Finance

Finance Redefined: Lifeline for Terra projects, proposed Terra hard fork and more

The previous week within the decentralized finance (DeFi) ecosystem was dominated by Terra’s collapse and its aftermath on varied ecosystems it was related. Now BNB chain has come to the rescue of a number of stranded initiatives on Terra by providing monetary and technical help.

After its spiral collapse, Terra co-founder Do Kown proposed a revival plan and a tough fork to revive the blockchain. Chainalysis launched new instruments to watch and monitor stolen funds throughout a number of blockchains. Swiss asset supervisor Julias Baer is eyeing crypto and DeFi potential.

Prime DeFi tokens noticed one other week of bleeding, with nearly all of these tokens buying and selling in purple over the previous week.

Do Kwon proposes Terra arduous fork to avoid wasting the ecosystem

Do Kwon, co-founder of the troubled Terra Luna blockchain, introduced a revised plan to revive the ecosystem after important market volatility and inherent protocol design flaws worn out a overwhelming majority of the blockchain’s market cap. As informed by Kwon, Terraform Labs proposed a brand new governance mannequin on Might 18 to fork the Terra Luna blockchain known as Terra (token identify: LUNA).

Nevertheless, the brand new chain is not going to be linked to the TerraUSD (UST) stablecoin. In the meantime, the previous Terra blockchain will live on with UST and be known as Terra Traditional (LUNC). Beneath Kwon’s plan, if handed, the brand new LUNA blockchain will go stay on Might 27.

Proceed studying

BNB Chain presents one other lifeline to Terra ecosystem initiatives

Binance will welcome migration and supply help to initiatives from the Terra ecosystem following this month’s unraveling of the DeFi platform and its algorithmic stablecoin.

BNB Chain (BNB) has dedicated to offering funding and help to initiatives contemplating migrating from the Terra ecosystem within the wake of the largest black swan occasion to hit the cryptocurrency house lately.

Proceed studying

DeFi-ing exploits: New Chainalysis instrument tracks stolen crypto throughout a number of chains

Chainalysis launched a beta model of its Storyline software program on Wednesday. Touted as a “Web3-native blockchain evaluation instrument,” Storyline goals to trace and visualize good contract transactions with a give attention to nonfungible tokens (NFTs) and DeFi platforms. That is in keeping with the rising reputation and prevalence of NFTs and DeFi within the cryptocurrency house over the previous yr.

Chainalysis offers blockchain evaluation and annual reviews on cryptocurrency crime traits and different analytics. The ever-changing panorama has seen DeFi and NFTs develop into vital cogs within the ecosystem, with Chainalysis estimating the 2 sectors account for greater than half of world cryptocurrency transactions.

Proceed studying

Swiss asset supervisor Julius Baer eyes crypto and DeFi potential

The 132-year-old Swiss asset administration agency, Julius Baer, intends to supply publicity to cryptocurrencies and decentralized finance for its excessive net-worth purchasers. The agency’s CEO Philipp Rickenbacher confirmed the transfer into the cryptocurrency house throughout his supply of the corporate’s technique replace for the following three years.

Rickenbacher famous that the current stoop within the cryptocurrency markets offered a watershed second for its purchasers to achieve publicity to the nascent asset class.

Proceed studying

DeFi market overview

Analytical information reveals that DeFi’s whole worth locked remained underneath the $100 billion mark, falling to $84.2 billion. Information from Cointelegraph Markets Professional and TradingView reveals that DeFi’s prime 100 tokens by market capitalization registered per week crammed with risky worth motion and fixed bearish strain.

Majority of the DeFi tokens within the top-100 rating by market cap traded in purple, barring just a few. Kyber Community Crystal v2 (KNC) was the largest gainer with a 74% rise over the previous week, adopted by Kava (KAVA) at 25% and PancakeSwap (CAKE) at 5%.

Thanks for studying our abstract of this week’s most impactful DeFi developments. Be a part of us once more subsequent Friday for extra tales, insights and schooling on this dynamically advancing house.

Finance

Harris's proposed unrealized capital gains tax is unlikely to pass: CIO

Unrealized capital gains tax proposals may be floating back into the zeitgeist as the Harris presidential campaign marches on, but for some, the noise around it is much ado about nothing.

“I don’t think this unrealized thing is going to have much momentum because it is a very onerous process to come up with those numbers,” Raymond James chief investment officer Larry Adam told Yahoo Finance Executive Editor Brian Sozzi on Yahoo Finance’s Opening Bid podcast (see video above or listen here).

“You start putting biases of what you think [something] is worth versus the reality,” said Adam. “That becomes a very difficult equation to really put into a place.”

