Finance

Self-Employed Workers Are About To Be The Majority Of The Workforce. What Should They Know About Running Their Own “finance Department”?

Self-Employed Employee

AdobeStock_341566764

Put up pandemic, we’ve seen waves of modifications within the office – from once we work to the place we work with decisions like distant vs. hybrid as figuring out components inside recruiting and retention. We’re additionally seeing a tidal wave of tech layoffs spurring what has been a rising need for a lot of to change into their very own bosses. The inhabitants of solopreneurs and self-employed is hovering throughout quite a lot of industries and can quickly surpass conventional employment to change into the vast majority of the American workforce. Nevertheless, when these newly rising self-employed employees come face-to-face with the occupational hurdles of working their very own companies, some are stymied of their tracks.

Discovered helps this rising inhabitants overcome these boundaries. By way of its platform, particularly designed for the self-employed, it equips customers with an arsenal of instruments to handle their enterprise operations and finally spend much less time worrying concerning the logistics and extra time on their passions and rising their enterprise. I had an opportunity to speak with Discovered’s co-founder and CEO Lauren Myrick about her mission, the state of self-employment at present and what’s subsequent on the horizon.

Gary Drenik: Taking a look at your background, I see a big a part of it consists of broad fintech expertise out of your time at Sq.. Are you able to inform us extra about that have in addition to what the driving pressure was so that you can begin your personal firm centered on the self-employed?

Lauren Myrick: I realized just a few classes at Sq. that impressed me to start out Discovered. First, I noticed the affect of tackling advanced monetary issues head on and utterly reimagining how a system may work to raised serve prospects.

After 4 years in product growth, I grew to become the GM of Sq.’s Payroll enterprise and was reminded of simply how difficult, painful and ubiquitous taxes are for small enterprise homeowners. Connor and I labored collectively for five years at Sq. to simplify payroll taxes for SMBs, and we had been impressed to go additional to see if we may clear up the top to finish monetary administration and overhead burden of self-employed enterprise homeowners. We started speaking to many self-employed enterprise homeowners, relations and pals. Shortly after, we formally began Discovered.

At present, roughly 60 million People are self-employed. Everyone knows how a lot small companies enrich our communities and relationships—and the pandemic bolstered this. But the instruments wanted to empower the self-employed have traditionally been missing. We created Discovered to treatment that hole. We’re constructing a contemporary monetary platform for one of many largest, most underserved segments of the U.S. financial system.

Drenik: What are the commonest challenges of being self-employed?

Myrick: Our analysis exhibits that almost all self-employed individuals cite a need for elevated flexibility as a main driver for changing into self-employed. Nevertheless, the flip aspect of the flexibleness related to being your personal boss is the truth that you’re additionally on the hook for issues that an employer would in any other case assist with. This consists of issues like sourcing your personal prospects, navigating irregular earnings, discovering and paying for healthcare, and needing to be an skilled in all components of your enterprise. This final piece is among the day-to-day challenges the self-employed wrestle with probably the most—particularly on the subject of being their very own “accounting division”—an space most have little or no experience in.

These accounting duties are sometimes issues like holding enterprise and private funds separate, accurately calculating & preemptively saving the right earnings tax, and monitoring finance deadlines, bills, and fines. It’s loads, and the instruments accessible to the self-employed are sometimes costly and disparate. Given the shortage of reasonably priced choices, most choose to attempt their finest at creating their very own system and navigating Excel on their very own—usually leading to a ton of time spent on irritating and complicated again workplace work that’s higher spent constructing and working a enterprise.

Having skilled that ache first hand, I wished to construct a free device that may assist freelancers and contractors maintain monitor of their funds—their funds, invoices, bills, and taxes—multi functional place.

In a market the place 47% of adults within the US are focusing extra on their wants than their needs in keeping with a current survey from Prosper Insights & Analytics, we need to make handing all of the fundamentals as simple as attainable so individuals can concentrate on the opposite issues that matter to them.

Prosper – Life Modifications Final 6 Months

Prosper Insights & Analytics

Drenik: With taxes on the horizon on this nation, what are a few of the most urgent points to your prospects?

