Finance

Sunday Summary: A Record Breaking Year and Roe’s CRE Implications

Properly, no one will ever say this wasn’t a news-heavy week.

The bombshell, after all, was the leaked opinion from the U.S. Supreme Court docket revealing that Justice Samuel Alito had apparently garnered 5 votes to overturn Roe v. Wade.

It was a choice that may upend 5 many years of established regulation, throw ladies’s well being care and ladies’s rights into disaster, and possibly scramble political calculations nationwide.

However one shouldn’t assume that there received’t be actual property ramifications as properly.

Firms have lengthy stored the issues and values of their staff in entrance of thoughts in terms of deciding the place to find. One of many causes New York nonetheless manages to safe premium tenants, regardless of dizzyingly excessive taxes, is as a result of it’s town the place the expertise pool needs to be.

Over the previous few years, states like Florida have tried their darndest to compete by making the incentives higher and higher to lure blue-chip corporations and their staff. However will a tax incentive be sufficient if Florida out of the blue decides to outlaw reproductive freedom?

Cultural questions play an actual and documentable function in tenant actual property choices. North Carolina’s controversial Home Invoice 2, aka the lavatory invoice, apparently eliminated Charlotte from competition when Costar was deciding the place to find its headquarters again in 2016.

The complicating issue is simply how a lot workplace tradition has modified within the final two years. Will distant work make firm HQ and incorporation choices much less essential to a expertise pool if staff stay in a state with reproductive rights? (Whether or not an organization calls for that staff work within the workplace and on a strict schedule is a serious determinant of their private happiness, with distant and hybrid staff reporting a lot higher ranges of job satisfaction.)

Quick reply: Who is aware of? However one shouldn’t count on this problem to die down any time quickly.

In barely much less political information …

For Industrial Observer the large information of the week was undoubtedly the truth that our Energy Finance record dropped.

That is our annual rating of the 50 most essential figures and companies who finance business actual property, and for the primary time a lady – Wells Fargo’s Kara McShane – occupied the highest spot solo. With $84.8 billion in transactions, it wasn’t troublesome to see how McShane reached the highest of the pecking order.

However past No. 1, it’s price a deep dive into all of the names on the record. Given how shaky sectors of the true property panorama really feel, it’s superb to delve into the numbers achieved by the creme de la creme within the final 12 months.

“If it wasn’t a report yr for you,” Starwood’s Jeff DiModica warned, “you must most likely rethink what you’re doing for a residing, as a result of the quantity of transactions was off the charts.”

Finance brokers have been busy throughout nearly all asset lessons, however the two massive winners had been industrial and multifamily.

CO discovered that life insurers had been placing out plenty of {dollars} for this progress spurt, and that almost all financiers have come away from the disaster of the final yr with smarter concepts about learn how to lend in any surroundings. Plus, we unpacked one of many massive business offers of the final yr: Greystone’s $500 million association with Cushman & Wakefield to construct out the latter’s debt platform.

All in all, it makes for an interesting portrait of the world of finance in 2022. Though, it ought to be famous there was a bit of extra chill within the air late final month on the St. Regis at CO’s Finance Discussion board, which included plenty of Energy Finance honorees. Panelists had been a bit of extra sober – perhaps this had one thing to do with the truth that it was on the identical day that authorities figures had been launched exhibiting the U.S. financial system shrank by 1.4 p.c.

In Floridian information …

Sure, there is perhaps backlash and ramifications to the pending Roe choice, however till we all know extra there’s little doubt that South Florida continues to attract a crowd.

The newest tenant is a very eye-catching one, so far as foodies are involved: Jon Shook and Vinny Dotolo, who made their bones in Los Angeles within the final decade or so with loopy nice eating places like Petit Trois, Jon & Vinny’s and the good however (hopefully briefly) departed Animal, have succumbed to Miami Seashore’s charms: They’re opening one other Jon & Vinny’s at Pharrell Williams and David Grutman’s Goodtime Resort. (Hey, Jon and Vinny: You realize that New York continues to be greater than Miami, proper?)

