Crypto

Navigating the crypto tax landscape: A global comparison

Some nations have adopted beneficial tax insurance policies in direction of cryptocurrencies, whereas others have carried out strict rules. On this article, we are going to look at the crypto tax insurance policies of a number of nations and see how they deal with this evolving asset class.

United States of America

In the USA, cryptocurrencies are handled as property for tax functions, much like property taxes. Transactions involving cryptos, similar to promoting for fiat foreign money, token airdrops, mining, or staking, are all taxable with charges starting from 0-37% for capital positive aspects and earnings tax.

Nonetheless, holding crypto for the long run or shopping for with fiat foreign money isn’t taxable. Taxpayers can select to calculate their crypto taxes utilizing both the FIFO (first in, first out) or LIFO (final in, first out) methodology. Capital positive aspects and losses, price foundation, and conserving data of transactions is necessary to bear in mind for tax reporting.

ETMarkets.com

ETMarkets.comUnited Kingdom

In the UK, taxes are levied on each incomes in crypto and capital positive aspects, with charges starting from 10-20%. Promoting crypto for fiat, buying and selling one token for one more, utilizing crypto to pay for real-world property, and incomes compensation in crypto are all taxable. The UK requires people to report and pay taxes on their crypto transactions, together with earnings tax on positive aspects, Nationwide Insurance coverage contributions, and VAT. Retaining data of all crypto transactions is critical for tax reporting.

ETMarkets.com

ETMarkets.comItaly

In Italy, crypto is taken into account a monetary instrument and is topic to capital positive aspects tax. If the worth of the portfolio exceeds 2000 euros, a 26% capital positive aspects tax is relevant. Promoting crypto for fiat, buying and selling one token for one more, and utilizing crypto to pay for real-world property are all taxable.

ETMarkets.com

ETMarkets.comGermany

In Germany, crypto is handled as personal property and is topic to earnings tax. Capital positive aspects tax normally applies solely to companies, not people, and earnings as much as 600 euros are tax-free. Mining and staking earnings could also be taxed as enterprise earnings, and token airdrops, NFTs, utilizing crypto to purchase fiat, different tokens or real-world property, incomes compensation in crypto, and DeFi lending are all taxable.

ETMarkets.com

ETMarkets.comPortugal

Portugal considers cryptocurrency capital or self-employment earnings. Crypto passive earnings is taxed at 28%. Mining, validation, and token issuance will likely be taxed at 14.5-53%. Portugal crypto customers calculate taxes utilizing the FIFO (first in, first out) approach. If customers cease being a resident of Portugal, they pay a 28% exit tax.

The PTA should be notified of all cryptocurrency transactions in Portugal. Their annual tax reviews should present bitcoin earnings and losses. Cryptocurrency transactions might also be topic to VAT. The PTA applies VAT to bitcoin transactions as items or providers.

ETMarkets.com

ETMarkets.comSingapore

When bought, cryptocurrency in Singapore is topic to GST. Capital positive aspects from cryptocurrency gross sales will not be taxed.

Singapore should disclose and pay taxes on cryptocurrency transactions, in accordance with IRAS. Crypto buying and selling, mining, and purchases are taxed. Capital positive aspects are taxed by lowering the token price foundation from the promoting value, whereas earnings is taxed at honest market worth.

(Rajagopal Menon is the Vice President at WazirX)

(Disclaimer: Suggestions, strategies, views and opinions given by the consultants are their very own. These don’t signify the views of The Financial Instances)

Crypto

Bitcoin will hit $185,000 in 2025, says leading crypto firm

Bitcoin price made history in 2024, and if a recent report is to be believed, the flagship cryptocurrency could reach $150,000 in the first half of 2025 and potentially hit $185,000 by the fourth quarter.

Galaxy Research, the research arm of the digital asset management firm Galaxy, released this report last week, and with that, it has aligned itself with another digital asset management firm, VanEck, which has also anticipated Bitcoin appreciating by more than 50% from its current levels by 2025.

Key excerpts from Galaxy Research’s report shared on the firm’s X account provide a glimpse into their outlook for Bitcoin and the broader cryptocurrency ecosystem.