Myrick: There are ever-changing tax legal guidelines, difficult by each state and federal politics. Moreover, there are additionally a big swath of recent apps and platforms all of us work together with that change how funds are invoiced, paid and tracked. For instance, hundreds of thousands of freelancers, gig employees, solopreneurs, and contract employees breathed a collective sigh of aid in December 2022 when the Inner Income Service (IRS) delayed the brand new tax reporting requirement for third-party fee platforms like Venmo, Money App, and PayPal – however that was only a non permanent measure till submitting 2023 taxes.

Discovered immediately helps the self-employed save for and pay quarterly taxes. We’re capable of robotically calculate and put aside cash for taxes. We are able to additionally present steerage on what can and can’t be deducted and assist our customers to simply categorize bills and establish write offs.

Drenik: Are there gaps within the present fintech market? How does your providing stand aside?

Myrick: Self-employed individuals have lengthy been underserved by conventional banks. Issues like minimal steadiness necessities, obligatory month-to-month account charges, and punitive overdraft charges can add up and change into prohibitively costly for small companies. They’re additionally usually disconnected from different providers that these prospects want, like expense monitoring and invoicing instruments, requiring many disparate accounts and platforms to maintain monitor of 1’s enterprise. And with clunky, cumbersome tech and a continued reliance on in-branch engagement, conventional banks could be irritating and time-consuming to navigate for small enterprise homeowners brief on time and in search of a streamlined, digital-first answer.

We designed Discovered particularly for sole proprietors and the self-employed. I’d say our fundamental differentiator is our sheer simplicity. We mix bookkeeping, banking, and taxes into one. It additionally helps that we provide a large chunk of our providers – similar to invoicing and tax and bookkeeping options – without cost.

Moreover, our customers can have funds despatched to their Discovered enterprise checking account, which calculates tax withholdings and units the right amount apart eliminating pointless scramble or surprises. Bills paid with the Discovered debit card are robotically categorized, and alternatives for tax deductions are flagged in actual time. Invoices could be despatched and paid throughout the Discovered account so that each one earnings is in a single place and taxes are taken care of. And are available tax time, Discovered will auto-generate time-consuming tax kinds and even submit quarterly tax funds.

Drenik: What developments do you see coming for the self-employed in 2023?

Myrick: First and maybe most significantly, we anticipate to see a continued pattern in the direction of self-employment general. It is a pattern that had began earlier than the pandemic, accelerated throughout the pandemic years, and has been furthered by Gen Z’s embrace of freelancing in contrast with different generations. And now that we’re seeing layoffs and a much less aggressive hiring market, significantly in sectors like know-how {and professional} providers the place we see many self-employed people already, we anticipate much more individuals will flip in the direction of self-employment as a greater monetary choice. Over 50% of Discovered prospects shared they grew to become self-employed to maximise earnings – and we consider the present financial local weather is barely positioned to additional that pattern.

And on the opposite aspect of that coin, a difficult financial surroundings usually results in a slowdown in hiring as firms look to tighten their belts. In response to a current survey by Prosper Insights & Analytics, solely about 35% of adults within the US are assured about at present’s financial system. Which means that employers could also be seeking to freelancers as a method of supplementing assets with out the monetary dedication of full-time staff, opening up extra alternatives for self-employed freelancers and contractors.

Prosper – Shopper Confidence

Prosper Insights & Analytics

One more reason we anticipate to see continued progress in self-employment: the emergence of influencers and creators. Whereas not fully new, their capacity to monetize is barely growing. Influencers and creators have change into an more and more common advertising choice for a lot of manufacturers – and these people are ceaselessly self-employed or use their platforms to generate “side-hustle” income. It will likely be essential for us to consider the enterprise wants this group has as we proceed into 2023.

Lastly, we’re additionally seeing many self-employed people beginning to add a number of ‘enterprise strains’ or income streams to their e-book of enterprise, with a need to trace these companies individually as nicely. These are people who’re discovering success in self-employment and doubling down or increasing their enterprise — and they’re going to want their instruments to develop with them as nicely.

Drenik: Thanks for diving in right here, Lauren. We’re excited to see how Discovered will proceed to help the accomplishments of impartial enterprise homeowners shifting ahead.

