News

Some NFL fans see disparities in its responses to Harrison Butker and Colin Kaepernick

Kansas City Chiefs kicker Harrison Butker, pictured at a December 2023 game, sparked conversation and controversy earlier this month with his commencement speech at Benedictine College in Kansas.

Noam Galai/Getty Images for The Gordon Parks Foundation and Jamie Squire/Getty Images

hide caption

toggle caption

Noam Galai/Getty Images for The Gordon Parks Foundation and Jamie Squire/Getty Images

Harrison Butker’s controversial commencement speech — and the reaction — continue to dominate conversation off the field, with key figures in the NFL weighing in publicly for the first time this week.

The Kansas City Chiefs kicker stirred up a culture war skirmish with his remarks at Benedictine College earlier this month, in which he denounced abortion rights, Pride Month, COVID-19 lockdowns, “dangerous gender ideologies” and “the tyranny of diversity, equity and inclusion,” while also encouraging female graduates to embrace the “vocation” of homemaker, all in 20 minutes.

The speech, which has since racked up nearly 2 million views on YouTube, resonated with some football fans and conservative public figures, including Missouri Sen. Josh Hawley. Online sales of Butker’s jersey spiked, becoming the Chiefs’ best-seller.

But the speech has drawn widespread criticism from many corners of the internet, including some current and former students of the Catholic liberal arts college, an order of affiliated nuns, Kansas City officials and fans of Taylor Swift, whom Butker quoted in the speech as “my teammate’s girlfriend.”

The NFL distanced itself from Butker’s comments in a brief statement last week, saying he made them “in his personal capacity” and “his views are not those of the NFL as an organization.”

“The NFL is steadfast in our commitment to inclusion, which only makes our league stronger,” it added.

NFL Commissioner Roger Goodell echoed that idea while speaking to reporters on Wednesday.

“We have over 3,000 players,” Goodell said, according to Yahoo Sports and the Associated Press. “We have executives around the league that have a diversity of opinions and thoughts just like America does. I think that’s something that we treasure, and that’s part of, I think, ultimately what makes us as a society better.”

But some social media users were quick to contrastGoodell’s comments with hisreaction to another high-profile controversy involving a football player exercising his right to self-expression: that of former San Francisco 49ers quarterback Colin Kaepernick.

When it comes to players’ self-expression, some see a double standard

Kaepernick, who is biracial, began sitting on the bench during the playing of the national anthem in the 2016 preseason to protest what he called “the injustices that are happening in America.”

He continued to kneel during the anthem for the rest of the season, inspiring some other players but prompting criticism from many — including then-President Donald Trump — who accused him of being anti-American.

Goodell bemoaned Trump’s comments as showing “an unfortunate lack of respect” for players but had already made a similar critique of Kaepernick’s protest himself.

“I think it’s important if they see things they want to change in society, and clearly we have things that can get better in society, and we should get better,” Goodell said in his first public comments on the protest in 2016. “But we have to choose respectful ways of doing that so that we can achieve the outcomes we ultimately want and do it with the values and ideals that make our country great.”

The following year, as the number of players kneeling — and the backlash to them — grew, Goodell told NFL teams in a memo that “everyone should stand” during the national anthem.

“The controversy over the Anthem is a barrier to having honest conversations and making real progress on the underlying issues,” he wrote. “We need to move past this controversy, and we want to do that together with our players.”

Kaepernick opted out of his contract with the 49ers in the spring of 2017 but wasn’t signed by any NFL team afterward, which led his supporters to accuse league owners of freezing him out because of his political beliefs. Kaepernick alleged the same in a grievance filed against the NFL later that year, which he withdrew after settling in 2019.

He hasn’t played professionally since but has continued his career as a civil rights activist and author.

In June 2020, as protests against racial injustice and police brutality rocked the U.S., and after players called on the NFL to speak out, Goodell released a video statement condemning racism and acknowledging the league’s shortcomings in that area.

