Crypto

Opinion | The Cryptocurrency Adventures of Mark Zuckerberg and SBF

Again in 2019,

Fb

needed to advertise a brand new digital forex, Libra, to prospects across the globe, a lot of them younger individuals coming into the money financial system for the primary time by their smartphones. It appeared then a promising innovation and nonetheless does now.

The proposal sadly landed at a second when the tech giants had been coming underneath political assault. A spirit of “let’s cease making an attempt new issues” was invading each political events. CEO

Mark Zuckerberg

shortly retreated when he might need put Libra on the market in defiance of the politicians to let a world public determine if it was helpful.

“You consider you’re above the legislation,” ranted liberal Democratic Rep.

Maxine Waters

in a listening to wherein, for as soon as, she was seconded by average and even conservative colleagues.

Consequence: Libra was stillborn for 2 years and primarily deserted by Fb. Different experiments akin to bitcoin have continued, after all, serving, like porn within the Nineteen Nineties, as a check mattress for brand spanking new enabling applied sciences. However none have caught on as a very standard medium of trade and retailer of worth: too unstable, too esoteric, extra like a tulip bulb you would possibly purchase hoping it should go up for no good motive.

The rise and fall of

Sam Bankman-Fried

and his FTX trade could be the greatest information in cryptocurrency, nevertheless it has performed nothing to reply fundamental questions. Will cryptocurrencies ever be helpful? Is blockchain an necessary innovation?

The episode does say one thing that hardly wanted saying about depositories or different companies that promise to maintain your property secure and don’t. If Mr. Bankman-Fried offered you a motorcycle lock and later was stealing your bike and getting in accidents with it, you’d have the identical grievance that prospects of his now-bankrupt cryptocurrency trade have.

The remainder of the story doesn’t ring any bells for novelty or originality both—the superficial fascination with a younger face and his short-lived, in a single day wealth primarily based on gee-whizzery that no one actually might clarify.

Yawn.

The irony that strikes me as fascinating is the best way Mr. Zuckerberg was handled vs. the best way Mr. Bankman-Fried was handled.

When Mr. Zuckerberg tried to launch his cryptocurrency, he positioned his invaluable, established, closely scrutinized firm behind it, deployed armies of legal professionals and had each company and private incentive to do a accountable job, if solely to guard his personal popularity and billions price of Fb shares.

He sought the permission of the permissioncrats, was keen to handle their complaints, search their enter. In an amusing account, the Monetary Instances describes

Janet Yellen

and

Jay Powell,

over breakfast, asking themselves “What’s in it for us?” and placing the ultimate stake in Libra on June 24, 2021.

To at the present time, as a result of it meets their wants, many nonetheless consider an infinitesimal driplet of Russian Fb advertisements elected

Donald Trump.

Of the trigger célèbre of 2018, the Fb-Cambridge Analytica scandal, who caught round by the authorized course of that exposed it to be a nothing-burger?

It didn’t assist that Mr. Zuckerberg had been the villain of a Hollywood film earlier than his still-thriving firm even IPOed, whereas the inevitable

Netflix

or Hulu collection on SBF will arrive lengthy after the actual fact.

In interview after interview, Mr. Bankman-Fried now berates himself for not instituting enough controls to cease buyer cash from by some means getting used to make proprietary crypto bets that every one have gone south. “I ask myself lots how I made a collection of errors,” he moaned to this newspaper.

The reply is straightforward. He didn’t institute controls as a result of he didn’t want any, as a result of buyer cash got here anyway on a crest of bought-and-paid-for credibility from politicians, superstar endorsers, sports activities groups sporting his emblem, media cheerleaders, sponsored business confabs wherein his pronouncements had been accorded gospel standing.

From the episode you would possibly deduce why caveat emptor is the worst regulator besides all of the others, and why authority figures are sometimes higher at looking for their very own pursuits than yours.

Joe Biden,

say, decides what he ought to do a few pending rail strike by asking what greatest serves the political pursuits of Joe Biden. As a rule, after all, this gives a workable method ahead and is why democracy stays the least horrible type of authorities.