And so they’re not alone: The spa milk + honey, the health studio F45, the eyeglass purveyor Classic Frames and attire retailers Vilebrequin and Vault are all coming to the Goodtime, too. Oh, and so is Binske, the marijuana retailer — which ought to get any prospects in a great state to feast at Jon & Vinny’s.

Stephen Ross definitely isn’t apprehensive about South Florida’s future: The tremendous developer scored $140 million from Wells Fargo for his deliberate 22-story residential constructing, 575 Rosemary. Oh, and talking of foodie issues, Ross additionally locked in a pleasant out-of-tower with identify recognition for among the retail area: Tacombi.

It’s exceptional; retail is a type of fraught matters that plenty of business graybeards fear and postulate about (together with at CO’s retail discussion board late final month). And with good purpose – on Wednesday it was revealed that the three.5 million-square-foot American Dream mall misplaced one other $60 million final yr. (Unhealthy, however chump change compared to its present obligations.) Nevertheless, as the remainder of the nation tries to get rid of retail, South Florida retains throwing more cash on the drawback. Electra America dropped greater than $100 million final week on the Southland Mall, which has been in foreclosures for greater than a yr. They’re planning to modernize and reposition the property.

And final week Miami Seashore metropolis commissioners superior a plan to transform parking heaps close to Lincoln Highway right into a 200,000-plus-square-foot pair of mixed-use workplace towers, which shall be developed by Starwood Property Group and Peebles Corp.

“This can be a very compelling mission,” Miami Seashore Commissioner Ricky Arriola advised CO. “This isn’t one other lodge. This isn’t one other high-rise condominium. That is one thing we don’t have sufficient of in Miami Seashore, which is Class A workplace area.”

Lastly, whereas it’s not in Miami, a three way partnership between Leste Group, The Bascom Group and East Hill Capital Companions secured the acquisition financing for Chatham Sq., a 448-unit multifamily improvement close to Disney World, due to a debt package deal from KKR.

Ecommerce without end!

Keep in mind what we mentioned a couple of paragraphs in the past concerning the significance of ecommerce? Amazon retains proving this case!

Regardless of current poor earnings and a steep sell-off in Amazon inventory final week, the enormous introduced some monster workplace leases in Southern California, taking roughly 439,000 sq. toes of area, which can even imply the creation of two,500 tech and company jobs. (Guess they’re feeling flush figuring out that a few of their staff are shying away from unionization.)

Amazon’s industrial actual property continues to be extraordinarily precious to others; CenterPoint Properties simply paid $170.1 million for a 700,000-square-foot Amazon-leased industrial complicated located on 44 acres in Miramar, Fla.

Certainly, within the coronary heart of Southern California’s Inland Empire traders are definitely seeing the worth round all that valuable industrial property. For instance, Texas-based MAG Capital Companions simply plunked down $23.9 million for Charlmont Village, a 55-unit townhome neighborhood, which works out to about $434,545 per unit — greater than twice the median worth per unit within the space.

Let’s discuss leases

Empire State Realty Belief did about 20,000 sq. toes of leases at 1359 Broadway, inserting tenants reminiscent of Italian retailer Calzedonia, Canadian IT supplier Converge Know-how Options, and inexperienced vitality developer BMR Vitality into the constructing.

At 7 Penn Plaza, Mulligan Safety swiped 9,087 sq. toes.

Giorgetti, the Italian furnishings firm, leased 12,000 sq. toes at 349 Fifth Avenue for its first Atelier Giorgetti Manhattan showroom.

Cadre, the true property funding platform, took 17,050 sq. toes at 315 Park Avenue South in Midtown South.

And the good jeweler, Tiffany & Co., is seemingly chopping greater than diamonds — it’s shedding a few of its workplace area at L&L’s 200 Fifth Avenue, however nonetheless renewed for 10 years on the constructing.

However the massive daddy of the week was HSBC’s 265,000-square-foot lease on the Bjarke Ingles-designed The Spiral in Hudson Yards.