“We, the National Football League admit we were wrong for not listening to NFL players earlier and encourage all to speak out and peacefully protest,” he said, without naming Kaepernick.

Goodell doubled down in a series of remarks that summer, including encouraging an NFL team to sign Kaepernick as a free agent and publicly apologizing.

“I wished we had listened earlier, Kaep, to what you were kneeling about and what you were trying to bring attention to,” he said.

On Wednesday, X (formerly Twitter) users and op-ed writers called Goodell’s comments hypocritical and wondered aloud what Kaepernick thinks of them. Some acknowledged that their situations differ, since Kaepernick protested in uniform during games while Butker made his speech off the field.

Kaepernick hasn’t commented publicly on Butker’s speech or Goodell’s response.

Last week, as controversy over Butker’s comments brewed, The View co-host Whoopi Goldberg said Butker and Kaepernick deserve equal respect for expressing their views.

“These are his beliefs and he’s welcome to them,” she said of Butker. “I don’t have to believe them, I don’t have to accept them, the ladies that were sitting in that audience don’t have to accept them.

“The same way we want respect when Colin Kaepernick takes a knee, we want to give respect to people whose ideas are different from ours because the man who says he wants to be president … he says the way to act is to take away people’s right to say how they feel. We don’t want to be that, we don’t want to be those people.”

Some Chiefs leaders have also spoken up for Butker

More members of the Chiefs acknowledged the controversy on Wednesday, coming to Butker’s defense.

Star quarterback Patrick Mahomes told reporters, “There are certain things that he said that I don’t necessarily agree with but I understand … he’s trying to do whatever he can to lead people in the right direction.”

He added that he’s known Butker for seven years and considers him a good person.

“I judge him by the character that he shows every single day,” he said. “That’s someone who cares about the people around him, cares about his family and wants to make a good impact in society.”

Chiefs Head Coach Andy Reid also addressed the response to the speech, though stayed away from its contents. He said he hadn’t talked to Butker about it because “I didn’t think we needed to.”

“We’re a microcosm of life,” he said of the team. “Everybody is from different areas, different religions, different races, and so, we all get along, we all respect each other’s opinions and not necessarily do we go by those, but we respect everybody to have a voice … My wish is that everybody could kind of follow that.”

News

SCOTUS allows dismantling of Education Dept. And, Trump threatens Russia with tariffs

Good morning. You’re reading the Up First newsletter. Subscribe here to get it delivered to your inbox, and listen to the Up First podcast for all the news you need to start your day.

Today’s top stories

The U.S. Supreme Court ruled yesterday that it will allow the Trump administration to resume dismantling the U.S. Department of Education. The Court overruled a lower court that temporarily paused massive cuts at the department. Congress created the department by law and President Trump promised to shut it down without any change in that law, which is why opponents sued.

The Washington, D.C., headquarters of the U.S. Department of Education shown in March.

Win McNamee/Getty Images North America

hide caption

toggle caption

Win McNamee/Getty Images North America

- 🎧 The court’s decision now means that roughly 1,400 Education Department workers will lose their jobs, NPR’s Cory Turner tells Up First. The work that those employees did, including helping local schools support kids with disabilities and children living in poverty, may also cease. The ruling isn’t the final word as the case continues to work its way through lower courts. The plaintiffs’ concern is that by the time they get a final ruling in court, it might not matter, as the harm to the department could be irreversible, Turner stated.

Some Trump supporters over the weekend were surprised when he urged them to move on from the Epstein files. The Justice Department and the FBI released a two-page memo last week stating they found no evidence to support conspiracy theories about the life and death of disgraced financier and convicted sex trafficker Jeffrey Epstein. They stated he really did kill himself in jail in 2019 and left no client list. This comes after Attorney General Pam Bondi previously said on Fox News that she had the list on her desk.