Nevertheless it additionally produces its haywire moments. One got here when the political institution banded collectively to crush Mr. Zuckerberg’s conscientious try at a cryptocurrency experiment. One other got here when the identical institution helped fan Mr. Bankman-Fried’s hole simulation of a accountable enterprise till it relieved its trusting prospects of an estimated $51 billion in private wealth.

Copyright ©2022 Dow Jones & Firm, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Crypto

Bitcoin Remains Above $65k—What’s Next For The Cryptocurrency?

Bitcoin prices have retained much of their recent gains today. (Photo illustration by Chesnot/Getty … [+]

Bitcoin prices have maintained their strength over the last 24 hours, retaining the vast majority of the gains that materialized during the cryptocurrency’s latest rally.

The world’s largest digital currency by total market capitalization was trading above $65,000 at the time of this writing, according to CoinMarketCap data.

The digital asset held that value after rallying more than 8% in under 24 hours, reaching its highest since approximately April 24 and then extending those gains, additional CoinMarketCap figures show.

Focusing in on bitcoin’s short-term outlook, several market observers highlighted key fundamental developments that could impact the digital asset’s price, in addition to singling out price levels that could provide key support or resistance.

Brett Sifling, an investment advisor for Gerber Kawasaki Wealth & Investment Management, offered some input on this situation.

“Bitcoin remains range bound since the end of February, as the halving event wasn’t enough to push it to new highs,” he stated via emailed comments.

“I don’t see any other major catalysts on the horizon, other than increased institutional adoption. There is also the potential for the Fed to lower rates later this year, which could bring increased optimism for risk-on assets like Bitcoin,” said Sifling, referring to the federal funds rate, which is controlled by Federal Reserve policymakers.

The decisions of the Federal Open Market Committee have generated quite a bit of visibility over the last few years, as these government officials pushed the fed funds rate, which has an impact on broader borrowing costs, to its highest level since 2008.

This, in turn, has provided a significant headwind for economic activity, but inflation data has remained stubbornly high at many points in spite of high borrowing costs.

Yesterday, headline inflation figures that fell short of economist estimates were cited as a catalyst that helped bitcoin prices rally. This development was credited with helping provide investors with greater hopes that the Fed will cut rates soon.

Technical Analysis

As for the key price levels that technical traders should monitor going forward, Sifling offered some guidance.

“The recent all-time highs in March of around ~$74,000 is a key level to watch, as well as the lows of this recent range at ~$56,500,” he stated.

Grant Tungate, head of business development for Blockforce Capital, also shed some light on this matter.

“I don’t want to make any predictions but I’ll provide some commentary on levels I believe are important,” he said via email.

“Key levels are the new 30d high ~$67.3k, then the all time high ~$74k. On the downside the 30d low ~$57k is an important zone,” Tungate added, pinpointing figures similar to those identified by Sifling.

Armando Aguilar, an independent cryptocurrency analyst, also offered some input on this subject.

“The next critical support level for BTC holds in the high $62k range, if BTC struggles to maintain these levels it could retest low $61k range,” he stated.

“The resistance levels for BTC are in the mid $66k which if breached, we could see the blue chip cryptocurrency cruise to mid/high $68k,” Aguilar added.

“The ATH does provide a key resistance level which would require BTC inflows to pick up as it was the case for the first 2 months since launch. Don’t immediately see levels passing ATH as most custodians have reached maximum distribution capacity thus seeing low inflows into BTC,” he concluded.

Disclosure: I own some bitcoin, bitcoin cash, litecoin, ether, EOS and sol.

Crypto

Portland police alert public to court scam involving cryptocurrency – Newport Dispatch

PORTLAND — The Portland Police Department is warning residents about a scam where callers, posing as officials from the Cumberland County Sheriff’s Office, claim that the victims are in contempt of court for failing to appear as witnesses in a trial.

The scammers then demand payment of a substantial fine to avoid further charges, including arrest.

Victims are being instructed to make payments through Coinstar machines using Dogecoin or other cryptocurrencies.

The phone number used for the scam calls, when searched on Google, appears to be associated with the Cumberland County Courthouse.

Authorities urge anyone who receives such calls not to engage with the scammer.

Instead, they should contact the courthouse directly at 207-822-4200 to verify the legitimacy of the call.