Finance

Kinatico Ltd’s (ASX:KYP) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

Kinatico (ASX:KYP) has had a rough month with its share price down 7.7%. But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. Specifically, we decided to study Kinatico’s ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder’s equity.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10bn in marketcap – there is still time to get in early.

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, based on the above formula, the ROE for Kinatico is:

3.2% = AU$840k ÷ AU$26m (Based on the trailing twelve months to December 2024).

The ‘return’ is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each A$1 of shareholders’ capital it has, the company made A$0.03 in profit.

See our latest analysis for Kinatico

So far, we’ve learned that ROE is a measure of a company’s profitability. We now need to evaluate how much profit the company reinvests or “retains” for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don’t necessarily bear these characteristics.

It is hard to argue that Kinatico’s ROE is much good in and of itself. Not just that, even compared to the industry average of 5.0%, the company’s ROE is entirely unremarkable. Despite this, surprisingly, Kinatico saw an exceptional 44% net income growth over the past five years. We reckon that there could be other factors at play here. Such as – high earnings retention or an efficient management in place.

Next, on comparing with the industry net income growth, we found that Kinatico’s growth is quite high when compared to the industry average growth of 24% in the same period, which is great to see.

Finance

Mutuum Finance Short-Term Price Forecast: Will It Be The Next Crypto To Hit $1?

Finance

The Best $100 Gen Z Can Spend on Retirement Planning

Gen Z may be decades away from retirement, but the steps they take today can significantly impact their future financial freedom.

Learn More: The Money You Need To Save Monthly To Retire Comfortably in Every State

Read Next: The New Retirement Problem Boomers Are Facing

With time on their side, small, smart investments can now compound into significant returns later. Whether it’s spending $100 on a one-time financial consult, a subscription to a savvy budgeting app or even investing in a starter index fund, the key is starting early and wisely.

Here’s the best $100 Gen Z can spend on retirement planning.

Budgeting apps and robo-advisors can turn passive habits into active wealth-building strategies. For Gen Z, investing a small fee in the right tool can lead to consistent savings, long-term growth and financial stability.

“Paid tools can be worthwhile when they nudge you into better habits or automate tasks you’d otherwise skip,” said Lily Vittayarukskul, CEO and co-founder of Waterlily.

Advertisement: High Yield Savings Offers

Powered by Money.com – Yahoo may earn commission from the links above.

Vittayarukskul said budgeting apps like YNAB come with a small subscription cost, but can help users become more deliberate with their spending. Meanwhile, robo-advisors like Betterment and Wealthfront offer automated investing services for a low annual fee. This approach appeals to around 40% of Gen Z investors who prefer a hands-off approach.

“The price tag is usually minor compared to the value of disciplined saving and diversified investing they facilitate,” Vittayarukskul said. “I personally use Copilot, and I like that the finally added savings goals last month, but I think that most of the options out there have become very comprehensive and user friendly.”

She added, “Just make sure any app you pay for truly gets you to invest and track your spending in a way that is compounding your wealth and taking care of any high interest debts.”

I’m a Financial Expert: This Is the No. 1 Mistake Americans Make With Their 401(k)

Gen Z can skip the hype and spend $100 opening an account with a reputable brokerage that offers diversified, long-term investment options.

“The biggest mistakes I see younger adults making when trying to get ahead financially are listening to the wrong people and chasing outsized returns,” said Tyler End, a certified financial planner and CEO of Retirable.

Starting with a solid, low-cost platform keeps new investors focused on sustainable growth without the distractions of viral trends or high-risk bets. Some examples include:

-

Fidelity: No minimum investment for many accounts, zero-commission trades and strong educational tools. Offers Roth IRAs and index funds with no expense ratio.

-

Vanguard: Known for low-cost index funds and long-term investing. Best suited for those who prefer a simple, set-it-and-forget-it approach.

-

Charles Schwab: $0 account minimums, a wide range of low-fee ETFs and mutual funds, and solid customer support.