- 🎧 Heading into the last election, a central concept of Trump’s MAGA ideology was the belief that there was a deep state cabal of shadowy figures protecting pedophiles and unsavory people running the government and obstructing Trump’s agenda, says NPR’s Stephen Fowler. Now, Trump has a baseless theory about the files, suggesting Democrats created them to target him. Fowler says it is uncertain if Trump’s shift on the topic has hurt his favorability with his supporters, but it does reiterate the stranglehold the president has on the shape and direction of the GOP.

Trump yesterday threatened to implement heavy tariffs on countries that trade with Moscow if the Kremlin doesn’t reach a ceasefire deal with Ukraine by September. The president also promised Ukraine billions of dollars worth of U.S.-made military equipment, which NATO countries in Europe will pay for.

- 🎧 NPR’s Charles Maynes says the president’s change of tone on Russia was quite a shift. A big driver in this shift is Trump’s frustration with and even a sense of betrayal by Russian President Vladimir Putin. The president said he thought he had a peace deal with Putin four separate times, only to see Russian attacks in Ukraine continue. Some in Moscow see the 50-day grace period provided for the ceasefire as a sign that Trump isn’t ready to give up on Russia.

Living better

Frank Frost found camaraderie in a cycling group in the U.K. that his doctor recommended he try. They call themselves the “Chain Gang” and members look after each other, he said. “We’re all of a certain age,” says Frost. ” We don’t leave anybody.”

Frank Frost

hide caption

toggle caption

Frank Frost

Living Better is a special series about what it takes to stay healthy in America.

Doctors are writing “social prescriptions” to get people engaged with nature, art, exercise and volunteering in the same way they would prescribe pills or therapy. Research has shown it can help with mental health, chronic disease and dementia. The method worked for Frank Frost. He gained weight and was diagnosed with Type 2 diabetes in his 50s. A doctor found out he used to love riding a bike as a kid and gave him a prescription for a 10-week cycling course for adults getting back into cycling. The prescription led to Frost developing friends, losing 100 pounds and getting his diabetes under control. Julia Hotz, the author of The Connection Cure: The Prescriptive Power of Movement, Nature, Art, Service, and Belonging, shares details on the health approach:

- 🚲 Health providers in around 30 countries are practicing social prescribing to address symptoms of Type 2 diabetes, chronic pain, dementia, attention deficit hyperactivity disorder, anxiety and depression, and more. A growing number of U.S. providers are also embracing the approach.

- 🚲 Social prescribing can save money due to a reduction in emergency room visits and repeat visits to primary care physicians. Health care systems have acknowledged that it can be cheaper to cover weeks of Zumba classes than medication over the course of a lifetime.

- 🚲 People interested in social prescribing can visit the map on Social Prescribing USA’s website to find a list of organizations and health systems involved in this practice.

Picture show

Evelyn del Rosario Morán Cojoc, an artist from Guatemala, creates a mural that depicts traditional foods from her Mayan culture — like that floating ear of corn and three yellow beans. She teaches art to kids across the country, encouraging them to depict their indigenous traditions.

Ben de la Cruz/NPR

hide caption

toggle caption

Ben de la Cruz/NPR

The theme of this year’s Smithsonian Folklife Festival in Washington, D.C., was youth and the future of culture. The event showcased a diverse range of talent. A 26-year-old Bolivian rapper infused his unique style into Spanish hip-hop by incorporating words from his father’s indigenous language. Two refugee weavers made a traditional bag as they work to revitalize their ancient art form. A Guatemalan artist created a mural that highlights her Mayan culture. A Mexican American dad and his two daughters demonstrated techniques for shaping a guitar passed down from their great-grandfather. The Goats and Soda team sat down with the four ensembles to talk about their craft, the youth they mentor and the cultural traditions they’re keeping alive. Read what they had to say and see photos of their craft.

3 things to know before you go

Andrew Cuomo speaks during an election party following the primaries at the Carpenters Union in New York City on June 24, 2025.

