Finance

Whiteland approves $7.2M bond to finance Patch mixed-use development – Daily Journal

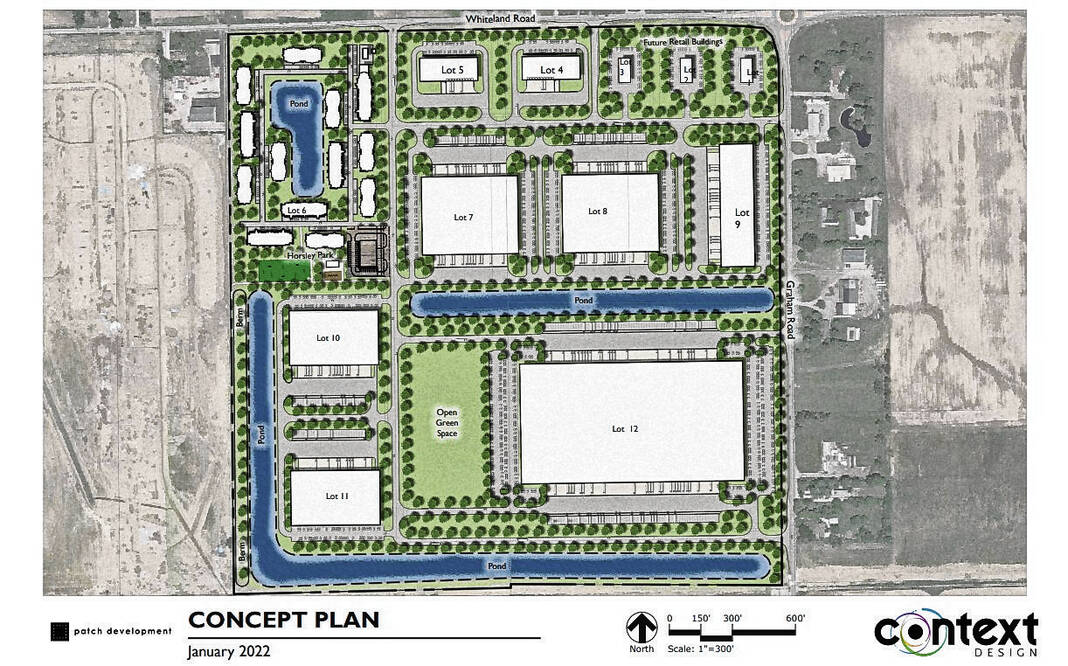

An idea plan for the brand new combined growth on Whiteland, known as Gateway at Whiteland, is proven. Westfield-based Patch Growth is creating the property on 159 acres of former farm land.

The Whiteland City Council this week accredited a $7.2 million bond to finance a part of an enormous mixed-use growth within the works at Graham and Whiteland roads.

A part of this deal additionally places into movement long-awaited plans to construct a brand new public security constructing within the city.

Westfield-based Patch Growth is constructing a 159-acre mixed-use growth that’s anticipated to deal with gentle industrial growth, residences, restaurant and retail areas, and medium-size industrial flex-space buildings.

Dubbed Gateway at Whiteland, work has already began on the primary section of the event, which features a 617,316-square-foot gentle industrial constructing on the again finish of the property.

A part of the undertaking settlement between the city of Whiteland and Patch features a financing methodology with assist from the city to pay for public infrastructure enhancements.

The Whiteland City Council on Tuesday unanimously accredited an roughly $7.25 million bond to Patch Growth, with a view to pay for infrastructure enhancements, corresponding to utilities and roads, for the primary section of development on the almost 160-acre property.

The newly-formed three-member Whiteland Financial Growth Fee unanimously accredited the bond. A public listening to was held earlier than the fee on Tuesday, nevertheless, no member of the general public attended the assembly.

This bond, often called an Financial Growth Income Bond, is a 25-year bond paid for with tax-increment finance, or TIF, funds generated instantly from the Patch Growth land. These bond funds are loaned to Patch Growth, so the debt is within the developer’s palms, not the city’s.

The city additionally earlier accredited carving out the 160-acre Patch Growth land, previously often called the Horseley property, into its personal TIF district. Which means tax revenues generated from the event itself would then return into paying off the $7.25 million bond — versus taking the cash out of the 4 different already present TIFs in Whiteland.

The city is projected to gather greater than sufficient from the TIF to cowl the debt over the 25-year interval, in keeping with Adam Stone, a neighborhood authorities monetary guide who introduced the bond data to the council in August.

The proceeds of the bond might be used to finance the prices of utility enhancements together with electrical, water, fuel and sewer important enhancements, roadway enhancements, together with enhancements to Graham Highway, stormwater enhancements, and “different associated infrastructure enhancements in reference to the financial growth undertaking,” in keeping with city paperwork.