We’ve seen unrealized capital gains tax proposals before, but they’ve met plenty of resistance.

Most recently, the Biden administration proposed an unrealized capital gains tax for those with a net worth of over $100 million. The proposal could affect more than 10,600 people in the US, according to estimates.

But, unlike a capital gains tax, which is imposed on a sold item, deploying an unrealized capital gains tax is a trickier move.

Stifel chief Washington strategist Brian Gardner said in a recent client note that under an unrealized capital gains tax system, “ranking illiquid assets would not only be complicated but controversial,” adding that there would also need to be a way to provide taxpayers with “rebates for future losses.”

While analysts scratch their heads about the subject, an unrealized capital gains tax also has plenty of tomato throwers. Donald Trump called it “beyond socialism,” telling a crowd of small-business owners, “You will be forced to sell your restaurant immediately.”

Trump’s onetime US Commerce Secretary, Wilbur Ross, concurred.

“Frankly, I think it’s a ridiculous proposal,” Ross said on Opening Bid.

Tesla (TSLA) CEO Elon Musk also had negative statements to share on the topic, proclaiming an unrealized capital gains tax would lead to “bread lines and ugly shoes.”

While Trump and Musk might deliver their messages to pack a wallop and make voters think, concerns aren’t necessarily unfounded.

Raymond James’s Adam has considered tax proposals made by both candidates, and thinks that regardless of the administration in office, higher taxes could impact households by almost $2,000. “[It] could be a big impact and a drag on the economy,” he said.

Both Harris and Trump face challenges given the expiration of a significant portion of the 2017 tax cuts at the end of 2025. Trump has proposed an additional extension of provisions from 2017 and potentially more tax cuts.

Harris proposed expanding the child tax credit and supported no increase in the capital gains tax, while taxing those making over $400,000 annually more.

While the presidential race is anyone’s game at this point, Adam isn’t that worried about an unrealized capital gains tax and the potential market losses. “[There’s] a low probability of it passing,” he said. “It’s pretty hard to mark to market every single year for your taxes.”

Three times each week, Yahoo Finance Executive Editor Brian Sozzi fields insight-filled conversations and chats with the biggest names in business and markets on Opening Bid. You can find more episodes on our video hub or watch on your preferred streaming service.

In the below Opening Bid episode, former Trump nominee to the Federal Reserve Judy Shelton shares her outlook for the economy.

This embedded content is not available in your region.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

Finance

Insider Sale: President Brian Hole Sells Shares of Willis Lease Finance Corp (WLFC)

On August 30, 2024, President Brian Hole sold 1,187 shares of Willis Lease Finance Corp (NASDAQ:WLFC), as reported in a recent SEC Filing. Following this transaction, the insider now owns 96,589 shares of the company.

Willis Lease Finance Corp specializes in the leasing of spare commercial aircraft engines, aircraft, and other aircraft-related equipment to airlines, aircraft engine manufacturers, and maintenance, repair, and overhaul providers worldwide.

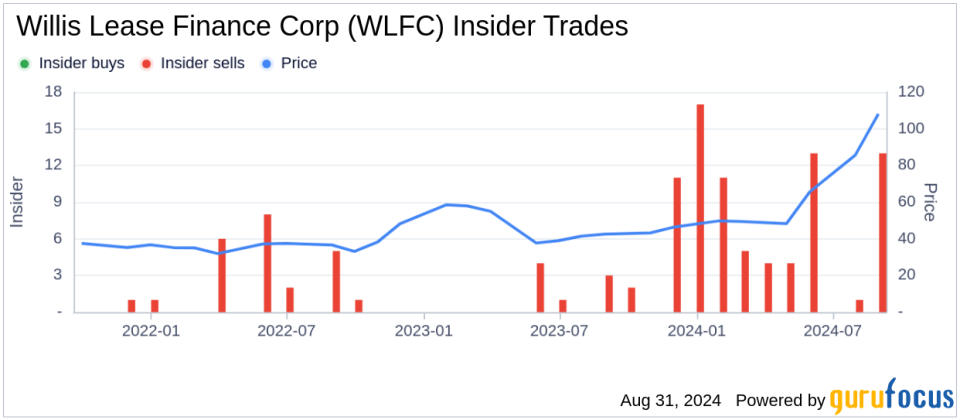

Over the past year, Brian Hole has engaged in multiple transactions involving the company’s stock, selling a total of 24,570 shares and purchasing none. This recent sale is part of a broader trend observed within the company, where there have been 82 insider sells and no insider buys over the past year.

Shares of Willis Lease Finance Corp were priced at $106.17 on the day of the transaction. The company currently holds a market cap of approximately $772.655 million. The price-earnings ratio stands at 8.41, which is below the industry median of 17.98.

