Crypto

How The Merge will slash Ethereum’s climate pollution

Ethereum simply set The Merge in movement — and the stakes are big for the planet. The Merge is arguably one of the anticipated occasions but in cryptocurrency historical past, when the Ethereum blockchain will swap from a disturbingly energy-hungry technique of validating transactions to a brand new technique that makes use of a fraction of the electrical energy because the community wolfed up earlier than.

The transition is meant to slash Ethereum’s power consumption by a whopping 99.95 p.c. That’s a critically huge deal since, simply final week, the cryptocurrency community was estimated to make use of as a lot electrical energy yearly because the nation of Bangladesh. All that power, after all, comes with lots of carbon dioxide air pollution that’s exacerbating local weather change. Ethereum’s native token, Ether, is the world’s second-largest cryptocurrency by market capitalization after Bitcoin.

How is sort of all of the air pollution Ethereum was beforehand pumping out speculated to just about disappear? It’s difficult, so let’s break it down as merely as we are able to.

What’s The Merge?

It boils right down to a dramatic change in how transactions are recorded on the Ethereum blockchain. A blockchain is a file of transactions that’s maintained communally quite than by a single establishment like a financial institution (take a look at The Verge’s helpful blockchain explainer right here). “Blocks” of transaction information are added to the chain by many alternative gamers, which is why blockchains are sometimes described as “distributed ledgers.”

With so many gamers — also referred to as nodes — concerned, blockchains want a safety system to verify nobody screws with or takes over the ledger. Ethereum’s outdated model of a safety system occurs to be deliberately energy-intensive, so the community is switching to a brand new one via The Merge.

What made Ethereum so polluting within the first place?

Vitality inefficiency was constructed into the community from the beginning, because of that outdated “safety system” Ethereum ran on known as proof of labor. With proof of labor, “miners” validate blocks of latest transactions by fixing computational puzzles. That is speculated to avert double-spending, and miners earn new tokens in return. To forestall too many new tokens from flooding the market, the puzzle fixing will get tougher over time — requiring extra power.

The price of fixing these puzzles, in tools and electrical energy payments, is supposed to make it tougher for anybody entity to realize an excessive amount of affect over the ledger. If that occurred, it will defeat the aim of getting a decentralized monetary system within the first place. Plus, it comes with the danger of a bully coming alongside and manipulating the ledger for their very own acquire.

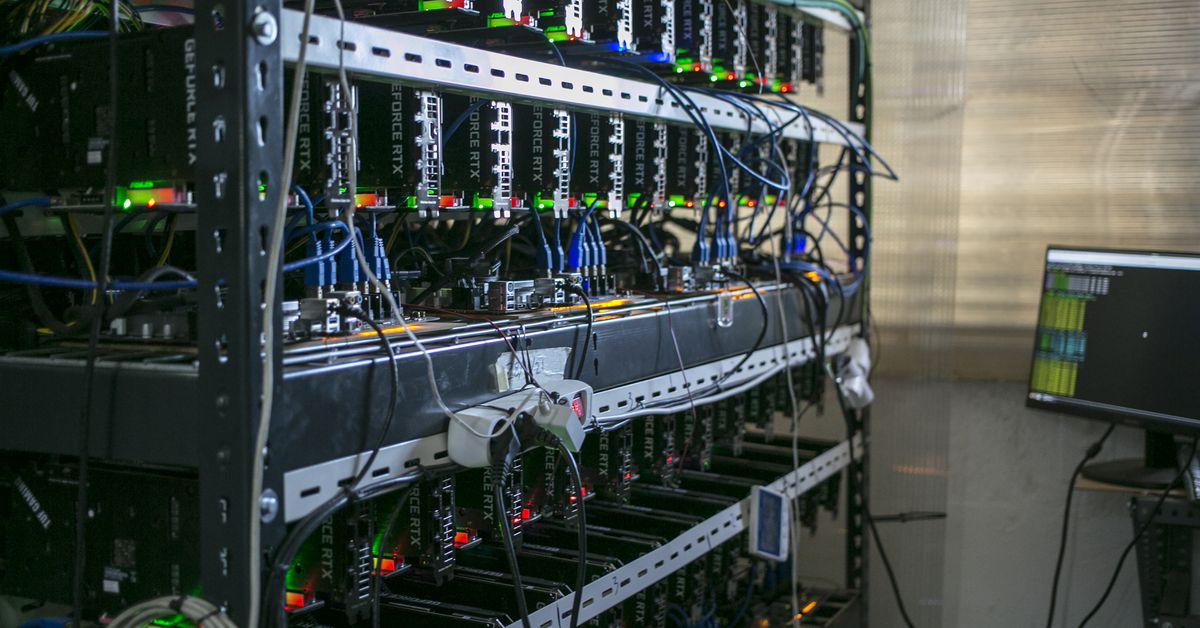

With proof of labor, power consumption and air pollution balloon as a result of miners can earn extra tokens by including extra highly effective computer systems to their operations. Crypto “mines” are primarily large knowledge farms full of {hardware} working across the clock to resolve puzzles. When miners arrange store in a brand new place, they sometimes drive up electrical energy payments for close by communities. Plus, they depart behind e-waste from the {hardware} they use to resolve these puzzles.