Though the vote from the council was unanimous, some Whiteland officers made clear they weren’t 100% supportive of utilizing an financial growth bond to fund the undertaking.

Council member David Hawkins has both abstained or voted in opposition to this financing methodology from the beginning. He, nevertheless, voted in favor of it on Tuesday as a result of he mentioned he acknowledged it was the desire of the council and the city to maneuver the bond ahead, regardless of his private emotions.

“All people is aware of that I’ve been for the undertaking, however in opposition to the financing,” Hawkins mentioned. “The financing and the undertaking have been accredited by the council, so due to this fact, I’ll attempt to start to encourage the expansion of the city with this in hopes that we prosper and past.”

City Supervisor Jim Lowhorn has additionally spoken in opposition to this financing methodology and needed to tug the undertaking due to it earlier this 12 months.

Although he nonetheless doesn’t agree with the city financing these enhancements with a TIF bond, he does just like the undertaking and thinks it will likely be good for Whiteland.

“It’s nothing that we’ve ever accomplished earlier than. We’ve by no means requested some other developer to do this,” Lowhorn mentioned. “However because it has handed by way of the council, and so they have accredited it, it’s my job to make the perfect of it and to attempt to work with the developer.”

One other massive a part of why the city was keen to enter into this settlement with Patch Growth for this undertaking is as a result of the city plans to construct a brand new public security constructing on the 160-acre Patch property.

The general public security constructing was an enormous sticking level that helped persuade city officers to conform to the bond financing, mentioned Stephen Watson, city lawyer.

The general public security constructing continues to be an idea, and is probably going nonetheless a couple of years out, Lowhorn mentioned. The plan is to construct an area massive sufficient for each the police and hearth departments — that are each in want of larger areas. It will even be funded primarily with TIF cash.

“It’s positively one thing with the enlargement of Whiteland and the brand new development, it’s positively one thing that we want,” Lowhorn mentioned.

He sees the Gateway at Whiteland undertaking total as a transition piece to develop the city, and transfer it ahead.

“For us to go from industrial to gentle industrial to the residences, flex house, these kinds of issues, and retail — these are issues that Whiteland really wants,” Lowhorn mentioned.

Finance

Envestnet to Sell Open Finance Subsidiary Yodlee to STG | PYMNTS.com

Wealth technology provider Envestnet plans to sell its open finance and data analytics subsidiary, Yodlee, to private equity firm STG.

Finance

Wendy Alexander 'was asked to leave' Dundee uni role claim over finance questions

PA

PAFormer MSP Wendy Alexander claims she was asked to leave her senior post at Dundee University after asking “uncomfortable” questions about the institution’s finances, MSPs have been told.

Alexander was the university’s vice principal international for almost a decade but retired last year rather than accept what she said was the offer of a “package and trips.”

She said “cakeism, profligacy and hubris at the very top” led to “a failure to reign in expenditure” and that she “chose not to be bought off”.

She said former principal Prof Iain Gillespie, who was heavily criticised in a recent damning report into the university’s finances, “made clear” he wanted her to leave last October.

University of Dundee

University of DundeeAlexander’s comments were made in a statement submitted to Holyrood’s education committee.

Gillespie resigned with immediate effect in December after telling staff the previous month that job losses were “inevitable”.

He is expected to give evidence in person at the committee on Thursday.

The university currently faces a £35m deficit and has said it must cut 300 jobs through a voluntary redundancy scheme.

The independent report, published last week, said university bosses and its governing body failed multiple times to identify the worsening crisis and continued to overspend instead of taking action.

In her statement, former Labour MSP Alexander said: “I personally, was progressively frozen out of meetings, my objectives changed, data withheld and when I challenged the absence/adequacy of financial information in Sept (20)24, I was then asked to leave.

“I declined the offer of overseas trips at the university’s expense to be followed by a generous settlement payment.

“Quite simply, it seemed unethical and morally wrong.”

Alexander, who now sits as a baroness at the House of Lords, said she felt “punished for speaking out” and that the university “failed to fix the roof when the sun shone”.

She said international fee income had quadrupled over eight years to 2023, but the university was “barely breaking even”.

She said that international income plateaued in 2023/24 and fell the following year.

Alexander said there was a “misguided” shift away from a “laser-like focus on international student recruitment to a new globalisation strategy”.

She added that the university “deprioritised international student recruitment when it mattered most” and left the university “poorly equipped to deal with the downturn”.

The education committee is currently hearing evidence from the university’s former director of finance Peter Fotheringham, former chief operating officer Dr Jim McGeorge, and former chair of court Amanda Millar.

Alexander submitted her evidence rather than appearing in person due to a prior family event abroad.

