Finance

The Book The Financial Industry Doesn’t Want You To Read

One of my favorite financial planning clients represents a story that is part success, part sadness. Betty, we’ll call her, married young and became a widow not long after. She never remarried, worked as a legal secretary, and lived in a neighborhood in Baltimore that could only be described as “rough,” where she was robbed multiple times and assaulted once.

She never took a vacation and worked into her 70’s.

She saved more than $3 million dollars, invested very conservatively, and lived off her meager Social Security retirement benefits without dipping into her investment principal.

She died in her 80’s with no heirs, giving a million dollars to three different, worthy, thankful charitable organizations.

Bill Perkins, hedge fund manager and author of the intriguing book, Die With Zero, would suggest Betty got it wrong. And in this particularly stark example, you can probably see why: Betty deferred the utilization of the very resources she worked so hard to save even though they clearly could’ve made her life much easier, if not better.

Die With Zero

But maybe Betty was just charitable, selfless, working hard, and living frugally to help these charities that were near and dear do amazing work. Perkins actually suggests, “You can’t be generous when you’re dead,” once the human element of the act of giving is eliminated.

Indeed, when Perkins implores us to let the last check bounce, he’s not calling for selfish hedonism, nor is he suggesting we should cut the kids out of an inheritance or avoid charitable giving—he just wants us to do most of that giving during life, allowing both the giver and the recipient to benefit more and sooner.

His aim is to help us live more deliberately. “To fully enjoy life instead of just surviving it,” Perkins writes, “you need to stop driving mindlessly and actively steer your life the way you want it to go.”

He encourages us, therefore, to get more out of life by maximizing the number of our positive experiences, introducing us to consider our ROE—Return On Experience—much as we’d consider our ROI—Return On Investment. To optimize our experiences, he recommends “time bucketing.”

For example, if you want to backpack across Europe, staying in hostels for a summer, that is an experience you’re likely to get the most out of when you’re in your 20’s. You don’t have the commitments of mid-life, you have your health and stamina, and because of your ability to maximize the experience to the fullest, it’s likely worth it to wipe out your bank account for the sake of the ROE and the rich “memory dividends” to be reaped.

But what if you’d like to attend all four tennis Grand Slam tournaments in a single year? This might be the perfect memory-creation pursuit to save for later in life, maybe early empty nesthood, when you have the money that it will take to travel to Australia, England, France, and Flushing Meadows, New York. At this stage of life, you don’t require nearly the level of fitness as the on-court participants, but you’re still healthy enough to navigate the trains, planes, and automobiles required for the trip.

Perkins recommends charting out your planned experiences in five-year increments, and he’s even created an online app to help you do it.

But let’s get back to the controversial title and themes. Is Perkins really suggesting that we “Die With Zero”? Well, as close to zero as possible. While acknowledging that there are those of us who truly love our jobs and find inherent meaning and joy in them, he suggests that the primary purpose of our work is to fund our life experiences; therefore, dying with a ton of money represents “life energy” that has effectively been wasted and experiences that could’ve been had that weren’t.

While I’m tempted to say that Perkins is underestimating the inherent value in work and overestimating the value of all other experiences, the point is still well taken, especially considering the quote we’ve all heard: “No one on their deathbed has ever said, ‘I wish I spent more time at the office.’”

But then Perkins takes special aim at two of the sacred cows of personal finance in saving early and “safe” withdrawal rates in retirement.

While we’ve all seen the charts that show the power of compounding investments and, therefore, the benefits of getting started saving and investing early in life, Perkins harkens back to a story when he was lambasted by a superior at work for scrimping and saving when he had virtually no margin making $18,000 a year in his first job.

Yes, Perkins wants us to “start early,” but it is experiences that he wants us to be chasing down in our younger years—especially the experiences that we’ll almost surely never be able to replicate when we’re married with kids or later when we’re retired and aging. Save more when you make more, he’d suggest.

Then, once we have saved up a nest egg, he wants us to spend it down. So, while the financial industry is arguing what a “safe withdrawal rate” is—an amount you can withdraw from your retirement portfolio that will (hopefully) ensure its sustenance—Perkins wants us to deliberately invade the principal of our investments, aiming to get as close to zero as possible, based on a realistic life expectancy, when we leave this earth.

The primary counter he hears from most of his wealthy friends is, “But what about the kids?” Again, Perkins doesn’t want us to forgo giving an inheritance or donating to causes that are important to us—in fact, he believes that everyone benefits more when we give during life.