John Lamparski/AFP via Getty Images

hide caption

toggle caption

John Lamparski/AFP via Getty Images

- Former New York Gov. Andrew Cuomo announced yesterday that he is relaunching his campaign for New York City mayor, this time as an independent candidate. (via Gothamist)

- South African President Cyril Ramaphosa has suspended his police minister after serious allegations linking him to organized crime.

- Los Angeles is now three years away from the Olympic Games, and to commemorate the occasion, organizers yesterday released a preview of the competition schedule. (via LAist)

This newsletter was edited by Suzanne Nuyen.

News

Trump does deal with Nato allies to arm Ukraine and warns Russia of severe sanctions

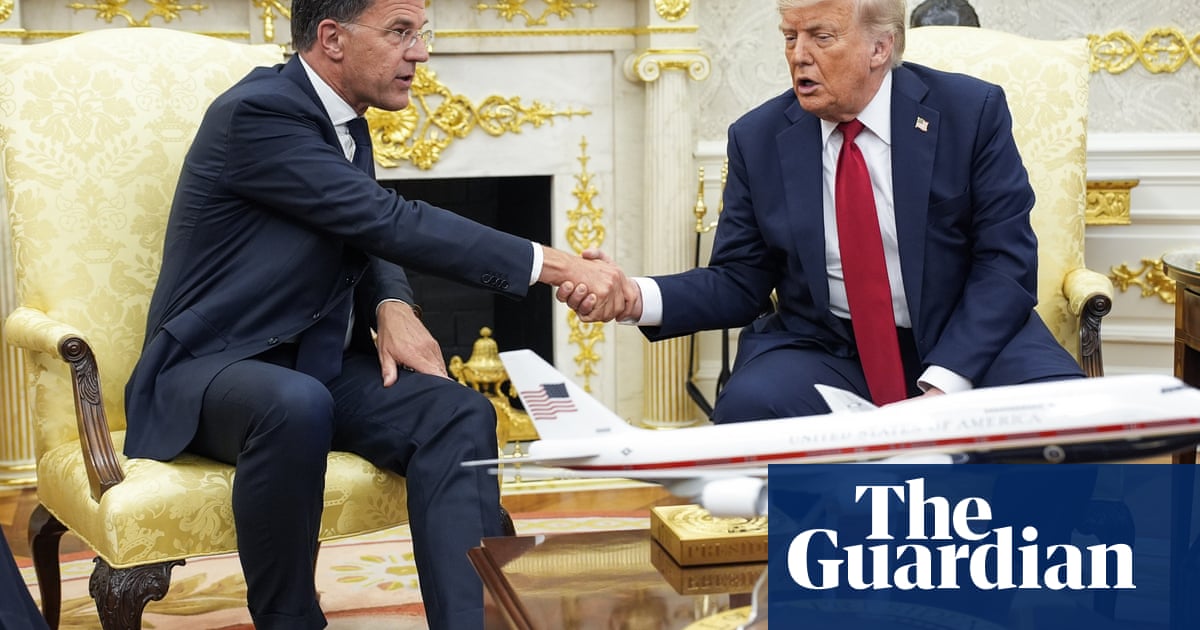

Donald Trump said he has sealed an agreement with Nato allies that will lead to large-scale arms deliveries to Ukraine, including Patriot missiles, and warned Russia that it will face severe sanctions if Moscow does not make peace within 50 days.

After a meeting with the Nato secretary general, Mark Rutte, Trump said they had agreed “a very big deal”, in which “billions of dollars’ worth of military equipment is going to be purchased from the United States, going to Nato … And that’s going to be quickly distributed to the battlefield.”

Speaking in the White House alongside a clearly delighted Rutte, the US president said the arms deliveries would be comprehensive and would include the Patriot missile batteries that Ukraine desperately needs for its air defences against a daily Russian aerial onslaught.

“It’s everything: it’s Patriots. It’s all of them. It’s a full complement, with the batteries,” Trump said.

