Tags on this story

invoice, Blockchain, Crypto, crypto trade, Cryptocurrencies, Cryptocurrency, DFAs, Digital Belongings, equities, Change, Laws, moex, moscow trade, receipts, Russia, russian, Securities

The Moscow Change has proposed to legalize the issuance of receipts for digital monetary property. The buying and selling platform says this can enable custodians to supply purchasers who should not prepared for distributed ledgers to primarily work with securities. MOEX additionally plans to turn out to be a licensed crypto trade operator.

The main trade for equities and derivatives in Russia has drafted new laws that will authorize depositories to challenge receipts for digital monetary property (DFAs). In present Russian regulation, the broad time period ‘DFAs’ encompasses cryptocurrencies within the absence of a extra exact definition, however primarily refers to digital cash and tokens which have an issuer.

Underneath such association, DFA receipts will be traded as securities, defined Sergey Shvetsov, who heads the supervisory board of the Moscow Change (MOEX). In the course of the newest version of the Worldwide Banking Discussion board, the official emphasised that the trade “will naturally enter this market” and said:

We’ve got ready a mission that permits you to challenge receipts for digital property, then these receipts are circulated as securities.

MOEX has already filed the respective invoice with the Central Financial institution of Russia (CBR) and also will coordinate the initiative with the Ministry of Finance. The laws will present those that should not able to work with distributed ledgers and afraid of custodial dangers a possibility to switch these dangers and have the ability to challenge securities, Shvetsov added.

“To ensure that DFAs to develop, we need to suggest that the market itself makes the selection – blockchain accounting or depositary accounting,” he additional elaborated, reminding the viewers that the Moscow Change additionally needs to acquire a license from the CBR to function as a digital asset trade. In August, MOEX introduced its intention to launch a DFA-based product by the top of the yr.

“If such a regulation is adopted, Russian depositories will have the ability to accumulate DFAs on their accounts within the blockchain and provides receipts in opposition to them to their purchasers. As quickly as a buyer wants the underlying asset, he would cancel the receipt and obtain his digital asset on his blockchain account,” Shvetsov was quoted as saying by the Prime enterprise information company.

Assist has been rising in Moscow to allow the usage of digital property reminiscent of cryptocurrencies for worldwide settlements amid sanctions, whereas it’s nonetheless unclear if regulators will enable their free circulation contained in the nation. In any case, Russia should create its personal crypto infrastructure, in line with the top of the parliamentary Monetary Market Committee. Anatoly Aksakov not too long ago stated that the inventory exchanges in Moscow and Saint Petersburg are prepared to supply it.

Do you count on the Moscow Change to turn out to be a significant participant in Russia’s crypto market? Share your ideas on the topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, T. Schneider / Shutterstock.com

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

New research by Cyble Research and Intelligence Labs (CRIL) has uncovered a large-scale phishing campaign involving more than 20 Android applications listed on the Google Play Store.

These apps, which appeared to be legitimate cryptocurrency wallet tools, were created with a singular purpose: stealing users’ mnemonic phrases, the crucial 12-word keys that provide full access to crypto wallets.

Once compromised, victims risk losing their entire cryptocurrency holdings, with no possibility of recovery.

Many of the malicious apps were built using the Median framework, which enables the rapid conversion of websites into Android applications.

Using this method, threat actors embedded phishing URLs directly into the app code or within privacy policy documents.

These links would then load deceptive login pages via a WebView, tricking users into entering their mnemonic phrases under the false belief they were interacting with trusted wallet services such as PancakeSwap, SushiSwap, Raydium, and Hyperliquid.

For example, a fraudulent PancakeSwap app used the URL hxxps://pancakefentfloyd[.]cz/api.php, which led to a phishing page mimicking the legitimate PancakeSwap interface.

Likewise, a fake Raydium app redirected users to hxxps://piwalletblog[.]blog to carry out a similar scam.

Despite variations in branding, these apps shared a common objective: extracting users’ private access keys.

CRIL’s analysis revealed that the phishing infrastructure supporting these apps was extensive. The IP address 94.156.177[.]209, used to host these malicious pages, was linked to over 50 other phishing domains.

These domains imitate popular crypto platforms and are reused across multiple apps, indicating a centralized and well-resourced operation.

Some malicious apps were even published under developer accounts previously associated with legitimate software, such as gaming or streaming applications, further lowering user suspicion.

This tactic complicates detection, as even advanced mobile security tools may struggle to identify threats hidden behind familiar branding or developer profiles.

To protect against such attacks, CRIL advises users to download apps only from verified developers and avoid any that request sensitive information.

Using reputable Android antivirus or endpoint protection software, along with ensuring that Google Play Protect is enabled, adds an important, though not infallible, layer of defense.

Strong, unique passwords and multi-factor authentication should be standard practice, and biometric security features should be enabled when available.

Users should also avoid clicking on suspicious links received via SMS or email, and never enter sensitive information into mobile apps unless their legitimacy is certain.

Ultimately, no legitimate app should ever request a full mnemonic phrase through a login prompt. If that happens, it’s likely already too late.

Former US President Donald Trump has disclosed nearly $60 million in income from his involvement in a cryptocurrency venture, shedding light on how he and his family continue to benefit from the digital asset industry. The Financial Times reported on Friday that Trump’s annual financial disclosure reveals $57.4 million earned through World Liberty Financial (WLF), a cryptocurrency enterprise backed by Trump alongside his sons Donald Jr. and Eric.

The detailed filing, exceeding 200 pages and published by the US Office of Government Ethics, shows Trump holds 15.75 billion governance tokens in WLF, granting him substantial voting rights in the operation. The cryptocurrency venture stands as one of Trump’s largest income sources, alongside revenues from books and real estate investments.

Trump’s financial ties to the crypto sector have drawn increasing scrutiny amid ongoing concerns about potential conflicts of interest. The White House did not immediately respond to requests for comment on the disclosures.

World Liberty Financial revealed in January that it had successfully sold 21 billion tokens during a public sale, reaching its target of raising $1 billion. Notably, a 2024 filing with the US Securities and Exchange Commission identified Trump’s special envoy, Steve Witkoff, as a “promoter” of the WLF project.

Trump’s vocal support for cryptocurrencies has helped drive market enthusiasm, pushing bitcoin prices above $100,000 per coin. Under SEC Chair Paul Atkins, several high-profile crypto-related legal cases have been dropped, further easing regulatory pressure on the industry.

Additionally, Trump has actively promoted his own $TRUMP memecoin via social media and hosted a gala last month honoring its major holders. The Trump family media company recently announced plans to launch an exchange-traded fund (ETF) directly holding bitcoin and revealed intentions to raise $2.5 billion to establish a “bitcoin treasury.”

At a bitcoin conference in Las Vegas last May, Eric Trump and Donald Trump Jr. praised cryptocurrencies as “cheaper,” “faster,” “safer,” and “more transparent” than traditional fiat currencies, signaling the family’s continued commitment to expanding their digital asset footprint.

US President Donald Trump has released his financial statement. According to the document, he received over $600 million in income from cryptocurrencies, golf clubs, licensing and other businesses. This was reported by Reuters, writes UNN.

The financial declaration was signed on June 13 and did not contain information about the period it covers. At the same time, some data in the declaration suggest that it was until the end of December 2024, which excludes most of the money raised by the Trump family’s cryptocurrency ventures.

According to the publication’s calculations, Trump declared assets worth at least $1.6 billion in total.

He previously stated that he had transferred his businesses to a trust managed by his children, but the published data indicate that income from these sources still goes to the president, which has led to accusations of conflicts of interest.

Some of Trump’s businesses in areas such as cryptocurrency are benefiting from changes in US policy under his leadership and have become a source of criticism, Reuters writes.

One meme coin issued by the president earlier this year – $TRUMP brought in approximately $320 million in commissions, although it is not publicly known how this amount was distributed between the Trump-controlled organization and its partners.

The feud between Trump and Musk caused Tesla’s stock to crash, with a market value drop of $150 billion.

06.06.25, 09:15 • 3708 views

In addition to the meme coin commissions, the Trump family earned more than $400 million from World Liberty Financial, a decentralized financial company. In his declarations, Trump indicated $57.35 million from the sale of World Liberty tokens.

The American president’s fortune also includes a significant stake in Trump Media&Technology Group (DJT.O), which owns the Truth Social social network, the report said.

In addition to assets and income from his business projects, Trump declared at least $12 million in income in the form of interest and dividends from passive investments totaling at least $211 million, according to Reuters calculations.

Trump’s three golf resorts in Jupiter, Doral and West Palm Beach, and a private members’ club in Mar-a-Lago, brought Trump at least another $217.7 million in income. Trump National Doral, a large golf center in the Miami area, was the Trump family’s largest source of income – $110.4 million.

Trump also received royalties from various deals – $1.3 million from Greenwood Bible, the “only Bible officially endorsed by Lee Greenwood and President Trump”, and $2.8 million from Trump Watches, $2.5 million from Trump Sneakers and Fragrances.

According to Reuters, the declaration often only indicates ranges of asset and income values, and the lower limit was used for calculations, so the real value of Trump’s assets and income is most likely even higher.

Trump changed his approach to deportations: raids on farms, hotels and restaurants have been stopped – NYT14.06.25, 10:18 • 2808 views

Battle over Space Command HQ location heats up as lawmakers press new Air Force secretary

iFixit says the Switch 2 is even harder to repair than the original

A History of Trump and Elon Musk's Relationship in their Own Words

There are only two commissioners left at the FCC

A former police chief who escaped from an Arkansas prison is captured

Ukraine: Kharkiv hit by massive Russian aerial attack

Colombia’s would-be presidential candidate shot at Bogota rally

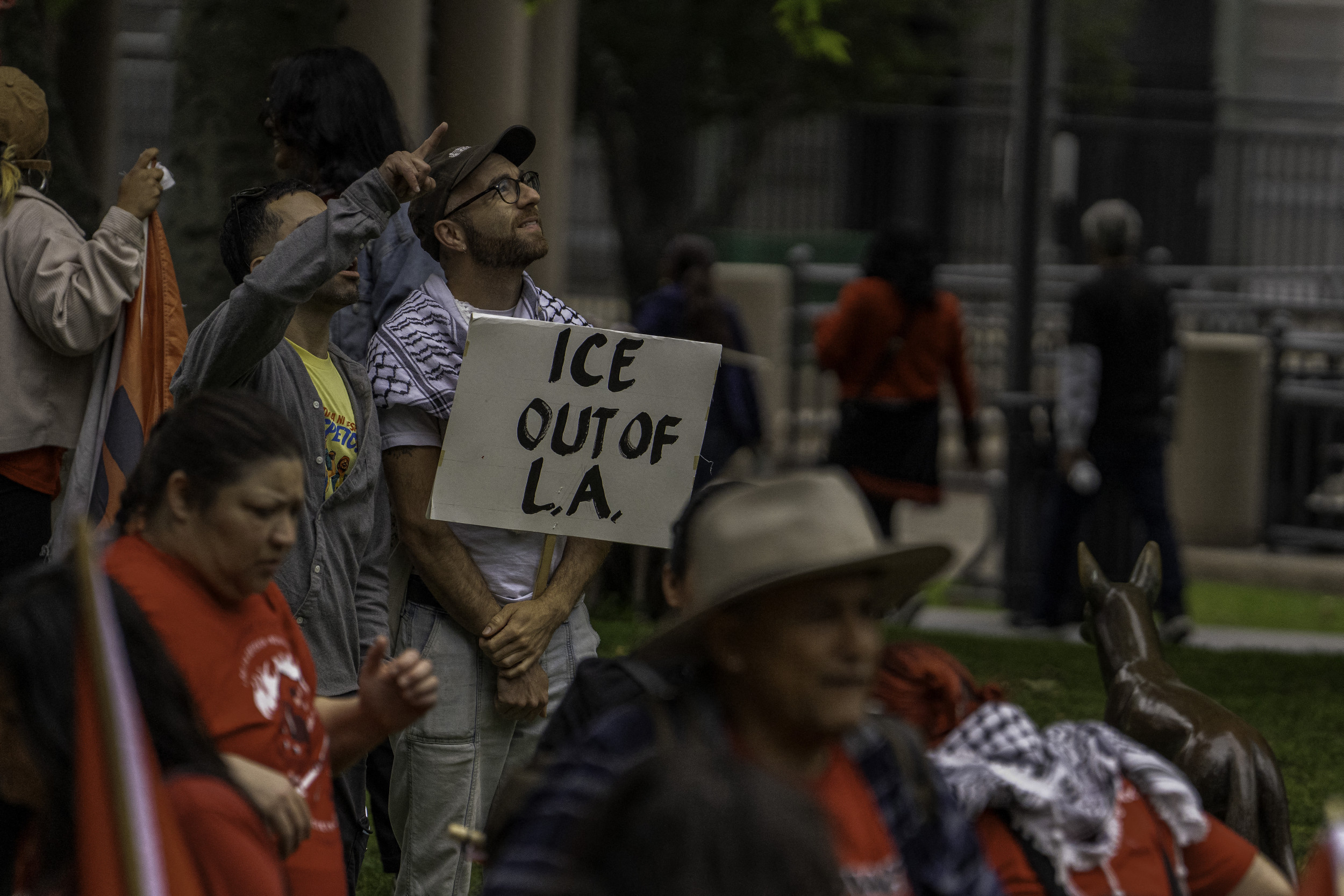

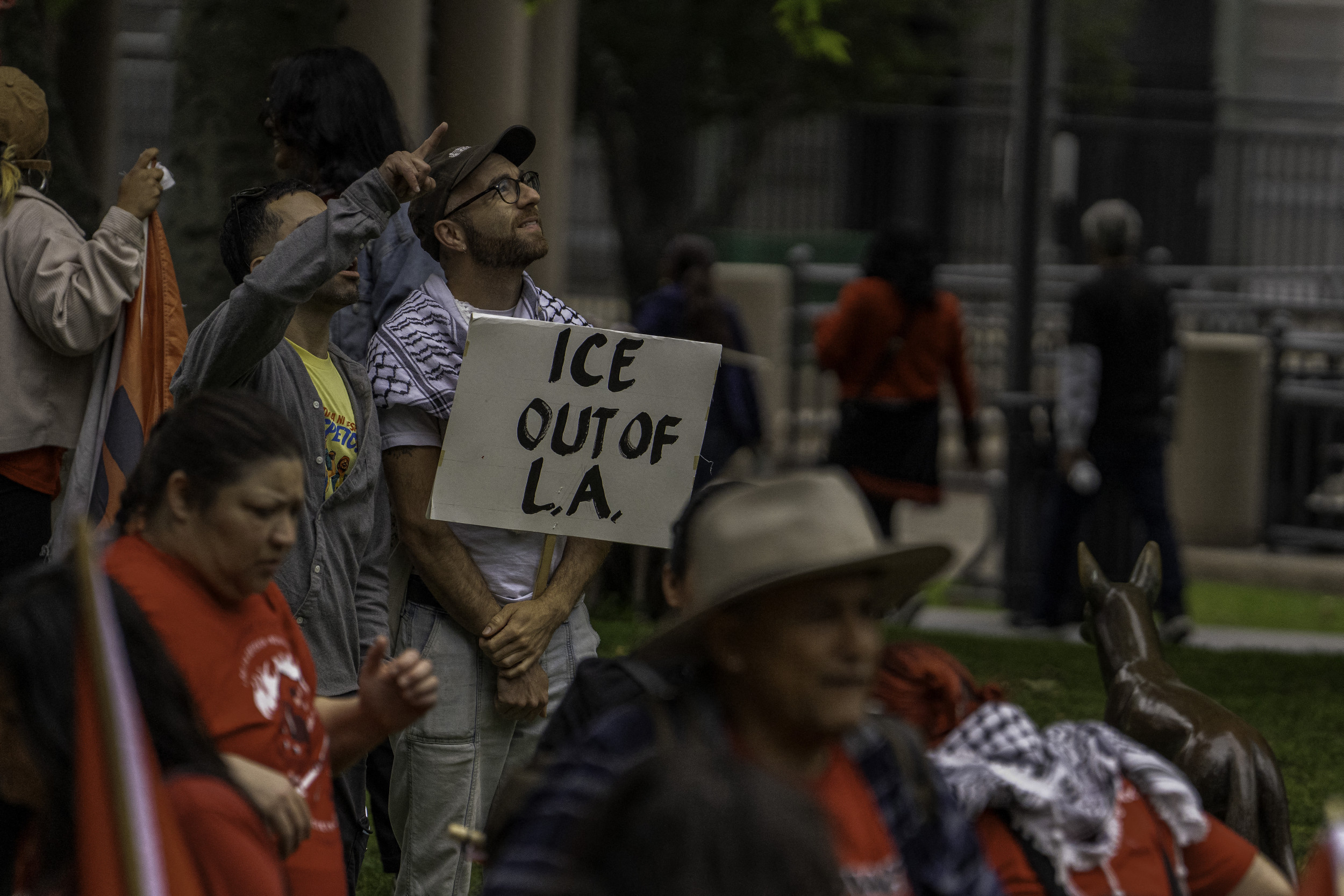

Major union boss injured, arrested during ICE raids