Finance

Free financial education workshops available at Federal Way 320th Library | Federal Way Mirror

Free monetary schooling workshops obtainable at Federal Method 320th Library

Three-part collection is obtainable by the Workplace of the State Treasurer and the King County Library System, starting April 26.

The Workplace of the State Treasurer (OST) and the King County Library System (KCLS) are partnering to offer a free three-part Monetary Basis workshop collection on the Federal Method 320th Library starting Wednesday, April 26.

Monetary Foundations Workshops are for adults trying to develop new abilities in managing private funds. Every workshop will deal with completely different points of private finance, together with budgeting, credit score and debt, and identification theft prevention and consciousness.

KCLS usually hosts studying and developmental alternatives each on-line and at libraries throughout the county. Katy Curtis, an Grownup Providers librarian with KCLS, connects library customers with the abilities and instruments they have to be efficient and demanding lifelong learners, researchers, and residents.

“This would be the first time partnering with the Workplace of the State Treasurer, and we’re excited to supply these workshops as a further alternative for the residents of King County,” mentioned Curtis.

Along with managing public funds for the state, OST focuses on monetary schooling as part of its providers to the general public.

OST Monetary Schooling Coordinator John McKenney will likely be conducting the workshops on the Federal Method 320th Library over the following three months. He has expertise working throughout the state as a facilitator for each in-person and on-line monetary wellness workshops to assist financially empower Washingtonians.

“Monetary schooling will be a useful instrument for anybody in Washington desirous about their subsequent steps and long-term private funds,” mentioned McKenney. “We’re honored to companion with the King County Library System to offer this growth alternative for folks within the Federal Method space.”

Registration isn’t required to attend any upcoming workshops on the Federal Method 320th Library, situated at 848 S 320th Road in Federal Method. Everyone seems to be welcome to attend.

Upcoming Monetary Foundations Workshops:

Budgeting: 6 – 7:30 p.m. Wednesday, April 26

Credit score and Debt: 6 – 7:30 p.m. Wednesday, Could 31

Identification Theft Prevention: 6 – 7:30 p.m. Wednesday, June 28

Contact John McKenney with questions concerning the Monetary Foundations Workshops at john.mckenney@tre.wa.gov.

Finance

Germany's Scholz fires ‘egotistic’ finance minister

STORY: :: November 6, 2024

:: Berlin, Germany

:: Germany’s Scholz sacks finance minister

Christian Lindner, seeks confidence vote

:: He says Lindner broke his trust

‘too many times’ and blocked lawmaking

:: Olaf Scholz, German Chancellor

“Ladies and gentlemen, I have just asked the President for the dismissal of the Finance Minister. I feel forced to take this step in order to avert damage from our country. We need a government that is able to act, that has the strength to make the necessary decisions for our country. That’s what was important to me in the past three years. That’s what’s important to me now. I have made another comprehensive offer to the Free Democrats coalition partner at noon today how we can close the gap in the federal budget without throwing our country into chaos.”

“Too many times did Finance Minister Lindner block laws irrelevantly. Too many times did he act to serve his clientele and party. Too many times did he break my trust. Even the agreement on the budget was withdrawn by him after we had agreed on it in long negotiations. There is no basis of trust for further cooperation. This way, serious government work is impossible.”

“In the very first week of the parliamentary session in the new year, I will call for the confidence vote so that the Bundestag can then vote on it on January 15. That way, parliamentarians can decide if they want to pave the way for a snap election. That election could then take place at the latest by the end of March while respecting the rules of the constitution.”

After firing Finance Minister Christian Lindner of the Free Democrats (FDP) party, Scholz is expected to head a minority government with his Social Democrats and the Greens, the second-largest party.

He would have to rely on cobbled-together parliamentary majorities to pass legislation and he plans to hold a parliamentary confidence vote in his government on Jan. 15.

The collapse of Scholz’s three-way alliance caps months of wrangling over budget policy and Germany’s economic direction, with the government’s popularity sinking and far-right and far-left forces surging.

“We need a government that is able to act, that has the strength to make the necessary decisions for our country,” Scholz told reporters.

Scholz said he fired Lindner for his obstructive behaviour on budget disputes, accusing the minister of putting party before country and blocking legislation on spurious grounds.

The move comes a day after the election of Republican Donald Trump as U.S. president, with Europe scrambling to form a united response on issues from possible new U.S. tariffs to Russia’s war in Ukraine and the future of the NATO alliance.

