Cleveland, OH

Ohio Senate’s Budget Kills DeWine’s Proposed Affordable Housing Tax Credit Program

Photo by Nick Evans, Ohio Capital Journal

The Ohio Senate’s proposed budget axed a new affordable housing tax credit program first introduced by Ohio Gov. Mike DeWine in his budget.

The program would entice developers to construct low-incoming housing by making state tax credits accessible to projects receiving federal aid, but the Senate killed it.

DeWine originally capped the amount of credits to $100 million, and the House boosted it to $500 million.

Instead, the Senate proposed to expand a law that prohibits Low-Income Housing Tax Credit properties from getting a historic rehabilitation tax credit to any other federally subsidized residential rental property.

“We were in no way, shape ,or form ready for the all out assault that the Senate took on rental housing,” said Coalition on Homelessness and Housing in Ohio (COHHIO) Executive Director Amy Riegel. “The state housing tax credits was going to be a tool that would have greatly enhanced the number of affordable housing units being built across the state.”

In 2018, there were only 199,118 affordable and available rental units for 455,993 for extremely low-income renters and a shortage of 256,875 units in Ohio, according to a 2021 Ohio Housing Finance Agency report.

“Too many Ohio families lack adequate and affordable housing,” DeWine said during his 2023 State of the State Address. “In recent years, we have experienced lower rates of housing construction and low vacancy rates in rental properties. This has put a strain on our housing market, especially affecting Ohioans with low and moderate incomes.”

Full-time workers in Ohio needed to make at least $17.05 an hour to afford a 2-bedroom apartment in Ohio in 2022, according to a joint report from the National Low Income Housing Coalition (NLIHC) and COHHIO.

“After generations of under investment, working families across Ohio are being locked out of dignified, affordable housing,” said Carlie J. Boos, executive director of the Affordable Housing Alliance of Central Ohio.

She praised both DeWine’s and the House’s budgets, calling them “a significant step forward that allows Ohio to create decent homes that our workers and their families can afford.”

The Senate introduced their version of the budget Tuesday with proposed changes likely coming next week. DeWine must sign the budget by June 30.

Abolishing the Ohio Housing Finance Agency

The Ohio Housing Finance Agency (OHFA) has a proposed budget of $16.8 million for fiscal year 2024 and $17.4 for fiscal year 2025 — a nearly 8% percent decrease for both years when compared to the House’s version of the budget.

But the OHFA would cease to exist as it currently operates under the Senate’s budget by transferring the organization to the newly established Governor’s Office of Housing Transformation starting in January.

“This action politicizes the Ohio Housing Finance Agency, an organization that is not supposed to be political, and it will create significant barriers to the creation of affordable housing,” Riegel said.

When reached for comment, OHFA said they are continuing to review the Senate’s budget.

While all the current employees of OHFA would be kept on staff, this would give the governor the ability to pick the director and appoint all new members.

The number of Tax Credit Authority members would increase from five to seven and the office would have to get the green light from the Tax Credit Authority before approving funding for multifamily rental housing.

The proposed budget would also nix their authority to create pilot programs to increase housing opportunities for “extremely low-income households, pregnant women, and new mothers,” according to an analysis by the nonpartisan Legislative Service Commission.

Originally published by the Ohio Capital Journal. Republished here with permission.

Cleveland, OH

Iron mine owner eyes Michigan for rare-earth mineral extraction

CLEVELAND, OH — U.S. steelmaker Cleveland-Cliffs plans to explore sites in Michigan and Minnesota for domestic rare-earth metals.

The company, which owns several Minnesota taconite facilities and two iron ore mines in the Upper Peninsula, told investors on Oct. 20 that surveys show promise in both states and expansion into rare-earth mining would align with U.S. strategy on critical minerals.

Cleveland-Cliffs CEO Lourenco Goncalves said the move toward rare-earth mining follows “comprehensive reviews of our ore bodies and tailings,” which identified two sites that show evidence of mineralization.

The initial focus would be Michigan, Goncalves said, although he did not specify exact locations and cautioned that the effort is still early stage.

“The important thing is that they are there. We found them there. And we want to make it viable,” he said. “We really believe that we have potential there. And that it will be good for Michigan — for the Upper Peninsula, primarily. And there’s even one site in Minnesota that we would go. It’s not very friendly to us, but we will still investigate there.“

“But we’ll definitely start in Michigan, the Upper Peninsula, because we love the Upper Peninsula,” he said.

Rare earths are a group of metals used in small amounts but vital to high-tech products such as electric vehicle motors, consumer electronics, renewable energy and military systems. Despite their name, they’re relatively common in the Earth’s crust but are hard to extract and process economically. Most global refining and production takes place in China, which has fueled U.S. efforts to build a domestic supply chain.

The metals have become a focal point in recent trade tensions and the move toward rare-earth exploration reflects shifting global trade dynamics. Company executives have credited federal tariffs on imported steel and parts with strengthening domestic manufacturing and creating new incentives for U.S.-based production.

