Kansas

Rate-Cutting, Flattening Tax Reform Rolls On In Ohio, Wisconsin, Iowa, Kansas And Beyond

Ohio Statehouse in Columbus.

getty

Legislators in eight blue states kicked off the yr introducing a coordinated bundle of tax hikes focusing on higher earnings households. Whereas that effort attracted appreciable media protection, the extra dominant theme in state capitals this yr on the subject of tax coverage just isn’t widespread curiosity in soaking the wealthy, however fairly a continuation of the multi-year development of states shifting to decrease and flatter earnings tax charges, with some lawmakers and governors aiming for full earnings tax repeal.

California’s $22 billion annual finances deficit has generated headlines, however the Golden State is an outlier amongst states on the subject of public funds. “State and native governments are actually flush today,” Federal Reserve Chairman Jerome Powell stated at a February 1 press convention, including that due to this, “lots of them are contemplating tax cuts and even sending checks.”

Fed Chair Powell is appropriate. In actual fact, a state that was an emblem for GOP dysfunction solely weeks in the past, Ohio, is now an instance of how, even amid intra-party discord, Republicans of all stripes are nonetheless in a position to unify within the identify of rate-reducing tax reform. By setting that as a high precedence for the yr, Ohio Home Speaker Jason Stephens (R) and his management workforce have put forth an agenda that can do a lot to rectify disharmony and ease tensions in Buckeye State Republican ranks stemming from Stephens’ sudden ascension to the speakership in January, one thing that was achieved with Democratic votes.

Ohio at the moment has a progressive earnings tax code with 4 brackets, the best charge being 3.99% and the bottom set at 2.765%. The invoice quantity that Speaker Stephens assigned to flat tax laws sponsored by Consultant Adam Mathews (R), which might transfer Ohio to a flat 2.75% private earnings tax charge, signifies how tax reform is the highest precedence in Columbus in 2023.

“It’s important that is referred to as Home Invoice 1,” says Consultant Mathews. “I hope this can move as a stand alone invoice or as a part of our finances framework. That may ship a message that Ohio is open for enterprise and we would like individuals to maneuver right here.”

The two.75% charge carried out by HB 1 would give Ohio the nation’s second lowest flat tax charge, simply behind Arizona’s 2.5% charge that took impact in the beginning of 2023. The transfer to a 2.75% flat tax in Ohio, beneath HB 1, could be facilitated partially by scaling again state support to localities.

The cash Ohio state authorities sends to native governments yearly, which might finish beneath HB 1 to be able to liberate income for state earnings tax aid, subsidizes decrease property tax charges than what is required to fund native authorities spending. HB 1 proponents level out that the invoice pays for state earnings tax aid by placing an finish to state spending that helps native officers conceal the complete price of native authorities from their constituents.

“We would like Ohio to be the chief, the financial engine within the Midwest and the nation,” provides Consultant Mathews. “We may take the lead now by passing HB 1, which might give Ohio the bottom earnings tax charge within the Midwest and make us among the many most enterprise and household pleasant states within the nation.”

Ohio isn’t the one state within the Midwest the place legislative management has proposed a decrease, flatter earnings tax. Wisconsin Senator Majority Chief Devin LeMahieu has launched laws to maneuver Wisconsin from a progressive earnings tax code with a high charge of seven.65% to a flat tax of three.25%.

Legislative management in Kansas, as is the case in Ohio and Wisconsin, has additionally launched payments to maneuver to a flat tax with a decrease charge than what’s at the moment assessed. In actual fact, the Kansas Senate handed laws this week that may implement a 4.75% flat earnings tax.

Republicans within the Kansas Home of Representatives, in the meantime, have launched a invoice shifting the state from a graduated earnings tax code with charges of three.1%, 5.2%, and 5.7%, to a flat 5% earnings tax. Each the Home and Senate flat tax proposals would end in a web lower on common for taxpayers of all earnings ranges.

Eric Stafford, vice chairman of presidency affairs on the Kansas Chamber of Commerce, says that the flat tax laws pending within the Kansas Home is modeled after the tax reform enacted in North Carolina, which facilitated important charge discount by making it contingent upon income triggers being met. North Carolinians who seen their a number of rounds of earnings tax rate-reducing reform incessantly in comparison with what was enacted in Kansas a decade in the past, disingenuously so many imagine, now get to get pleasure from vindication and affirmation that, opposite to the narrative revealed in lots of media retailers, it’s North Carolina and never Kansas that’s seen because the mannequin for conservative tax reform. That is evidenced by the truth that Kansas lawmakers at the moment are explicitly following North Carolina’s lead.

“It took braveness for the conservative Common Meeting in North Carolina to restrain spending and lower taxes,” says Paige Terryberry, senior analyst for fiscal coverage on the John Locke Basis, a Raleigh-based suppose tank. “North Carolina’s daring reforms are an enormous success. It’s thrilling to see different states comply with go well with.”

