Finance

The Debt Ceiling: Still An Arcane Financial Fiction Too Useless And Dangerous For These Dumb Times – Above the Law

Anybody who’s been writing lengthy sufficient can look again and discover outdated work that didn’t age nicely. Comes with the territory.

Then again, now and again you get to appear fairly prescient. Which brings me to the debt ceiling piece I wrote virtually two years in the past once we have been dealing with the identical dumb financial disaster we’re dealing with right now.

When you don’t wish to click on again to my outdated column, actually fast right here, the debt ceiling is probably the most the U.S. Treasury can borrow, by greenback worth, by means of bond gross sales. It’s typically additionally referred to as the “debt restrict.” It does probably not have something to do with spending. Quite, elevating the debt restrict means persevering with to pay for obligations the USA has already incurred.

If a lawmaker needs to extend or lower spending per se, the talk over that’s presupposed to occur when Congress passes a finances. The debt ceiling was first created greater than 100 years in the past, and it form of made sense again then, however it definitely doesn’t now, and virtually all different nations get by with none debt ceiling in any respect.

Consider it this manner: the family equal of getting a debt restrict can be getting collectively in a household assembly each few months to vote on whether or not mother and pop hold paying the mortgage or simply cease and see what occurs. On this situation, the youngsters get an equal and binding say. So, let’s hope they don’t outnumber the adults.

Lengthy story brief, the debt ceiling will not be solely pointless, it’s silly. If Congress ever fails to boost it, that can imply the USA will default on its debt, that America will lose its standing because the world’s most reliable financial powerhouse, and that the world economic system will fall right into a tailspin.

Given how necessary it’s for Congress to boost the debt restrict when it’s in peril of being breached, lawmakers have by no means failed at it. It’s been raised dozens and dozens of occasions submit World Conflict II. But, we dwell in significantly dumb occasions.

Now, each time we method the debt ceiling when a Democrat is within the White Home, Republican lawmakers threaten to explode the economic system until their calls for are met. It’s not like horrible individuals in Congress is a brand new phenomenon. Nonetheless, you didn’t have segregationists within the mid-Twentieth century holding up debt restrict will increase with calls for that all of us undertake racism.

It’s probably not a thriller the place the massive drawback with the debt restrict comes from today. Authorities spending elevated heinously below Donald Trump, however you realize what occurred nonetheless when the debt ceiling needed to be raised? Congress voted with a big bipartisan majority to boost it.

Now, nevertheless, Republicans management the Home, and Joe Biden is president. Which means Republicans can as soon as once more put us all in an financial hostage state of affairs of their try and safe ridiculously sweeping spending cuts.

The debt ceiling is a monetary self-destruct button for all the nation. That doesn’t appear to be one thing it’s sensible to place in entrance of individuals like Marjorie Taylor Greene, Lauren Boebert, and Matt Gaetz.

After all, on condition that it not serves any significant objective, the debt restrict might merely be eradicated. This might occur legislatively, wouldn’t have any in poor health results on the economic system, and would permit us to by no means once more have to listen to a couple of debt ceiling showdown in Congress.

For such an eminently smart factor to happen although, first we’d need to dwell in a world the place laws might theoretically move in any respect. Second, we’d need to cease calling it the “debt ceiling” or the “debt restrict.” Sorry, of us, however most voters aren’t going to dig into this any additional than its identify, and on its face it sounds good, proper? Like a restrict to debt? The disingenuous pearl-clutching marketing campaign postcards about so-and-so “VOTING TO ELIMINATE THE DEBT LIMIT” just about write themselves.

There is no such thing as a good purpose for the existence of the debt ceiling. Regardless, it would stay a thorn within the aspect of the U.S. economic system, and one other potential disaster now we have to take care of anew each few months, as long as a Democrat is within the White Home and the trendy Republican Social gathering stays largely unreasonable.