In addition to Ethereum, the opposite main cryptocurrency notorious for issues related to proof of labor is Bitcoin. Bitcoin miners’ seek for ample, reasonably priced power to energy their operations has breathed new life into fossil gasoline energy crops that have been dying away. These crops then spew extra air pollution into the air.

Policymakers are grappling with learn how to handle all these penalties stemming from proof of labor. State legislators in New York, which turned a hub for crypto mining after China cracked down on it in 2021, handed a moratorium this yr on cryptocurrency mining operations that use proof of labor. Nationally, Democratic lawmakers have probed crypto mining corporations about their power use and have requested federal regulators to determine new guidelines for crypto mining within the US.

There’s even a marketing campaign known as Change the Code, Not the Local weather led by the nonprofits Greenpeace USA and Environmental Working Group that’s pushing the Bitcoin community to comply with Ethereum’s transfer.

Is The Merge going to repair Ethereum’s environmental issues?

The Merge, if all goes nicely, is predicted to shrink Ethereum’s environmental footprint considerably. To go away proof of labor behind, Ethereum is transitioning to a brand new course of for validating transactions known as proof of stake. This technique removes all that pesky puzzle fixing altogether — eliminating the necessity for highly effective {hardware} and big quantities of electrical energy to maintain the blockchain going.

As a substitute of utilizing monumental power prices as a deterrent to dangerous habits, proof of stake requires validators to lock up crypto tokens as collateral. That method, the validators have a stake in preserving the ledger correct. If anybody else on the community finds that somebody has added defective blocks to the chain, the responsible occasion loses tokens they’ve staked. In Ethereum’s case, it is advisable stake 32 ETH tokens to get began as a validator. With every token value round $1,600 at present — dangerous actors threat shedding a hefty amount of money.

Validators will nonetheless be rewarded with new tokens for doing the job proper. Staking tokens enters them into a brand new type of lottery to confirm blocks of transactions and obtain that reward. An algorithm randomly picks which validators, amongst those that have staked tokens, to create the subsequent block within the chain. To extend the chances of being the one chosen so as to add the block, you want extra tokens — not extra computing energy.

In consequence, a profitable transition to proof of stake is predicted to slash Ethereum’s power use by not less than 99 p.c. The Ethereum Basis put the quantity at roughly 99.95 p.c. There’s a couple of p.c of wiggle room based mostly on how a lot power is used after The Merge by the computer systems nonetheless wanted to retailer knowledge and confirm transactions. Validators will nonetheless need to preserve computer systems working 24/7, however they received’t be utilizing up as a lot juice to resolve these pesky puzzles.

General, we’re speaking about critical power financial savings. It’s equal to about as a lot electrical energy as 1 / 4 of the world’s knowledge facilities use yearly, in line with Alex de Vries, a researcher who runs the web site Digiconomist that tracks Bitcoin and Ethereum power use. de Vries expects that dramatic drop in power use to slash 30 to 35 million metric tons of carbon dioxide emissions a yr if The Merge is profitable.

How is that this all going to go down?

In a nutshell, all of the computer systems that run the blockchain’s software program must replace that software program to the latest model that makes use of proof of stake. After all, that’s simpler mentioned than executed whenever you’ve bought a whole lot of hundreds of nodes within the community. However we’ll get again to that later.

To get so far, researchers developed a brand new “Beacon Chain” that makes use of proof of stake that’s been working parallel to Ethereum’s most important proof of labor blockchain. The outdated blockchain ought to finally merge with the Beacon Chain, eliminating proof of labor. The Merge will happen in two phases, and the primary one simply kicked off after years of delays. The Bellatrix improve went dwell at present, which is able to get the Beacon chain prepared for the ultimate transition within the subsequent few weeks. Within the second part, the Paris improve, crypto mining for Ethereum that makes use of proof of labor, ought to lastly come to a cease.

What may go mistaken?

The massive fear is that too many miners will mutiny and determine to stay with proof of labor. They’ve already invested in establishing their crypto mining farms, and lots of will probably be hard-pressed to let go of their {hardware}. There are a pair alternative ways this mutiny may play out.

