Crypto

Is Coinbase Stock A Buy Or Sell Amidst Cryptocurrency Crash? (NASDAQ:COIN)

Photographs we create and what truly occurs are at all times stunning when we have now creativeness./iStock Editorial by way of Getty Photographs

For so long as I can keep in mind, I’ve been bullish on the prospects for cryptocurrencies. No, this doesn’t imply that I invested in Bitcoin (BTC-USD), and that’s as a result of I discovered no conclusive proof to imagine one cryptocurrency is best than one other. I used to be excited when Coinbase International, Inc. (NASDAQ:COIN) went public final yr as a result of investing in Coinbase would not directly expose me to the crypto {industry} with out having to bear the dangers related to particular person tokens. I discovered Coinbase engaging even at its IPO worth, however the hype round cryptocurrencies and digital property in 2021 prompted me to stay on the sidelines to see whether or not the keenness would fade, giving traders a greater alternative to spend money on the crypto sector. With crypto costs down considerably for the reason that starting of the yr, it appears a superb time to guage the long-term prospects for Coinbase International.

Why Is Cryptocurrency Falling?

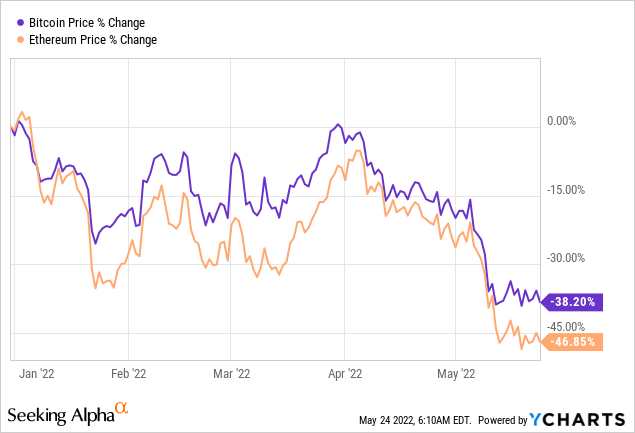

Following the discharge of the Labor Division’s month-to-month client worth index report, which revealed that inflation exceeded expectations, Bitcoin’s worth dipped under $30,000 on Might 12 to its lowest stage since December 2020. The Federal Reserve’s intention to spice up rates of interest by 2023 to fight rising inflation has fueled fears of an impending recession. Because of this, the market witnessed an elevated sell-off of dangerous property, and cryptocurrencies bought hammered within the course of.

Rising costs and a bleak financial outlook are inflicting traders to promote out of cryptocurrencies and different extremely risky property. Bitcoin plummeted under $26,000 briefly amid a bigger cryptocurrency sell-off that noticed the market lose virtually $200 billion in a single day. Ethereum (ETH-USD), the second hottest digital forex, fell under $2,000 as effectively. The decline was exacerbated by the collapse of TerraUSD (UST-USD) stablecoin. UST is an algorithmic stablecoin backed by code and reportedly pegged to the greenback at 1:1. UST may at all times be exchanged for $1 value of Terra (LUNA-USD), a sister coin on the identical blockchain with a floating worth that was designed to soak up UST worth shocks. Nevertheless, on Might 10, the stablecoin started to lose its peg, sparking a frantic sell-off as holders hurried to unload LUNA, wiping off 99% of its worth and pushing UST under $1.

Exhibit 1: YTD efficiency of Bitcoin and Ethereum

Along with recession fears and the collapse of TerraUSD, regulatory pressures and the volatility in capital markets have additionally performed an element within the decline in cryptocurrency costs this yr.

How Is Coinbase Inventory Impacted By Cryptocurrency?

