Finance

Josh Harris to meet with NFL finance committee for Commanders sale

Josh Harris is making some moves to secure his bid to buy the Washington Commanders.

In May, Dan and Tanya Snyder reached an agreement to sell the team to Philadelphia 76ers and New Jersey Devils managing partner Josh Harris for a record $6.05 billion.

Now, as the deal comes into view, Harris — a Maryland native — is set to meet with the league’s finance committee, and he will make any adjustments necessary to get the deal done, sources told the Washington Post.

While the deal is not a foregone conclusion, the newspaper reported that it is getting closer toward the endgame.

“It’s not done yet,” a source told the Washington Post. “It’s not concluded. But it’s headed in that direction. It’s in that 90-percent-plus range now.”

The deal surpasses the purchase of the Denver Broncos for $4.55 billion as the largest North American professional sports franchise sale.

Three-quarters of the 31 owners will need to approve of the sale during a vote that is expected to come later in 2023.

The transaction will include Maryland-based FedEx Field, home to the Commanders since 1997, and the team practice facility in Virginia.

According to the Washington Post, the NFL’s finance committee has issues with the structure of the agreement and that it could be beyond the $1.1 billion debt limit on team purchases.

“It’s not definitely done,” a source told the Washington Post. “But now there’s every reason to believe it will get done. Josh Harris has made the personal commitment to getting it done.”

The group that would be acquiring the club includes Magic Johnson, who is part of groups that bought the Los Angeles Dodgers and WNBA’s Sparks.

“I could not be more excited to be a partner in the proposed new ownership group for the Washington Commanders,” the NBA legend wrote after the agreement.

“Josh Harris has assembled an amazing group who share a commitment to not only doing great things on the field but to making a real impact in the DMV community.”

If Harris and his group get to take over the franchise, they might have to deal with another name change.

On May 18, the Commanders’ trademark application was denied by the US Patent and Trademark Office, a trademark attorney tweeted, because the phrase “Commanders’ Classic” had already been trademarked.

Washington had changed its team name in February 2022 from Washington Football Team after years of controversy surrounding their previous name.

Finance

‘Money pervades everything’: the psychotherapist delving into our deep anxiety about finances

I am a generous tipper. I’ve always thought, to the extent that I have thought about it at all, that this is a positive trait. Recently, however, I’ve begun to wonder. Is it normal to feel a deep sense of anxiety after ordering a takeaway pizza, then realising there is no change in the house? Does everyone spend their spare time searching Google to find out if one should tip the Waitrose delivery driver – or whether to do so might cause offence? Are hotel stays meant to be such a stressful experience, requiring constant calculations to determine the appropriate amount of cash to reward every personal interaction?

These are the kinds of questions that arise while I’m reading Money on Your Mind: The Psychology Behind Your Financial Habits. Written by Vicky Reynal, Britain’s first self-styled “financial psychotherapist”, the book outlines a wide range of unhelpful financial behaviours, offering something that will resonate with almost every reader, and makes a convincing case that these are rooted in our emotions – driven by fears and desires – and influenced by past experiences. Perhaps we struggle to spend money on ourselves or others. What do we fear might happen if we do? Some of us are incapable of budgeting. What do we gain from our overspending? We may see our colleagues rewarded with salary increases while we languish on the same pay grade. Why do we struggle to ask for a raise? Are we battling with doubts about our self-worth?

I’m fascinated by what my own financial choices might reveal about my psyche. So, when I go to meet Reynal at her consulting space in Vauxhall, London, I take the opportunity to ask her. Reynal greets me in the manner one would expect from someone who deals with money matters: with a firm handshake and a businesslike demeanour. Smartly dressed in black trousers and shirt under a monochrome patterned blazer, she would not look out of place in any boardroom in the City. After we take our seats, she encourages me to think more deeply about my behaviour. What is behind my compulsion to express gratitude for small acts of service? What do I fear might happen if I don’t? “Is it about wanting to be liked by the other, or wanting the other to think positively of you, even if it is just for a few minutes?” she asks. “I guess the question that pops into my mind would be: is there a part of you that expects people to be critical, so you choose to appease them upfront to avoid that feeling?” I have to admit, this sounds like a definite possibility.