Other than Ohio, Wisconsin, and Kansas, there are lots of different states the place rate-reducing tax reform has been launched and is being debated. Laws has been filed within the Arkansas Legislature to take their high earnings tax charge from 4.9% to 4.5%. Montana’s earnings tax charge is scheduled to fall from 6.75% to six.5% subsequent yr. Legislators in Montana, one among 5 states with no state gross sales tax, at the moment are contemplating a proposal to chop the earnings tax charge to five.9% subsequent yr as an alternative of 6.5%.

Lawmakers in Iowa, the place some of the important tax code overhauls has been enacted by Governor Kim Reynolds (R), are contemplating proposals to implement additional charge discount and probably part out the state earnings tax totally. In Kentucky, Governor Andy Beshear (D) introduced on February 17 that he’ll signal into regulation the earnings tax lower lately handed out of the Kentucky Home and Senate, which can scale back the state’s flat earnings from 4.5% to 4%.

Legislative management in each North Carolina, which has a 4.75% flat charge scheduled to fall to three.99%, and Arizona, which has a 2.5% flat charge, the bottom within the nation, are pursuing additional earnings tax charge discount this yr. As in Iowa, laws to part out the state earnings tax has been filed in Arizona.

It assumed the mantle lower than two months in the past, however Arizona might not maintain the title of nation’s lowest flat tax for for much longer. Prior to now week the North Dakota Home handed Home Invoice 1158, which can transfer North Dakota to a 1.5% flat earnings tax, coupled with a comparatively beneficiant normal deduction.

North Dakota at the moment has 5 earnings tax brackets with a high charge of two.9%. The 1.5% flat tax invoice handed within the Home this week, which is sponsored by Rep. Craig Headland and has been endorsed by Governor Doug Burgum (R), would give North Dakota the nation’s lowest flat tax charge if enacted. This previous week the North Dakota Home additionally handed Home Invoice 1425, laws that may part out the state earnings tax over time time based mostly on income triggers, and accepted pension reform that can scale back taxpayer prices.

When lawmakers in eight blue states rolled out new proposals to lift taxes in January, Illinois Consultant Will Guzzardi (D) stated they did so in a coordinated style “to ship a message that there’s nowhere to cover.” Because the above rundown proves, not solely are there many states the place one can keep away from the tax hikes lately launched in Illinois, California, New York, and different blue states, lawmakers in states which have been widespread locations for former blue state residents at the moment are working to make their tax codes even much less burdensome and extra engaging than they already are.

Kansas

Bill Self and Kansas Offer Ascending 2026 Recruit Kohl Rosario

The Kansas Jayhawks coaching staff has been active on the recruiting trail lately, popping in to watch several players on the AAU circuit.

Per his X page, Bill Self recently offered highly touted 2026 guard Kohl Rosario, a 6-foot-5 sharpshooter attending Moravian Prep in North Carolina.

Rosario is a 4-star recruit and the No. 96 overall player in 247 Sports Composite rankings for the Class of 2026.

An incoming high school senior holding offers from programs like Baylor, Tennessee, and Villanova, Rosario is absolutely killing it in AAU and Overtime Elite tournaments.

In the Nextgen Euroleague Tournament in Abu Dhabi, Rosario recently finished with an incredible 30-point performance for Overtime Elite.

He went a perfect 10-for-10 from the field, knocking down all six of his 3-point attempts in a 113-89 victory over Zalgiris Kaunas.

Rosario plays for Team CP3 in the Nike Elite Youth Basketball League and the YNG Dreamerz in Overtime Elite. He averaged 15.7 points, 5.6 rebounds, and 2.1 assists for the Dreamerz this past season.

Kansas is just the latest blue blood to enter Rosario’s recruitment. Duke reportedly reached out to him last week, which makes sense given his location.

A versatile combo guard, Rosario is a dangerous shooter from beyond the arc and possesses exceptional traits on the defensive end.

All eyes in Lawrence are on top-ranked recruit Tyran Stokes, but KU recently contacted under-the-radar prospects like Rosario, Jahda Swann, Trey Thompson, and others.

Considering the Jayhawks are without a commitment in their 2026 recruiting class, Rosario could be a player worth watching moving forward.

Kansas

Family safe after car flips off side of Kansas interstate in slick conditions

KANSAS CITY, Kan. (KCTV) – The Kansas Highway Patrol was on the scene of a rollover crash Sunday that was attributed to the rain-covered roadways.

The crash happened at 11:44 p.m. on May 25 as six people in a 2012 Nissan Quest were driving south on Interstate 635. Just past State Avenue, the driver lost control in the slick conditions and ran off the right side of the road, causing the vehicle to overturn.