Goncalves said successful extraction would align Cleveland-Cliffs with broader U.S. strategy for critical mineral independence, “similar to what we achieved in steel.”

“America’s industrial foundation must never depend on China or any other foreign source for essential minerals, and Cliffs intends to be part of the solution,” he said.

In Michigan, the potential for rare earths and other critical minerals offers a possible extension of mining in a region that once thrived on iron ore and copper, but today is home to only two operating mines: the Eagle nickel and copper mine and the Tilden iron ore mine.

Cleveland-Cliffs owns the Tilden Mine and the next-door Empire Mine, which has been indefinitely idled since 2016. The company asked the Trump administration for exemptions from new emissions controls at the two mines earlier this year.

The hunt is on for new U.P. mineral deposits. Talon Metals, an exploration company jointly developing a new Minnesota nickel mine with Rio Tinto, has been hunting for nickel deposits in the U.P. for several years. In March, Talon announced a non-finalized deal with Eagle Mine owner Lundin to finance drilling at drilling at two exploration sites.

In addition to new deposit exploration, old mine waste is being examined, too. Lundin is partner in a startup that won a $145 million federal grant awarded this year to reclaim nickel from Eagle Mine’s Humboldt Mill processing waste. The Michigan Geological Survey is using federal grants to analyze waste rock and mine tailings for traces of nickel, cobalt, copper and rare-earths that could be recovered with modern technology.

The mining efforts are supported by local governments and economic development organizations but they haven’t been without pushback. Plans to develop the fully-permitted Copperwood Mine near Porcupine Mountains Wilderness State Park have drawn loud opposition from environmental groups and Indigenous tribes. Development of the proposed Back Forty open-pit gold mine near Menominee has apparently stalled amid fierce opposition from environmental groups and tribes.

If you purchase a product or register for an account through a link on our site, we may receive compensation. By using this site, you consent to our User Agreement and agree that your clicks, interactions, and personal information may be collected, recorded, and/or stored by us and social media and other third-party partners in accordance with our Privacy Policy.

Cleveland, OH

PHOTOS: Ominous clouds spotted over NE Ohio amid storms, strong winds

CLEVELAND (WJW) – Ominous clouds have been spotted over Cleveland and Northeast Ohio as a round of rain and thunderstorms made its way across Northeast Ohio on Tuesday evening.

The FOX 8 weather team captured these timelapse photos from The Flats just after 6 p.m., showing a shelf cloud passing over downtown Cleveland.

“Ominous looking shelf cloud engulfing downtown Cleveland!” FOX 8 Meteorologist Dontae Jones wrote on X. “A line of rain and storms are moving through Northeast Ohio this evening with gusty winds.”

Several FOX 8 viewers also shared photos of ominous clouds hanging over Northeast Ohio.

According to FOX 8 meteorologists, Tuesday night’s batch of rain will contain a few thunderstorms with up to 40-60 mph wind gusts. Some small hail or graupel are possible too.

A Severe Thunderstorm Warning was issued for Ashland and Richland counties, but the alert has since expired.

Keep up with the latest weather conditions here.

Cleveland, OH

The NRP Group Celebrates Opening of 316-Unit The Collins Luxury Apartment Community in Cleveland’s Vibrant Scranton Peninsula | MultifamilyBiz.com

CLEVELAND, OH – The NRP Group, a vertically integrated, best-in-class developer, builder and manager of multifamily housing, announced the grand opening of The Collins, a 316-unit luxury community on the Scranton Peninsula in Cleveland, Ohio. The development has transformed a long-underutilized waterfront site into a vibrant new neighborhood, adding modern housing, open space and direct access to downtown Cleveland, Tremont and Ohio City.

Just steps from the Cuyahoga River and a short drive to downtown Cleveland, The Collins offers highly amenitized residences designed for a wide range of residents. The project responds to the city’s growing need for high-quality, modern housing while activating a key part of the Scranton Peninsula.

“The Collins demonstrates what is possible when you invest in Cleveland,” said Aaron Pechota, Executive Vice President at The NRP Group. “As a Cleveland-based company, we are proud to support the city’s growth by reimagining this long-underutilized stretch of the Scranton Peninsula into a vibrant, well-connected neighborhood closely tied to downtown and everything that makes this city special. By leading early investment in this rediscovered area, we are bringing new energy and opportunity to one of Cleveland’s most central neighborhoods.”

Located at 1957 Carter Road, The Collins is close to major employers and medical centers including Cleveland Clinic, University Hospitals and MetroHealth, along with cultural and dining destinations such as the West Side Market, Great Lakes Brewing and Irish Town Bend.

Designed by BKV Group, The Collins spans over seven acres and comprises two five-story apartment buildings and three townhome buildings. Apartments range from studios to three-bedroom layouts. Townhomes include private entry, rooftop balconies and two-car garages. All homes are designed with high-quality finishes such as stainless-steel GE appliances, polished quartz countertops, modern cabinetry and luxury vinyl plank flooring.