If sufficient of them determine to forego the software program replace, then they might preserve Ethereum’s outdated proof of labor blockchain alive. There’s already a push by some miners to do that. If that blockchain persists, so will the air pollution it produces. How a lot air pollution relies upon once more on what number of miners mutiny and the way a lot worth the tokens on that zombie chain, known as a “fork,” retain. They’ll primarily solely have the ability to maintain as a lot mining as the worth of the token permits since they’ve to have the ability to repay their electrical energy payments and nonetheless flip a revenue.

Or, the miners may select to seek out one other, extra established proof-of-work blockchain. The Ethereum community has already break up in two previously in response to a hack in 2016, which created two blockchains: Ethereum and Ethereum Basic (each use proof of labor). Now it appears to be like like some Ethereum miners are already shifting over to Basic in response to The Merge, sticking to their energy-hungry methods.

There are additionally safety dangers for Ethereum if there finally aren’t sufficient validators collaborating on the brand new proof of stake blockchain. “When you have very, only a few validators, then it’s simple to assault the community. So we need to be sure that the participation charge of a whole lot of hundreds of validators is near 99 p.c,” says Leonardo Bautista Gomez, founding father of the blockchain analysis group Miga Labs, who has additionally labored with the Ethereum Basis to assist develop the Beacon chain.

To Bautista Gomez, The Merge “exhibits that although it might be technically troublesome to implement, we take some time to do that as a result of we’re acutely aware of our environmental duties.”

However even when the whole lot goes easily with The Merge, blockchains are nonetheless inherently inefficient, says de Vries, who additionally works as a knowledge scientist for De Nederlandsche Financial institution. By nature of being a distributed database, knowledge is replicated throughout many gadgets, and that makes use of extra power. Nonetheless, de Vries acknowledges that proof of stake is orders of magnitude much less wasteful than proof of labor.

The Merge is tentatively anticipated to be executed by the end of the month. Then we’ll see how profitable the transition was and what new challenges might need arisen.

Crypto

Illegal Cryptocurrency Mixers Targeted: Operators Charged with Money Laundering – Regtechtimes

A federal grand jury in Georgia recently indicted three Russian nationals for their involvement in running illegal cryptocurrency mixer services that helped criminals launder money. The indictment, announced on January 7, 2025, involves Roman Vitalyevich Ostapenko, Alexander Evgenievich Oleynik, and Anton Vyachslavovich Tarasov. These individuals are accused of operating two online services called Blender.io and Sinbad.io, which helped criminals hide the source of their illegal funds.

A cryptocurrency mixer is a tool used to mix cryptocurrencies like Bitcoin, making it harder for authorities to trace the origin of digital money. These services are attractive to criminals involved in activities such as ransomware attacks and fraud, as they allow them to send funds anonymously.

Ostapenko and Oleynik were arrested in December 2024, while Tarasov is still on the run. The three men face serious charges related to money laundering and operating unlicensed financial businesses. If convicted, they could face up to 20 years in prison for laundering money and up to five years for running an unlicensed business. The indictment follows the earlier shutdown of the Sinbad.io service after it was seized by law enforcement in 2023.

The Role of Blender.io and Sinbad.io

Blender.io and Sinbad.io were both cryptocurrency mixers, meaning they offered a way to send digital money anonymously. For a fee, these services allowed criminals to send their funds without revealing where the money came from. This feature made these mixers attractive to those who wanted to hide stolen funds or profits from illegal activities, such as ransomware attacks, fraud, and even theft of virtual currencies.

Extradited for Fraud: Do Kwon Faces Justice After $40B Crypto Crash

Blender.io operated from 2018 to 2022 and was known for its promise of anonymity. It advertised a “No Logs Policy,” meaning it claimed to have no records of transactions. The site also reassured users that no personal details were needed to use the service. This allowed criminals to send and receive Bitcoin without leaving a trace of their identity.

After Blender.io was shut down in 2022, the defendants launched Sinbad.io, which offered similar services. This service continued until law enforcement authorities took it down in November 2023, marking a significant victory in the fight against cybercrime. The shutdowns of both services were the result of coordinated efforts by authorities from several countries, including the U.S., the Netherlands, Finland, and Australia.

Both Blender.io and Sinbad.io were not only used by ordinary criminals but were also linked to state-sponsored hacking groups. For instance, Blender.io was used by North Korean hackers to launder funds stolen through cyberattacks. Similarly, Sinbad.io had connections to cybercriminals who targeted businesses and individuals. These cryptocurrency mixers served as a vital tool in helping these criminals profit from their illegal activities, making it harder for authorities to trace the stolen money back to its original source.

