Finance

Where are people under the most financial stress? See the list of top 10 American cities

US economy masks credit crisis as debt hits millions

Despite the overall health of the US economy, there are growing concerns as Americans face record-high credit card debt.

unbranded – Newsworthy

Chicago and Houston rank as the cities with the most people in financial distress, according to a new report from the personal finance site WalletHub.

The analysis ranked 100 large cities on several metrics of financial duress, including bankruptcy filings, credit scores and accounts in forbearance over money troubles.

Researchers also tabulated how often people in each city searched the internet for “debt” or “loans,” a measure of financial concern.

“The search index is a good indicator of people who are struggling but maybe haven’t taken action to try to get out of debt just yet,” said Cassandra Happe, a WalletHub analyst.

Chicago, Houston, New York and Los Angeles rank highest for citizens in financial duress

New York and Los Angeles ranked third and fourth on the financial distress list. Boise, Idaho, ranked last − which means that city has the fewest citizens in financial peril.

To control for each city’s size, the ranking emphasized rates of distress over raw numbers.

The report comes at a moment when Americans are spending more, borrowing more and saving less.

Credit card debt, an increasingly perilous form of borrowing, reached a record $1.13 trillion at the end of last year.

The personal savings rate, the share of income that savers sock away, was 3.8% in January, down from about 7% before the COVID-19 pandemic.

People are falling behind in their finances amid a surge in interest rates and consumer prices.

“As inflation kicked in, people spent more,” said Mike Croxson, CEO of the National Foundation for Credit Counseling. “But they didn’t have free cash flow anymore, so a lot of people began using unsecured debt,” borrowing on their credit cards.

Inflation peaked at a 40-year high of 9.1% in summer 2022. Prices continue to creep up.

In an aggressive campaign to tamp down inflation, the Fed raised its key short-term interest rate from near zero to a 22-year high of 5.25% to 5.5% between March 2022 and July 2023.

Inflation and rising interest rates are pinching urban consumers

Inflation is vexing consumers in several cities that sit near the top of the new WalletHub ranking, researchers said.

“The rise in inflation, and just cost of goods in general, has been playing a big role in what we’ve been seeing in the past year or so,” Happe said. “A lot of people have turned to credit cards and loans just to fill that gap.”

Chicago, the city with the most citizens in financial distress, ranked 6th on another recent WalletHub list of cities with the biggest inflation problems. Houston ranked 10th on that list, among 23 metropolitan areas. Houston prices rose 4.5% in the past year, and Chicago prices rose 3.3%, the report said.

Of the 100 cities WalletHub studied, Chicago had the largest increase in the share of citizens with credit accounts in distress, a nearly 30% bump from the fourth quarter of 2022 to the fourth quarter of 2023.

That means a growing number of Chicagoans were allowed to skip payments because of financial difficulty, with their accounts placed in forbearance or deferral.

Chicago also had one of the highest rates of search interest in “debt” and “loans,” a sign that residents are already in debt, seeking to borrow or searching for debt counseling.

“The good news is, people are raising their hand and looking for help,” said Croxson of the National Foundation for Credit Counseling.

Houstonians, too, are spending a lot of time online searching for loans or debt relief. Houston ranked relatively high for its share of residents with accounts in financial distress, more than 8% of the population.

Recession risk? Americans are saving less and spending more.

Which are the top 10 cities for residents in financial trouble?

Here are the other cities ranked in the top 10 by WalletHub for citizens in financial distress:

3. New York. The city tied for first (with Chicago, Houston and Los Angeles) for search interest in “loans” and debt.” New York ranked sixth among large cities for rising bankruptcy filings between 2022 and 2023.

4. Los Angeles. Angelenos are spending a lot of time searching online about debt. The city also ranks poorly on credit scores, meaning many Angelenos have weak or weakening credit.

5. Dallas. The city ranks high for a year-to-year rise in bankruptcy filings and for search interest in debt and loans. In an earlier report, WalletHub ranked Dallas first in the nation for rising inflation.

6. Las Vegas. Sin City ranks high on several measures of consumer distress: weak credit scores, residents with accounts in distress, rising bankruptcy filings and people searching online about debt.

7. San Antonio, Texas. The city ranks high for residents with accounts in distress and for year-to-year rise in bankruptcy filings.

8. Atlanta. The city is tied with Dallas (and other cities) for fifth place in the ranking for frequency of online searches about debt and loans.

9. Riverside, California. Riverside ranks high for online searches about debt.

10. Jacksonville, Florida. Many residents have credit accounts in distress. The city ranks high for internet searches about debt.

Finance

What RBI proposal for tighter project finance rules will mean for REC, PFC?