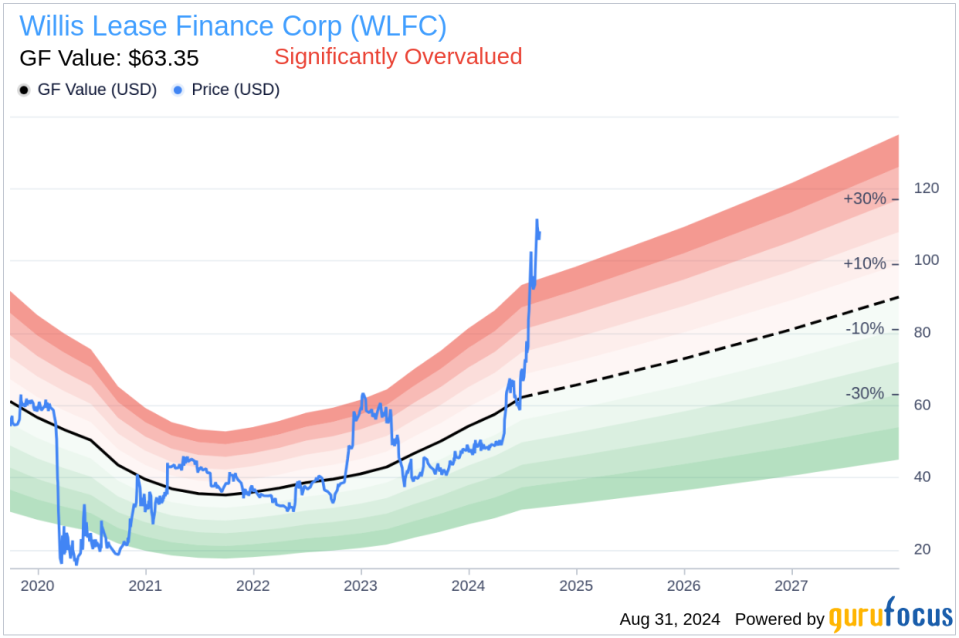

According to the GF Value, the intrinsic value estimate for Willis Lease Finance Corp is $63.35 per share, making the stock significantly overvalued with a price-to-GF-Value ratio of 1.68.

The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates provided by Morningstar analysts.

This sale by the insider might be of interest to current and potential investors, providing insight into insider confidence and valuation perspectives at Willis Lease Finance Corp.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Finance

Super Micro Confirms It Will Delay Annual Financial Filings

(Bloomberg) — Super Micro Computer Inc. said that it won’t file its annual financial report while a special board committee reviews internal controls, confirming a statement earlier this week that sent the shares on their worst drop in almost six years.

Most Read from Bloomberg

The maker of computer servers said it would take “unreasonable effort or expense” to file on time its annual 10-K financial disclosures for the quarter and fiscal year ended June 30.

Super Micro first announced on Aug. 28 that it would delay the financial documents and confirmed its decision Friday in a regulatory filing. The San Jose, California-based company said a special committee is working diligently to assess the effectiveness of its internal controls over financial reporting.

Earlier this week, short-seller Hindenburg Research released a critical report alleging “glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.”

Super Micro repeated its assertion that it doesn’t expect the annual financial filing to contain any material changes to its results announced on Aug. 6.

After Friday’s filing, the shares gained about 2% in extended trading. Earlier, the stock suffered its worst week since October 2018, dropping 29% to $437.70 at the close in New York.

The company sells high-powered servers for data centers and has experienced an explosion in demand for its wares amid the artificial intelligence boom, making its shares a proxy for enthusiasm in the technology. Super Micro’s stock more than tripled last year.

–With assistance from Brody Ford.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

-

Connecticut1 week ago

Connecticut1 week agoOxford church provides sanctuary during Sunday's damaging storm

-

Technology1 week ago

Technology1 week agoBreakthrough robo-glove gives you superhuman grip

-

Politics1 week ago

Politics1 week agoClinton lauds Biden as modern-day George Washington and president who 'healed our sick' in DNC speech

-

Politics1 week ago

Politics1 week ago2024 showdown: What happens next in the Kamala Harris-Donald Trump face-off

-

News1 week ago

News1 week agoWho Are Kamala Harris’s 1.5 Million New Donors?

-

Politics1 week ago

Politics1 week agoTrump taunted over speculated RFK Jr endorsement: 'Weird as hell'

-

Politics1 week ago

Politics1 week agoVivek Ramaswamy sounds off on potential RFK Jr. role in a Trump administration

-

World6 days ago

World6 days agoPortugal coast hit by 5.3 magnitude earthquake