Jonathan Wolf is a civil litigator and writer of Your Debt-Free JD (affiliate hyperlink). He has taught authorized writing, written for all kinds of publications, and made it each his enterprise and his pleasure to be financially and scientifically literate. Any views he expresses are most likely pure gold, however are nonetheless solely his personal and shouldn’t be attributed to any group with which he’s affiliated. He wouldn’t wish to share the credit score anyway. He may be reached at jon_wolf@hotmail.com.

Finance

JSB Financial Inc. Reports Earnings for the Third Quarter and First Nine Months of 2024

SHEPHERDSTOWN, W. Va., November 15, 2024–(BUSINESS WIRE)–JSB Financial Inc. (OTCPink: JFWV) reported net income of $2.0 million for the quarter ended September 30, 2024, representing an increase of $1.3 million when compared to $643 thousand for the quarter ended September 30, 2023. Basic and diluted earnings per common share were $7.64 and $2.33 for the third quarter of 2024 and 2023, respectively. The third quarter results include the recognition of an interest recovery totaling $1.3 million, a recovery to the allowance for credit losses on loans totaling $252 thousand and a recovery of legal fees totaling $17 thousand on prior nonperforming loans. Excluding the impact of these notable items, pre-tax income of $959 thousand for the third quarter of 2024 was $187 thousand more than the same period in 2023.

Net income for the nine months ended September 30, 2024 totaled $3.4 million, representing an increase of $1.1 million when compared to $2.3 million for the same period in 2023. Basic and diluted earnings per common share were $13.33 and $8.46 for the nine months ended September 30, 2024 and 2023, respectively. Annualized return on average assets and average equity for September 30, 2024 was 0.87% and 17.65%, respectively, and 0.66% and 13.17%, respectively, for September 30, 2023. Excluding the impact of the notable items in the third quarter of 2024, pre-tax income of $2.7 million for the nine months ended September 30, 2024 was $96 thousand lower than the same period in 2023.

“We are pleased with our performance for the third quarter, which includes one-time recoveries on nonperforming loans totaling $1.5 million. Additionally, our team continued to create, deepen and expand our customer relationships which resulted in an increase in total deposits of 10% when compared to the second quarter and 17% year-over-year,” said President and Chief Executive Officer, Cindy Kitner. “During the third quarter, we saw stable loan growth, which was funded through loan maturities and deposit growth, and we continue to have strong credit quality metrics including past dues, nonaccruals, charge offs and nonperforming loans, all of which remained at historically low levels.”

Finance

Interested In Manulife Financial’s (TSE:MFC) Upcoming CA$0.40 Dividend? You Have Four Days Left

Regular readers will know that we love our dividends at Simply Wall St, which is why it’s exciting to see Manulife Financial Corporation (TSE:MFC) is about to trade ex-dividend in the next 4 days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company’s books as a shareholder in order to receive the dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Accordingly, Manulife Financial investors that purchase the stock on or after the 20th of November will not receive the dividend, which will be paid on the 19th of December.

The company’s next dividend payment will be CA$0.40 per share. Last year, in total, the company distributed CA$1.60 to shareholders. Looking at the last 12 months of distributions, Manulife Financial has a trailing yield of approximately 3.5% on its current stock price of CA$46.23. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Manulife Financial can afford its dividend, and if the dividend could grow.

View our latest analysis for Manulife Financial

If a company pays out more in dividends than it earned, then the dividend might become unsustainable – hardly an ideal situation. Manulife Financial paid out more than half (55%) of its earnings last year, which is a regular payout ratio for most companies.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see the company’s payout ratio, plus analyst estimates of its future dividends.

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we’re encouraged by the steady growth at Manulife Financial, with earnings per share up 4.5% on average over the last five years.

Another key way to measure a company’s dividend prospects is by measuring its historical rate of dividend growth. In the past 10 years, Manulife Financial has increased its dividend at approximately 12% a year on average. It’s encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

Finance

Solving the Adaptation Finance Gap: Plans are in Place, but Funding Falls Short – Climate 411

The UN climate talks, COP29, is well underway, and countries have entered final negotiations on the New Collective Quantified Goal (NCQG), a new climate finance goal to boost funding for climate action in developing countries. Reaching agreement on the goal may be difficult in the face of the U.S election results, but it remains an urgent priority.