Seeing the implication of the RBI proposal for tighter project finance rules play out on the likes of an REC and PFC, gives us a sense of the negative implication for such

Anil Gupta: Basically, the regulation which has come out is harmonising the guidelines which were there for banks and NBFCs earlier. For example, today if a project defers its DCCO and that deferment is within a period of two years, the standard asset provisioning norm for a bank is 0.4% and for an NBFC it is 0.25%. Now what this circular is saying is that even if there is a deferment of DCCO within a period of two years, because there have been some deterioration in the project fundamentals, the standard asset provisioning should increase to 5%. So, this 5% provisioning requirement, which is specified with this circular, in our view is applicable only for the projects which are taking a DCCO extension and not for all the projects which are under construction. Now, if this deferment is beyond the two-year period, let us say for an infra project, the earlier guidelines required a provisioning to increase to 5%. The new guidelines which they are proposing says that if the deferment is beyond two years, then additional 2.5% over and above the 5%, which it is currently specifying, will kick in.

Unlock Leadership Excellence with a Range of CXO Courses

| Offering College | Course | Website |

|---|---|---|

| IIM Lucknow | Chief Operations Officer Programme | Visit |

| IIM Lucknow | Chief Executive Officer Programme | Visit |

| Indian School of Business | ISB Chief Technology Officer | Visit |

So, total provisioning requirement for cases or projects which are deferring DCCO by more than two years, will be 7.5%. While this is good from the strengthening of the balance sheets for the banks, because any project, let us say, which is undergoing a DCCO extension has undergone a change in the risk. So, the increased provisioning requirement, even if the DCCO extension is up to two years, is a positive thing and that is a good thing. Another positive which we are seeing in the circular is that as per our understanding, the 5% provisioning which was there in the earlier guidelines for the projects who have taken a DCCO extension beyond two years, now the current guidelines allow that reduction in the provisioning from 5% to 2.5% and to 1% if the project commences the COD and also repays the debt to the extent of 20%. So, that way, it will be positive if the project is able to demonstrate the repayment to the extent of 20% of the debt at the time of DCCO extension, then the lenders will be able to release the provision also from 5% to 1%. So that way, we believe that it is positive for the bank’s riskiness; if there is a DCCO extension, then you increase the provision that will also force the lenders as well as the borrowers to possibly fix up a DCCO which is more realistic and you do not take a leeway in terms of a DCCO extension which is available let us say up to two years without additional provision.

So, you will fix up a more realistic DCCOs, more mindful in terms of setting out a repayment schedule which will align with your cash flows so that you do not have to avail a DCCO extension even though the project is complete but is not generating good enough revenues to service the debt. Overall, it is a good thing from the balance sheet strengthening as well as provision release once the project is operational and repays the debt.

PFC and REC are well capitalised. Do you sense that it may not lead to any damage on their profits and losses because their balance sheet is well capitalised?

Anil Gupta: I will not comment on the stock specific things but in general, it is applicable only for the projects which are availing DCCO extension. So, one, that the DCCO portfolio for the banks will not be very high or the lenders will not be very high; we are not talking about entire under construction portfolio of the lenders, we are talking only on the portfolio which would have availed DCCO extension and we should be mindful of that in the last few years if we leave aside maybe the thermal power or the roads which have been a long gestation projects and are more prone to DCCO extension, the recent expansions have largely been in the renewable energy space or let us say projects which are less prone to maybe DCCO extension.

But lenders and the borrowers have to be mindful of setting up DCCO because in the current set of rules being proposed, DCCO deferment will kick in a higher provisioning requirement.Down the line, could this regulation lead to lower loan growth?

Anil Gupta: No. First given the market reaction, there could be a case where maybe more clarification can emerge as to whether 5% provision requirement is on the entire under-construction portfolio of the lenders because our reading is that it is only for the cases where the project is under construction and has sought a DCCO extension.

So, if that clarification comes, it should not be really negative for the sector because it is only a positive from the balance sheet perspective of the lenders that you are taking care of the risk which has gone up because of DCCO extension. So, per se, if that clarification comes, it should not be any negative for the credit flow for the sector.

Finance

Finance Secretary Marasini seeks international funds for climate action

Finance Secretary Madhu Kumar Marasini has urged the Asian Development Bank and other multilateral development banks to prioritise financing for coordinated, focused, and tangible climate actions that complement current initiatives while maximising infrastructure projects that also contribute positively to climate objectives.

Marasini said Nepal’s focus is on aligning financing with the country’s current projects, improving infrastructure, and addressing climate change in an integrated manner.

“With political stability, Nepal stands at a pivotal juncture in its pursuit of economic growth and prosperity,” he said while addressing the 57th annual meetings of board of governors of the Asian Development Bank held in Tbilisi of Georgia. “The Government of Nepal is dedicated to ensuring good governance, social justice, and economic prosperity.”

He also said that Nepal’s efforts are directed towards achieving sustainable development goals, with equal emphasis on climate action, social inclusion, and economic development.