As a financial planner, I’m tempted to begin responding to some of Perkins suggestions with technical counters—like the tax benefits to be derived from a step-up in the cost basis of capital assets when someone dies. But on a more personal level, I can’t refute any of his logic.

It’s simply true that we grow and protect our savings for the sake of living and giving. Period.

Personal finance gurus, like Dave Ramsey, will hate Perkins’ message because he kills the sacred cow of saving early. The financial industry will hate Die With Zero because it wants to charge fees and commissions on portfolios into perpetuity rather than see them spent down. But there is a great deal of unavoidable truth to this book that is worthy of your consideration, and perhaps your implementation.

Finance

The Container Store files for Chapter 11 bankruptcy

Investors in The Container Store (TCSG) have been sent packing as the struggling home goods chain files for bankruptcy.

The retailer filed for Chapter 11 bankruptcy protection late Sunday, Yahoo Finance learned exclusively. The company said in a press release it is doing this in order to refinance its debt to “bolster its financial position, fuel growth initiatives, and drive enhanced long-term profitability.”

For the quarter-ended Sept. 28, 2024, The Container Store listed total liabilities of $836.4 million against $969 million in total assets.

CEO Satish Malhotra — a former Sephora executive who took over atop The Container Store in 2021 — is confident the maneuver will allow the 46-year old company to stick around.

“The Container Store is here to stay,” Malhotra said in a statement, adding that it is taking these necessary steps in order to advance the business, strengthen customer relationships, expand its reach and bolster its capabilities.

It plans to lean into custom space offerings, “which continue to demonstrate strength,” he said.

The bankruptcy process is expected to last several weeks with the reorganization anticipated to happen within 35 days. The bankruptcy does not include the company’s Elfa home goods business in Sweden.

The business will operate as usual across all stores, online and in-home services. The company operates 102 stores across 34 states.

The company says all customer deposits are safe and protected, and vendors will get paid in full. There are no planned layoffs.

There are also no planned store closures, but that may be a possibility in the future as the company goes through the reorganization process.

Chapter 11 allows companies to “renegotiate the terms of their leases to align their store footprint with market realities and business needs,” sources told Yahoo Finance, adding “if they do not achieve meaningful rent reductions, they may be forced to close a select few locations.”

The filing has been expected by industry experts.

Read more: Why Walmart won the 2024 Yahoo Finance Company of the Year award

The Container Store — a chain founded in 1978 that rose to fame for its nifty home organizational goods in the 1990s — was delisted from the New York Stock Exchange on Dec. 9 after it fell below the exchange’s standard to maintain a market cap of $15 million over 30 consecutive trading days.

The company has seen its profits plunge post the home remodeling frenzy fueled by the COVID-19 pandemic and competition picked up from Walmart (WMT), Amazon (AMZN) and Target (TGT). It has been unprofitable for the past two fiscal years, with losses tallying about $10 million for the fiscal year-ended Sept. 28, 2024.

Finance

Personal finance lessons from Warren Buffett’s latest letter

Last Nov. 25, Warren Buffett announced that he would donate a substantial portion of the shares he owned in Berkshire Hathaway to his four family foundations.

In his announcement, he included a letter which contained some important personal finance lessons that we can apply to our own situation.

One of my favorites is his comment that hugely wealthy parents should only leave their children enough so they can do anything but not enough that they can do nothing.

Despite being one of the richest men in the world, Buffett shared that his children only received $10 million each when his wife died. Although $10 million is a lot of money, it’s less than 1% of his wife’s estate.

I am not hugely wealthy, nor do I have $10 million. However, Buffett’s comment about just giving our children enough made me reflect on the importance of also making our children resilient.

Many of us want to make sure that our children will be financially secure by the time we pass away. While there is nothing wrong with this, sometimes we go overboard in making sure that this goal is met.

Article continues after this advertisement

For example, sometimes my husband and I are guilty of overindulging our children.

Article continues after this advertisement

Warren Buffett’s comment reminded me that we should also allow our children to go through difficulties so that they will become resilient and learn how to survive comfortably with less. Aside from letting them know that they shouldn’t expect much in terms of inheritance, this could mean limiting their allowance, allowing them to commute to school when there is no car available, and saying “no” to their request to buy nice and expensive things like the latest top of the line gadgets.

Another thing that we are guilty of (especially if you are Filipino Chinese like me) is thinking that we need to build a successful business so that our children will eventually have a steady source of income and the bragging rights of being their own boss.

Although there is nothing wrong with building a successful business, passing it on to our children should not be a priority. This is because there’s no guarantee that our children will want to run our business. In fact, they might not be equipped to run the business properly. If that is the case, they may end up running our business to the ground. This would put them in a worse position, especially if they were raised to think that they do not have to worry about money because they have a business that will take care of them.