Spot Bitcoin ETPs to cross $250 billion in AUM

The firm predicted that spot Bitcoin exchange-traded products (ETPs) will continue to thrive, potentially surpassing $250 billion in assets under management (AUM) by 2025. Alex Thorn, the firm’s Head of Research, noted on X that U.S. Bitcoin ETPs are just $24 billion shy of overtaking all U.S. gold ETPs in AUM.

Ether to cross above $5,500 in 2025

Galaxy Research reported another big projection related to Ethereum’s native token, Ether, and said it would trade above $5,500 in 2025. That will happen because of the relaxation in regulations and the corporations’ adaptation and experimentation with the Ethereum technology.

Along with that, the Ethereum staking rate will increase by 50%, per report.

In the world of cryptocurrency, staking involves committing a certain amount of cryptocurrency to a blockchain network for a specified period. This process plays a crucial role in supporting the network’s operations, including validating transactions and maintaining its overall security.

“The Trump administration is likely to offer greater regulatory clarity and guidance for the crypto industry in the U.S. Among other outcomes, it is likely that spot-based ETH ETPs will be allowed to stake some percentage of the ETH they hold on behalf of shareholders,” Galaxy Research posted on X.

Dogecoin will hit $1 in 2025

As per the report, Dogecoin—the most popular memecoin and a favorite of Elon Musk—will reach $1 by 2025.

“Dogecoin market cap will be eclipsed by the Department of Government Efficiency, which will identify and successfully enact cuts in amounts exceeding Dogecoin’s 2025 high-water mark market cap, “ Galaxy Research posted on X.

Other than these forecasts, the report offers optimistic predictions for stablecoins, top publicly traded companies adopting Bitcoin, and other market trends. However, it clearly mentioned that these projections are not intended as investment advice but are purely illustrative of potential market directions.

Crypto

Best Cryptocurrency To Buy Now | Top 10 Crypto Coins To Invest Before Trump Presidency – Brave New Coin

Questions like “What’s the best cryptocurrency to buy now?” have taken center stage as crypto coins such as JetBolt, Polkadot, Chainlink, Solana, Aptos, Kaspa, Celestia, Bitcoin, Pepe, and Dogecoin capture attention. JetBolt (JBOLT), in particular, has blown past the 200-million-token milestone during its presale thanks to its innovative zero-gas technology and AI-powered tools.

As the spotlight intensifies, JetBolt, Polkadot, Chainlink, Solana, Aptos, Kaspa, Celestia, Bitcoin, Pepe, and Dogecoin are positioned to dominate discussions before Trump’s return to the White House. Read on as we dive into why crypto enthusiasts have added these projects to the list of Top 10 Crypto Coins To Invest Before Trump Presidency.

Best Crypto To Buy Now: A Brief Overview

- JetBolt (JBOLT): Trailblazing crypto with zero-gas technology and AI-driven tools.

- Kaspa (KAS): High-speed blockchain using innovative DAG architecture.

- Toncoin (TON): Blockchain integrated with Telegram for seamless social applications.

- Solana (SOL): Fast and cost-efficient blockchain powering DeFi and NFTs.

- Bitcoin (BTC): The original cryptocurrency and digital gold.

Best Crypto To Buy Now: Complete Insight Into the Top 10 Crypto Coins To Invest Before Trump Presidency

-

JetBolt (JBOLT)

JetBolt has quickly established itself as a standout in the cryptocurrency landscape, selling over 100 million tokens during its presale. It’s not just the numbers driving interest; JetBolt’s forward-thinking features are reshaping what users expect from an altcoin.

One of JetBolt’s most defining innovations is its zero-gas technology. Built on the Skale Network, JetBolt eliminates gas fees entirely, making blockchain transactions smoother and more cost-effective. For developers building dApps or casual users making token transfers, JetBolt opens doors that were previously locked behind high costs.

But the innovation doesn’t stop there. JetBolt’s AI-powered aggregator curates third-party crypto news and tags stories with bullish or bearish sentiment. This adds a layer of entertainment and simplicity, turning what could be a complex stream of information into an engaging experience for users who want to keep abreast of all things crypto.

The presale has also attracted significant attention thanks to its unique incentives. Early buyers can access up to 25% additional JBOLT tokens through Alpha Boxes, a feature that rewards bulk purchases.

-

Polkadot (DOT)

Polkadot connects blockchains, letting them share data and work together. This approach could transform industries like finance and logistics, where systems often operate in silos. By supporting Web3 development, Polkadot positions itself as a cornerstone of blockchain’s collaborative future.