Finance

Look out for these personal finance pain points in the U.S. election aftermath

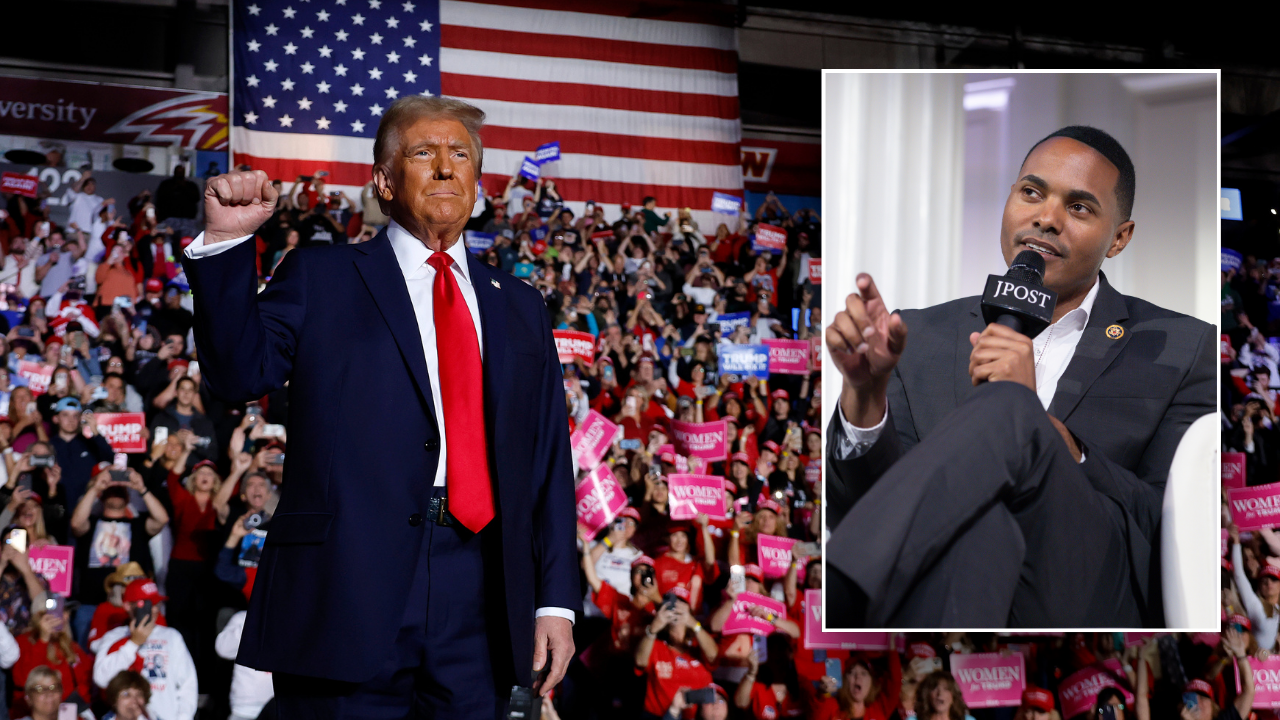

The rally for stocks and crypto following Donald Trump’s U.S. election win is a head fake that diverts attention from several investing and personal finance pain points ahead.

Mr. Trump was seen as better for stocks than Democratic candidate Kamala Harris, and he’s thought to be a booster of crypto currency. The S&P 500 and several cryptocurrencies surged in morning trading on Wednesday, but signs of trouble were there if you looked for them in the bond market.

Investors sold U.S. Treasury bonds, which has the effect of making bond yields rise. Why we care about bond yields in the United States: They have a big influence on bonds here in Canada and, in turn, on the cost of mortgages.

Mortgage rates are well off their recent peaks, but still well above the level where many homeowners locked in several years ago. Waves of these homeowners will renew mortgages in the next 12 months, and they have to be wondering how much more they’ll be required to pay. Events in the bond market suggest further mortgage rate cuts aren’t imminent, a point worth noting if you’re on the housing market sidelines waiting for lower borrowing costs.

Stocks rise and fall on expectations for corporate profits, while bonds are dependent on how investors view economic prospects, including inflation. Mr. Trump’s plan to introduce tariffs on imports is considered inflationary because it will increase the cost of imported goods, while also potentially slowing growth.

Something else investors worry about is the creditworthiness of bond issuers, an area where the United States is generating concern through its US$35-trillion debt. Neither Mr. Trump nor Ms. Harris focused on government debts and deficits in the election campaign, but his policies were judged as adding more to overall debt levels. There’s justifiable concern about Canadian government’s finances, but the U.S. is in worse shape.

Without attention to government debt in the United States, it’s possible that bond yields could rise from current levels. The Bank of Canada and U.S. Federal Reserve will keep lowering their benchmark interest rates, which in turn will push down rates for variable-rate mortgages, lines of credit and floating-rate loans. But bond yields are a bigger influence on fixed-rate mortgages, which happen to be a popular pick right now.

A takeaway for homeowners from these developments is that variable-rate mortgages are worth a look. If you go variable, each Bank of Canada rate cut – and there are several expected over the remainder of this year and next – will lower your borrowing costs.