Officials have clarified that the courthouse will never request payments over the phone.

Crypto

The First Web3 RPG From Saudi Arabia Astra Nova Launches a SocialFi Platform on Immutable zkEVM – Press release Bitcoin News

-

Politics1 week ago

Politics1 week agoBiden takes role as bystander on border and campus protests, surrenders the bully pulpit

-

Politics1 week ago

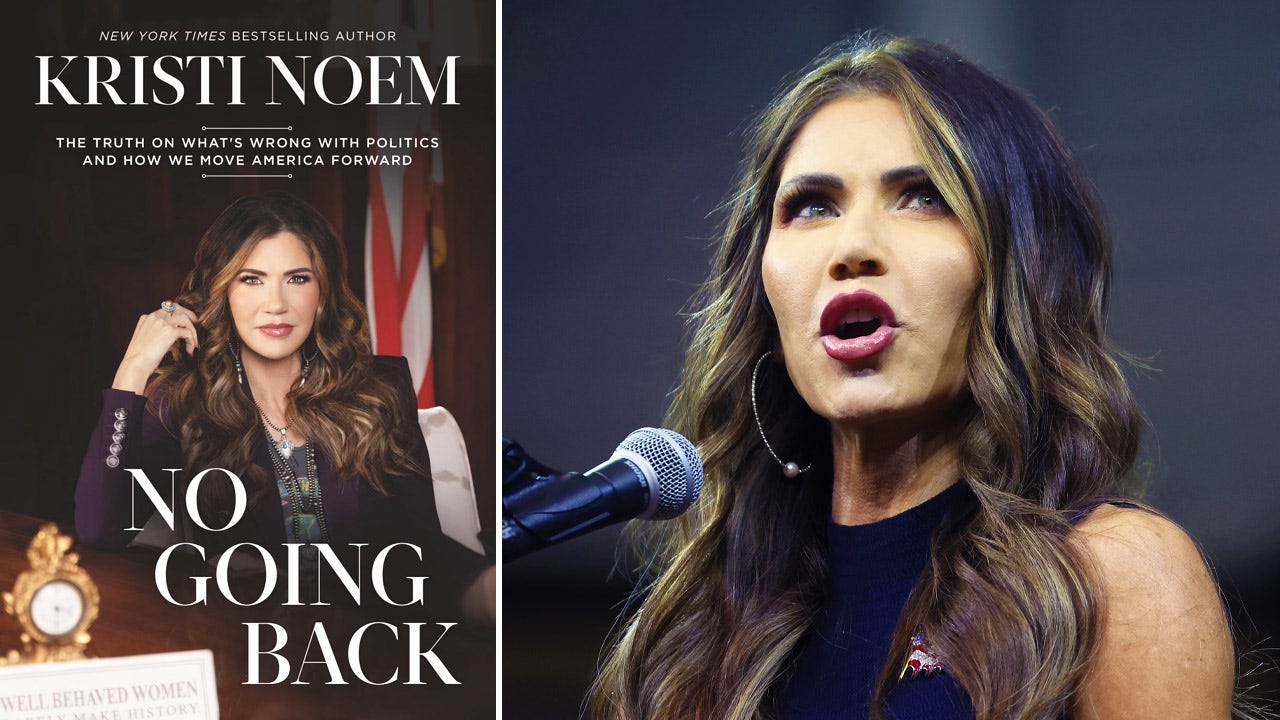

Politics1 week ago'You need to stop': Gov. Noem lashes out during heated interview over book anecdote about killing dog

-

News1 week ago

News1 week agoMan, 75, confesses to killing wife in hospital because he couldn’t afford her care, court documents say

-

Politics1 week ago

Politics1 week agoRFK Jr said a worm ate part of his brain and died in his head

-

World1 week ago

World1 week agoPentagon chief confirms US pause on weapons shipment to Israel

-

Politics1 week ago

Politics1 week agoHere's what GOP rebels want from Johnson amid threats to oust him from speakership

-

World1 week ago

World1 week agoPro-Palestine protests: How some universities reached deals with students

-

World1 week ago

World1 week agoConvicted MEP's expense claims must be published: EU court