-

Chainlink (LINK)

Chainlink brings the outside world onto the blockchain, making smart contracts smarter. Its technology helps DeFi projects use real-time data, like prices or weather reports, to execute transactions. LINK is already a crucial part of the blockchain ecosystem and continues to expand as more use cases emerge.

-

Solana (SOL)

Solana offers speed and low costs, making it a favorite for developers. From NFTs to DeFi platforms, its growing ecosystem attracts innovators who need scalability. Solana’s efficiency ensures it stays relevant in a competitive market.

-

Aptos (APT)

Aptos, designed by former Meta engineers, is making waves for its unique programming language, Move. Its focus on security and performance makes it ideal for NFTs and dApps. As blockchain demand grows, Aptos is committed to meet user and developer needs.

-

Kaspa (KAS)

Kaspa’s architecture stands out by enabling parallel block creation, making transactions faster. It’s efficient, sustainable, and still maintains decentralization. This balance of innovation and eco-consciousness makes it one to watch.

-

Celestia (TIA)

Celestia shakes up blockchain design by letting developers customize what they need. Its modular system supports scalable and secure projects, paving the way for next-gen blockchain applications. Celestia makes building easier without compromising performance.

-

Bitcoin (BTC)

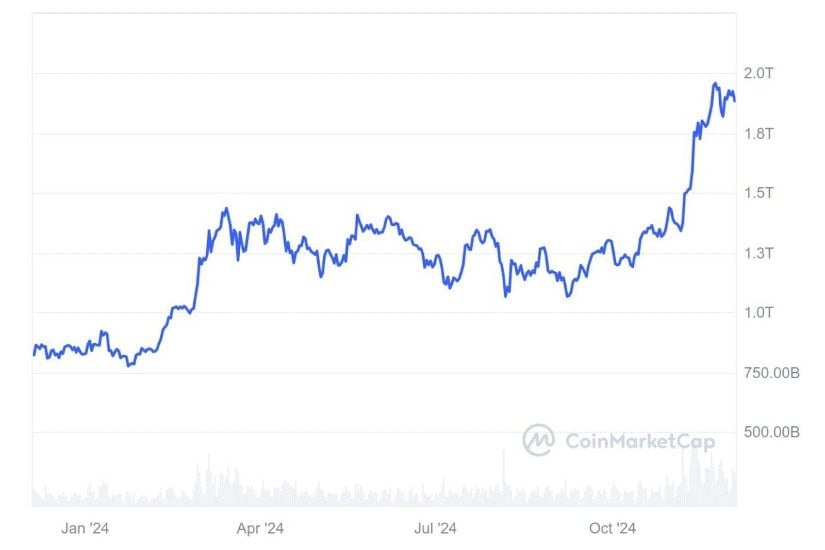

As the first cryptocurrency, Bitcoin remains the foundation of the digital asset space. Known as digital gold, it’s widely used as a store of value and for cross-border payments, offering security and trust to its users. As of press time, BTC’s total market cap is $1.89T.

Chart of Bitcoin’s market capitalization over the past year (Source: CoinMarketCap)

-

Pepe (PEPE)

Pepe Coin taps into internet culture, rallying a community of meme enthusiasts. Its value thrives on social engagement, creating opportunities during viral trends. While speculative, its loyal following drives attention and excitement.

-

Dogecoin (DOGE)

Dogecoin’s journey from joke to genuine utility is remarkable. Low fees and a fun community make it perfect for tipping and microtransactions. Its widespread adoption shows it has staying power beyond the memes.

Conclusion: What Are The Best Cryptocurrencies To Buy Before Trump’s Presidency?

This article explored the best cryptocurrencies to consider before Trump’s presidency in 2025, featuring JetBolt, Polkadot, Chainlink, Solana, Aptos, Kaspa, Celestia, Bitcoin, Pepe, and Dogecoin. Each project offers something unique: from Polkadot’s multi-chain network to Chainlink’s real-world data integrations and Solana’s unmatched speed for dApps.

Notably, JetBolt steals the show with its forward-thinking innovations. Its zero-gas transactions and AI-driven sentiment aggregator have set a new standard for user-friendly blockchain technology.

FAQs

What are the top crypto coins to invest in before Trump’s presidency?

The top cryptocurrencies to consider before Trump’s presidency include:

- Polkadot

- Chainlink

- Solana

- JetBolt

- Aptos

- Kaspa

- Celestia

- Bitcoin

- Pepe

- Dogecoin

What is the best cryptocurrency to buy now?

Choosing the best cryptocurrency to buy now isn’t just about picking the trendiest name—it’s about understanding what each project brings to the table and how it aligns with your financial goals. Currently, coins like JetBolt, Polkadot, Chainlink, Solana, Aptos, Kaspa, Celestia, Bitcoin, Pepe, and Dogecoin are making waves. Take JetBolt, for example. This rising star is rewriting the rules with its zero-gas technology, offering a smoother, more affordable blockchain experience.

Explore JetBolt’s groundbreaking features today by heading to the official JetBolt website, following JetBolt on X, or joining the Telegram community.

This article does not provide financial advice. Always conduct thorough research and understand the risks before buying crypto coins.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

Crypto

Tether's Success Sparks Banks' Interest in Stablecoins | PYMNTS.com

Inspired by Tether’s success, the world’s banking giants are showing interest in stablecoins.

As Bloomberg News reported Saturday (Dec. 28), some banks are already there, with Societe Generale – Forge (SG-Forge) opening its euro-backed stablecoin to retail investors earlier this year. Revolut is reportedly considering its own version, as is AllUnity, a venture involving the Deutsche Bank-owned DWS.

Meanwhile, the report added, American banks are expected to follow suit once Congress enacts stablecoin legislation. A similar thing happened in Europe: the adoption of the Markets in Crypto Assets (MiCA) regulation and Tether’s decision to discontinue its EURt stablecoin has opened the door for competitors.

“Do I think that other banks will be issuing their own stablecoins?” Jean-Marc Stenger, CEO of SG-Forge, said in an interview with Bloomberg. “The answer is yes. It’s heavy lifting, I am not sure it will happen any time soon, but it will happen.”

He added that his firm is already in discussions with other banks that want to use its stablecoins, and is also exploring partnerships or white-labeling its techs to allow banks to issue their own coins.

Visa, meanwhile, launched a tokenization network in October for banks to issue stablecoins, is collaborating with BBVA on a pilot in next year, and is in talks with many other banks.

“We’ve seen demand from banks in Hong Kong, Singapore and Brazil,” Cuy Sheffield, Visa’s head of crypto, told Bloomberg. “We are actively engaged with a number of banks across the world at various stages of the process.”

As PYMNTS wrote in October, the scale of Visa’s network and its relationship with financial institutions around the world allow it to add stability and legitimacy to stablecoins.

“By enabling banks to issue their own stablecoins and integrate tokenized deposits into their systems, Visa could foster widespread adoption, reducing the risk of market panic that often leads to de-pegging events,” that report said.

“Moreover, as banks enter the fray with their regulatory frameworks in place, the perception of stablecoins as a credible asset class could improve.”

Writing about the issue last week, PYMNTS argued that stablecoins’ rise has become impossible to dismiss, as the currency continues its ascent as the foundation of cross-border and enterprise crypto payments and a bridge to traditional finance.

“Cross-border payments, historically plagued by high fees and slow transaction times, underwent a significant transformation in 2024,” that report said. “Blockchain technology emerged as a key enabler, offering transparency, speed and cost efficiency. Stablecoins played a crucial role, allowing businesses to bypass traditional correspondent banking networks and settle transactions almost instantaneously.”

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology1 week ago

Technology1 week agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png) Technology6 days ago

Technology6 days agoThere’s a reason Metaphor: ReFantanzio’s battle music sounds as cool as it does

-

News1 week ago

News1 week agoFrance’s new premier selects Eric Lombard as finance minister

-

Business5 days ago

Business5 days agoOn a quest for global domination, Chinese EV makers are upending Thailand's auto industry

-

Health2 days ago

Health2 days agoNew Year life lessons from country star: 'Never forget where you came from'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg) Technology2 days ago

Technology2 days agoMeta’s ‘software update issue’ has been breaking Quest headsets for weeks

-

World6 days ago

World6 days agoPassenger plane crashes in Kazakhstan: Emergencies ministry

-

World1 week ago

World1 week agoControversy plagued UN agency that employed Oct. 7 terrorists facing new problems as country redirects funding