One thing to consider

After all, seeing exercise just like the HSBC lease would make any New York developer breathe a cheerful sigh of aid. However the truth stays that almost all tenants usually are not HSBC, and most buildings usually are not The Spiral.

There nonetheless stays a ton of provide. At CO’s State of CRE occasion final week, Michael Cohen of Colliers (not the opposite Michael Cohen) gave viewers members some robust speak: The emptiness charge for workplace has practically doubled for the reason that pandemic hit. “We’re not going to lease our approach out of this,” Cohen advised the viewers.

Might all that surplus area be … used for youngster care?

Mayor Eric Adams apparently needs to show New York’s empty workplaces into day care facilities.

It’s definitely one thing to consider. (Spoiler alert: There’s no less than one main drawback.) However one can ponder this resolution after one calls one’s mom.

Blissful Mom’s Day!

Finance

Private equity firm will finance Harvard research lab, in possible template for future

A private equity firm has stepped in to finance a biological research lab at Harvard University, administrators said Monday, while also launching a biotech alongside it that will develop new therapies for metabolic conditions.

As Harvard grapples with severe financing cuts undertaken by the Trump administration, some university officials believe the unusual arrangement could be at least one model to fund other academic research in the future.

Under the deal announced Monday, İş Private Equity, a Turkish firm, has committed $39 million to a laboratory run by Gökhan Hotamışlıgil, a professor of genetics and metabolism at the T.H. Chan School of Public Health. The firm, which is a branch of Turkey’s İşbank Group, also plans to invest an undisclosed amount of money in any drug candidates that come out of Hotamışlıgil’s laboratory and are moved into a new biotech called Enlila.

It’s a relatively modest deal, in the scope of investment banking. But the collaboration provides much-needed capital at a time when the model for funding scientific research has been thrown into chaos.

This article is exclusive to STAT+ subscribers

Unlock this article — plus daily coverage and analysis of the biotech sector — by subscribing to STAT+.

Already have an account? Log in

View All Plans

Finance

Kinatico Ltd’s (ASX:KYP) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

Kinatico (ASX:KYP) has had a rough month with its share price down 7.7%. But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. Specifically, we decided to study Kinatico’s ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder’s equity.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10bn in marketcap – there is still time to get in early.

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, based on the above formula, the ROE for Kinatico is:

3.2% = AU$840k ÷ AU$26m (Based on the trailing twelve months to December 2024).

The ‘return’ is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each A$1 of shareholders’ capital it has, the company made A$0.03 in profit.

See our latest analysis for Kinatico

So far, we’ve learned that ROE is a measure of a company’s profitability. We now need to evaluate how much profit the company reinvests or “retains” for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don’t necessarily bear these characteristics.

It is hard to argue that Kinatico’s ROE is much good in and of itself. Not just that, even compared to the industry average of 5.0%, the company’s ROE is entirely unremarkable. Despite this, surprisingly, Kinatico saw an exceptional 44% net income growth over the past five years. We reckon that there could be other factors at play here. Such as – high earnings retention or an efficient management in place.

Next, on comparing with the industry net income growth, we found that Kinatico’s growth is quite high when compared to the industry average growth of 24% in the same period, which is great to see.

Finance

Mutuum Finance Short-Term Price Forecast: Will It Be The Next Crypto To Hit $1?

-

West1 week ago

West1 week agoBattle over Space Command HQ location heats up as lawmakers press new Air Force secretary

-

Technology1 week ago

Technology1 week agoThere are only two commissioners left at the FCC

-

News1 week ago

News1 week agoA former police chief who escaped from an Arkansas prison is captured

-

Technology1 week ago

Technology1 week agoXbox console games are suddenly showing up inside the Xbox PC app