One glaring finance gap that we need to address in the new goal is finance for climate adaptation. Adaptation is how governments and communities prepare for and adjust to the impacts of climate change. It’s about making changes to reduce or prevent the harm caused by climate impacts like rising sea levels, more frequent storms, and hotter temperatures.

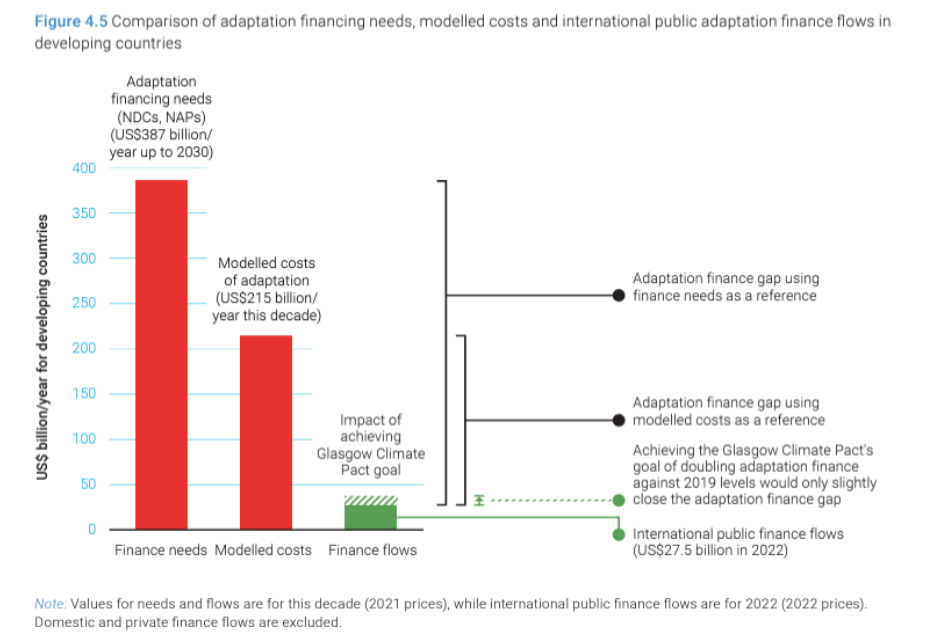

According to a new report from the United Nations Environment Programme (UNEP), adaptation needs are not being met worldwide. Developing countries will need $215 billion per year over the next decade for their adaptation priorities, from building climate resilient infrastructure to restoring ecosystems. Yet international finance flows for adaptation were just $28 billion in 2022 – an increase over prior years, but nowhere near enough.

Transformational adaptation requires closing the finance gap and maximizing the impact of every dollar.

Where is the world falling behind on adaptation?

Many developing countries are particularly vulnerable to climate change impacts, and the good news is that they are prioritizing efforts to build resilience. UNEP’s Adaptation Gap Report found that 87% of countries have at least one national adaptation planning instrument in place, compared to around just 50% a decade ago. These instruments include National Adaptation Plans (NAPs) and other strategies or policies that guide adaptation.

Now time for the bad news: although planning has improved, there is a growing gap in implementation as countries lack the necessary finance to meet their objectives. Adaptation has consistently been underfunded compared to mitigation, and while developed countries are working to double adaptation finance, the current $28 billion in annual flows represents just 13% of the $215 billion needed annually.

[Source: UNEP Adaptation Gap Report 2024]

The lack of finance for adaptation has serious implications for many developing countries, especially small island states which urgently need international support to strengthen resilience. For example, the Caribbean nation of Dominica is installing early warning systems to improve preparedness and reduce the impact of future hurricanes, but by 2023 they had only installed three systems and need 50 more to adequately cover the island. Without sufficient adaptation finance, the country will remain highly exposed to sudden climate shocks.

