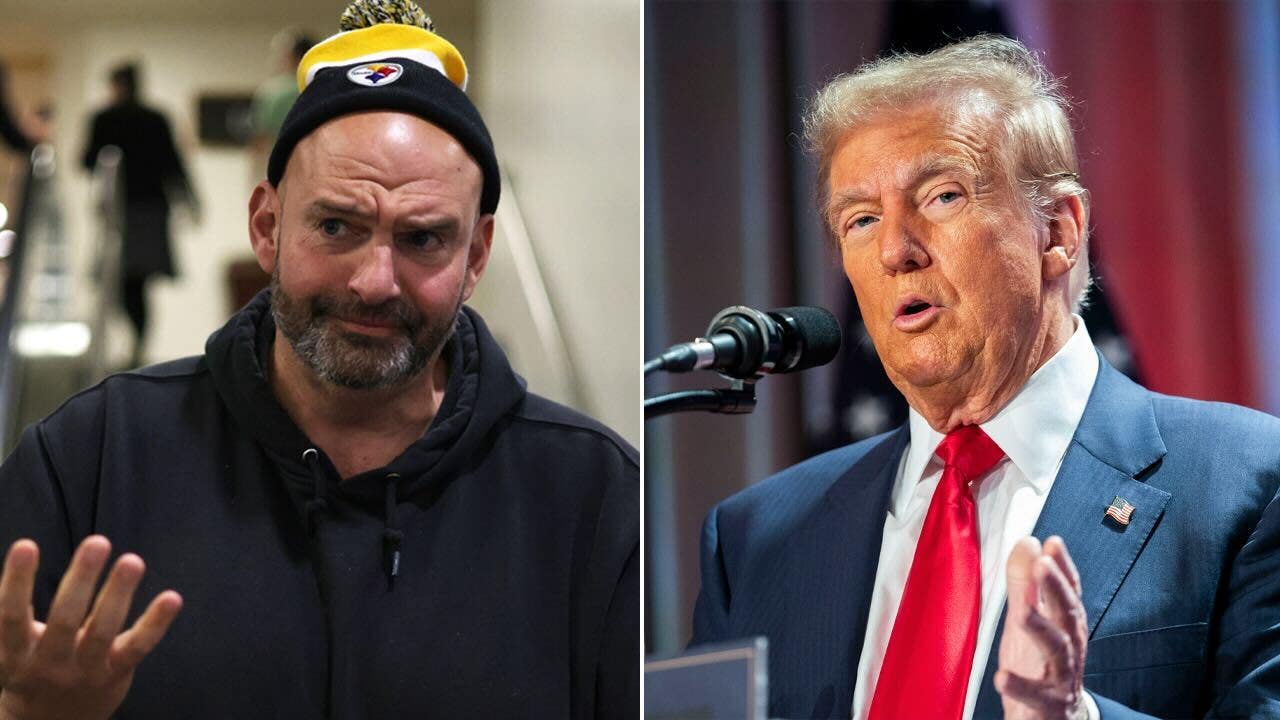

Donald Trump has tapped Stephen Miran, an economist who served during his first term, to chair his Council of Economic Advisers.

With the nomination, the president-elect is seeking to elevate to a White House economic post not only a critic of Federal Reserve chair Jay Powell but one who has accused the Biden administration of manipulating the economy and “usurping” the central bank’s role.

“Steve will work with the rest of my Economic Team to deliver a Great Economic Boom that lifts up all Americans,” Trump said in a statement on Sunday.

Miran was a senior adviser for economic policy at the Treasury department in the first Trump administration.

Currently a senior strategist at hedge fund Hudson Bay Capital Management, he said he was honoured. “I look forward to working to help implement the President’s policy agenda to create a booming, noninflationary economy that brings prosperity to all Americans!” he posted on X.

The White House Council of Economic Advisers is a three-person group that advises the president on economic policy.

Trump has threatened US trading partners, vowing to impose sweeping tariffs, including 25 per cent levies on goods from Mexico and Canada and 10 per cent on China’s imports, on his first day in office.

On the campaign trail, Trump vowed to impose blanket levies of 20 per cent on all US imports, as well as tariffs of 60 per cent on those from China, suggesting his second-term policies could be more protectionist and disruptive to the global economy and markets than his first.

The president-elect has also pledged to renew tax cuts he enacted during his first spell in the White House.

Earlier this year, Miran co-wrote a paper accusing Biden’s Treasury department of manipulating the economy during the election, arguing the government’s dependence on short-term debt amounted to “stealth quantitative easing and impedes the Fed’s ability to fight inflation.

“By adjusting the maturity profile of its debt issuance, Treasury is dynamically managing financial conditions and, through them, the economy, usurping core functions of the Federal Reserve”, he wrote with economist Nouriel Roubini.

“We dub this novel tool ‘activist Treasury issuance,’ or ATI. By manipulating the amount of interest-rate risk owned by investors, ATI works through the same channels as the Fed’s quantitative easing programs.”

In FT Alphaville last year, Miran co-authored a piece warning against the perils of a two-tier bond market, which “would impair Treasuries’ ability to serve as risk-free collateral underpinning the global financial system” and bring to the US the chaos of a defaulting emerging economy.

Miran has also hit out at Powell for urging more aggressive fiscal and monetary stimulus in October 2020, about a month before that year’s election, to aid the economic recovery amid the Covid-19 pandemic.

“Powell was wrong politically and economically when he urged Congress to ‘go big’ on fiscal stimulus in October of 2020, on the eve of a Presidential election, suggesting that voters favour Democrats’ $3 trillion proposals over Republicans’ $500 billion”, Miran wrote on X in September. “We know what happened next.”

Miran must be confirmed by the US Senate.

Last month, Trump named Kevin Hassett as chair of the National Economic Council.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)