Finance

Automating Tax Inside Dynamics 365 Finance & Operations

When a business lacks the right tools to automate tax management, they open themselves up to a range of compliance risks. Join us for a live demo of the Vertex solution for Microsoft D365 Finance and Operations, where you can learn about its unique features and advantages over native Dynamics 365 tax tools.

Vertex Tax Director Larry Mellon and Partner Solutions Engineer James Karst and will illustrate the importance of these capabilities, discuss the potential tax risks businesses could face without automation, and explain how F&O customers can get started on upgrading their tax operations the right way.

Finance

Mark J. Epley Joins SEDA Experts, Bringing Decades of Corporate Finance, Leveraged Finance, and M&A Expertise

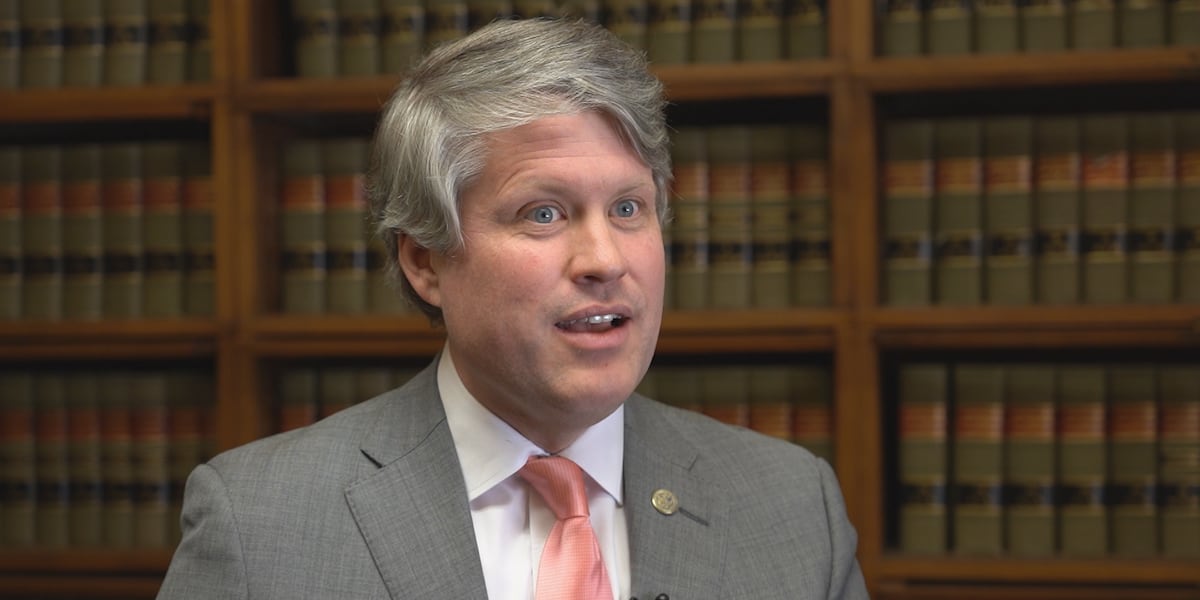

SEDA Experts LLC, a leading expert witness firm providing world-class financial expert witness services, announced today that Mark J. Epley joined the firm as Managing Director.

New York, NY, July 08, 2025 (GLOBE NEWSWIRE) — “Mark brings exceptional knowledge of corporate finance to our franchise,” said Peter Selman, Managing Partner of SEDA Experts.

Mark Epley is a seasoned investment banking executive with over 30 years of experience in corporate finance, leveraged finance, and M&A. He served as Chairman of the Financial Sponsors Group Americas at HSBC Securities, where he led global coverage teams and delivered significant growth. Mark has also held senior leadership roles at other global franchises including Nomura, Deutsche Bank, and Morgan Stanley.

At HSBC, Mark built and grew the Americas Financial Sponsors Group. He managed coverage for premier clients such as Blackstone, Apollo, BlackRock, Carlyle, Bain Capital, TPG, and Warburg Pincus. Additionally, Mark contributed strategically as a member of HSBC’s Americas Investment Banking Division Management Committee, influencing firm-wide strategy and talent recruitment.

Prior to HSBC, Mark co-founded the Americas Investment Banking Division at Nomura Securities International and held roles as Global Head of the Financial Sponsors Group and Co-head of Corporate Finance Americas. He led a global team of 80 bankers across five offices, and was an active member of Nomura’s Global Investment Banking Division Executive Committee. Mark joined Nomura from Deutsche Bank Securities where he also served as Global Head of the Financial Sponsors Group,

Mark began his career at Morgan Stanley & Company, where he was Executive Director and founded the middle market coverage effort within the Financial Sponsors Group. He managed over 100 equity capital markets transactions, including IPOs, follow-ons, convertible bonds, and spin-offs. He was also involved in Mergers & Acquisitions and Restructuring transactions. His career started at a predecessor firm to JP Morgan, Manufacturers Hanover Trust (MHT), focusing on credit analysis and corporate coverage.