This finance gap is further complicated by limited private sector engagement in adaptation. UNEP finds that many transformational adaptation projects are seen as risky by private investors, due to their longer time frame for benefits and less clear return on investment. Private finance does flow to projects in infrastructure and commercial agriculture, but often not without efforts by the public sector to de-risk investments.

It is not surprising that two-thirds of adaptation financing needs are anticipated to be financed by the public sector. But the quality of public finance for adaptation has room for improvement as well. 62% of public finance for adaptation is delivered through loans, of which 25% are non-concessional, or at market rate with no favorable terms. And the use of non-concessional loans for adaptation in most vulnerable countries has actually increased in recent years. These tools have the potential to drive up the debt burden in developing nations which are already struggling to pay the bills. Expanding grant and concessional finance will be important to mitigate these challenges.

How do we unlock quality adaptation finance?

The Adaptation Gap Report suggests that filling the finance gap will require several enabling factors that can unlock new finance flows. Notably, in EDF’s new report ‘Quality Matters: Strengthening Climate Finance to Drive Climate Action,’ we identify similar strategies as we call for structural reforms within the international climate finance system. Three key recommendations overlap in both reports.

First, countries need to mainstream their climate objectives and adaptation goals within national planning and budgeting processes. This integration should be paired with robust stakeholder engagement that systematically includes subnational authorities, marginalized groups and potential implementing entities in the planning process. Doing so will better align adaptation activities with other national priorities and create more fundable projects. Moreover, planning processes should emphasize project evaluation and evidence gathering to better understand what interventions are most impactful and maximize the potential of climate resources.

Second, countries should adopt investment planning approaches to climate action. Specifically, they should work to develop a pipeline of bankable projects that can meet the objectives within their NAPs and other planning instruments. This can help attract investors to projects and ensure successful implementation of adaptation plans.

Third, multilateral financial institutions including multilateral development banks (MDBs) and climate funds need to undergo structural reform to improve the quality of finance. The MDBs are currently pursuing reforms to become better fit-for-purpose for addressing the climate crisis, and at COP29 they jointly announced that their collective climate finance will reach $120 billion by 2030 – though only $42 billion will be dedicated for adaptation. Improving the balance between mitigation and adaptation finance will be important to ensure that developing countries’ priorities don’t go unfunded. Additional actions these institutions can take include strengthening the concessionality of terms for adaptation projects to alleviate debt burdens and spark new blended finance opportunities, and leveraging innovative instruments like adaptation swaps which can foster positive adaptation outcomes in exchange for forgiving debt.

The NCQG is an important milestone which has the potential to advance action on these reforms and strengthen adaptation finance flows. Alongside supporting a strong quantitative goal, countries should call for improvements in the quality of finance, to ensure that finance for adaptation projects is available, accessible, concessional, and impactful.

-

Health1 week ago

Health1 week agoLose Weight Without the Gym? Try These Easy Lifestyle Hacks

-

Culture1 week ago

Culture1 week agoThe NFL is heading to Germany – and the country has fallen for American football

-

Business7 days ago

Business7 days agoRef needs glasses? Not anymore. Lasik company offers free procedures for referees

-

Sports1 week ago

Sports1 week agoAll-Free-Agent Team: Closers and corner outfielders aplenty, harder to fill up the middle

-

News4 days ago

News4 days agoHerbert Smith Freehills to merge with US-based law firm Kramer Levin

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25724877/Super_Nintendo_World.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25724877/Super_Nintendo_World.png) Technology5 days ago

Technology5 days agoThe next Nintendo Direct is all about Super Nintendo World’s Donkey Kong Country

-

Business3 days ago

Column: OpenAI just scored a huge victory in a copyright case … or did it?

-

Health3 days ago

Health3 days agoBird flu leaves teen in critical condition after country's first reported case