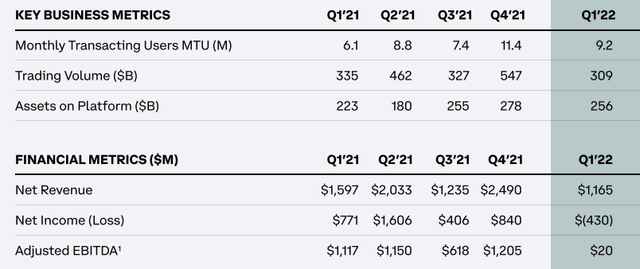

An investor solely has to have a look at the Q1 monetary efficiency of Coinbase to gauge a measure of the correlation between the corporate’s fortunes and the energy within the cryptocurrency market.

Decrease buying and selling quantity and a weak marketplace for cryptocurrencies resulted in a 36% YoY drop in income for Coinbase within the first quarter. The corporate posted a worse-than-expected lack of $430 million within the first quarter, in comparison with a revenue of $771 million within the comparable quarter final yr. The vast majority of Coinbase’s income comes from buying and selling charges, which fell resulting from falling crypto costs and volatility that started in 2021, driving commerce quantity all the way down to $309 billion, down 8% year-over-year and 44% sequentially. The variety of retail month-to-month transacting customers fell 19.3% QoQ to 9.2 million. The corporate expects additional declines in month-to-month transacting customers and buying and selling quantity, in addition to subscription and repair income, within the coming quarter.

Exhibit 2: Q1 key metrics

Shareholder letter

Source: Q1 shareholder letter

Coinbase’s quarterly monetary submitting with the Securities and Trade Fee, which cautioned about chapter dangers, led to further worries for traders. Coinbase disclosed the way it holds buyer property and what would occur if it had been to go bankrupt. The corporate said that within the case of a chapter, crypto-assets it holds in custody on behalf of its clients could possibly be topic to chapter procedures, and people clients could possibly be classed as unsecured collectors basically. Because of this clients could be unable to entry funds if Coinbase goes bankrupt. Though Coinbase CEO Brian Armstrong tried to reassure clients by saying that their funds are protected at Coinbase and that the corporate just isn’t in peril of going bankrupt, it goes with out saying that failing to safeguard and handle clients’ fiat currencies and crypto property may hurt the corporate’s operations and monetary outcomes. As crypto-assets aren’t insured or assured by any authorities establishment, the corporate’s enterprise depends on inside controls to guard property, in addition to public religion in its competence to appropriately handle buyer funds.

Some traders are starting to comprehend for the primary time that their crypto property differ from different investments as these digital property aren’t backed by a regulator, which makes holding cryptocurrencies riskier throughout instances of financial turbulence. One among crypto’s main strengths – regulatory independence – is proving to be an impediment to Coinbase’s short-term profitability.

What Is The Future Worth Of Coinbase Inventory?

Volatility just isn’t the identical as threat. There are numerous dangers related to investing in cryptocurrencies and Coinbase inventory, however volatility shouldn’t be thought-about one. Volatility is a part of the long-term worth cycles of cryptocurrencies, and it’ll have an effect on Coinbase because it is likely one of the largest operators of digital property on the planet. The corporate is actively investing to diversify its enterprise away from risky buying and selling and there may be extra room for the corporate to develop with the increasing digital economic system and the extensive adoption of digital currencies. There are a number of the explanation why COIN inventory seems to be a discount in the present day.

Regardless that transaction charges make for almost all of the corporate’s income (87%), Coinbase goals to increase the utilization of crypto and digital property as a monetary system. Coinbase is concentrated on rising as a service supplier that provides comparable capabilities to a digital pockets and cell cost service with the one distinction being transacting in crypto property as a substitute of fiat currencies. As a result of the corporate presents engaging security measures which are thought-about industry-leading and cryptocurrencies traded on its platform are insured towards on-line safety breaches, we imagine shoppers will undertake crypto cost providers launched by Coinbase together with the rising recognition of cryptos amongst regulators.

