting matches, and with no audience or press in the room, it was quiet. The moderators played a background role, leaving the debate largely a back-and-forth dialogue between Trump and Biden.

However CNN was criticised for one significant choice: moderators Jake Tapper and Dana Bash largely avoided fact-checking the candidates in real time. The format seemed to favour Trump, who was allowed to make a series of unsubstantiated claims without being challenged during the 90-minute programme.

The debate was a big test for CNN — the network that pioneered the dramatic, ultra-competitive cable news format in the US in the 1980s, but whose audiences have dwindled in recent years. It was easily the biggest moment yet for CNN chief executive Sir Mark Thompson, who took over as leader of the channel last year and has been tasked with turning around its business and restoring its brand.

CNN landed the sponsorship of the debate in May, beating out competitors including Fox News. The network seized on the moment, promoting the event heavily and forcing its rivals, who simultaneously broadcast the debate, to display CNN’s logo prominently on their screens.

The event was unique for a number of reasons. It was the first presidential debate in decades that was not organised by an independent commission, after Biden and Trump chose to bypass the tradition. It was also scheduled far earlier than usual in the election cycle. In previous years, the initial match-ups between presidential candidates took place in September or October.

CNN has a fraught history with Trump, who frequently attacked the channel during his presidency. But on Friday morning, the Trump campaign blasted an email out to his supporters titled: “I love CNN . . . Because they gave me the opportunity to wipe the floor with Joe Biden.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25510864/airgo_vision_3.jpg)