Finance

Voya Financial declares common and preferred stock dividends

NEW YORK, January 30, 2025–(BUSINESS WIRE)–Voya Financial, Inc. (NYSE: VOYA) announced today that its board of directors has declared a common stock dividend of $0.45 per share for the first quarter of 2025. The common stock dividend is payable on March 27, 2025, to shareholders of record as of Feb. 25, 2025.

Additionally, Voya’s board declared a semi-annual dividend of $38.79 per share on the company’s Series A 7.758% fixed-rate reset non-cumulative preferred stock (the “Series A Preferred Stock”). The board also declared a quarterly dividend of $13.3750 per share on the company’s Series B 5.35% fixed-rate reset non-cumulative preferred stock (the “Series B Preferred Stock”), equivalent to $0.334375 per depositary share, each of which represents a 1/40th ownership interest in a share of Series B Preferred Stock. The first quarter preferred stock dividends are payable on March 17, 2025, to shareholders of record as of Feb. 25, 2025.

About Voya Financial®

Voya Financial, Inc. (NYSE: VOYA) is a leading health, wealth and investment company with approximately 9,000 employees who are focused on achieving Voya’s aspirational vision: “Clearing your path to financial confidence and a more fulfilling life.” Through products, solutions and technologies, Voya helps its 15.2 million individual, workplace and institutional clients become well planned, well invested and well protected. Benefitfocus, a Voya company and a leading benefits administration provider, extends the reach of Voya’s workplace benefits and savings offerings by engaging directly with over 12 million employees in the U.S. Certified as a “Great Place to Work” by the Great Place to Work® Institute, Voya is purpose-driven and committed to conducting business in a way that is economically, ethically, socially and environmentally responsible. Voya has earned recognition as: one of the World’s Most Ethical Companies® by Ethisphere; a member of the Bloomberg Gender-Equality Index; and a “Best Place to Work for Disability Inclusion” on the Disability Equality Index. For more information, visit voya.com. Follow Voya Financial on Facebook, LinkedIn and Instagram.

VOYA-IR VOYA-CF

View source version on businesswire.com: https://www.businesswire.com/news/home/20250130274359/en/

Contacts

Media Contact:

Donna Sullivan

(860) 580-2980

Donna.Sullivan@voya.com

Investor Contact:

Mei Ni Chu

(212) 309-8999

IR@voya.com

Finance

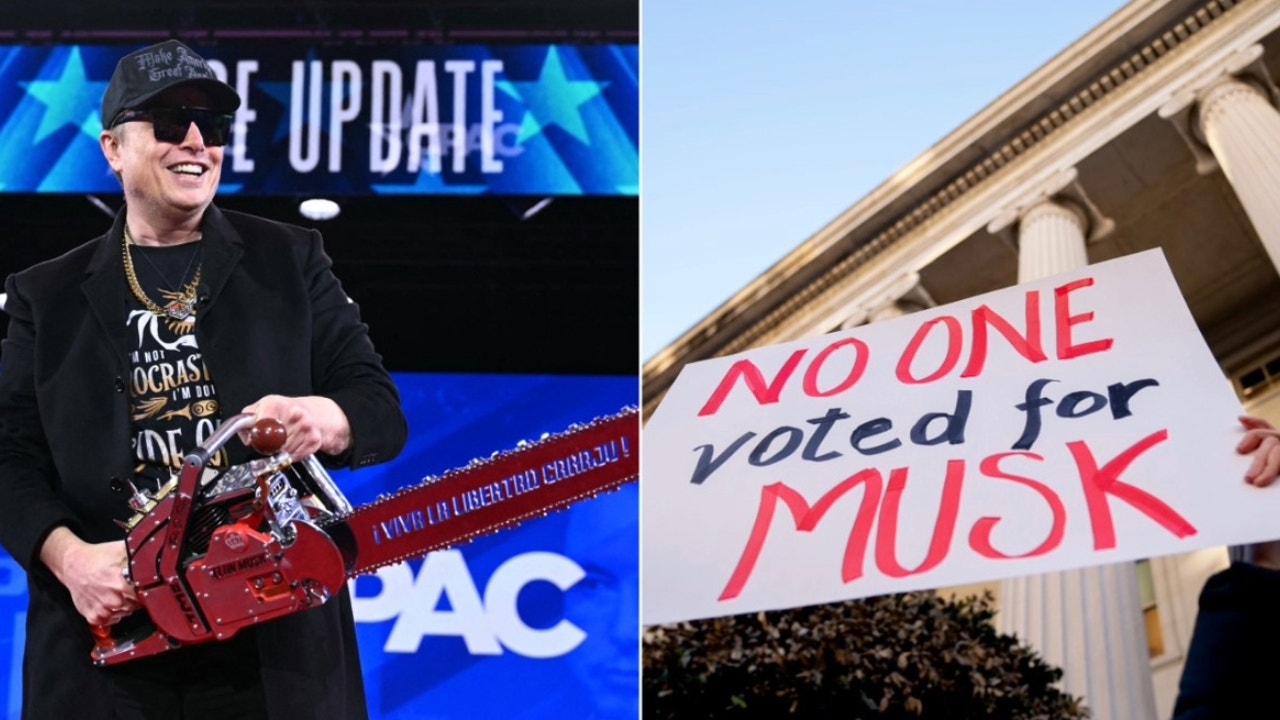

The industry hit hardest by DOGE cuts so far (hint: it’s not the media)

Specific companies are already feeling the effects of cost cutting by Elon Musk’s Department of Government Efficiency (DOGE), with the first wave of publicly available data showing a number of government consultants facing hundreds of millions of dollars in canceled or renegotiated contracts.