Coinbase presently earns nearly all of its income from charges charged to customers who purchase and promote digital property on the platform. Nevertheless, in current quarters, the corporate has targeted on diversifying into extra secure recurring income streams corresponding to offering companies with entry to its Coinbase Cloud computing answer, crypto staking, custodial digital wallets, cost providers together with its new debit card, and an NFT market. Regardless of the lackluster progress within the current quarter on the income entrance, diversification is prone to increase the corporate’s future earnings potential ensuing from the regular progress of MTUs. Coinbase will entice a variety of customers in the long term – not simply merchants who wish to make some fast cash by flipping cryptocurrencies.

For now, Coinbase inventory may be very prone to observe the strikes within the cryptocurrency market, specifically the likes of Bitcoin. In the long term, nonetheless, I imagine COIN inventory will detach from crypto costs as the corporate builds on its recurring income streams and the subscription enterprise. This transition will enable Coinbase inventory to observe its earnings, and that is when early traders are prone to see good-looking returns. For this to occur, the blockchain economic system ought to evolve from its present state the place cryptocurrency buying and selling has taken the middle stage to a sophisticated state the place blockchain expertise performs an integral position within the international economic system.

Exhibit 3: The evolution of the blockchain economic system

For the blockchain economic system to evolve to a extra mature stage, it would take time. Even within the best-case situation, we have to look forward for at the least 5 years from now, that means it could take persistence and a powerful abdomen to climate short-term volatility in inventory costs till issues flip for the higher. Due to the substantial volatility in enterprise circumstances, it appears futile to assign an intrinsic worth estimate for Coinbase as cryptocurrency costs are tough to foretell. In the long term (5 years+), Coinbase inventory ought to commerce significantly increased than present market costs given the huge runway for progress as an enabler of the blockchain economic system.

Investments Will Value Earnings

A better have a look at Coinbase’s financials reveals that prices are rising, which could not be an encouraging signal for a lot of traders. Though Coinbase reported a lack of $430 million for Q1 on buying and selling quantity of $309 billion, MTUs of 9.2 million, and whole property of $256 billion, the corporate has beforehand been worthwhile or carried out a lot better at comparable enterprise and monetary metrics ranges (for instance, in Q3 2021). This commentary suggests Coinbase’s value base has elevated. Nevertheless, one of many greatest contributors to this enhance has been investments within the enterprise to construct the mandatory IT infrastructure to help superior options to customers. Though these investments will likely be a drag on short-term profitability, these investments are essential to safe the sustainability of long-run earnings.

Takeaway

Coinbase inventory stays beneath stress together with cryptocurrencies. The short-term volatility in inventory costs, nonetheless, presents long-term-oriented traders a chance to double down on Coinbase inventory. There are numerous shifting components, however Coinbase appears well-positioned to develop in the long term, which ought to convert into increased inventory costs.

Crypto

Should You Forget Bitcoin and Buy Solana Instead? | The Motley Fool

Bitcoin‘s (BTC -0.48%) price hit an all-time high of $103,332 on Dec. 4. Four main catalysts drove it to that point: the approvals of its first spot price ETFs in January; its latest halving in April, which cuts its rewards for mining in half every four years; interest rate cuts; and President-elect Trump’s crypto-friendly policies.

Bitcoin’s price has pulled back to about $97,000 as of this writing, but it remains up more than 120% over the past 12 months. With a market capitalization of $1.93 trillion, it’s the world’s top cryptocurrency and seventh most valuable asset.

Image source: Getty Images.

Bitcoin is still a solid long-term play on the cryptocurrency market, but it might have less upside potential than its smaller coins. Could one of those tokens be Solana (SOL -0.99%), which trades at about $190 with a market cap of $90 billion?

What sets Solana apart from Bitcoin?

Solana’s tokens are validated with the proof of stake (PoS) method, which doesn’t require any tokens to be digitally mined. That approach is faster and more energy efficient than the proof of work (PoW) mining mechanism used by Bitcoin.