It was announced on Tuesday that the university will receive an extra £40m from the Scottish government as the institution continues to tackle its financial crisis.

Education Secretary Jenny Gilruth said the decision would place specific conditions on the funding which will be paid over two academic years.

The university received £22m from the Scottish Funding Council in February as part of funding to support universities facing financial challenges.

Finance

Bonn bulletin: Developing nations ask x3 adaptation finance by 2030

Call to triple adaptation finance

At COP26 four years ago, governments agreed to “urge” developed countries to double finance for adapting to climate change up to around $40 billion a year by 2025.

That goal ends this year, although we will not know until 2027 if it has been met. But at a press conference in Bonn this afternoon, the Least Developed Countries group chair Evan Njewa called for a successor goal – tripling adaptation finance by 2030 on 2022 levels. “Adaptation is a lifeline,” he explained.

Other developing countries are likely to back this. Grupo Sur and the Like-Minded Developing countries have made the same call in different negotiating rooms and Njewa said he was sure that the small islands group AOSIS would back it too.

“We’re never going to say no to adaptation finance,” AOSIS finance negotiator Thibyan Ibrahim told Climate Home in Bonn. But he noted that even tripling “does little to close the adaptation finance gap”. The UN estimates that developing countries need $160-340 billion a year by 2030, whereas tripling on 2022 levels would bring in just under $100 billion.

Last year in Baku, developed governments would not agree to having a sub-goal on adaptation in the wider $300-billion-by-2035 finance goal and it’s not currently clear which negotiating track a new adaptation goal could be included in.

The doubling-by-2025 goal was in the COP26 cover decision – a stand-alone declaration all governments agree to – but the COP30 Presidency has said it does not want a cover decision.

It would fit in the Baku to Belem roadmap to $1.3 trillion or the Global Goal on Adaptation. But the roadmap is not an official negotiated UN agreement – so may not be followed up on – and developed-country governments have been resisting financial indicators in the Global Goal on Adaptation.

Meanwhile outside the world of UN climate talks, a recent CARE report showed that adaptation finance is likely to fall by 10% in 2026. France, Germany, the Netherlands and particularly the UK are set to make big cuts between 2025 and 2026.

The US is giving nothing in either 2025 or 2026. Commenting on US climate finance cuts generally, Njewa said he expects “someone somewhere to rise up and fill in the gap that that party has left”.

From Bonn to Nairobi?

Denouncing the visa problems faced by some developing country delegates heading to Bonn, more than 200 climate campaign groups made a joint call yesterday for governments to consider whether Germany should remain the default host for the mid-year climate talks.

Chanting “no borders, no nations, no visa applications”, a dozen campaigners gathered outside the conference centre on Tuesday morning, holding up a banner calling to move the annual talks to “visa-friendly countries”.

With many of those affected by the perennial issue unable to protest themselves, the demonstrators played a voice note from Roaa Alobeid, a young Sudanese climate activist who spoke movingly at COP28 about the war in her country.

She said she had gone to great lengths to get a visa for the Schengen area, which includes Germany, making an appointment, submitting 15 documents – including five letters of support and a bank statement – but was still rejected.

“I’m not there. I will never be there”, she said. “Why? I’m not worth it?” “We shouldn’t be left behind when we are the ones impacted.”

Cameroonian activist Zoneziwoh Mbondgulo-Wondieh did make it, but told the protest her one-year-old daughter had been refused a visa for being too young. She asked why Germany would implicitly tell a nursing mother they must stay at home and not work abroad.

When Climate Home questioned the German foreign office on this issue last year, a spokesperson said it was important to the government that all delegates could attend but there are legal requirements for getting a visa for the EU’s Schengen zone of free movement.

Rachitaa Gupta, head of the Global Campaign to Demand Climate Justice, said it would be better to hold the annual mid-year talks somewhere like Nairobi or Bangkok – where UN facilities already exist and visas are easier to obtain. Holding the meetings in the Global South would also be cheaper, Gupta added.

Climate finance on the rise – mostly for the rich

New figures out today paint a fairly positive picture of global climate finance, showing it climbed to a record $1.9 trillion in 2023, more than tripling over six years.

Climate Policy Initiative (CPI), which compiles the data, said that at the current rate of growth, the world could deliver $6 trillion in annual climate investment – the most conservative estimate of needs – by 2028.

Private-sector funding rose above $1 trillion for the first time in 2023, driven by household spending on electric vehicles, solar and energy-efficient housing – with clean energy in advanced economies and China receiving the bulk of the money.

While this suggests the long-touted need to “shift the trillions” towards green investment is underway, the headline numbers mask the fact that many of the poorest countries are still failing to receive anything like the amounts they need.