Ten years ago, Reynal started practising psychotherapy and began to notice how often clients’ problems were linked to finances. We tend to think of money in terms of cold hard numbers: the size of our bank balance, the interest rate on our savings account or credit card debt, the number of years it will take to save a house deposit. We believe our financial decisions to be rooted in rationality. Having worked with enough clients for whom money was the source of emotional distress, Reynal sees things differently. Five years ago, she began describing herself as a financial psychotherapist, helping people explore their money troubles as a formal part of her practice.

In the book, Reynal cites a series of statistics to illustrate how money is causing us all kinds of problems. One UK poll found that 32% of us find it stressful talking about our finances with family and friends. Another found a third of couples had argued about money. People with substantial debt are reportedly more likely to suffer from ulcers and migraines, and six times more likely to experience anxiety and depression. Clearly, an absence of money can have a serious impact on the quality of our relationships and our health. But Reynal sees money troubles among the wealthy, too. “If anything, they feel guiltier about their unhappiness, because there is this conception that money should buy happiness,” she says. “And so, if you’re unhappy despite having a lot of wealth, it brings up a lot of shame and guilt.”

Reynal remembers a conversation in her consulting room that drove this point home. A client came to her with what he described as a “£2m problem”. Reynal assumed the man had somehow run up a huge debt. In fact, it emerged he had been granted an unexpected windfall. “They were completely distraught over it,” she recalls, “and who could they tell that to, hoping to find empathy and understanding and to really help them unpick what’s behind that? There was this real fear of people’s envy, how it would spoil the children, how it would ruin his marriage trying to decide what to spend all this money on. It was a person in distress, even if some people might find it difficult to empathise with that.”

Listening to this story, I do find it a little hard to empathise. I don’t doubt that to this particular client this was a very real problem. On the other hand, to many people struggling through a cost of living crisis, a £2m problem will not sound like much of a problem at all. Reynal’s case is that, while money can cause us real problems, for some, the way we feel about money can be just as challenging. And aren’t all money problems relative? No doubt my own money anxieties would cause some eyes to roll. But by focusing so intently on our individual relationship with money, I wonder if we risk ignoring the factors that create inequality and leave so many people facing financial hardship. “Well, they definitely relate, because what is going on at a macro scale often affects the individual,” says Reynal. “But ultimately, all we can do is manage our own experience of what is going on out there in the world.”

Reynal believes financial literacy can only take us so far. “I do make the point in the book that we have to teach children about money, because it’s not an innate skill. A lot of books out there tell people how they should behave with money and what they should do with money. But, for many, something gets in the way of being the way they want to be with money. So they end up overspending, or being overly greedy, or keeping financial secrets from their partners. And what I tried to do in this book is go to the roots of what experiences, what feelings, what longings, sit behind our money behaviours. It’s only by understanding these that we stand the chance of changing them.”

It won’t surprise you to learn that the process often involves looking back to childhood. Here, Reynal’s own story is illuminating. She is cagey about revealing certain personal details, in case that affects the way clients relate to her in her practice. (When I ask about her accent, she declines to say where it’s from, explaining that clients’ assumptions about her background can often be revealing.) She is happy, however, to reveal certain biographical information. After completing a psychotherapy degree, she studied for an MBA at the London Business School. Why the MBA? “Family pressures?” she laughs. “I think that in itself says a lot about the meaning of money in my family.”

Reynal learned early in life how money can cause heartbreak. “My father had two very difficult experiences with money that involved loss, betrayal and deceit,” she says. “The consequences of that – both financial and emotional – affected the whole family negatively.” Through therapy, she explored the meaning of those experiences, which she now describes as “financial trauma”, and their broader ramifications. “Unpacking all the different aspects of that was important to move on from it and to make different choices.” She felt drawn to the idea that she could help others do the same.