By the time emergency crews arrived, all six occupants were outside the vehicle. The driver and passengers included two adults, two children and two teens. One of the teens was believed to have suffered minor injuries and was taken to Children’s Mercy, but the rest were reportedly uninjured.

ALSO READ: Man suffers life-threatening injuries in shooting at 18th and Oak

Copyright 2025 KCTV. All rights reserved.

Kansas

Kansas City Royals’ Future Star Now Leading Minor Leagues in Impressive Category

Kansas City Royals’ top prospect Jac Caglianone is now leading the minor leagues in RBIs with 50 after another big game on Saturday for Triple-A Omaha.

The No. 6 overall draft choice just last season out of Florida, Caglianone is now the No. 10 prospect in baseball, per MLB Pipeline. His home run on Saturday came off the bat at 107 mph. In addition to his run-producing ability, he’s also hitting .318 across Double-A and Triple-A.

The Royals enter play on Sunday at 28-25 and in fourth place in the American League Central, but they figure to be in the playoff race until the end. As a result, Caglianone could find himself called up sooner rather than later in order to help impact that playoff race. The Royals got to the playoffs last season, falling to the New York Yankees in the American League Division Series.

The following comes from a portion of his MLB.com prospect profile:

Caglianone’s power was arguably the best in the 2024 Draft class. The left-handed slugger maxed out with a 121.7 mph exit velocity as a junior and didn’t stop there with a 117.3 mph max EV in the Fall League, second-best among batted balls measured by Statcast. That comes from Caglianone’s major strength at 6-foot-5 and the long levers that come with such a frame. He significantly cut his swing-and-miss rate in college in ’24, but he also swung a ton in general with a 39 percent chase rate. That was down only a touch in the Fall League, and more advanced arms will be able to take advantage if Caglianone can’t rein in his approach.

At the big-league level, the Royals will take on the Minnesota Twins on Sunday at 2:10 p.m. ET. It’s unclear how long Caglianone will need to wait for his major league call-up, but recent reports have indicated it might not be long.

MAYER TO WBC? According to reports out of Mexico, Boston Red Sox’ top prospect Marcelo Mayer is interested in representing Mexico at the WBC. CLICK HERE:

MAGIC IN GREENSBORO? Keiner Delgado, a top-30 prospect for the Pittsburgh Pirates, had a three-homer game on Wednesday, continuing a ridiculous streak for the High-A franchise. CLICK HERE:

SLOAN TIME: Ryan Sloan, a second-round pick of the Mariners, continues to thrive in his first professional season at Single-A Modesto. CLICK HERE:

-

World1 week ago

World1 week agoSevere storms kill at least 21 across US Midwest and South

-

News1 week ago

News1 week agoWatch: Chaos as Mexican Navy ship collides with Brooklyn Bridge, sailors seen dangling – Times of India

-

News1 week ago

News1 week agoMaps: 3.8-Magnitude Earthquake Strikes Southern California

-

Politics1 week ago

Politics1 week agoTexas AG Ken Paxton sued over new rule to rein in 'rogue' DAs by allowing him access to their case records

-

Politics1 week ago

Politics1 week agoAfghan Christian pastor pleads with Trump, warns of Taliban revenge after admin revokes refugee protections