Another post-election pain point is the Canadian dollar, which has dropped to 71.9 US cents as of Wednesday morning from 74.2 US cents in late September. Part of the reason for that is that money flows are drawn to the higher interest rates in the United States. A five-year Canada bond had a yield of 3.1 per cent early Wednesday, while a comparable U.S. Treasury bond had a yield of 4.3 per cent.

But Canada’s lack of economic competitiveness also contributes to its dollar weakness. If a Trump government offers tax cuts to business and removes regulations, then we may see additional downward pressure on the dollar. Now seems a good time to buy some U.S. currency if you plan to head south this winter.

Stocks had a great run Wednesday morning on the Trump win, but the comparative returns for the U.S. and Canadian markets suggests another pain point. The S&P 500 was up 1.7 per cent by late morning, while the S&P/TSX composite index was up just 0.3 per cent.

In addition to being seen as friendly for business, Mr. Trump is also regarded as someone who will have policies favouring the mega-size tech companies that are dominant in the S&P 500 and non-existent in the S&P/TSX composite.

The Canadian market has benefited lately from a rebound in blue-chip dividend stocks, but that was driven by the decline in interest rates on bonds. Sticky bond yields could limit near-term gains for dividend stocks.

The rally in the price of bitcoin, ethereum, dogecoin and other cryptocurrencies was a win for investors holding these speculative assets. But if you’re a traditioal investor or money manager who has avoided them, prepare for FOMO, or fear of missing out. Crypto remains a non-essential portfolio holding, but has the potential to move beyond that if it becomes more widely adopted.

Are you a young Canadian with money on your mind? To set yourself up for success and steer clear of costly mistakes, listen to our award-winning Stress Test podcast.

Finance

Deadlock over climate finance is undermining Paris agreement, Singapore minister says

By David Stanway

SINGAPORE (Reuters) – Efforts by the United States and others to persuade more countries to contribute to a new global climate financing initiative risks undermining the Paris agreement, Singapore’s Environment Minister Grace Fu told Reuters on Wednesday.

Nearly 200 nations will gather in Baku, Azerbaijan for COP29 climate talks on Monday to thrash out the details of a deal known as the New Collective Quantified Goal, designed to deliver billions of dollars of climate finance to the regions that need it the most.

But the United States, Europe and others will only commit to the fund if the list of countries contributing to it is widened to include the likes of China, South Korea and Singapore, and the resulting deadlock could block progress during the talks.

Fu said there were “tough negotiations” going on about the definition and structure of the fund, but widening the donor base risks “unravelling” the Paris Agreement.

“The Paris Agreement has clear provisions … that talk about the responsibility of developed parties in supporting developing countries in mitigation and adaptation,” she said.

She said Singapore, which has already set up funds designed to speed up decarbonisation in Southeast Asia, would be willing to participate in the NCQG on a voluntary basis, but not as a “donor”.

The issue could be further complicated by the United States’ presidential election, with Donald Trump expected to withdraw from the Paris agreement for a second time if he is re-elected, narrowing the existing donor base.

Fu said it was too early to talk about the impact of the U.S. election on COP29, adding that Singapore hopes Washington will continue to be “involved, engaged and providing the necessary leadership”.

Also on the agenda in Baku will be Article 6 of the Paris Agreement, with countries still negotiating the small print on a global carbon credit market that will allow them to meet their climate goals by financing green projects beyond their borders.

There were hopes that Azerbaijan would be able to announce the completion of a key part of Article 6 in the first few days of COP29, which could build momentum for success elsewhere, but Fu said it was too early to say whether that would happen.

“The presidency has expressed their intention or their desire to see an early conclusion, and we, as co-facilitator are doing all we can to help bring that process forward,” she said.

“Obviously, there’s still a lot of work that needs to be done.”

(Reporting by David Stanway; Editing by Michael Perry)

-

Business5 days ago

Carol Lombardini, studio negotiator during Hollywood strikes, to step down

-

Health6 days ago

Health6 days agoJust Walking Can Help You Lose Weight: Try These Simple Fat-Burning Tips!

-

Business5 days ago

Hall of Fame won't get Freddie Freeman's grand slam ball, but Dodgers donate World Series memorabilia

-

Business1 week ago

Business1 week agoWill Newsom's expanded tax credit program save California's film industry?

-

Culture4 days ago

Culture4 days agoYankees’ Gerrit Cole opts out of contract, per source: How New York could prevent him from testing free agency

-

Culture3 days ago

Culture3 days agoTry This Quiz on Books That Were Made Into Great Space Movies

-

Business1 week ago

Business1 week agoApple is trying to sell loyal iPhone users on AI tools. Here's what Apple Intelligence can do

-

Culture1 week ago

Culture1 week agoTry This Quiz on Spooky Novels for Halloween

/cdn.vox-cdn.com/uploads/chorus_asset/file/25262997/STK461_INTERNET_CHILD_SAFETY_E_Stock_CVirginia.jpg)