-

World1 week ago

World1 week agoUkraine: Kharkiv hit by massive Russian aerial attack

-

News1 week ago

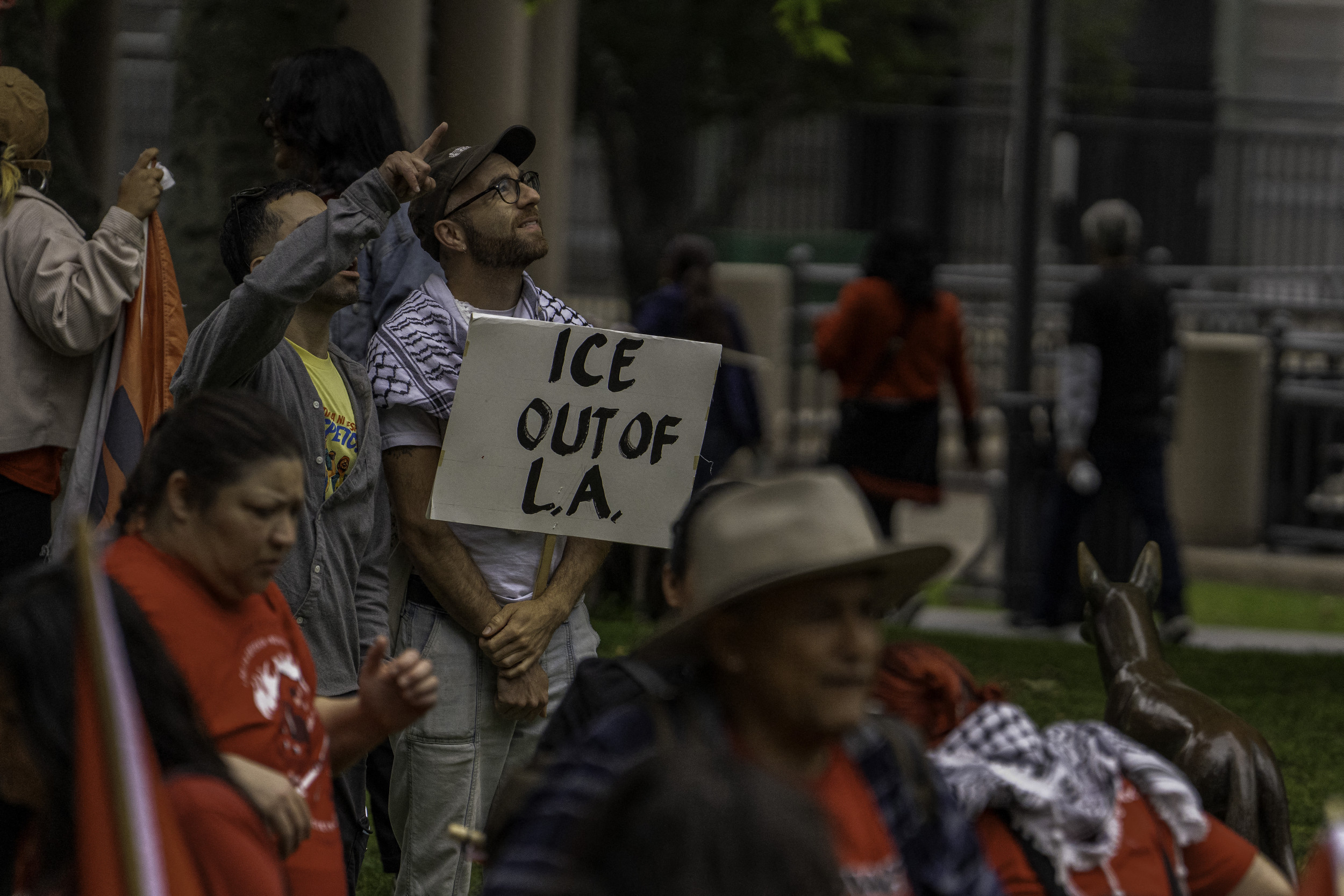

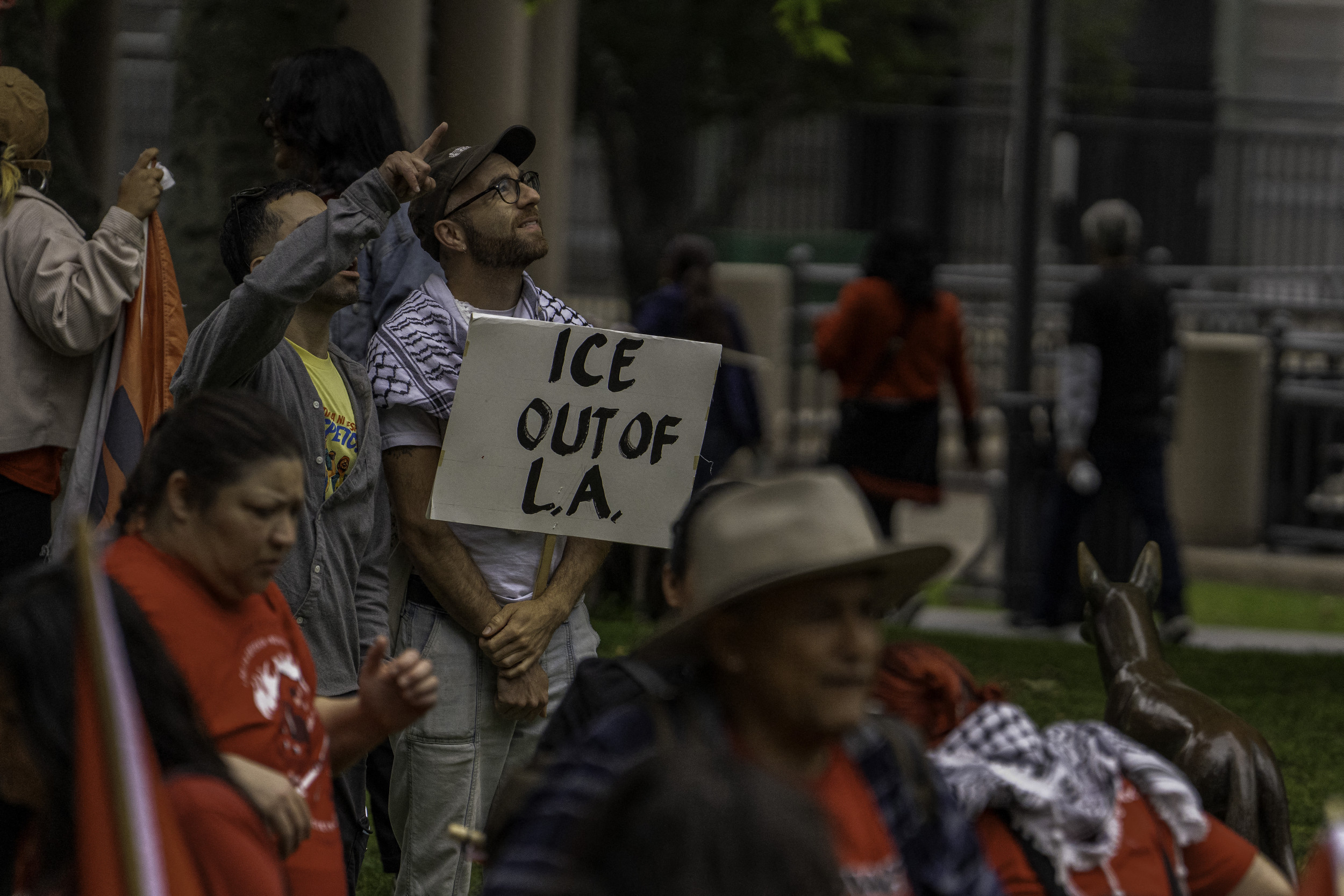

News1 week agoMajor union boss injured, arrested during ICE raids

-

Technology1 week ago

Technology1 week agoMassive DMV phishing scam tricks drivers with fake texts

-

World1 week ago

World1 week agoColombia’s would-be presidential candidate shot at Bogota rally