-

West1 week ago

West1 week agoBattle over Space Command HQ location heats up as lawmakers press new Air Force secretary

-

Technology1 week ago

Technology1 week agoiFixit says the Switch 2 is even harder to repair than the original

-

Politics1 week ago

Politics1 week agoA History of Trump and Elon Musk's Relationship in their Own Words

-

Technology1 week ago

Technology1 week agoThere are only two commissioners left at the FCC

-

News1 week ago

News1 week agoA former police chief who escaped from an Arkansas prison is captured

-

World1 week ago

World1 week agoUkraine: Kharkiv hit by massive Russian aerial attack

-

News1 week ago

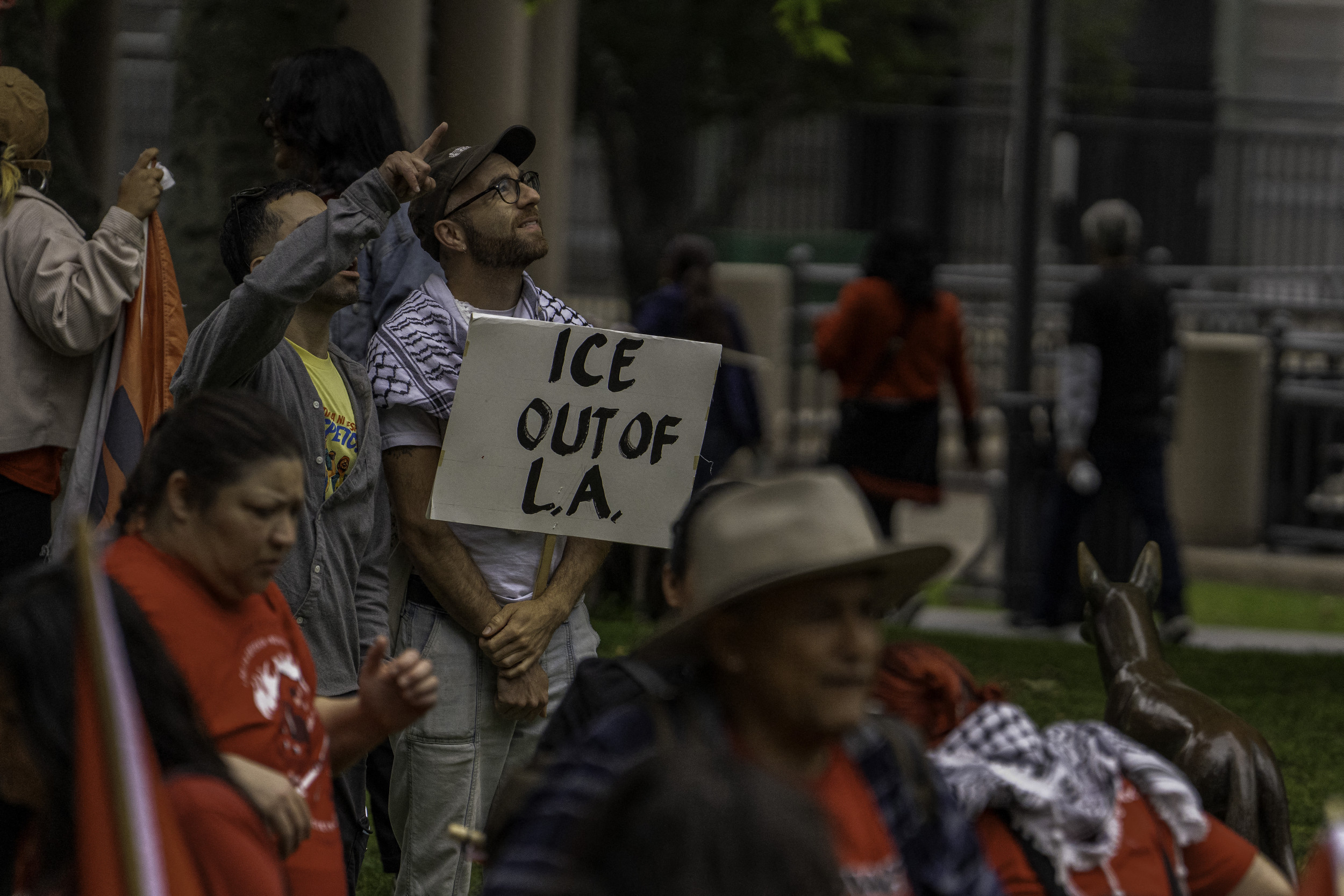

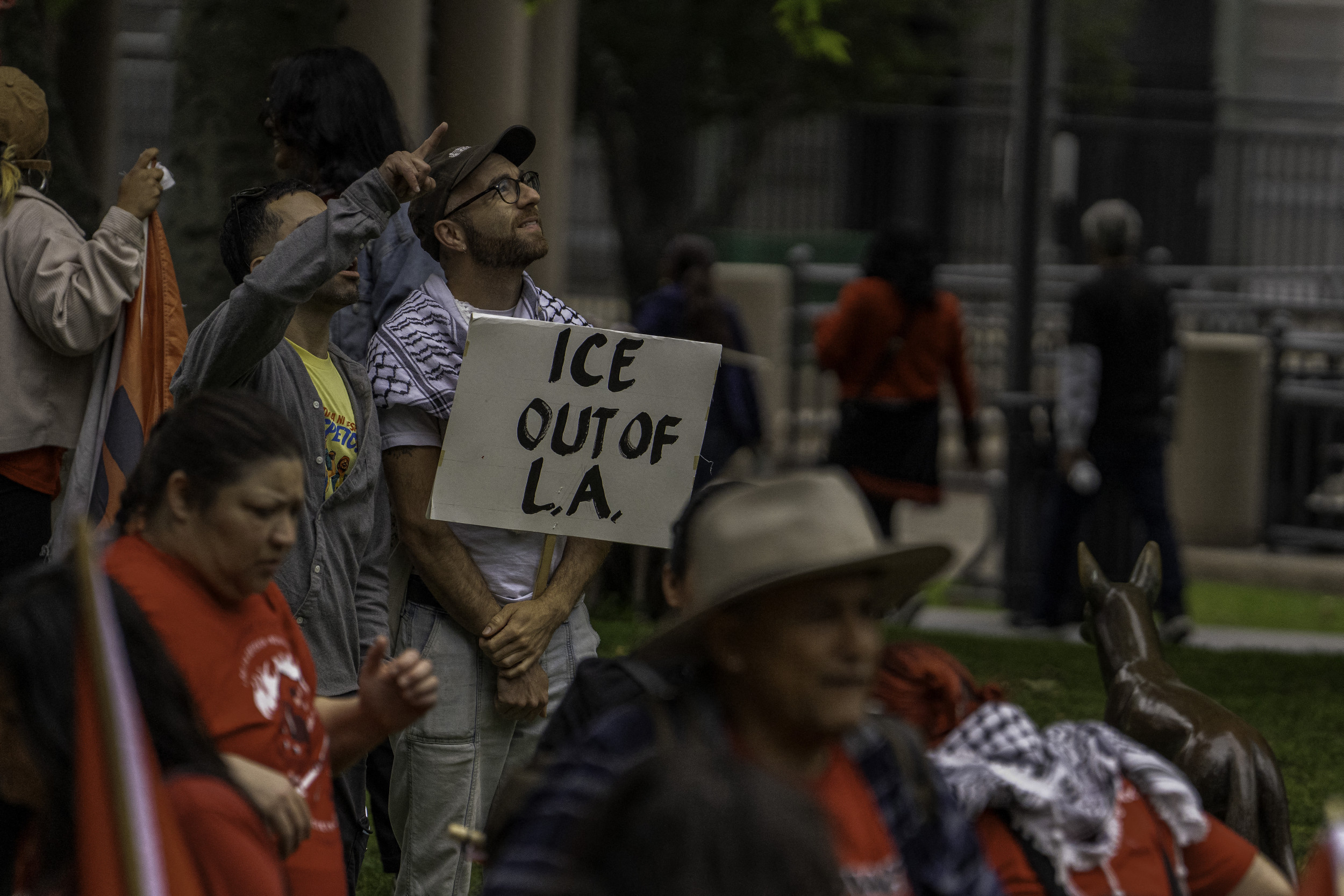

News1 week agoMajor union boss injured, arrested during ICE raids

-

World1 week ago

World1 week agoColombia’s would-be presidential candidate shot at Bogota rally