News

Read Representative Jerrold Nadler’s Letter

JERROLD NADLER

12TH DISTRICT, NEW YORK

JUDICIARY COMMITTEE

RANKING MEMBER

Congress of the United States

House of Representatives

Washington, DC 20515

NADLER.HOUSE.GOV

December 4, 2024

Dear Democratic Colleague:

It has been the greatest honor of my life to serve as Chairman and Ranking Member of the House Judiciary

Committee these past 7 years. I am grateful to have had the opportunity to help lead our party’s efforts to

preserve the rule of law and to provide for a more just society that respects the civil rights and civil liberties of

all Americans.

Under my leadership, the Committee responded to some of our nation’s biggest challenges. When Donald

Trump and his administration threatened the rule of law and our democratic order, I led the Judiciary

Committee’s efforts to hold him accountable for his various abuses of power, culminating in two historic

impeachments. As the epidemic of gun violences rages on, we advanced historic legislation to keep Americans

safe in their communities, leading to enactment of the Bipartisan Safer Communities Act—the first significant

gun safety legislation enacted in a generation. When the Supreme Court threatened to undermine protections for

same sex marriage, we enshrined marriage equality in the law with passage of the Respect for Marriage Act.

When the nation watched in horror as George Floyd was brutalized by police, we advanced legislation to hold

law enforcement accountable, while also working to ensure that our communities have the tools and resources to

keep our citizens safe. As Republican voter suppression efforts took hold across the country, we passed

legislation named after our beloved late colleague, Rep. John Lewis, to protect this most fundamental right to

vote. We worked to repair our broken immigration system with legislation to protect Dreamers and to prevent

another Muslim ban. We brought forward the Equality Act, the first comprehensive civil rights legislation

protecting the LGBTQ community. We worked to provide justice to victims of the deadly September 11th

attacks and other victims of terrorism. And we worked to preserve access to justice in the federal courts, protect

consumers from corporate abuses, lower prescription drug prices, and preserve a strong intellectual property

system that promotes innovation and drives economic growth.

The Committee also shined a light on critical issues, such as threats to reproductive freedom and bodily

autonomy in the wake of the Dobbs decision, the need for further criminal justice reform and ending mass

incarceration, the ethics crisis at the Supreme Court, and proposals to strengthen our antitrust laws to preserve

and promote healthy competition in the marketplace.

REPLY TO:

WASHINGTON OFFICE:

2132 RAYBURN HOUSE OFFICE BUILDING

WASHINGTON, DC 20515

(202) 225-5635

DISTRICT OFFICE:

201 VARICK STREET

SUITE 669

NEW YORK, NY 10014

(212) 367-7350

News

Video: How Trump’s Election Lie Could Impact 2026 Midterms

new video loaded: How Trump’s Election Lie Could Impact 2026 Midterms

By Nick Corasaniti, Coleman Lowndes, James Surdam, Nikolay Nikolov and Rafaela Balster

March 12, 2026

News

‘Songs from the Hole’: The story behind JJ’88’s documentary and visual album

Actors gaze up to the sky during JJ’88’s “ROOT” in the hip-hop artist and former inmate’s documentary and visual album Songs from the Hole. Before the song starts, protagonist and producer James “JJ’88” Jacobs describes meditating on his and others’ redemption while incarcerated and in solitary confinement.

Courtesy of Netflix

hide caption

toggle caption

Courtesy of Netflix

“‘I’m dangerous,’ they said.”