He did not go into any more detail, but made clear the weapons would be entirely paid for by Washington’s European allies, and that initial missile deliveries would come “within days” from European stocks, on the understanding they would be replenished with US supplies.

At a White House lunch with religious leaders later in the day, Trump said the deal was “fully approved, fully done”.

“We’ll send them a lot of weapons of all kinds and they’re going to deliver those weapons immediately … and they’re going to pay,” he said.

At his meeting with Trump, Rutte said there was a significant number of Nato allies – including Germany, Finland, Denmark, Sweden, Norway, the Netherlands and Canada – ready to rearm Ukraine as part of the deal.

“They all want to be part of this. And this is only the first wave. There will be more,” he said.

The German chancellor, Friedrich Merz, said last week that Berlin was ready to acquire additional Patriot systems.

Trump claimed there was one country, which he did not name, but which had “17 Patriots getting ready to be shipped”. Monday’s deal would include that stockpile, or “a big portion of the 17”, he said.

Such an arms delivery would represent a significant reinforcement of Ukraine’s air defences. Kyiv is currently thought to have only six Patriot batteries, at a time when it is coming under frequent and intense Russian drone and missile bombardments.

At the same time, Trump expressed increased frustration with Vladimir Putin, whom he accused of giving the impression of pursuing peace while intensifying attacks on Ukrainian cities. He gave the Russian president a new deadline of 50 days to end the fighting or face 100% tariffs on Russian goods, and more importantly, sweeping “secondary tariffs”, suggesting trade sanctions would be imposed on countries who continue to pay for Russian oil and other commodities.

“The secondary tariffs are very, very powerful,” the president said.

The announcement marked a dramatic change for the administration, both in substance and tone.

The Trump White House had not only made clear it would continue its predecessor’s policy of continuing to supply Ukraine out of US stocks, but the president and his top officials have been derisive about Kyiv’s chances of prevailing.

On Monday, Trump delivered his most admiring language on Ukraine and its European backers to date, with Rutte on one side and the US vice-president, JD Vance, the administration’s biggest sceptic on US involvement in Europe, on the other.

“They fought with tremendous courage, and they continue to fight with tremendous courage,” Trump said of the Ukrainians.

“Europe has a lot of spirit for this war,” he said, suggesting he had been taken by surprise by the level of commitment shown by European allies at the Nato summit in The Hague last month. “The level of esprit de corps spirit that they have is amazing,” he said. “They really think it’s very, very important.

“Having a strong Europe is a very good thing. It’s a very good thing. So I’m okay with it,” he said.

Trump described his deepening disillusion with Putin, and suggested his wife, Melania, may have played a role in pointing out the Russian leader’s duplicity in talks over a peace deal.

“My conversations with him are always very pleasant. I say, isn’t that a very lovely conversation? And then the missiles go off that night,” Trump said. “I go home, I tell the first lady: I spoke with Vladimir today. We had a wonderful conversation. She said: Really? Another city was just hit.”

Ukrainian regional officials reported at least six civilians killed and 30 injured by Russian bombing in the past 24 hours. The country’s air force said Moscow had attacked with 136 drones and four S-300 or S-400 missiles.

“Look, I don’t want to say he’s an assassin, but he’s a tough guy. It’s been proven over the years. He’s fooled a lot of people,” Trump said, listing his predecessors in the White House.

“He didn’t fool me. But what I do say is that at a certain point, ultimately talk doesn’t talk. It’s got to be action,” he said.

Russian officials and pro-war bloggers on Monday largely shrugged off Trump’s announcement, declaring it to be less significant than anticipated.

Konstantin Kosachev, a senior Russian lawmaker, wrote on Telegram that it amounted to “hot air”.

It was broadly welcomed in Kyiv, where there has been longstanding and deep anxiety about Trump’s intentions. Andrii Kovalenko, a member of Ukraine’s national security and defence council, posted a one-word response: “Cool.”