-

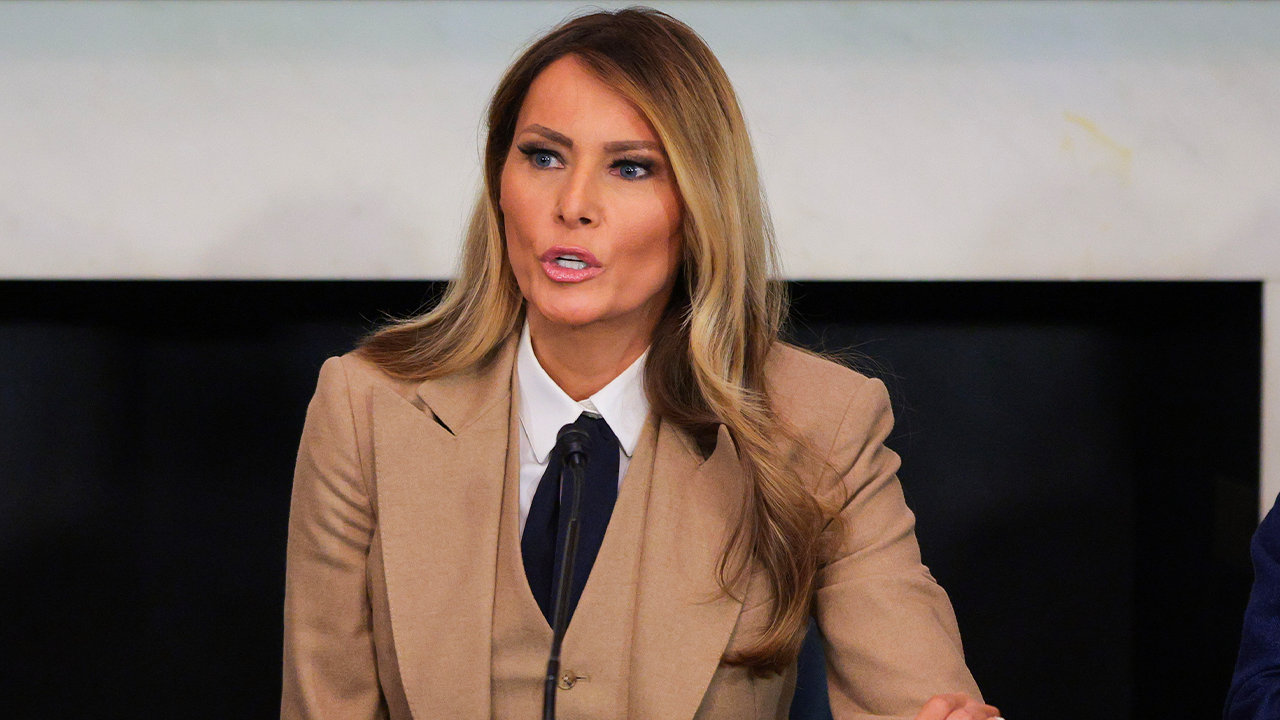

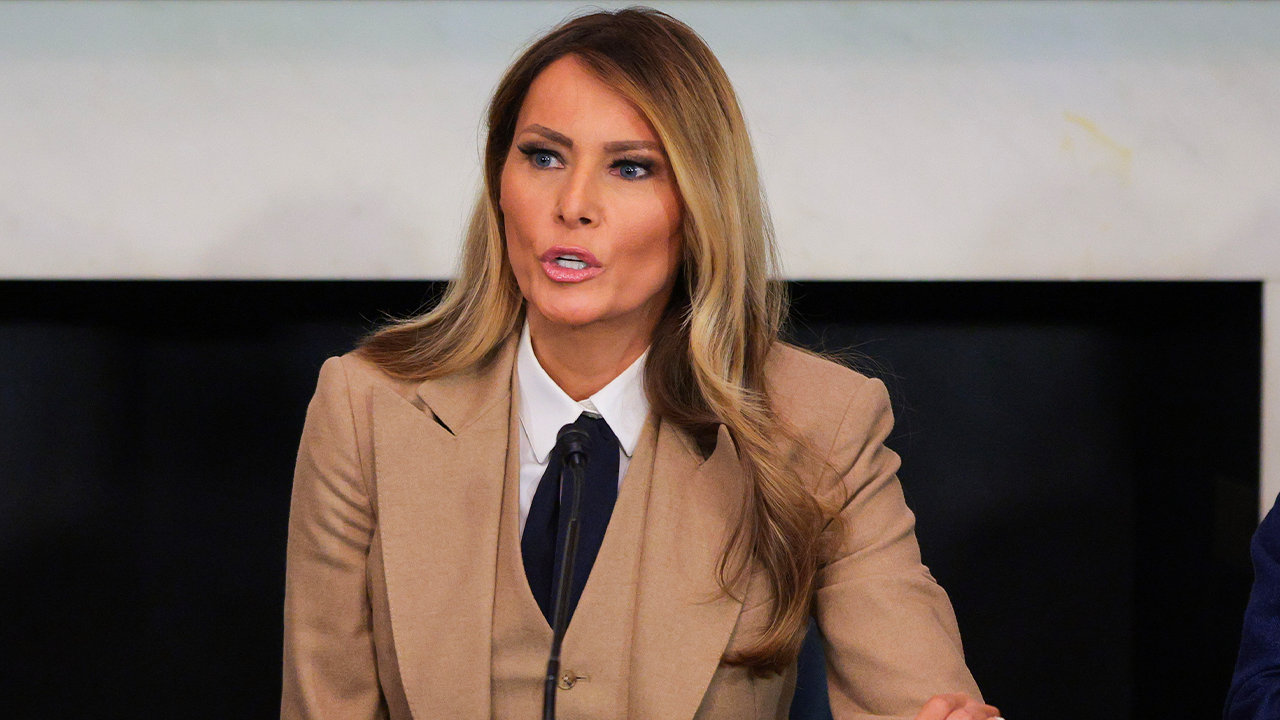

Politics1 week ago

Politics1 week agoTrump, alongside first lady, to sign bill criminalizing revenge porn and AI deepfakes

-

World1 week ago

World1 week agoPortuguese PM’s party set to win general election, fall short of majority

-

News1 week ago

News1 week agoVideo: One Person Dead in Explosion Outside Palm Springs Fertility Clinic