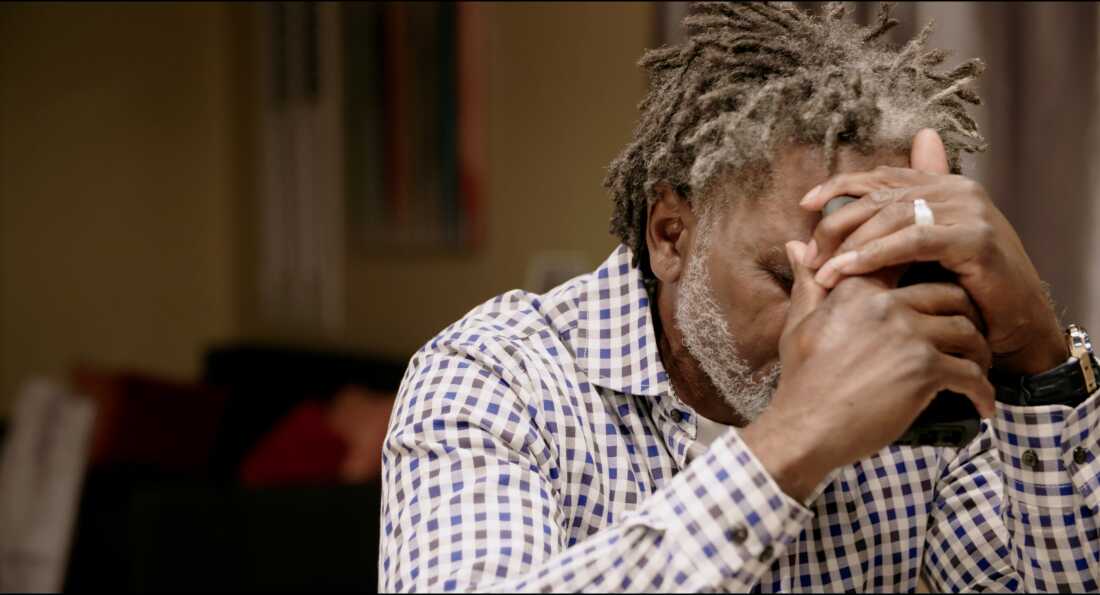

Through tears over the phone, James Jacobs, the hip-hop artist who goes by the stage name of JJ’88, tells his father that the hearing to reduce his sentence was denied. In April 2004, a 15-year-old Jacobs shot and killed an 18-year-old at a party in Bellflower, Calif. At the time he received the letter rejecting his request for a resentencing in 2020, he had lived more years in prison than outside of it.

“They don’t believe me. They don’t believe who I am,” he continues. “They said that all the work that I’m doing, my art and my advocacy work … they said that it’s not real. They say I am a clear and present threat to the community.”

In 2020, Jacobs was denied a hearing to reduce his prison sentence. His father, pictured here, grapples with the news while trying to comfort his son.

Courtesy of Netflix

hide caption

toggle caption

Courtesy of Netflix

As his father tries to comfort him, an automated voice cuts in: “You have 60 seconds remaining.”

Filmmaker and director Contessa Gayles was in the room with Jacobs’ father as he received that call.

“I remember, too, after that moment, obviously being incredibly concerned for you and your well-being,” Gayles tells Jacobs during an interview with NPR, “but I hesitated, for a long time, to ask you if you wanted to continue with the film. … I just was too afraid for your answer.”

The pair had been working with Jacobs’ producer on a documentary and visual album together. But he said he did want to continue.

“I’ve seen hard moments in film before, I’ve seen hard moments talked about in music — really hard moments — and this was one of the hardest moments in my life,” Jacobs says. “I love [Shakespeare’s] Titus Andronicus — it’s a tragic story, and I remember reading that and I was, like, ‘this is art too’ — it doesn’t always have to be this fairytale Disney ending that I was used to, as a kid and as a fan of films. Some stories end in, ‘this guy found spiritual enlightenment but died in prison.’ That’s the wisdom of the world, I guess. That’s the wisdom of our universe. I couldn’t argue with it, so I was comfortable [with continuing the film].”

Actor Miles Lassiter, as “kid James,” wears antlers in Songs from the Hole. Jacobs says it’s the image he’s asked about most often. “These antlers, along with being [for the song] ‘Most Hunted,’ are very gun-hunting, violent-culture — the experience, as a Black man, was that [Black men] were being hunted like deer, like buck in this country. And early references of Black men in this country — we were called Bucks. And so I thought — we [Jacobs and Gayles] thought — it was fitting … that this character represented the coming-of-age through antlers and the symbolism of being hunted with antlers on his head.”

Courtesy of Netflix

hide caption

toggle caption

Courtesy of Netflix

Songs from the Hole follows Jacobs’ story as he reflects on his coming-of-age within California’s state prison system, finds healing in an unlikely place and contemplates forgiveness. After meeting and befriending Gayles when she was on assignment for CNN at California’s Correctional Training Facility, commonly known as Soledad State Prison, in 2017, Jacobs and his producer, Richie Reseda, reached out with an ambitious idea: to direct and bring to life the visual album that Jacobs had written entirely from solitary confinement. The request reached Gayles at an important moment of her career: when she was ready to pursue independent filmmaking.

Gayles says she was inspired, during the making of Songs from the Hole, by the 2014 film Boyhood. “I was just thinking about representations that we have of white childhood and the plethora that exists of those depictions, and that often, with storytelling around Black people — Black young people — it’s very limited in scope. And so I was just meditating on, ‘[Richard] Linklater spent 12 years making [Boyhood] about white childhood,’ and I was just saying in my head, ‘we deserve to have as much space to be as indulgent and wide-ranging with how we tell the stories of Black childhood.’”

Courtesy of Netflix

hide caption

toggle caption

Courtesy of Netflix

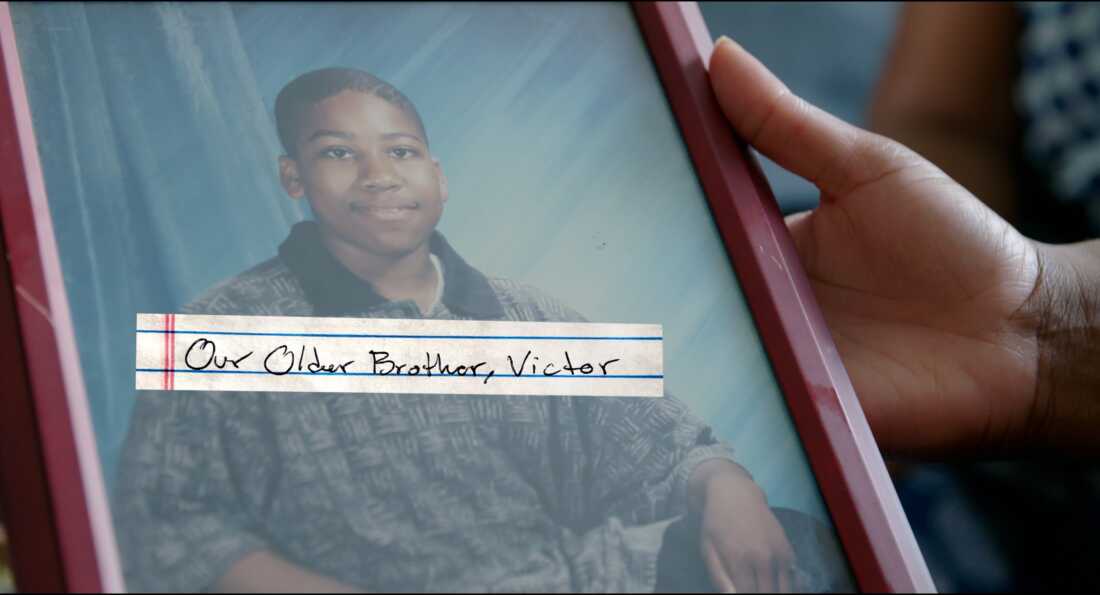

Reneasha Jacobs holds a photograph of her and James’ older brother, Victor Benjamin. Benjamin was shot and killed on April 19, 2004.

Courtesy of Netflix

hide caption

toggle caption

Courtesy of Netflix

Actors reenact a memory from Jacobs’ childhood in Songs from the Hole. In the film, Jacobs says, “Memories are crucial in maintaining your sanity in prison. I remember — maybe accurately or inaccurately — but I remember things from my childhood and relive them, sitting on that bunk, and it reminds me that I was a person and I am a person before being incarcerated.”

Courtesy of Netflix

hide caption

toggle caption

Courtesy of Netflix

![Actor Myles Lassiter portrays young Jacobs lying in the bed of a pickup truck, holding a toy gun, during the song, "Most Hunted." Jacobs says the visual was important to him because "in the song itself, I mentioned ... a couple of references to 'Friday,' one of them being during the hook, 'the government launched four drones. Still, I need a Glock to walk Smoke home. I'm not a man with it. I'm a man without it.' And those lines kind of hint toward quotes from the film 'Friday,' which is where Craig [played by Ice Cube] is in the room with his father. He just discovered that his father just discovered that he owns a gun. And [his dad] says, "Back in my day, we would use these," [referencing his fists]. Are you a man or are you not?" And [Craig] says, 'I'm a man without it. I'm a man without this gun.' And I knew when I first saw that, that I was like, 'I'm a man without a gun, but in this world, they don't see a man unless I have a gun."](https://npr.brightspotcdn.com/dims3/default/strip/false/crop/3840x2076+0+0/resize/1100/quality/50/format/jpeg/?url=http%3A%2F%2Fnpr-brightspot.s3.amazonaws.com%2F73%2Fbf%2F5306a1244a41b25fddca6158fdfd%2Fsfth-most-hunted-truck-bed.jpg)

Actor Myles Lassiter portrays a young Jacobs lying in the bed of a pickup truck, holding a toy gun, during the song, “Most Hunted.” Jacobs says the visual was important to him because “in the song itself, I mentioned … a couple of references to ‘Friday,’ one of them being during the hook, ‘the government launched four drones. Still, I need a Glock to walk Smoke home. I’m not a man with it. I’m a man without it.’ And those lines kind of hint toward quotes from the film ‘Friday,’ which is where Craig [played by Ice Cube] is in the room with his father. He just discovered that his father just discovered that he owns a gun. And [his dad] says, ‘Back in my day, we would use these [referencing his fists]. Are you a man or are you not?’ And [Craig] says, ‘I’m a man without it. I’m a man without this gun.’ And I knew when I first saw that, that I was like, ‘I’m a man without a gun, but in this world, they don’t see a man unless I have a gun.’”