The CPI report shows that overall public climate finance fell by about 8% from 2022 to 2023, as government budgets were tight after the COVID-19 pandemic. It also warned that recently announced cuts to official development assistance, in countries such as the US and the UK, raise concern that money from this source could decline further.

International climate finance for emerging markets and developing countries reached $196 billion in 2023, with 78% of that from public sources. Yet while both climate-related development finance and private investment rose, CPI said the least-developed countries still face barriers to accessing affordable capital, and need more financial innovation and support.

In a separate report released on Monday, however, Oil Change International and 17 other NGOs warned that a widely used approach of using government money to lower investment risk and bring in more commercial cash – known as “blended finance” – is falling short of expectations.

The report found that every public dollar of concessional lending is bringing in 4-7 times less private investment than anticipated, leaving the Global South with massive shortfalls of cash for its energy transition. Most money, it said, is going to Global North countries and China, with the remaining 69% of the world’s population receiving just 15% of finance in 2023-2024.

“A just energy transition is dramatically more affordable than continued fossil fuel dependence. But unfortunately affordable doesn’t mean ‘attractive to banks and hedge funds’,” said Bronwen Tucker, global public finance lead at Oil Change. “It is clear from the data that private investors are not fit to lead the way to the fossil free future we need, and that governments must step in.”

Mineral justice for Africa

Efforts to revive the Lobito Corridor trade route in central Africa must prioritise local economic development over raw material exports, researchers at the International Institute for Environment and Development (IIED) said, as campaigners in Bonn call for justice for resource-rich countries and an end to the extractive injustices of the fossil fuel era.

The US and the European Union are providing financial support to Angola, the Democratic Republic of Congo and Zambia to upgrade their infrastructure to aid transport of critical energy transition minerals like cobalt and copper through a rail system which terminates at the port of Lobito on Angola’s Atlantic coast.

In a policy brief issued this week, highlighting the Corridor’s opportunities and challenges for a just transition, the researchers questioned how the project’s development will benefit the wider economies of the countries involved, while protecting social benefits and human rights including being fair to the people whose land it might encroach upon and the artisanal miners who dig up many of the raw materials.

They said the involvement of the EU and the US has raised concerns in participating countries such as Zambia, where a parliamentary committee has said the Lobito Corridor project appears to focus on “mopping up critical raw materials” to respond to the energy security concerns of wealthy nations without adding value to the countries.

Lorenzo Cotula, IIED principal researcher, said if the EU and other prospective funders are interested in a genuine, long-term partnership with Angola, Congo and Zambia, they should support their efforts to promote economic development and improve the lives of their citizens.

“This project shouldn’t just be a means to export more raw materials more quickly to wealthier countries, or another chess piece in the great power game,” Cotula said.

“Millions of people in mineral-rich, lower-income countries are being sidelined in a global rush for materials to power electric cars, computers and even military technologies in richer nations,” he added.

Sharing similar concern, campaigners from Power Shift Africa and the Natural Resource Governance Institute (NRGI) convened a press conference at the ongoing talks in Bonn calling for the need for just minerals in the just transition, because one cannot exist without the other.

Anabella Rosemberg, senior advisor on just transition at Climate Action Network International (CAN-I), said the transition that is happening is not one that is needed for a climate-compatible world because the needs of resource-rich countries are being ignored.

Rosemberg said there is need for international cooperation to overturn the current competition over resources, adding that “we know that investment and trade deals are being arranged to secure the supply of these minerals, and in the end, we are reproducing all the mistakes that have been done in the past with the fossil-based economy”.

Samira Ally, project officer at Power Shift Africa, said Africa’s mineral wealth can accelerate a global shift to net zero when governed by justice and stability with necessary guardrails in place.

To do this, she asked governments to integrate language from the G20 and the UN panel on critical minerals into the climate talks and national climate plans so that they “reference sustainable supply chains and the right to development and industrialisation in the Global South”.

-

Arizona1 week ago

Arizona1 week agoSuspect in Arizona Rangers' death killed by Missouri troopers

-

Business6 days ago

Business6 days agoDriverless disruption: Tech titans gird for robotaxi wars with new factory and territories

-

Education1 week ago

Education1 week agoJudge Delays Ruling on Trump Efforts to Bar Harvard’s International Students

-

Culture1 week ago

Culture1 week agoMatch These Books to Their Movie Versions

-

Business1 week ago

Business1 week agoWilliam Langewiesche, the ‘Steve McQueen of Journalism,’ Dies at 70

-

News1 week ago

News1 week ago‘The Age of Trump’ Enters Its Second Decade

-

News1 week ago

News1 week agoDog shot during Minnesota lawmaker's murder put down days after attack

-

Technology1 week ago

Technology1 week agoReddit will help advertisers turn ‘positive’ posts into ads