Another personal finance lesson Warren Buffett shared is the importance of being grateful and learning to give back.

In his comments, Warren Buffett acknowledged the role of luck in making him wealthy—being born in the US as a white male in 1930 and living long enough to enjoy the power compounding.

However, he recognized that not everyone is as lucky as he is. Because of this, Buffett and his family are focused on giving back so that others who were given a very short straw at birth would have a better chance at gaining wealth.

Learning how to be grateful is very important. We cannot be truly happy unless we are grateful for what we have. In fact, many people who are rich are unhappy because they constantly compare themselves to others who have something that they don’t.

Meanwhile, giving back is a natural outcome of being grateful. It is also very fulfilling. For example, in my company COL Financial, we believe that everyone deserves to be rich. This is why we actively educate Filipinos on personal finance and the stock market.

Helping Filipinos better manage their hard-earned money is one of the greatest fulfillments of my career as an analyst. In fact, this is one of the reasons why I have stayed as an analyst despite the availability of other higher paying jobs.

Finally, Warren Buffett shared the importance of learning how to say no.

People who are wealthy will always be approached by friends, family and others seeking help. Although giving back is important, there is a limit as to how much we can give. Because of that, we need to learn how to say no, even if it is difficult or unpleasant.

To make it easier for his children to say no, Buffett’s foundations have a “unanimous decision” provision which states that unless all his three children agree, the foundations cannot distribute funds to grant seekers.

Although most of us are not as rich as Buffett, we can also benefit from having an accountability partner to help us say no to requests for help. That person can be our spouse, our sibling, or someone who shares our values and understands that while we want to be generous, our resources are limited. Our accountability partner can also help us decide who we should or should not help which is also a difficult task.

Warren Buffett ended his letter by saying that his children spend more time directly helping others than he has and are financially comfortable but not preoccupied with wealth. Because of that, his late wife would be proud of them and so is he.

As a parent, I’d be happier to have children who grow up to become productive citizens with good values rather than to have children who become very rich but are dishonest and greedy. INQ