Courtesy of Netflix

hide caption

toggle caption

Courtesy of Netflix

Throughout its production, the visual album quickly evolved into a documentary, heavily inspired by Beyoncé’s Lemonade. Where Beyoncé added poetic interludes between songs, in Songs from the Hole, the audience learns about Jacobs’ story and how his music spiritually liberates him while simultaneously being among the reasons officials cited for not considering his request for resentencing.

Gayles uses messages Jacobs wrote while in solitary to portray his vision for the album. When asked about the decision, Galyes says, “We really made use of 88’s handwriting because it was so much a part of his process.” She said she also felt “it would be more impactful to have the audience experience 88 in a similar manner to his loved ones … which is primarily over phone calls and letters.”

Courtesy of Netflix

hide caption

toggle caption

Courtesy of Netflix

Reneasha Jacobs, James’ older sister, holds an old photograph of herself and her two brothers from when they were kids. James shot and killed someone on April 16, 2004. Three days later, their older brother was murdered.

Courtesy of Netflix

hide caption

toggle caption

Courtesy of Netflix

The film relies heavily on Jacobs’ letters and recorded phone calls, through which he, Gayles and Reseda talk about the album’s production. The letters consist of scripts, shot lists and lyrics. Through the calls, Jacobs serves as the film’s narrator, speaking about his life and the symbolism of the imagery he’d dreamt up in solitary. The film explores cultural themes that touch on Black boyhood, familial relationships, growing up in the church, crime, forgiveness and redemption.

Actor Devonte Hoy depicts Jacobs forgiving the man who murdered his brother. In the film, Jacobs says, “Tears start coming down my face. And I said, ‘Man, you killed my brother.’ And the first thing out of his mouth was, ‘I’m sorry for what I took from you, bro.’ … And I just told him, ‘Man, I forgive you. If you want my forgiveness, you have it.’ And I got up and left.”

Courtesy of Netflix

hide caption

toggle caption

Courtesy of Netflix

Jacobs was released in 2022, after serving 18 years in prison.

Now, with the film streaming on Netflix and the team holding screenings in prisons across the country, Jacobs says he hopes the parole board commissioners who kept him locked up think differently about him if they see the film.

“If only you understood me, you’d see my humanity,” he says in the film.

“I would absolutely love to show this film to the commissioners that told me I was a danger to society,” he told NPR. “I would love it. I can’t wait to catch word that they watched it so that I can see — let’s talk again; I don’t even have to go to board, but I would love to talk to you now.”

Hoy depicts an older Jacobs talking to his father through glass during a visitation. In the film, Jacobs says he had just finished writing two verses of his song “Steel Grave,” and rapped both verses over the phone for his dad. When he finished, Jacobs says his father asked him, “What happens to the character? You just described he was in this dark world. Does he ever come out?”

Courtesy of Netflix

hide caption

toggle caption

Courtesy of Netflix

Songs from the Hole is currently streaming on Netflix. Find more of JJ’88’s work at linktr.ee/jj_eightyeight and on Instagram, at @jj_eightyeight, and more of Contessa’s work on her website, ContessaGayles.com, or on Instagram, at @contessagayles.

News

ICE Lawyer Who Told Judge She Was Overwhelmed Is Running for Congress

Julie T. Le, a former government lawyer, described in stark terms how overstretched the legal system had become during the administration’s immigration crackdown in Minnesota. Now, she said, she hopes to fix the “system’s failures” by running for Congress.

-

Massachusetts1 week ago

Massachusetts1 week agoMassachusetts man awaits word from family in Iran after attacks

-

Detroit, MI6 days ago

Detroit, MI6 days agoU.S. Postal Service could run out of money within a year

-

Miami, FL1 week ago

Miami, FL1 week agoCity of Miami celebrates reopening of Flagler Street as part of beautification project

-

Pennsylvania1 week ago

Pennsylvania1 week agoPa. man found guilty of raping teen girl who he took to Mexico

-

Sports1 week ago

Sports1 week agoKeith Olbermann under fire for calling Lou Holtz a ‘scumbag’ after legendary coach’s death

-

Michigan3 days ago

Michigan3 days agoOperation BBQ Relief helping with Southwest Michigan tornado recovery

-

Southeast3 days ago

Southeast3 days ago‘90 Day Fiancé’ alum’s boyfriend on trial for attempted murder over wild ‘Boca Bash’ accusations

-

Virginia1 week ago

Virginia1 week agoGiants will hold 2026 training camp in West Virginia