PoW blockchains are only used for mining more tokens. PoS blockchains support smart contracts, which can be used to develop decentralized apps (dApps), games, non-fungible tokens (NFTs), and other crypto assets. PoS tokens can also be “staked,” or locked up, on the blockchain for a period of time to earn interest-like rewards.

Bitcoin’s value is often defined by its scarcity. It has a maximum supply of 21 million tokens, and nearly 20 million of them have already been mined. The last Bitcoin is expected to be mined in 2140, which makes it somewhat comparable to gold or silver.

Solana and other PoS tokens are usually valued by the speed of their blockchains and the growth of their developer ecosystems. Solana has a current supply of nearly 591 million tokens and no maximum supply, but it’s set to reduce its annual inflation rate, currently at 4.83%, by 15% every “epoch year,” which amounts to 450-630 days.

What sets Solana apart from other PoS tokens?

Solana is often overshadowed by Ethereum (ETH -1.34%), the world’s second largest cryptocurrency and top PoS blockchain. Ethereum has its own native token, Ether, but many other smaller PoS tokens, including Shiba Inu, Polygon, and Render, run on its blockchain. It’s easier to directly launch a new token on Ethereum’s blockchain than to build one from scratch, but these tokens are ultimately constrained by Ethereum’s speed limitations.

Solana is a newer PoS blockchain that accelerates its transactions with its own proof-of-history (PoH) mechanism. That upgrade already enables Solana’s blockchain to process transactions roughly 46 times faster than Ethereum, but it’s only achieved less than 2% of its theoretical max speed so far.

Solana’s high-speed blockchain has attracted a lot of developers and partners. It’s been used to develop meme coins such as BONK and WIF, and it powers decentralized exchanges including Jupiter and Orca. It supports stablecoin transactions for Visa, PayPal, and Circle, and it’s integrated its Solana Pay payment protocol into Shopify‘s platform.

Solana even launched its own Android smartphone for Web3 apps, the Saga Phone, in 2023. It’s still a niche gadget, but it sports its own dApps Store as an alternative to Alphabet‘s Google Play Store.

But over the past two years, Solana dealt with network congestion problems, spam transactions, and security failures. One of its top investors was also the failed crypto exchange FTX, which hastily liquidated its tokens at a discount to pay off its creditors. All of those challenges, along with rising interest rates, drove its price below $10 in December 2022.

What’s next for Solana?

Solana’s price has already soared nearly 19 times from its all-time low, but it could head even higher as it resolves its network issues, it laps FTX’s big sale, and interest rates gradually decline. Several big crypto firms, including Grayscale, Bitwise, and VanEck, have also recently filed for the approvals of Solana spot price ETFs.

Those ETF approvals could stabilize Solana’s price while bringing in more retail and institutional investors. They would also probably mark its transition from a smaller altcoin to a “blue chip” cryptocurrency such as Bitcoin and Ether.

But is Solana a viable alternative to Bitcoin?

Solana is an interesting alternative to Ether, but it’s not a viable replacement for Bitcoin yet. Solana might be a good investment if you believe it can keep increasing its speed, expanding its ecosystem, and gaining new ETF approvals. However, it’s still an inflationary token that’s much harder to value than Bitcoin.

It could be smart to invest in both Bitcoin and Solana, but investors should be aware of their differences. Bitcoin can be considered a digital alternative to gold, but Solana’s value will be defined by its transaction speeds and developer appeal.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Leo Sun has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Bitcoin, Ethereum, PayPal, Render Token, Shopify, Solana, and Visa. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal and short December 2024 $70 calls on PayPal. The Motley Fool has a disclosure policy.

Crypto

How Bitcoin and other cryptocurrency made a strong comeback in 2024

)

As the year 2024 ends, here is a look at the performance of cryptocurrency, especially bitcoin, that turned fortune of the investors within days

read more

Crypto was not much known to a common man or small scale investors till the digital currencies in the basket, including the oldest and most-traded – bitcoin, broke all records to touch a new life-time high especially after Donald Trump’s win in the November 5, 2024 US Presidential election.