Mark presently acts as a Senior Advisor to SQ Capital supporting the origination and build at a unique and differentiated fund focused on investing in Private Equity secondary transactions.

Mark holds an MBA in Finance from Columbia Business School, where he earned Dean’s List honors, and a BA in Politics from Princeton University. He has also completed executive education programs in Energy Innovation & Emerging Technologies at Stanford University and Strategic Wealth Management at Columbia University.

Finance

Do you really save money on Prime Day?

One of the biggest online shopping events of the year — Prime Day — will take place July 8-11 across 26 countries. What began in 2015 as a celebration of Amazon’s anniversary has since grown into a multiday retail extravaganza that rivals Black Friday and Cyber Monday in both hype and sales volume.

But amid the excitement, an important question remains: Do you really save money on Prime Day? Here’s what you need to know before loading up your virtual cart.

This embedded content is not available in your region.

Prime Day is a global sales event created by Amazon that allows Prime members to access exclusive discounts and deals on a number of products across the site.

The first Prime Day took place a decade ago to mark Amazon’s 20th anniversary. It has since evolved to span several days throughout many countries, with this year’s Prime Day event being the longest so far at four days.

Shoppers can score limited-time deals on a wide range of products, from big-ticket electronics and home appliances to beauty products, clothing, and Amazon’s own devices like Echo speakers and Fire tablets. And millions participate each year. In 2024, global sales for Amazon Prime Day totaled $14.2 billion over a 48-hour period, according to Capital One Shopping Research.

Keep in mind that to access these deals, you must be a Prime member, which costs $14.99 per month or $139 per year. However, Amazon offers a free 30-day trial, allowing new users to shop the event without paying up front.

Read more: Amazon Prime Day 2025: We found the best deals to shop before the sale officially kicks off

You may be wondering whether Prime Day is just another overblown shopping holiday like Black Friday, when retailers offer increasingly unimpressive deals to encourage unnecessary spending.

There’s no denying that some Prime Day deals offer real value. The key is having a smart shopping strategy in place to purchase items you actually need at a steep discount — not impulsively spending to take advantage of perceived savings.

Historically, shoppers have seen discounts of 30%-70% on items such as Apple AirPods, laptops, robot vacuums, smart home devices, and branded kitchen appliances. Amazon’s own products, including Kindles, Fire TVs, and Echo Dots, usually come with the deepest discounts. In 2023, Prime Day purchase discounts totaled $2.5 billion, according to Capital One.

Retail analysts have found that many of these items are offered at their lowest prices of the year. So yes, if you’ve had your eye on a specific product and it happens to be on sale during Prime Day, you could walk away with serious savings.

Read more: 7 money-saving perks for Amazon Prime members

Keep in mind that not all the deals offered on Prime Day are really worth it. It’s important to have a plan and do your research ahead of time so you know whether you’re looking at a true discount.

One common tactic retailers use to encourage spending is “price anchoring,” where the listed original price is inflated, making the discount look more impressive than it actually is. In some cases, the so-called sale price is just a return to the item’s normal price after a brief increase in the weeks leading up to Prime Day.

Another issue is the impulse-buy nature of the event. Flash deals and lightning sales are designed to create urgency, leading many shoppers to make purchases they wouldn’t otherwise consider. If you buy something you don’t need — or wouldn’t have bought without the flashy red countdown clock — you’re not really saving money, even if the price is lower.

If you’re hoping to cash in on Amazon Prime savings, it’s important to make a game plan.

It’s easy to get distracted by discounts and make impulsive purchases while browsing. Before you start shopping, make a list of the key items you really want. Prioritize finding deals on those must-haves — and only buy them if it makes sense for your budget.

Decide how much money you can comfortably afford to spend on Prime Day ahead of time and stick to that limit. You’ll avoid throwing your budget off track and ending up with buyer’s remorse.

This year, Amazon is offering over 40 personalized deal features to help shoppers find discounts on products they’re most likely to be interested in. Look for personalized suggestions within the “Recommended deals for you,” “Top deals for you,” and “Customers’ Most-Loved” features to zero in on the deals you may be looking for.

Subscribe and save (if it makes sense)

Amazon’s Subscribe and Save feature offers year-round discounts on items you need to stock up on regularly. On Prime Day, these items may have an additional discount that could help you score extra savings.