Still, for some time, Reynal felt torn between her passion for psychology and the expectation that she go into business – to forge a career in the world of money. Gradually, she began to wonder if the two paths needed to be distinct. She was fascinated by the aspects of her MBA studies that touched on psychology, such as behavioural finance. Fittingly, it was a piece of advice from one of the world’s richest men that encouraged Reynal to combine her two interests. As part of her MBA studies, she was invited to Nebraska to meet the legendary investor Warren Buffett. She asked him how to make such a pivotal decision as how to spend one’s professional life. His message? “Follow your passion, because only by doing something you love, can you ever be good at it.”

after newsletter promotion

Buffett’s advice stuck. After spending some time in the corporate world, Reynal returned to study psychotherapy at postgraduate level. Just as she had been struck by the psychological aspects of finance, she observed how discussions about money were largely absent in therapeutic circles. “If you look at the psychoanalytic literature, there’s thousands of papers written about the relationship with sex, with food, with other objects,” she says. “And so little written about money.” Reynal saw a way to bridge a gap between her two passions – and also, perhaps, to meet both her family’s expectations and her own.

Sometimes, we need to hear advice in terms we’re primed to understand. In the face of family pressure, it took some words of encouragement from Warren Buffett for Reynal to act in her own interests. Intriguingly, she saw something similar happening when she started calling herself a financial psychotherapist, attracting clients who finally had permission to seek help. “More men started coming,” she says. “I think you can interpret that in a number of ways. But I think, especially for some of the older men I saw, who might have grown up in a generation that wasn’t open-minded to psychotherapy, calling it financial psychotherapy might have enabled them to access it with less shame than if they were just going to a psychotherapist.”

The behaviour Reynal hears about in the consulting room and which she describes in Money on Your Mind, ranges from the mundane to the extreme. Some people engage in unsustainable shopping habits, others steal from their employers or blow their life savings engaging in “findom” (financial domination), a sexual kink in which the participant derives pleasure from giving money for nothing tangible in return. On the spectrum of money troubles, I feel reassured that my anxiety around tipping must fall at the less troubling end of the scale. Nevertheless, Reynal’s questions point to the way even my seemingly mundane behaviour may still be emotionally revealing. What does tipping represent for me? What does my anxiety say about the way I see myself and what I expect of others?

Addressing the way money affects our relationships, Reynal writes: “Arguments about money are rarely about money.” I think about the times my partner and I have argued about money. Were these disagreements really about money or were they about other things, such as fearing the loss of independence – or coming to terms with new responsibilities? Thinking about these questions, I realise how many of our relationships have a financial aspect to them. Money pervades everything. Examining our emotions may give us a way to understand how we feel about it. But should we all be thinking about money in order to understand our emotions? “It’s a window into something, you know?” says Reynal. “By being curious about why you behave a certain way with money, you can find out something about yourself.”

There are rarely easy answers when it comes to self-discovery, says Reynal. Regular readers of financial self-help literature may be disappointed to find Money on Your Mind lacking in investment tips or simple saving strategies. That’s an attitude Reynal has encountered among money-minded people who seek therapy. “It takes a bit of time to break through that so that we can get into a more reflective space,” she says. “We can get into: ‘What is this really about?’” Then there are those who seek to avoid money discussions altogether. For Reynal, the remedy is the same: “Understanding it more, understanding our relationship with it more, will ease our anxiety,” she says. “But to do that, we need to start talking and thinking about it.”

Money on Your Mind: The Psychology Behind Your Financial Habits by Vicky Reynal is published by Lagom at £16.99

Finance

TikTok Star Behind Viral 'Looking for a Man in Finance' Song Says Life Has Completely Changed (Exclusive)

:max_bytes(150000):strip_icc():focal(462x390:464x392)/megan-boni-051124-89aa21cdf541419b972544078fadcfb7.jpg)

One TikTok star wasn’t looking for a job in showbiz — but that’s what’s happening.

Nine days ago, creator Megan Boni, who goes by the username Girl On Couch on the social media platform, was just your typical 26-year-old working a day job in sales and making funny videos on the side.

Then her satirical song “Looking for a Man in Finance” went viral. Now it’s been remixed endlessly, has gone viral all around the globe, and Boni says her life has turned completely upside down.

“I haven’t slept. I feel like I’ve been blacked out for a week,” she tells PEOPLE. “I suddenly have an agent.”

Boni, who went to Penn State and moved to New York City after graduation in 2019, adds, “I’m about to hire a manager. I even quit my job!” (She notes that her company was cool about it. “They were like, ‘We get it! You do you,’ ” she says.)

But Boni notes that it’s all been beyond surreal.

“I have calls with major companies. I have all these DJs who want to release the first single with me, so I’m suddenly navigating the music industry,” she explains.

Boni also says that the song is already in heavy rotation at concerts and clubs.

“People are asking if I’m annoyed that I’m not getting credit, and I’m like no way, I literally asked for DJs to remix it!” she says.

Still, Boni adds that she’s looking forward to releasing the official single so she can get royalties.

According to the TikToker, the idea for the song stemmed from making fun of girls who complained about being single but then had a laundry list of expectations for potential partners.

“It was just making fun of that, so I started thinking of the most outlandish, hardest things to find in a man and wrote it down, then I came up with that rhyme.” (The tune goes, “I’m looking for a man in finance / Trust fund, 6’5,” blue eyes.”)

Not only have plenty of people added beats to the lyrics, but the next trend is putting their own spin on the lyrics.

Music producer FINNEAS posted, “I’m looking for the WiFi network. Friend’s house. Hotel. Airport.”

As for what’s next, Boni says the song will be released as a single, and she hopes to make appearances at shows and festivals. She also wants to try her hand at comedy.

“I’d love to take some stand up or improv classes, maybe some acting classes. And I’ll probably head to YouTube,” she explains.

The up-and-coming star adds that her family and friends can’t believe what’s going on.

“I have two brothers who probably hate me right now because everyone keeps asking them about it. But my parents are over the moon,” she says.

Boni adds, “You always hope that your content will get views, but I had no idea this was going to resonate. It’s turned into a monster! The Internet is crazy.”

Finance

Mother’s Day 2024: Five useful tips to manage finances for a caregiver woman

In the words of American writer Washington Irving, “A mother is the truest friend we have, when trials heavy and sudden fall upon us; when adversity takes the place of prosperity; when friends desert us; when trouble thickens around us, still will she cling to us, and endeavour by her kind precepts and counsels to dissipate the clouds of darkness, and cause peace to return to our hearts.”

As Mother’s Day approaches, it’s a poignant moment to recognize the unsung heroes among us—mothers who find themselves balancing the demands of caring for both their children and ageing parents. In this modern era, characterised by its unique blend of emotional, physical, and financial challenges, mothers stand at the intersection of caregiving and financial stewardship.

For these mothers, the responsibility of managing their family’s financial well-being can feel like navigating uncharted waters. From juggling medical emergencies to providing for their children’s future, the burden can be overwhelming. However, amidst these challenges, there are practical strategies that can offer solace and stability.

Here are some actionable steps for managing finances as a mother caring for both ageing parents and children, especially on this occasion of Mother’s Day:

Support fund and health insurance for parents

In an era of escalating healthcare costs, having robust health insurance coverage is essential. Setting up a dedicated parents’ support fund, alongside investing in health insurance, can provide a safety net for unforeseen medical expenses. This fund should be distinct from contingency funds and can be invested in instruments such as arbitrage or liquid funds for liquidity and stability.

Maximising post-retirement funds for elderly parents

Many elderly parents may have traditionally favoured investments in real estate, gold, or traditional insurance plans. Assisting elderly parents in diversifying their post-retirement investments can ensure a steady income stream while safeguarding their financial security. Investing in avenues like Senior Citizens Savings Scheme (SCSS), annuity plans, or Pradhan Mantri Vaya Vandana Yojana can provide regular income while safeguarding capital, ensuring lower pressure on your financial status.

Protecting their wishes by facilitating parental will drafting

While it is painful to think of the finality of old age, encouraging parents to draft a will enables them to retain control over their assets. This can facilitate a smooth transition of assets, reducing the likelihood of disputes among heirs.

Investing today for a better future for children

For mothers managing the financial well-being of their children, investing early in children’s futures through equity SIPs can harness the power of compounding, laying a strong financial foundation for their education and beyond. Further, instilling financial discipline in children from an early age and involving them in discussions about family finances can impart valuable lessons about responsible money management, making them capable of handling their finances optimally in their adulthood.

Avoid high-risk products and follow prudent paths to prosperity

While striving for financial security, it’s prudent to steer clear of high-risk investment ventures and opt for well-understood, diversified portfolios.

By implementing these practical strategies and fostering open communication, mothers can navigate the challenges of caring for ageing parents and children while safeguarding their own financial well-being. Here’s to the mothers who embody strength, resilience, and unwavering love. Celebrating the ONE woman who shaped your world and believed in you, always – Happy Mother’s Day!

Anupama Sharma is Executive Director, 360 ONE Wealth.

Unlock a world of Benefits! From insightful newsletters to real-time stock tracking, breaking news and a personalized newsfeed – it’s all here, just a click away! Login Now!

Download The Mint News App to get Daily Market Updates.

More

Less

Published: 12 May 2024, 10:25 AM IST

-

Education1 week ago

Education1 week agoVideo: President Biden Addresses Campus Protests

-

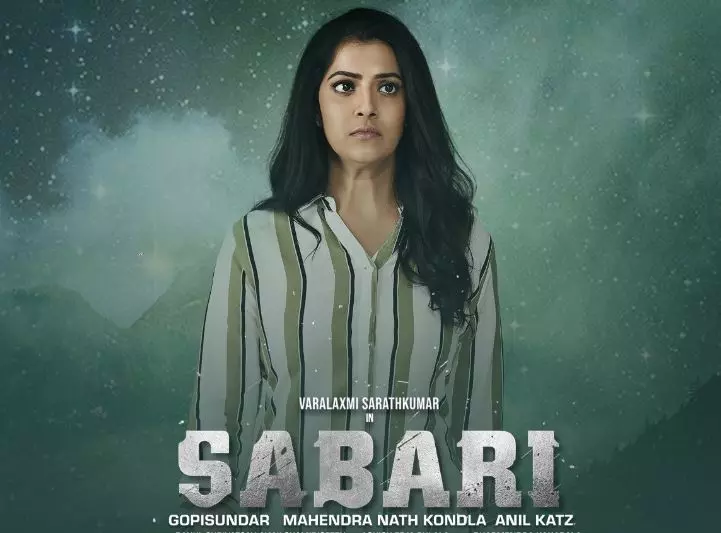

Movie Reviews1 week ago

Movie Reviews1 week agoSabari Movie Review: Varalaxmi Proves She Can Do Female Centric Roles

-

World1 week ago

World1 week agoEuropean elections: What do voters want? What have candidates pledged?

-

News1 week ago

News1 week agoWhistleblower Joshua Dean, who raised concerns about Boeing jets, dies at 45

-

Politics1 week ago

Politics1 week agoAustralian lawmakers send letter urging Biden to drop case against Julian Assange on World Press Freedom Day

-

World1 week ago

World1 week agoBrussels, my love? Champage cracked open to celebrate the Big Bang

-

News1 week ago

A group of Republicans has united to defend the legitimacy of US elections and those who run them

-

Politics7 days ago

Politics7 days agoHouse Dems seeking re-election seemingly reverse course, call on Biden to 'bring order to the southern border'