Indoor amenities include a state-of-the-art fitness center, resident clubhouse, conference room, private breakout pods and a pet spa. A fifth-floor lounge provides sweeping views of the river and city skyline. Outdoor amenities emphasize connection and community. The Collins features a resort-style pool, firepits, grilling stations and a woonerf-inspired plaza designed for events, food trucks and neighborhood gatherings. Wide walkways prioritize pedestrians and connect directly to the Towpath Trail, with free onsite bike rentals available for residents to ride the trail to Irish Town Bend, Ohio City and downtown Cleveland.

“Dollar Bank is proud to support a project that reimagines what urban living can look like in Cleveland,” said Bill Elliott, Executive Vice President and Regional Lending Director at Dollar Bank. “Financing developments like The Collins allows us to channel capital into projects that create long-term local value by adding housing, green space and connectivity that strengthen neighborhoods and help drive Cleveland’s economic future.”

Dollar Bank served as the construction lender. The Ohio Department of Development provided critical funds through its Brownfield Remediation and State Opportunity Zone Programs. The Ohio Water Development Authority provided gap financing as well. The City of Cleveland also provided tax abatement and Tax Increment Financing (TIF). All were crucial in achieving a successful project.

-

World2 days ago

World2 days agoIsrael continues deadly Gaza truce breaches as US seeks to strengthen deal

-

Technology2 days ago

Technology2 days agoAI girlfriend apps leak millions of private chats

-

News2 days ago

News2 days agoTrump news at a glance: president can send national guard to Portland, for now

-

Business2 days ago

Business2 days agoUnionized baristas want Olympics to drop Starbucks as its ‘official coffee partner’

-

Politics2 days ago

Politics2 days agoTrump admin on pace to shatter deportation record by end of first year: ‘Just the beginning’

-

Science2 days ago

Peanut allergies in children drop following advice to feed the allergen to babies, study finds

-

News1 day ago

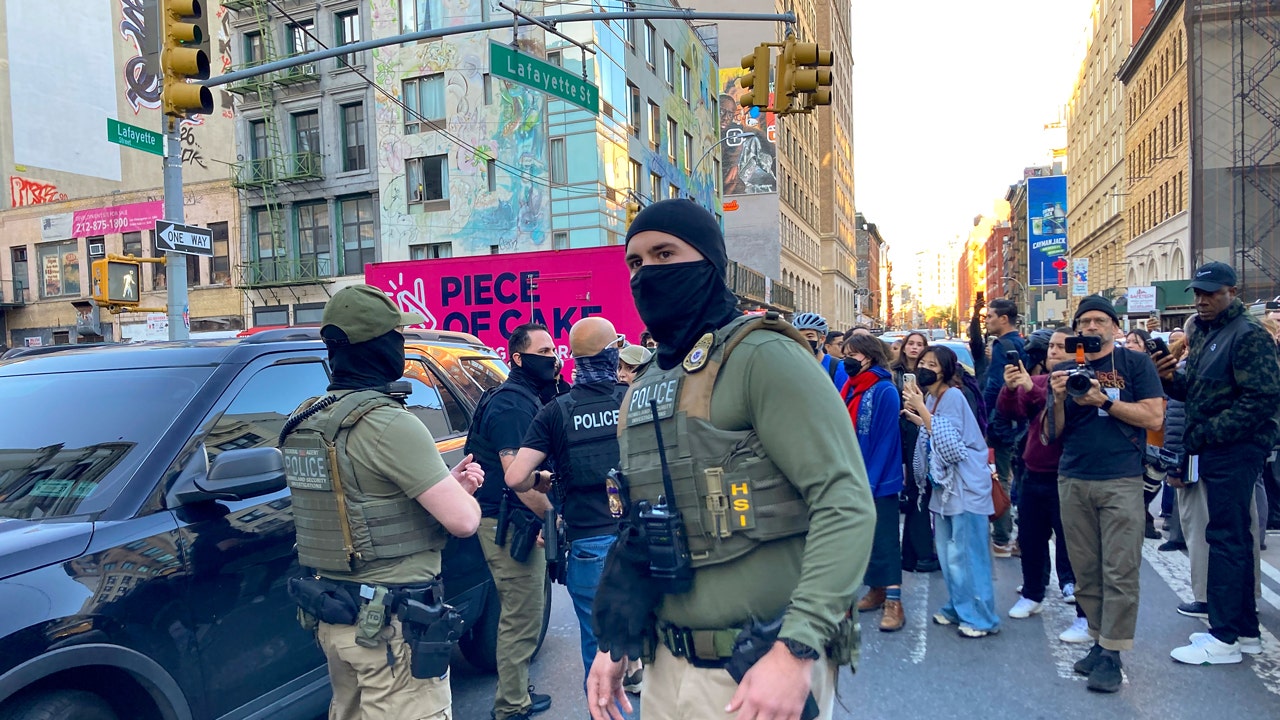

News1 day agoVideo: Federal Agents Detain Man During New York City Raid

-

News2 days ago

News2 days agoBooks about race and gender to be returned to school libraries on some military bases