Finance

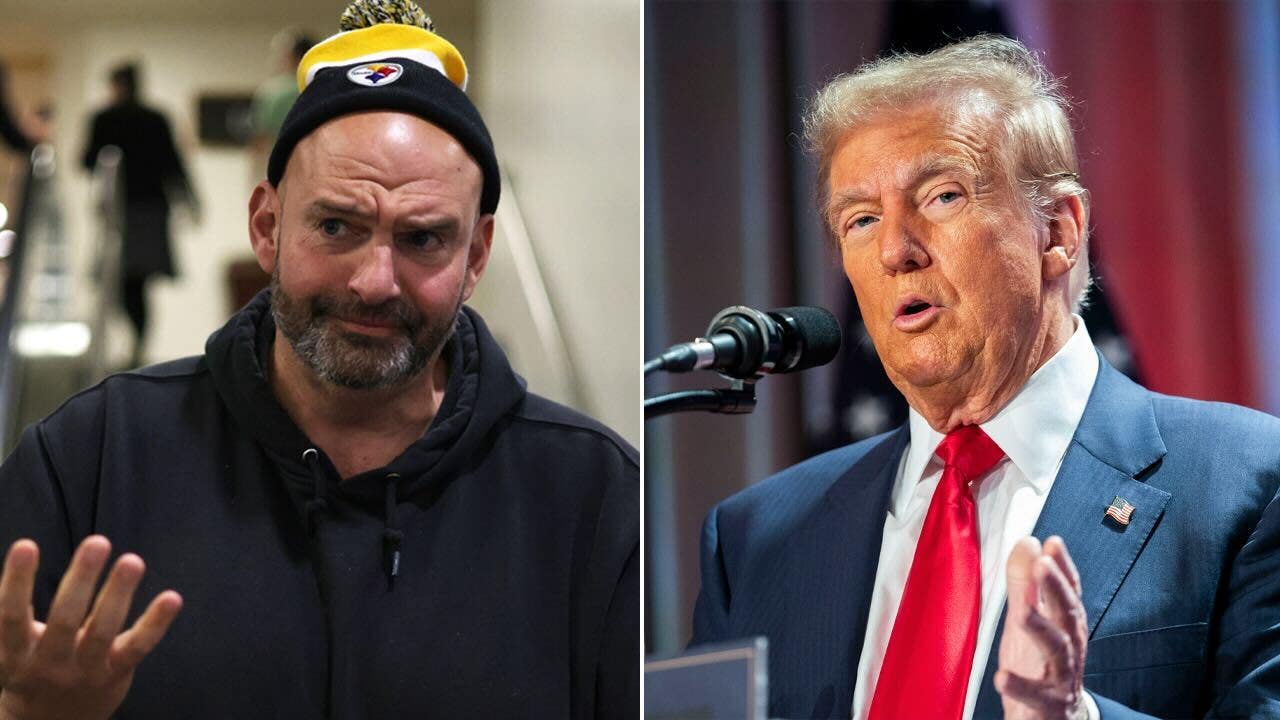

Personal finance guru Dave Ramsey warns over 'mind-blowing' Christmas debt

Personal finance expert Dave Ramsey joined ‘Fox & Friends’ to discuss the Federal Reserve possibly cutting interest rates and how Americans can avoid overspending during the holidays.

Holiday spending is putting a big strain on American wallets and leaving some in debt well past the holiday season; however, personal finance expert Dave Ramsey said ‘mind-blowing’ debt can be avoided.

“The average over the last several years has been that people pay their credit card debt from Christmas into May,” The Ramsey Solutions personality shared during an appearance on “Fox & Friends” on Wednesday. “So it takes them about half the year to come back, and because they don’t plan for Christmas… it sneaks up on them like they move it or something.”

According to a study conducted by Achieve, the average American will spend more than $2,000 for the 2024 holiday season, breaking down the outflow of cash into travel and holiday spending on hosting parties, food, clothing, and other gifts.

STOP OVERSPENDING OVER THE HOLIDAYS AND START THE NEW YEAR OFF FINANCIALLY STRONG

Another recent survey by CouponBirds indicated that parents will spend an average of $461 per child and that 49% of parents will go into debt to pay for this Christmas.

Ramsey Solutions’ Dave Ramsey says “you won’t overspend” if you stick to a Christmas budget. (Getty Images)

The Ramsey Solutions personality balked at the amount of money shelled out for the season while explaining that the holiday should not come as a shock, and that spending for it should be planned out.

“Those numbers are mind-blowing when you look at the averages there. That’s a lot of money going out,” Ramsey added, “all in the name of happiness comes from stuff, and it doesn’t.”

He also weighed in and agreed on advice from fellow expert, Ramsey Solutions personality and daughter Rachel Cruze, who suggested making a list of people to shop for and noting how much to spend on each.

FOX Business’ Lauren Simonetti details the holiday shopping season on ‘Cavuto: Coast to Coast.’

“You know, I’m old, and I met a guy from the North Pole,” the expert joked. “He said ‘make a list and check it twice,’ so Rachel’s right.”

Ramsey followed up by expanding on his daughter’s suggestion: “If you do that, and you put a name beside it, and then you total up those dollar amounts, you have what’s called a Christmas budget.”

“If you stick to that, you won’t overspend,” “The Ramsey Show” host remarked.

National Retail Federation CEO Matt Shay reacts to the latest report that holiday spending is expected to reach $989B this year.

The money guru pointed out what he sees as problematic with the holiday season – not taking a shot at Christmas itself – but referring back to the spending issues.

“The problem with Christmas is not that we enjoy buying gifts for someone else. That’s a wonderful thing,” he reassured. “The problem is we impulse our butts off, and we double up what we spend because the retailers make all their money during this season.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Ramsey concluded by advising shoppers to be wary of retailers and to not be ensnared by their marketing strategies.

“They’re great merchandisers,” he warned. “They’re great at putting stuff in front of us that we hadn’t planned to buy.”

READ MORE FROM FOX BUSINESS

Ramsey Solutions personality Jade Warshaw breaks down the latest economic data that shows consumer credit card debt is piling up amid a jump in spending.

-

Politics1 week ago

Politics1 week agoCanadian premier threatens to cut off energy imports to US if Trump imposes tariff on country

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg) Technology1 week ago

Technology1 week agoOpenAI cofounder Ilya Sutskever says the way AI is built is about to change

-

Politics1 week ago

Politics1 week agoU.S. Supreme Court will decide if oil industry may sue to block California's zero-emissions goal

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg) Technology1 week ago

Technology1 week agoMeta asks the US government to block OpenAI’s switch to a for-profit

-

Business1 week ago

Business1 week agoFreddie Freeman's World Series walk-off grand slam baseball sells at auction for $1.56 million

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg) Technology1 week ago

Technology1 week agoMeta’s Instagram boss: who posted something matters more in the AI age

-

News1 week ago

East’s wintry mix could make travel dicey. And yes, that was a tornado in Calif.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology2 days ago

Technology2 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps