Finance

IFF Kicks off Annual Green Finance Award Selection on World Environment Day

BEIJING, June 5, 2022 /PRNewswire/ — The Worldwide Finance Discussion board (IFF) will begin accepting functions for the annual IFF World Inexperienced Finance Award, from June 5, which can be the World Surroundings Day.

Echoing the theme of World Surroundings Day ,”Solely One Earth”, which stresses on the necessity to change by means of coverage modifications and our selections to stay in concord with nature in a sustainable means, the IFF World Inexperienced Finance Award is focusing on candidates providing inexperienced monetary options that promote the transformation of financial development modes, contribute to air pollution prevention and management and handle local weather change, in addition to enhance power effectivity, power conservation and emission reductions. This 12 months’s award is a world name for improvements and software practices in coverage, system, business, companies, expertise and expertise constructing.

The Earth is our solely residence, and we should defend its restricted sources. Unsustainable consumption and manufacturing are contributing to local weather change, pure degradation and biodiversity loss, in addition to air pollution and waste disaster. All of those points intersect and overlap, severely jeopardizing the way forward for the planet.

Pure sources are the premise for many items, companies and services, and the muse that helps our financial system. Nevertheless, the linear “take-make-dispose” mannequin is driving the worldwide financial system whereas consuming huge quantities of pure sources. Nature is within the “emergency mode” and we’ve little time left.

To restrict world warming to 1.5°C this century, we should make sure that annual world greenhouse fuel emissions are minimize in half by 2030. Nevertheless, because of the ongoing affect of the COVID-19 pandemic over the previous three years and the latest intense geopolitical turmoil on the planet, economies across the globe are sliding to the brink of financial and power crises. We should take pressing motion to handle the looming disaster. Nevertheless, all these require sturdy monetary assist.

Confronted with the twin challenges of local weather change and world financial disaster, inexperienced finance has turn into sturdy device that international locations around the globe are striving to advertise. Many pioneering practices and makes an attempt have been made when it comes to insurance policies, programs, industries, and human sources improvement. It’s essential to advertise these profitable greatest practices globally and speed up the popularization of inexperienced finance with the intention to promote inexperienced development and sustainable improvement.

The IFF World Inexperienced Finance Award was launched by the IFF in 2020, and is judged by a panel of 25 globally influential and authoritative monetary leaders and elites from the monetary and environmental sectors. In 2022, the award will embrace 10 Innovation Awards for modern initiatives and 10 Annual Awards for establishments.

Annual Awards for Establishments are granted to establishments which have made excellent contributions to world, regional or nationwide sustainable improvement by means of inexperienced finance practices, together with attaining carbon peak and carbon neutrality, addressing local weather change and biodiversity conservation. The inexperienced finance enterprise of the establishments have to be sustainable and worthwhile.

Innovation Awards for Revolutionary Tasks are granted to initiatives that exhibit vital innovation within the subject of inexperienced finance, particularly those who have made vital contributions to attaining carbon peak and carbon neutrality, addressing local weather change and selling biodiversity conservation.

Any establishment that carries out actions which foster inexperienced finance improvement and produce actual advantages are eligible to use for the Awards, together with public, non-public and non-profit organizations.

“Finance is a resilient and efficient device to foster sustainable improvement, and inexperienced finance goes to play an more and more vital function. The winners of ‘the IFF World Inexperienced Finance Innovation Award’ are pioneers, initiators and advocators of inexperienced and low-carbon industries. They information the move of inexperienced investments to the sustainable improvement sector,” stated Han Seung-soo, chairman of the Jury Committee, IFF co-chairman, the 56th president of UN Basic Meeting and former prime minister of Republic of Korea.

“‘The IFF World Inexperienced Finance Innovation Award’ will proceed to push ahead the event of inexperienced finance and assist a sustainable world with shared advantages for the mankind.”

The IFF has been extremely praised by the United Nations and a number of other worldwide organizations and well known for its vital function in selling the observe of inexperienced and sustainable improvement by monetary establishments. Within the annual stories and CSR stories disclosed by Chinese language monetary establishments in 2022, Financial institution of China, China Securities, Postal Financial savings Financial institution of China, Industrial and Business Financial institution of China, Financial institution of Qingdao, Industrial Financial institution and Huaxia Financial institution, amongst others, have introduced the award to the general public as an vital achievement in strictly fulfilling their social duty and vigorously growing inexperienced finance. Along with selling the observe of inexperienced finance by monetary establishments, the IFF World Inexperienced Finance Award additionally performs an energetic function in serving to native governments to implement the twin carbon targets.

The Worldwide Finance Discussion board (IFF) is an unbiased, non-profit, non-governmental worldwide group based in Beijing in October 2003, and established by monetary leaders from G20 international locations, rising markets and worldwide organizations together with China, the USA, the European Union and the United Nations, the World Financial institution and the IMF. IFF is a long-standing, high-level platform for dialogue and communication, in addition to a analysis community within the monetary realm, and has been upgraded to F20 (Finance 20) standing.

SOURCE Worldwide Finance Discussion board (IFF)

Finance

Personal finance lessons from Warren Buffett’s latest letter

Last Nov. 25, Warren Buffett announced that he would donate a substantial portion of the shares he owned in Berkshire Hathaway to his four family foundations.

In his announcement, he included a letter which contained some important personal finance lessons that we can apply to our own situation.

One of my favorites is his comment that hugely wealthy parents should only leave their children enough so they can do anything but not enough that they can do nothing.

Despite being one of the richest men in the world, Buffett shared that his children only received $10 million each when his wife died. Although $10 million is a lot of money, it’s less than 1% of his wife’s estate.

I am not hugely wealthy, nor do I have $10 million. However, Buffett’s comment about just giving our children enough made me reflect on the importance of also making our children resilient.

Many of us want to make sure that our children will be financially secure by the time we pass away. While there is nothing wrong with this, sometimes we go overboard in making sure that this goal is met.

Article continues after this advertisement

For example, sometimes my husband and I are guilty of overindulging our children.

Article continues after this advertisement

Warren Buffett’s comment reminded me that we should also allow our children to go through difficulties so that they will become resilient and learn how to survive comfortably with less. Aside from letting them know that they shouldn’t expect much in terms of inheritance, this could mean limiting their allowance, allowing them to commute to school when there is no car available, and saying “no” to their request to buy nice and expensive things like the latest top of the line gadgets.

Another thing that we are guilty of (especially if you are Filipino Chinese like me) is thinking that we need to build a successful business so that our children will eventually have a steady source of income and the bragging rights of being their own boss.

Although there is nothing wrong with building a successful business, passing it on to our children should not be a priority. This is because there’s no guarantee that our children will want to run our business. In fact, they might not be equipped to run the business properly. If that is the case, they may end up running our business to the ground. This would put them in a worse position, especially if they were raised to think that they do not have to worry about money because they have a business that will take care of them.

Another personal finance lesson Warren Buffett shared is the importance of being grateful and learning to give back.

In his comments, Warren Buffett acknowledged the role of luck in making him wealthy—being born in the US as a white male in 1930 and living long enough to enjoy the power compounding.

However, he recognized that not everyone is as lucky as he is. Because of this, Buffett and his family are focused on giving back so that others who were given a very short straw at birth would have a better chance at gaining wealth.

Learning how to be grateful is very important. We cannot be truly happy unless we are grateful for what we have. In fact, many people who are rich are unhappy because they constantly compare themselves to others who have something that they don’t.

Meanwhile, giving back is a natural outcome of being grateful. It is also very fulfilling. For example, in my company COL Financial, we believe that everyone deserves to be rich. This is why we actively educate Filipinos on personal finance and the stock market.

Helping Filipinos better manage their hard-earned money is one of the greatest fulfillments of my career as an analyst. In fact, this is one of the reasons why I have stayed as an analyst despite the availability of other higher paying jobs.

Finally, Warren Buffett shared the importance of learning how to say no.

People who are wealthy will always be approached by friends, family and others seeking help. Although giving back is important, there is a limit as to how much we can give. Because of that, we need to learn how to say no, even if it is difficult or unpleasant.

To make it easier for his children to say no, Buffett’s foundations have a “unanimous decision” provision which states that unless all his three children agree, the foundations cannot distribute funds to grant seekers.

Although most of us are not as rich as Buffett, we can also benefit from having an accountability partner to help us say no to requests for help. That person can be our spouse, our sibling, or someone who shares our values and understands that while we want to be generous, our resources are limited. Our accountability partner can also help us decide who we should or should not help which is also a difficult task.

Warren Buffett ended his letter by saying that his children spend more time directly helping others than he has and are financially comfortable but not preoccupied with wealth. Because of that, his late wife would be proud of them and so is he.

As a parent, I’d be happier to have children who grow up to become productive citizens with good values rather than to have children who become very rich but are dishonest and greedy. INQ

Finance

Personal finance guru Dave Ramsey warns over 'mind-blowing' Christmas debt

Personal finance expert Dave Ramsey joined ‘Fox & Friends’ to discuss the Federal Reserve possibly cutting interest rates and how Americans can avoid overspending during the holidays.

Holiday spending is putting a big strain on American wallets and leaving some in debt well past the holiday season; however, personal finance expert Dave Ramsey said ‘mind-blowing’ debt can be avoided.

“The average over the last several years has been that people pay their credit card debt from Christmas into May,” The Ramsey Solutions personality shared during an appearance on “Fox & Friends” on Wednesday. “So it takes them about half the year to come back, and because they don’t plan for Christmas… it sneaks up on them like they move it or something.”

According to a study conducted by Achieve, the average American will spend more than $2,000 for the 2024 holiday season, breaking down the outflow of cash into travel and holiday spending on hosting parties, food, clothing, and other gifts.

STOP OVERSPENDING OVER THE HOLIDAYS AND START THE NEW YEAR OFF FINANCIALLY STRONG

Another recent survey by CouponBirds indicated that parents will spend an average of $461 per child and that 49% of parents will go into debt to pay for this Christmas.

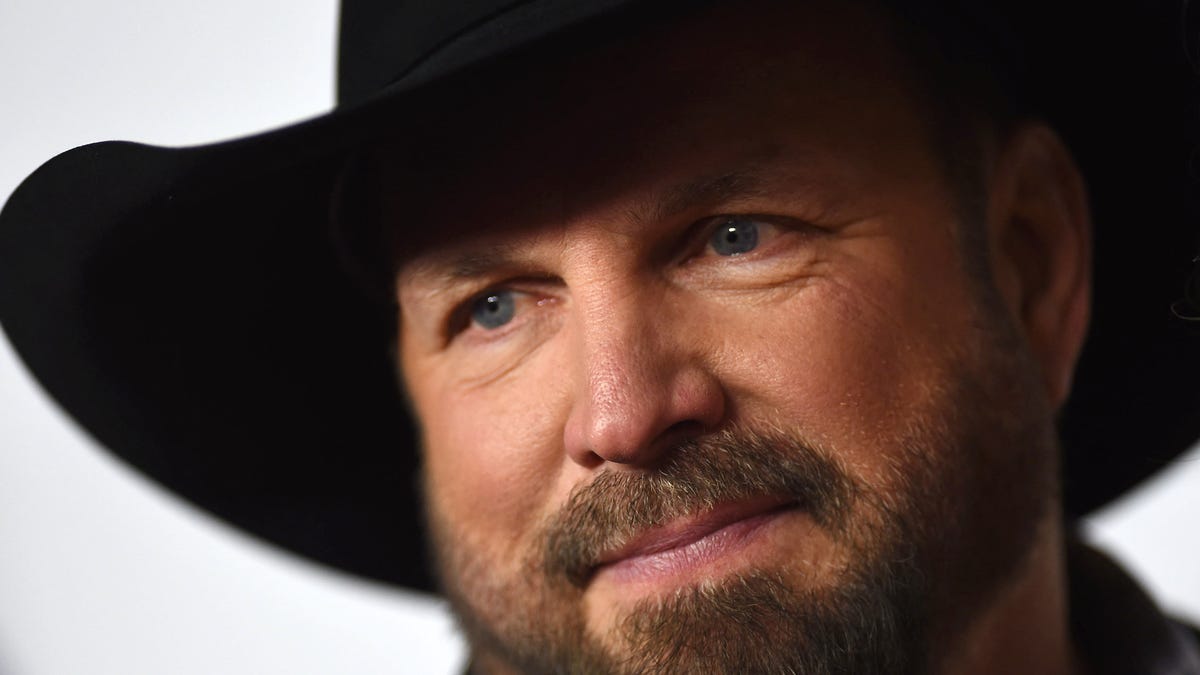

Ramsey Solutions’ Dave Ramsey says “you won’t overspend” if you stick to a Christmas budget. (Getty Images)

The Ramsey Solutions personality balked at the amount of money shelled out for the season while explaining that the holiday should not come as a shock, and that spending for it should be planned out.

“Those numbers are mind-blowing when you look at the averages there. That’s a lot of money going out,” Ramsey added, “all in the name of happiness comes from stuff, and it doesn’t.”

He also weighed in and agreed on advice from fellow expert, Ramsey Solutions personality and daughter Rachel Cruze, who suggested making a list of people to shop for and noting how much to spend on each.

FOX Business’ Lauren Simonetti details the holiday shopping season on ‘Cavuto: Coast to Coast.’

“You know, I’m old, and I met a guy from the North Pole,” the expert joked. “He said ‘make a list and check it twice,’ so Rachel’s right.”

Ramsey followed up by expanding on his daughter’s suggestion: “If you do that, and you put a name beside it, and then you total up those dollar amounts, you have what’s called a Christmas budget.”

“If you stick to that, you won’t overspend,” “The Ramsey Show” host remarked.

National Retail Federation CEO Matt Shay reacts to the latest report that holiday spending is expected to reach $989B this year.

The money guru pointed out what he sees as problematic with the holiday season – not taking a shot at Christmas itself – but referring back to the spending issues.

“The problem with Christmas is not that we enjoy buying gifts for someone else. That’s a wonderful thing,” he reassured. “The problem is we impulse our butts off, and we double up what we spend because the retailers make all their money during this season.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Ramsey concluded by advising shoppers to be wary of retailers and to not be ensnared by their marketing strategies.

“They’re great merchandisers,” he warned. “They’re great at putting stuff in front of us that we hadn’t planned to buy.”

READ MORE FROM FOX BUSINESS

Ramsey Solutions personality Jade Warshaw breaks down the latest economic data that shows consumer credit card debt is piling up amid a jump in spending.

Finance

Can AI Solve Your Personal Finance Problems? Well …

Switch the Market flag

for targeted data from your country of choice.

Open the menu and switch the

Market flag for targeted data from your country of choice.

Need More Chart Options?

Right-click on the chart to open the Interactive Chart menu.

Use your up/down arrows to move through the symbols.

-

Politics1 week ago

Politics1 week agoCanadian premier threatens to cut off energy imports to US if Trump imposes tariff on country

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg) Technology1 week ago

Technology1 week agoOpenAI cofounder Ilya Sutskever says the way AI is built is about to change

-

Politics1 week ago

Politics1 week agoU.S. Supreme Court will decide if oil industry may sue to block California's zero-emissions goal

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg) Technology1 week ago

Technology1 week agoMeta asks the US government to block OpenAI’s switch to a for-profit

-

Business1 week ago

Business1 week agoFreddie Freeman's World Series walk-off grand slam baseball sells at auction for $1.56 million

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg) Technology1 week ago

Technology1 week agoMeta’s Instagram boss: who posted something matters more in the AI age

-

News1 week ago

East’s wintry mix could make travel dicey. And yes, that was a tornado in Calif.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology2 days ago

Technology2 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps