Crypto

Is Now A Good Time To Invest In Cryptocurrency?

Laser-Eyed People Be In Triage Proper Now

FG Commerce/E+ through Getty Photos

DISCLAIMER: This observe is meant for US recipients solely and, particularly, will not be directed at, nor supposed to be relied upon by any UK recipients. Any info or evaluation on this observe will not be a proposal to promote or the solicitation of a proposal to purchase any securities. Nothing on this observe is meant to be funding recommendation and nor ought to or not it’s relied upon to make funding choices. Cestrian Capital Analysis, Inc., its workers, brokers or associates, together with the creator of this observe, or associated individuals, could have a place in any shares, safety, or monetary instrument referenced on this observe. Any opinions, analyses, or possibilities expressed on this observe are these of the creator as of the observe’s date of publication and are topic to vary with out discover. Firms referenced on this observe or their workers or associates could also be clients of Cestrian Capital Analysis, Inc. Cestrian Capital Analysis, Inc. values each its independence and transparency and doesn’t consider that this presents a cloth potential battle of curiosity or impacts the content material of its analysis or publications.

Is The Crypto Crash Possible To Finish Quickly?

To reply this query, first, we will declare our personal stance on cryptocurrencies; you should use that to interpret the remainder of this observe which can show you how to resolve whether or not this work is of any use to you!

In brief, while we are not any spring chickens right here at Cestrian, neither are we boomers. This offers us, we predict, a point of neutrality as regards the utility and longevity of crypto as an asset class. No one right here makes use of crypto as something apart from an investable, tradable safety, as a result of nobody is aware of why they would wish to really ever spend it. In consequence, no person right here has ever owned crypto in its native type, preferring to achieve publicity to it by funds (Grayscale Bitcoin Belief (OTC:GBTC), Grayscale Ethereum Belief (OTCQX:ETHE), ProShares Bitcoin Technique ETF (BITO)) or shares (Coinbase (COIN) at current; Marathon Digital (MARA) and Riot Blockchain (RIOT) up to now). (We may give you every kind of excessive falutin causes for this, however in the long run, it is as a result of we simply know that we’ll lose our chilly wallets and be that man combing by the municipal landfill to seek out what was meant to be his future Lambo however is now only a soggy USB stick lined in carrot mush).

To us, the asset class is one thing of a curio. We neither see rapid private utility, so we aren’t true believers; nor do we predict “bah humbug, this rip-off will finish badly for these pesky youngsters”. Primarily although, as profession tech traders we way back discovered that writing off the new-new factor is often a mistake. So in investing usually we lean towards progress and our curiosity in crypto is from that angle.

What Ought to Traders Know About Cryptocurrency?

Amongst the laser-eyed group, one can find a transparent division drawn between “fiat currencies” and “decentralized crypto”. Fiat, they argue, is a rip-off, being government-controlled, deflatable at will by central financial institution coverage, and so forth. Previous people alternatively consider that crypto is not more than a grand pump & dump scheme which can inevitably finish in catastrophe as a result of the basic worth of any explicit crypto is zero.

Neither of those excessive views is kind of true, in fact. The worth of any foreign money is fashioned solely by consensus, simply as is the case for the worth of any explicit safety. What’s the right worth of the SPDR S&P 500 Belief ETF (SPY)? There isn’t any right worth! The right worth is what market individuals are agreeing to pay each other on the present time. You’ll be able to have an opinion about what market individuals could resolve to pay each other sooner or later, and you could make investments or commerce on the idea of your opinion, however nothing about this calculation relies on any sort of immutable bodily actuality; it is simply opinion.

Truly, the widespread time period ‘fiat’, often used to imply currencies not pegged to bodily items like gold, may also be allotted with right here as a result of, what’s gold price? Once more, it is simply price what people comply with pay each other at any explicit time.

So let’s use a distinct lens. Let’s discuss state-backed currencies just like the greenback or the euro or the yen, and many others., after which about crypto.

The rise of state-backed currencies was, because the identify suggests, a operate of the rise of the nation-state. And the rise of the nation-state was a operate of the power of those that sought to acquire and keep political energy to have the ability to centralize and implement that energy by precise or threatened violence which they deemed to be the only real type of respectable violence. If you wish to learn the long-form model of this idea, you might begin by studying the OG, Thomas Hobbes, whose Leviathan could have been written within the seventeenth century however stays a fairly darn correct portrayal of what the state is and why. When you’re busy, nonetheless, simply watch the Clint Eastwood western, Dangle ‘Em Excessive, which makes all the identical factors.

State currencies are solely precious as a result of someone says so. Within the Center Ages, the sovereign. Immediately, federal governments and market individuals.

Cryptocurrencies are solely precious as a result of someone says so. Since Satoshi by no means did wield any centralized energy, Bitcoin’s (BTC-USD) viability comes right down to its market individuals.

To us, it is that easy.

The query is, will market individuals resolve that crypto will likely be price extra, or much less sooner or later? The entire ecosystem simply bought slammed as threat urge for food was diminished, and the minor cash particularly have been roadkill. We suspect most of them will stay that means as a result of they lacked the vital mass to be self-sustaining when hassle hits. Per Hobbes, life has certainly confirmed nasty, brutish, and quick for a lot of of them.

Our personal curiosity is in Bitcoin and Ether (ETH-USD), the 2 main cryptos by market capitalization. To this point they’ve been broken by the selloff however not more than your common too-hot-to-handle progress inventory. So let’s dig into these some.

Is Now A Good Time To Make investments In Crypto?

Now for another out-loud statements of our personal prejudice. We consider that at a minimal, two cryptocurrencies will survive and doubtless prosper long run.

Bitcoin, as a result of it’s the closest to the gold normal amongst crypto. It’s really decentralized, does not have a guru (or furu!) kind chief espousing its potential to vary the world or change your means to fund your youngsters’ faculty charges, and it has been round a very long time now. Establishments have began to spend money on Bitcoin in cheap quantity and so they have most certainly carried out in order they comply with the altering demographic of their purchasers. If GNUs Not Unix, Bitcoin Is Not Beenz.

And Ether, as a result of though it most definitely does have a founding guru it additionally really has utility insofar as you want it for ‘gasoline charges’ for transactions on its blockchain… and crucially its blockchain would possibly change into a serious transaction bus for the Metaverse even because the Metaverse goes mainstream. And by the best way we very a lot consider that the Metaverse is a factor and going to be extra of a factor.

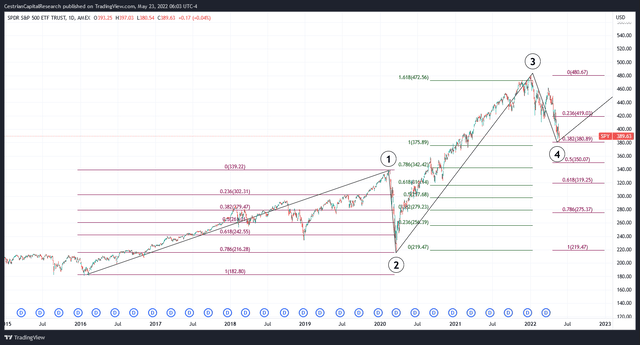

Crypto in our view can solely be invested in or traded on a technical foundation, particularly as a result of it lacks fundamentals. Now, in our personal work, we discover that attempting to speculate or commerce on technicals is dangerous within the excessive when coping with area of interest property – which for us means most if not all of the altcoins – as a result of the gang habits that technical buying and selling strategies try and measure and predict does not happen in a means in keeping with these technical strategies. While all technical strategies differ, usually talking, they work finest in extremely liquid devices which can be freely traded by each establishments and retail alike. We like to make use of the Elliott Wave / Fibonacci methodology in our work – not as a result of we consider it’s the distinctive or supremely legitimate methodology however as a result of we have discovered success with it. And the extra liquid, the bigger, the much less associated to fundamentals of the instrument, the higher we discover the tactic works. Take SPY – the S&P500 proxy ETF – as an illustration. For the reason that 2016 lows, we discover it has moved with textbook readability based on wave & Fibonacci rules – the extensions up and retracements down have (to date! let’s have a look at how the remainder of 2022 performs out) been very predictable on this system. You’ll be able to open a full-page model of this chart, right here. (And earlier than you ask, sure we did name the underside in March 2020 and sure the highest in November 2021, in our subscriber service Development Investor Professional the place these articles can nonetheless be discovered).

SPY Chart (TradingView, Cestrian Evaluation)

So let’s check out whether or not both Bitcoin or Ether may be traded utilizing this methodology. Finest guess is that Bitcoin fits the tactic higher than Ether, as a result of it’s bigger, higher recognized and has extra institutional involvement.

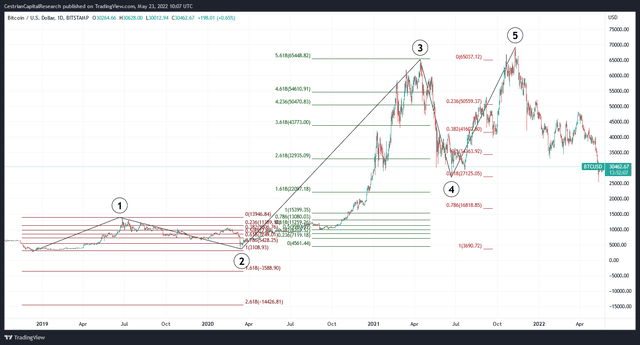

First, the previous. From the 2018 lows, BTC places in a Wave 1 up adopted by a Wave 2 down that troughs slightly beneath (our) preferrred 0.786 retracement. It then places in a monster Wave 3 up peaking on the 5.618 extension of Wave 1, which is loopy and barely seen in our world. For comparability, the latest highs in SPY, the Invesco QQQ ETF (QQQ) and ARK Innovation ETF (ARKK) represented the 1.618, 2.618 and three.618 extensions of their respective prior wave 1s up. Sure, that spooked us out too but it surely’s true. So 5.618 up is actually prolonged and traders would have causes to be fearful at that time. Then comes a Wave 4 down troughing at a textbook 0.618 retracement of that Wave 3 – after which a brand new Wave 5 larger that peaks simply above the prior Wave 3 excessive. So from the tip of 2018 to early November 2021, we will say, yup, this methodology appears to work fairly properly.

BTC Chart (TradingView, Cestrian Evaluation)

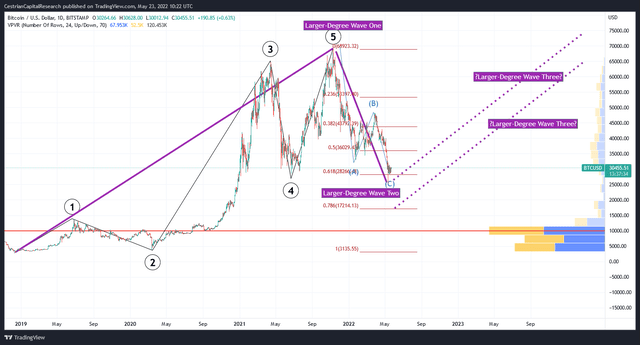

Let’s take a look at the ‘arduous proper edge’ now although. Can we use the tactic to forecast what occurs subsequent? On this methodology, at the very least as we use it, we prefer to discover a Wave 1 up and a Wave 2 down that conforms to kind (particularly a 0.786 retracement of the W1 up) to provide us confidence in projecting the interval to return. We do not have that but in BTC. We expect that BTC is in a ‘bigger diploma’ Wave 2 down, like this (full web page model, right here)

BTC Chart II (TradingView, Cestrian Evaluation)

To this point that Bigger Diploma W2 down discovered help on the 0.618 retracement of the Bigger Diploma W1 up. That would possibly show to be the underside of the wave however (1) the 0.618 degree was breached as soon as already and (2) that A, B, C corrective sample you see in gentle blue – if you would like a very excessive confidence assertion to say a correction has ended, you wish to see A = C, i.e., the worth drop within the A-leg is similar as the worth drop within the C-leg. We do not have that but. A=C would put BTC within the mid-12000s. Countering that you might say, properly, that is beneath the 0.786 retracement degree (17,200) in order that’s unlikely – however countering that you might say, properly, the final substantial W2 down in BTC – the drop into the Covid disaster – troughed beneath the 0.786 too. As a result of crypto be like that – tremendous unstable.

Supporting that evaluation could be – take a look at the quantity profile. The primary excessive quantity node (the place a complete lot of quantity was transacted) does not begin till the 14,200 space – that can doubtless show stronger help than the current worth which has nothing however low quantity nodes round it (certainly the entire transfer up from the mid-14ks to the excessive 60ks may be seen to be a reasonably low-volume train, which may clarify why the instrument was so easy-up in addition to why so easy-down).

Our conclusion on BTC for now could be: we do consider it’s going to experience once more, we aren’t certain the promoting is finished but, and while we maintain some BITO just lately acquired, we are going to doubtless take quick time period earnings ought to they come up fairly than attempting to play long-longtime from right here. If the 0.618 retrace holds agency then we’d change our view however our intestine is, a bear rally now, then one other leg down, then a real transfer again up.

Ether?

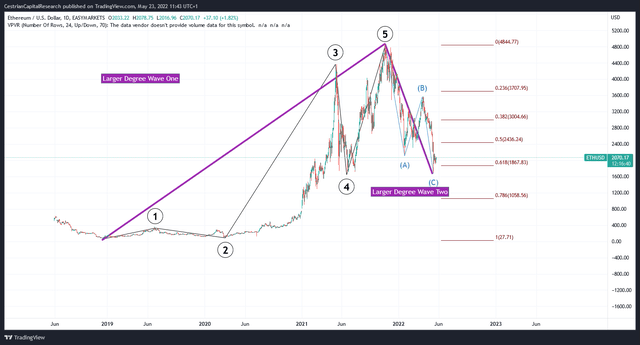

Ether Chart (TradingView, Cestrian Evaluation)

It might amuse you to see precisely the identical sample as BTC! The Wave 3 up was an excellent crazier extension however the large Wave One up and the large Wave Two down are actually on the identical place, i.e., looking for help at that 0.618 retracement of the bigger diploma wave one up (which means round 1867 could show to be of help) however with threat to the draw back as a result of the A-B-C correction hasn’t concluded (but) at A=C. If A=C that places ETHUSD at round 800, once more beneath the 0.786 retracement. So for Ether we predict – there can most definitely be some quick time period upside however talking for workers private accounts we are going to in all probability not be treating that as an actual transfer up till such time as help is absolutely confirmed, i.e., with a number of retests, the remainder of the market additionally transferring up, and many others.

Backside Line – Which Cryptocurrency Is Finest To Make investments In?

Our personal view is that Bitcoin and Ether are right here to remain and that they’re investable. When you have been minded to open new positions in each – straight or through proxies reminiscent of GBTC and ETHE – we will see the sense in beginning now however we’d counsel not betting the farm, as a substitute ready to see if that is simply non permanent respite from promoting till a decrease low kinds help.

If we bought a 0.786 retracement in these two cryptocurrencies, we’d be rather more inclined to begin layering in greater allocations within the hope of having fun with the following main experience upwards.

Cestrian Capital Analysis, Inc. – 23 Might 2022

Crypto

Should You Forget Bitcoin and Buy Solana Instead? | The Motley Fool

Bitcoin‘s (BTC -0.48%) price hit an all-time high of $103,332 on Dec. 4. Four main catalysts drove it to that point: the approvals of its first spot price ETFs in January; its latest halving in April, which cuts its rewards for mining in half every four years; interest rate cuts; and President-elect Trump’s crypto-friendly policies.

Bitcoin’s price has pulled back to about $97,000 as of this writing, but it remains up more than 120% over the past 12 months. With a market capitalization of $1.93 trillion, it’s the world’s top cryptocurrency and seventh most valuable asset.

Image source: Getty Images.

Bitcoin is still a solid long-term play on the cryptocurrency market, but it might have less upside potential than its smaller coins. Could one of those tokens be Solana (SOL -0.99%), which trades at about $190 with a market cap of $90 billion?

What sets Solana apart from Bitcoin?

Solana’s tokens are validated with the proof of stake (PoS) method, which doesn’t require any tokens to be digitally mined. That approach is faster and more energy efficient than the proof of work (PoW) mining mechanism used by Bitcoin.

PoW blockchains are only used for mining more tokens. PoS blockchains support smart contracts, which can be used to develop decentralized apps (dApps), games, non-fungible tokens (NFTs), and other crypto assets. PoS tokens can also be “staked,” or locked up, on the blockchain for a period of time to earn interest-like rewards.

Bitcoin’s value is often defined by its scarcity. It has a maximum supply of 21 million tokens, and nearly 20 million of them have already been mined. The last Bitcoin is expected to be mined in 2140, which makes it somewhat comparable to gold or silver.

Solana and other PoS tokens are usually valued by the speed of their blockchains and the growth of their developer ecosystems. Solana has a current supply of nearly 591 million tokens and no maximum supply, but it’s set to reduce its annual inflation rate, currently at 4.83%, by 15% every “epoch year,” which amounts to 450-630 days.

What sets Solana apart from other PoS tokens?

Solana is often overshadowed by Ethereum (ETH -1.34%), the world’s second largest cryptocurrency and top PoS blockchain. Ethereum has its own native token, Ether, but many other smaller PoS tokens, including Shiba Inu, Polygon, and Render, run on its blockchain. It’s easier to directly launch a new token on Ethereum’s blockchain than to build one from scratch, but these tokens are ultimately constrained by Ethereum’s speed limitations.

Solana is a newer PoS blockchain that accelerates its transactions with its own proof-of-history (PoH) mechanism. That upgrade already enables Solana’s blockchain to process transactions roughly 46 times faster than Ethereum, but it’s only achieved less than 2% of its theoretical max speed so far.

Solana’s high-speed blockchain has attracted a lot of developers and partners. It’s been used to develop meme coins such as BONK and WIF, and it powers decentralized exchanges including Jupiter and Orca. It supports stablecoin transactions for Visa, PayPal, and Circle, and it’s integrated its Solana Pay payment protocol into Shopify‘s platform.

Solana even launched its own Android smartphone for Web3 apps, the Saga Phone, in 2023. It’s still a niche gadget, but it sports its own dApps Store as an alternative to Alphabet‘s Google Play Store.

But over the past two years, Solana dealt with network congestion problems, spam transactions, and security failures. One of its top investors was also the failed crypto exchange FTX, which hastily liquidated its tokens at a discount to pay off its creditors. All of those challenges, along with rising interest rates, drove its price below $10 in December 2022.

What’s next for Solana?

Solana’s price has already soared nearly 19 times from its all-time low, but it could head even higher as it resolves its network issues, it laps FTX’s big sale, and interest rates gradually decline. Several big crypto firms, including Grayscale, Bitwise, and VanEck, have also recently filed for the approvals of Solana spot price ETFs.

Those ETF approvals could stabilize Solana’s price while bringing in more retail and institutional investors. They would also probably mark its transition from a smaller altcoin to a “blue chip” cryptocurrency such as Bitcoin and Ether.

But is Solana a viable alternative to Bitcoin?

Solana is an interesting alternative to Ether, but it’s not a viable replacement for Bitcoin yet. Solana might be a good investment if you believe it can keep increasing its speed, expanding its ecosystem, and gaining new ETF approvals. However, it’s still an inflationary token that’s much harder to value than Bitcoin.

It could be smart to invest in both Bitcoin and Solana, but investors should be aware of their differences. Bitcoin can be considered a digital alternative to gold, but Solana’s value will be defined by its transaction speeds and developer appeal.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Leo Sun has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Bitcoin, Ethereum, PayPal, Render Token, Shopify, Solana, and Visa. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal and short December 2024 $70 calls on PayPal. The Motley Fool has a disclosure policy.

Crypto

How Bitcoin and other cryptocurrency made a strong comeback in 2024

)

As the year 2024 ends, here is a look at the performance of cryptocurrency, especially bitcoin, that turned fortune of the investors within days

read more

Crypto was not much known to a common man or small scale investors till the digital currencies in the basket, including the oldest and most-traded – bitcoin, broke all records to touch a new life-time high especially after Donald Trump’s win in the November 5, 2024 US Presidential election.

But before understanding about a strong comeback, let us understand what cryptocurrency is.

Cryptocurrency is a virtual or digital currency and is not in a physical coin or bill based. It can be used to buy goods and services and all the transactions take place online.

Cryptocurrency runs on the system of cryptography.

However, before 2024, crypto was just a fringe sideshow for the investing public. Now, crypto assets like bitcoin can now be owned and traded by Americans like a stock.

What gave more boost to cryptocurrency is the assurance of major legislative changes by the incoming administration in Washington to support the industry.

Investors who were holding bitcoin are up 130 per cent since the beginning of the year as the price of the largest cryptocurrency broke all records and surged past $100,000 following Trump’s triumph in November 2024 presidential elections. As per Coinmarketcap, the market value of all crypto rose by nearly $1.7 trillion.

Another factor that helped crypto surge was the US SEC approving Bitcoin and Ethereum ETFs earlier in the year. Following this financial giants including BlackRock and Fidelity significantly increased their crypto investments.

It was because of this, bitcoin rallied earlier in the year too as it witnessed massive demand from newly launched spot bitcoin exchange-traded funds (ETFs).

Also, enhanced blockchain infrastructure, with improved scalability and security features, attracted a host of new users.

Crypto’s upward movement began around the US Presidential election, when Trump promised to establish a crypto presidential advisory committee to draft robust regulations, enable individuals to mine bitcoin, allow self-custody of digital assets, and reduce government oversight.

He also proposed the idea of a strategic bitcoin reserve to position the US as the dominant “Bitcoin superpower.” The US President also proposed leveraging bitcoin reserves to reduce the US’ national debt.

Most of us associate with bitcoin when we hear about cryptocurrency, however, Pepe – a token inspired by the meme frog – emerged as the top performer with a market capatilisation surpassing $5 billion.

Pepe soared by a staggering 1,570.7 per cent, reaching a market cap of $9 billion.

Similarly, SUI, the native token for the Sui blockchain, posted a remarkable 509 per cent gain. According to Forbes report, Dogecoin, a favorite among meme coin enthusiasts and promoted by Elon Musk, surged 333.1 per cent.

Meme coins including Dogecoin and Shiba Inu were among the major contributors to the expansion of the crypto market in 2024.

After a well performing 2024, market participants are positive about the cryptocurrency prospects for 2025 as the Trump-led administration returns to the White House.

Most of the analysts and experts see bitcoin to reach $200,000 by the end of 2025.

Crypto

China’s new forex rules require banks to tighten scrutiny on crypto trades

The rules, applicable to local banks across mainland China, also require them to track such activities based on the identity of the institutions and individuals involved, source of funds and trading frequency, among other factors.

In addition, banks are required to put in place risk-control measures that cover those entities and restrict provision of certain services to them, the regulator said.

The latest rules reflect how Beijing continues to exercise draconian regulation to root out commercial cryptocurrency activities, such as bitcoin trading and mining, as the digital asset is considered a threat to the country’s financial stability.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png) Technology1 week ago

Technology1 week agoThere’s a reason Metaphor: ReFantanzio’s battle music sounds as cool as it does

-

News1 week ago

News1 week agoFrance’s new premier selects Eric Lombard as finance minister

-

Business6 days ago

Business6 days agoOn a quest for global domination, Chinese EV makers are upending Thailand's auto industry

-

Health3 days ago

Health3 days agoNew Year life lessons from country star: 'Never forget where you came from'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg) Technology3 days ago

Technology3 days agoMeta’s ‘software update issue’ has been breaking Quest headsets for weeks

-

World7 days ago

World7 days agoPassenger plane crashes in Kazakhstan: Emergencies ministry

-

Politics7 days ago

Politics7 days agoIt's official: Biden signs new law, designates bald eagle as 'national bird'

-

Politics5 days ago

Politics5 days ago'Politics is bad for business.' Why Disney's Bob Iger is trying to avoid hot buttons