Many major retailers such as Walmart, Target, and Best Buy will have their own sales and promotions around Prime Day when they know shoppers are in the mood to splurge. Before you check out, compare the price of items in your cart across a few different retailers to ensure you’re getting the lowest price overall.

Finance

One college major is more popular than ever—but comes with financial catch

One college major is soaring in popularity—but graduates shouldn’t expect to be making good money from that alone.

A degree in psychology has proven an increasingly popular choice for college students year after year, with a noted spike in degrees awarded following 2020.

In 2023, 140,711 bachelor’s degrees in psychology were awarded to graduates across the United States, compared to 86,989 two decades earlier in 2004, according to the American Psychologial Association (APA).

The trend has been attributed to several possible factors, from younger generations becoming more open about mental health discussions, to online psychology influencers gaining popularity, and even certain films and TV shows.

But while the number of psychology graduates is increasing, the monetary reward may not be what they hope.

According to a 2025 report from the Federal Reserve Bank of New York, the median wage of a psychology graduate in their early career is $45,000—moving to $70,000 by mid-career.

Dr. Ryan Sultan MD, double board-certified and the founder and director of Integrative Psych, believes the rise in psychology degrees is generational.

“Younger people tend to be more open to discussing mental health topics, including anxiety, depression, and trauma,” he told Newsweek. “They’re more comfortable having conversations about psychological wellbeing compared to previous generations. They have more exposure to psychology and related concepts, and therefore more people are seeking out psychology degrees.”

Lacheev/Getty Images

Career strategist Patrice Williams Lindo, CEO of Career Nomad, suggested this choice of major is rising “because people are desperate to understand themselves and the world around them, especially in the wake of collective trauma from the pandemic, social unrest, and economic uncertainty.

“Gen Z in particular is drawn to psychology not only through TikTok therapy culture but because they see mental health work as purpose-driven—even if it doesn’t pay six figures out the gate.”

Lindo pointed to a particular uptick of interest in psychology majors post-pandemic, as discourse around mental health became more mainstream on social platfoms, which may have made psychology degrees feel culturally relevant and important, despite it not having a clear career path post-graduation.

When it comes to graduate roles being relatively poorly paid, Sultan believes this is a positive thing “for the future of psychology.”

“I find that these younger psychology students are conscious of the fact that it’s not a money-driven profession, and therefore choose this field because they are genuinely interested in understanding the mind and human behavior,” he suggested.

However, Sultan works closely with psychology students at his practice, and notes some may not know exactly what the course and career entail, as they “often tell me that they weren’t expecting the field to have such a large research component.”

Career strategist Linda said people may not realize that a bachelor’s degree in psychology alone rarely leads to a high-paying role, and being a clinician requires a lot of further work.

“You need a clear plan for either further training or using your psych background in allied fields—like UX research, HR, or policy—if you want sustainable income.”

This correlates with the experience of Dr. Azadeh Weber, who now runs a private practice in California where she says she makes $200,000 a year working part-time. But after graduating with a bachelor’s in psychology, she couldn’t find a job in her field and ended up with a career in tech sales, unrelated to her degree.

At the age of 30, she returned to education, attending graduate school, and became a doctor of clinical psychology at the age of 36.

“I believe the reason why getting an undergraduate degree in psychology is popular is because many people are intrinsically motivated to understand themselves and others,” she said.

“One of the most beautiful parts of my job is also learning from my clients. Everyone has something to teach others,” she said.

She noted that, had she stayed in her tech sales career, at this stage she “may be making the same income as I do now” but it would likely mean having to work “full-time at a corporation.”

“This would mean less time with my family. Overall, I am happy with my decision and love my job.”

-

Politics1 week ago

Politics1 week agoSchumer to force Senate reading of Trump's entire 'big, beautiful bill'

-

Business1 week ago

Business1 week agoNew L.A. Trader Joe's opens across the street from … another Trader Joe's

-

Technology1 week ago

Technology1 week ago5.4 million patient records exposed in healthcare data breach

-

Politics1 week ago

Politics1 week agoTrump administration takes on new battle shutting down initial Iran strike assessments

-

World1 week ago

World1 week agoCommissioner and MEPs in Budapest to challenge Orban’s Pride ban

-

Technology1 week ago

Technology1 week agoTesla says it delivered its first car autonomously from factory to customer

-

World1 week ago

World1 week agoUganda’s President Museveni confirms bid to extend nearly 40-year rule

-

News1 week ago

Live updates: Republicans race to meet Trump’s July 4 deadline for agenda bill | CNN Politics