There was still scepticism however, over whether even the promise of new weaponry for Ukraine combined with the threat of trade sanctions would be enough to halt Russia’s offensive.

Illia Ponomarenko, a Ukrainian journalist and blogger wrote: “How many Ukrainian lives could have been saved if, from the very beginning, Trump had listened to wise and honest people about helping Ukraine, instead of the artful lies of that cannibal Putin on the phone?”.

News

Senate committee details failures by Secret Service in preventing Trump shooting

Then-candidate Donald Trump is rushed offstage by U.S. Secret Service agents after being struck by a bullet during a rally on July 13, 2024, in Butler, Pa.

Anna Moneymaker/Getty Images

hide caption

toggle caption

Anna Moneymaker/Getty Images

A Senate committee report released Sunday blames the U.S. Secret Service for a “cascade of preventable failures” that led up to the assassination attempt against then-presidential candidate Donald Trump during a rally in Butler, Pa., last summer.

Trump was injured in the shooting when a bullet whizzed past his head, grazing his ear. Two attendees were wounded, and rally-goer and former fire chief Corey Comperatore was killed.

A Secret Service sniper shot and killed the perpetrator, 20-year-old Thomas Matthew Crooks of Bethel Park, Pa.

In its report, the Senate Homeland Security and Governmental Affairs Committee said the Secret Service’s “lack of structured communication was likely the greatest contributor to the failures” on the day of the rally. The report was released by the committee’s chairman, Sen. Rand Paul, R-Ky.

For instance, the Secret Service security room agent, who is responsible for collecting and disseminating information, learned about a suspicious person with a rangefinder from a counterpart in the Pennsylvania State Police roughly 25 minutes before the shooting. That agent relayed the report to a fellow Secret Service agent in the room, but the information did not go out over the radio or make it to Trump’s security detail in time for them to prevent him from taking the stage.

There were communication gaps both within the Secret Service hierarchy, and also among the agency and the state and federal law enforcement agencies on scene, the committee said.

There were organizational mistakes, too. The committee noted that one of the Secret Service countersniper teams protecting Trump at the Butler rally had an obstructed view of the roof of the nearby American Glass Research building where Crooks was located.

The report, released one year to the day after the shooting, also found that the Secret Service had denied some resources to Trump’s detail during the 2024 presidential election and said former Secret Service Director Kimberly Cheatle had falsely testified to Congress when she said no requests were denied for the Butler rally.

In a statement on Sunday, Secret Service Director Sean Curran said the agency “took a serious look at our operations” following last year’s shooting and “implemented substantive reforms to address the failures that occurred that day.”

The agency announced last week that it had put in place 21 of 46 recommendations made by congressional oversight bodies, including streamlining communication procedures and clarifying the responsibilities of advance teams.

The Secret Service also said it had disciplined six employees in relation to the Butler shooting, with suspensions ranging from 10 to 42 days without pay. Still, the committee said in its report that “not a single person has been fired.”

Curran, who was one of the agents who surrounded Trump as shots were fired in Butler, added in his statement that the Secret Service will “continue to work cooperatively with the committee as we move forward in our mission.”

-

Culture1 week ago

Culture1 week agoTry to Match These Snarky Quotations to Their Novels and Stories

-

News6 days ago

News6 days agoVideo: Trump Compliments President of Liberia on His ‘Beautiful English’

-

News1 week ago

News1 week agoTexas Flooding Map: See How the Floodwaters Rose Along the Guadalupe River

-

Business1 week ago

Companies keep slashing jobs. How worried should workers be about AI replacing them?

-

Finance1 week ago

Do you really save money on Prime Day?

-

Technology1 week ago

Technology1 week agoApple’s latest AirPods are already on sale for $99 before Prime Day

-

News5 days ago

News5 days agoVideo: Clashes After Immigration Raid at California Cannabis Farm

-

Politics1 week ago

Politics1 week agoJournalist who refused to duck during Trump assassination attempt reflects on Butler rally in new book