“To achieve our goals of economic prosperity, graduation from LDC status, and meeting the Sustainable Development Goals, we face a significant funding gap that cannot be filled solely through public finance,” he said. “We need to address this sizeable financing gap by leveraging investments from private capital.”

The finance secretary informed the international community at the event about the third investment summit recently held in Kathmandu. He said the ADB can play a significant role in mobilising technical assistance and knowledge solutions to design attractive investment arrangements in sectors where Nepal has comparative advantage, such as tourism, hydropower, and information technology.

“Considering the huge financing needs and underlying fiscal challenges, I call upon the ADB and other development partners to substantially increase concessional resources,” Secretary Marasini said. “I believe Nepal’s home grown Green Resilient Inclusive Development (GRID) approach provides a partnership platform to all development partners to join hands in delivering development impact in necessary scale and speed.”

He also called for additional efforts for deeper economic integration to establish South Asia as an emerging region. “We now need to focus on enhancing connectivity, innovation, and digitalisation by leveraging our collective strength for the benefit of the entire region,” he added.

Finance

Genpact partners with Microsoft for finance transformation across enterprises – Times of India

This collaboration aims to combine Microsoft Azure OpenAI Service with Genpact’s extensive expertise to propel finance organizations into the future.The goal is to facilitate faster decision-making supported by a robust foundation of data and AI.

Balkrishan “BK” Kalra, President and CEO of Genpact, emphasized the company’s long-standing leadership in finance and accounting services, stating that the collaboration with Microsoft will usher in the next wave of finance transformation.

Nicole Dezen, Chief Partner Officer at Microsoft, highlighted the transformative potential of AI in the finance industry, expressing excitement about partnering with Genpact to empower finance organizations to harness the power of data for business transformation.

Genpact is not only driving transformation for its clients but also modernizing its own finance function through extensive use of Microsoft’s AI tools. By harnessing the power of data, technology, and AI, Genpact has achieved significant improvements across various areas of finance:

- Enhanced vendor management automation with advanced AI algorithms, resulting in 85% accuracy in response and doubled supplier satisfaction.

- Transformed customer collections process with AI-powered analytics and automation, coupled with streamlining of invoice and payment tracking.

- Implemented a large language model-based digital assistant to streamline tax document submissions, leading to a 53% reduction in support tickets and improved employee experience.

This collaboration underscores Genpact’s commitment to AI innovation and its strategy of leveraging data, technology, AI, and strategic partnerships to drive outcomes for shareholders, clients, communities, and talent. For more information on Genpact’s partners and generative AI solutions, visit their website.

-

Politics1 week ago

Politics1 week agoColumbia University’s policy-making senate votes for resolution calling to investigate school’s leadership

-

News1 week ago

News1 week agoBoth sides prepare as Florida's six-week abortion ban is set to take effect Wednesday

-

Politics1 week ago

Politics1 week agoRepublican makes major announcement in push to grow GOP support from once-solid Dem voting bloc

-

News1 week ago

News1 week agoPro-Palestinian campus protesters face looming deadlines and risk of arrest