They include some prominent names, such as Deloitte. The ended contracts for that multinational London-based firm, DOGE claims, total more than $219 million in savings for taxpayers.

The effect on Deloitte’s bottom line isn’t clear but is a relatively small piece of Deloitte Worldwide’s reported 2024 revenue of $67.2 billion.

Other development and consulting firms — many such smaller businesses dot the Washington area and focus on US government contracts as their main source of revenue — could see much deeper relative cuts.

One recent lawsuit filed by a group of these companies — Global Health Council v. Donald J. Trump — charged that “they have suffered and will continue to suffer enormous and concrete harm to their businesses” because of the administration’s actions.

At least one plaintiff charged that actions by the White House and DOGE have also left open “months of unpaid invoices” for work already done.

An official at one firm told Yahoo Finance that 20 contracts had been terminated in recent weeks and added that “the immediate issue is the federal government’s failure to pay for work it commissioned and approved — that’s fundamentally unfair.”

Another — perhaps more prominent — group of companies also faces cuts but at a vastly smaller scale: media outlets. They are now selling fewer subscriptions to the government for their services after a wave of cancellations.

Those savings add up to a bit more than $13 million in possible lost revenue, a Yahoo Finance analysis found, representing only about 0.18% of the overall claimed DOGE savings so far.

The final impact for all of these companies — and actual savings to taxpayers — remains far from clear as the DOGE team has repeatedly revised its claimed savings downward in recent days in response to errors being pointed out. The exact terms of the contracts also aren’t known.

What is clear is that much of the early focus has been on consulting and development companies such as Deloitte, DAI Global, and International Development Group.

In one example — the largest cut claimed by Musk’s team — the group says taxpayers have been saved $654,990,000 due to ending a contract with International Development Group Advisory Services.

Finance

House tackles finance, sex trafficking curriculum

BISMARCK, N.D. (KUMV) – House lawmakers debated a pair of bills covering school curriculum.

One bill requiring school districts to offer a sex trafficking course was voted down.

House Bill 1569 would have required districts to develop a curriculum explaining sex trafficking while identifying possible signs of individuals being trafficked.

Rep. Liz Conmy, D-Fargo, says while it’s a noble effort, the bill is missing important guidelines when it comes to curriculum.

“In no way do we want to diminish the importance or significance of making students aware of human trafficking, but we felt this bill, unfunded and bypassing curriculum review, was not the best way to do this,” said Conmy.

Lawmakers passed House Bill 1533 unanimously, requiring school districts to offer some sort of financial literacy education, whether that comes through a financial lit class or a problems of democracy class.

Copyright 2025 KFYR. All rights reserved.

Finance

Japan’s Kato Warns That Higher Bond Yields May Strain Finances

(Bloomberg) — Rising government bond yields may strain Japan’s already tight finances, the nation’s finance minister warned, after the 10-year benchmark yield hit its highest level in 15 years.

Most Read from Bloomberg

“An increase in long-term yields means higher interest rates and increased debt-servicing costs,” finance minister Katsunobu Kato told reporters on Friday. “This could put pressure on policy spending, given Japan’s high debt-to-GDP ratio.”

Benchmark 10-year bond yields rose Friday to 1.455%, the highest level since 2009, as traders considered the Bank of Japan’s likely rate hike path. The move came after consumer inflation accelerated more than expected in January.

While most economists expect the central bank to wait until summer before hiking rates again, recent data have raised the risk that the tightening cycle might be faster than previously expected.

Those views in the market intensified this week after stronger-than-expected growth figures for the final quarter of last year and some hawkish remarks by BOJ board member Hajime Takata.

Kato refrained from commenting on the possible causes of the yield increase, noting that multiple factors are likely at play.

BOJ Governor Kazuo Ueda said he didn’t discuss yields with Prime Minister Shigeru Ishiba when the pair met Thursday, in their first regular meeting since October.

Japan’s public debt will be 232.7% of gross domestic product this year, according to a report released earlier this month by the International Monetary Fund.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

-

Education1 week ago

Education1 week agoHow Schools Are Responding to Trump’s D.E.I. Orders

-

Education1 week ago

Education1 week agoCovid Learning Losses

-

News1 week ago

News1 week agoDonald Trump opens the door to Vladimir Putin’s grandest ambitions

-

News1 week ago

News1 week agoImmigration poll shows growing support for restrictions, but deep divisions remain

-

World1 week ago

World1 week agoEU Commission promises 'firm, immediate' reaction to new US tariffs

-

World1 week ago

World1 week agoHamas says three captives to be released amid ceasefire deal collapse fears

-

Politics1 week ago

Politics1 week agoTrump Agriculture pick confirmed as president racks up Cabinet wins

-

Politics1 week ago

Politics1 week agoAbolish property taxes? DeSantis endorses the idea and explains how it could be done in Florida