But before understanding about a strong comeback, let us understand what cryptocurrency is.

Cryptocurrency is a virtual or digital currency and is not in a physical coin or bill based. It can be used to buy goods and services and all the transactions take place online.

Cryptocurrency runs on the system of cryptography.

However, before 2024, crypto was just a fringe sideshow for the investing public. Now, crypto assets like bitcoin can now be owned and traded by Americans like a stock.

What gave more boost to cryptocurrency is the assurance of major legislative changes by the incoming administration in Washington to support the industry.

Investors who were holding bitcoin are up 130 per cent since the beginning of the year as the price of the largest cryptocurrency broke all records and surged past $100,000 following Trump’s triumph in November 2024 presidential elections. As per Coinmarketcap, the market value of all crypto rose by nearly $1.7 trillion.

Another factor that helped crypto surge was the US SEC approving Bitcoin and Ethereum ETFs earlier in the year. Following this financial giants including BlackRock and Fidelity significantly increased their crypto investments.

It was because of this, bitcoin rallied earlier in the year too as it witnessed massive demand from newly launched spot bitcoin exchange-traded funds (ETFs).

Also, enhanced blockchain infrastructure, with improved scalability and security features, attracted a host of new users.

Crypto’s upward movement began around the US Presidential election, when Trump promised to establish a crypto presidential advisory committee to draft robust regulations, enable individuals to mine bitcoin, allow self-custody of digital assets, and reduce government oversight.

He also proposed the idea of a strategic bitcoin reserve to position the US as the dominant “Bitcoin superpower.” The US President also proposed leveraging bitcoin reserves to reduce the US’ national debt.

Most of us associate with bitcoin when we hear about cryptocurrency, however, Pepe – a token inspired by the meme frog – emerged as the top performer with a market capatilisation surpassing $5 billion.

Pepe soared by a staggering 1,570.7 per cent, reaching a market cap of $9 billion.

Similarly, SUI, the native token for the Sui blockchain, posted a remarkable 509 per cent gain. According to Forbes report, Dogecoin, a favorite among meme coin enthusiasts and promoted by Elon Musk, surged 333.1 per cent.

Meme coins including Dogecoin and Shiba Inu were among the major contributors to the expansion of the crypto market in 2024.

After a well performing 2024, market participants are positive about the cryptocurrency prospects for 2025 as the Trump-led administration returns to the White House.

Most of the analysts and experts see bitcoin to reach $200,000 by the end of 2025.

Crypto

China’s new forex rules require banks to tighten scrutiny on crypto trades

The rules, applicable to local banks across mainland China, also require them to track such activities based on the identity of the institutions and individuals involved, source of funds and trading frequency, among other factors.

In addition, banks are required to put in place risk-control measures that cover those entities and restrict provision of certain services to them, the regulator said.

The latest rules reflect how Beijing continues to exercise draconian regulation to root out commercial cryptocurrency activities, such as bitcoin trading and mining, as the digital asset is considered a threat to the country’s financial stability.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png) Technology1 week ago

Technology1 week agoThere’s a reason Metaphor: ReFantanzio’s battle music sounds as cool as it does

-

News1 week ago

News1 week agoFrance’s new premier selects Eric Lombard as finance minister

-

Business6 days ago

Business6 days agoOn a quest for global domination, Chinese EV makers are upending Thailand's auto industry

-

Health3 days ago

Health3 days agoNew Year life lessons from country star: 'Never forget where you came from'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg) Technology3 days ago

Technology3 days agoMeta’s ‘software update issue’ has been breaking Quest headsets for weeks

-

World7 days ago

World7 days agoPassenger plane crashes in Kazakhstan: Emergencies ministry

-

Politics7 days ago

Politics7 days agoIt's official: Biden signs new law, designates bald eagle as 'national bird'

-

Politics5 days ago

Politics5 days ago'Politics is bad for business.' Why Disney's Bob Iger is trying to avoid hot buttons