-

Politics1 week ago

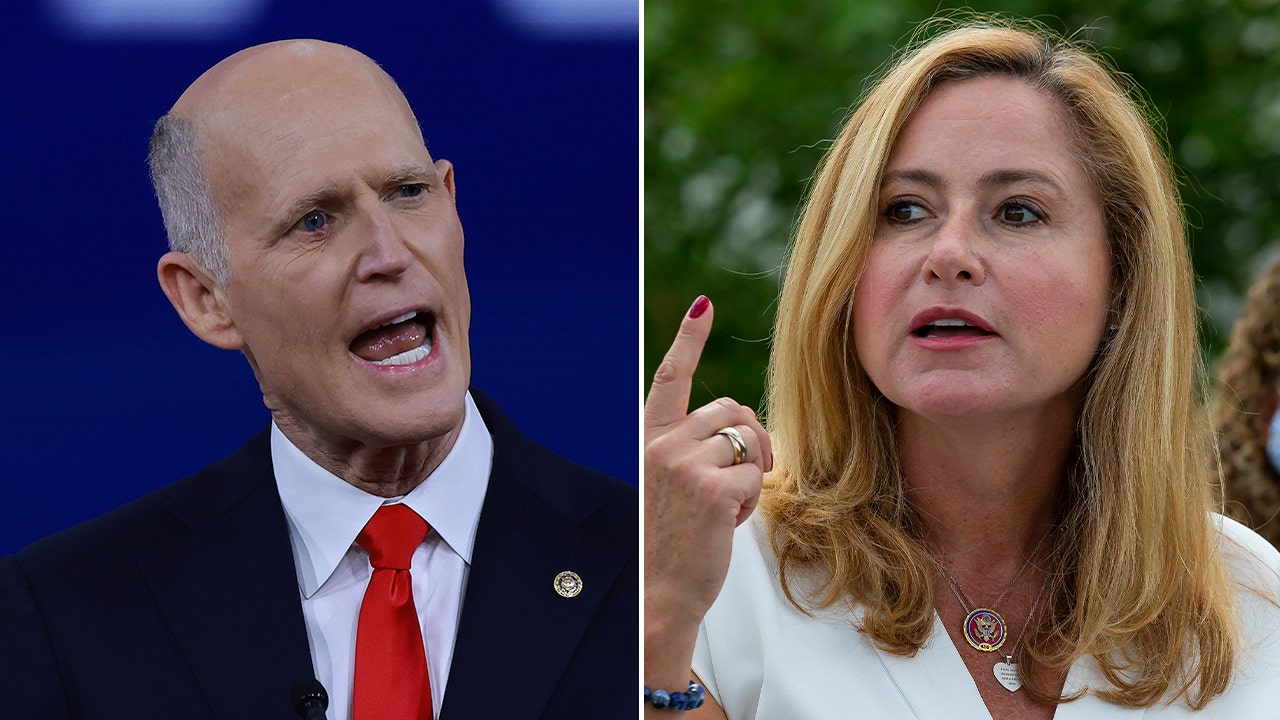

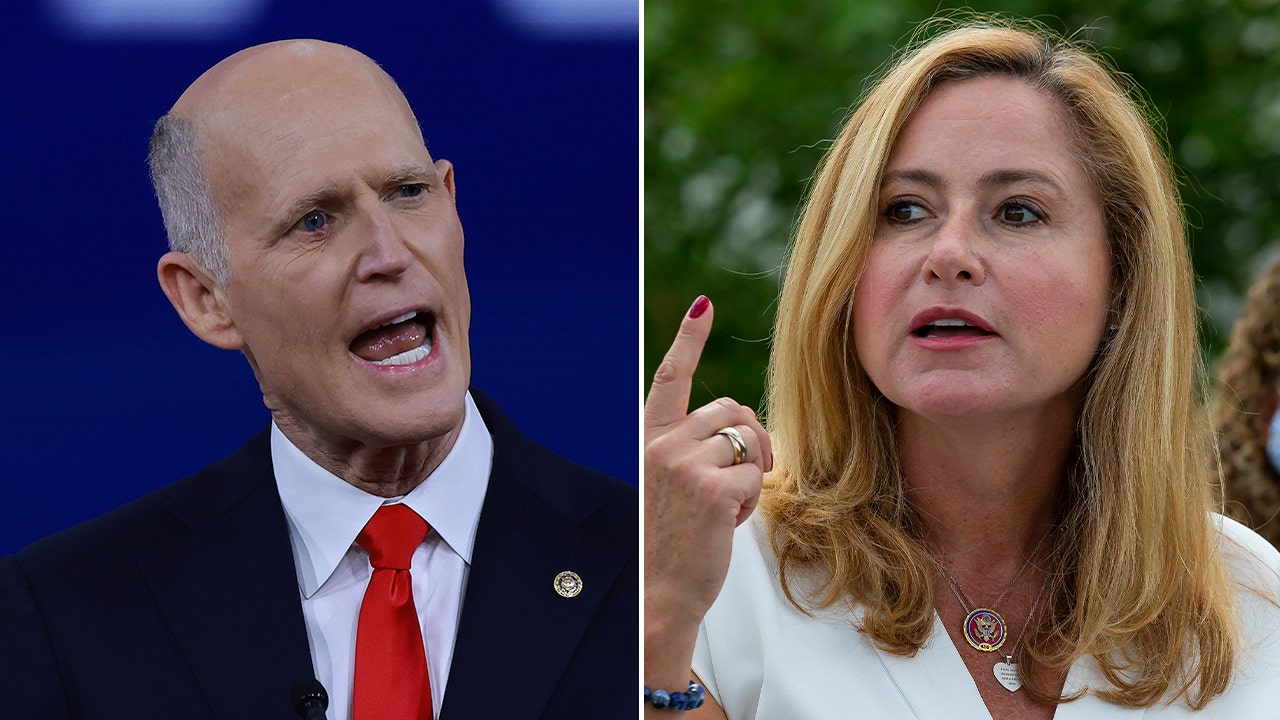

Politics1 week agoGOP Rep. Bill Posey won't seek re-election, endorses former Florida Senate President as replacement

-

World1 week ago

World1 week agoBrussels, my love? MEPs check out of Strasbourg after 5 eventful years

-

Politics1 week ago

Politics1 week agoHouse Republicans brace for spring legislative sprint with one less GOP vote

-

World1 week ago

World1 week agoAt least four dead in US after dozens of tornadoes rip through Oklahoma