Crypto-currency Scam Wipes Out $425,000 from Ohio Man’s Retirement Fund

International Cooperation in Combating Cybercrime

The investigation into Blender.io and Sinbad.io showcases the power of international cooperation in tackling cybercrime. The indictment was made possible by the joint efforts of law enforcement agencies from different countries, including the U.S. Department of Justice, the FBI, the Netherlands’ Financial Intelligence Service, and Finland’s National Bureau of Investigation. Their collaboration helped track down the operators of these illegal services and ultimately led to their takedown.

In addition to the U.S. authorities, international agencies like the Australian Federal Police and Finland’s National Bureau of Investigation played key roles in the investigation. Their contributions were essential in identifying the people responsible for running these cryptocurrency mixers and disrupting their illegal activities.

The importance of international cooperation cannot be overstated. Cybercrime often crosses national borders, and without the efforts of multiple countries working together, it would be much harder to stop these crimes. The arrests of Ostapenko and Oleynik, along with the ongoing search for Tarasov, send a strong message to cybercriminals around the world: law enforcement agencies are committed to identifying and holding accountable those who operate illicit financial networks.

This case highlights how dangerous these cryptocurrency mixers can be in enabling serious criminal activities. By breaking down these networks, authorities are making it harder for criminals to profit from their wrongdoing, while also protecting public safety and national security.

To read the original order please visit DOJ website

Crypto

US Rep. Bryan Steil to chair House cryptocurrency subcommittee

A Wisconsin congressman will head the House Subcommittee on Digital Assets, Financial Technology, and Artificial Intelligence.

Bryan Steil, a Republican representing the 1st Congressional District in southeast Wisconsin, was appointed to the role Thursday.

His subcommittee’s jurisdiction includes things like mobile banking and non-fungible tokens, or NFTs. It’ll also be the first stop for legislation on cryptocurrency.

Stay informed on the latest news

Sign up for WPR’s email newsletter.

Digital currencies have a murky federal regulatory status. That allowed President Joe Biden’s Securities and Exchange Commission Chair Gary Gensler to go after the crypto industry.

The industry responded by spending over $130 million in 2024’s election cycle through its PAC, Fairshake.

It spent $764,206 to independently help re-elect Steil, according to campaign finance database OpenSecrets.

In a statement, Steil said “technologies like financial apps, digital assets, and machine learning revolutionize our economy,” adding that he looks forward to continuing “to provide the rules of the road to move our economy into the future.”

Steil was appointed to his new role by House Financial Services Chair French Hill, R-Arkansas. Hill’s top campaign contributors include the CEOs of the crypto exchange platform Coinbase and the Charles Schwab Corporation.

One of his legislative priorities has been a bill that would set up clearer, crypto-friendly federal financial regulations, which passed the House with bipartisan support in May. He called Steil “instrumental” in passing that bill, and in overturning an SEC rule requiring crypto exchanges to list their digital assets as liabilities on their balance sheets.

Now, the Janesville native will oversee hearings and votes on new crypto-related legislation.

Wisconsin Public Radio, © Copyright 2025, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.

Crypto

Which Crypto To Buy Right Now? 10 Best Cryptocurrency Coins For 2025

As Ripple’s XRP ongoing legal troubles continue to keep traders on edge, Polkadot (DOT), Ethereum (ETH), Ethena (ENA), and Cardano (ADA) remain steady. Meanwhile, Injective (INJ), Optimism (OP), Uniswap (UNI), and Tron (TRX) show mixed signals in trading activities. In the middle of all this, whispers of a new market disruptor are growing louder—JetBolt (JBOLT), making headlines with its blazing presale and zero-gas technology. With over 250 million JBOLT tokens already sold, JetBolt’s momentum is undeniable.

With everything from groundbreaking ecosystems to cross-chain powerhouses, the question remains: which crypto to buy right now? Would established crypto coins or rising blockchain superstars dominate 2025? Let’s explore why JetBolt, Polkadot, XRP, Ethereum, Ethena, Optimism, Injective, Uniswap, Cardano, and Tron are the 10 best cryptocurrency coins for 2025.

Which Crypto To Buy Right Now? A Quick List

- JetBolt (JBOLT): Surging new altcoin empowering gas-free transactions, AI intelligence and staking.

- Ethena (ENA): Redefining stablecoins with decentralized innovation.

- Optimism (OP): Scaling Ethereum with lightning-fast rollups.

- Injective (INJ): Unlocking limitless decentralized trading possibilities.

- Uniswap (UNI): Revolutionizing DeFi through seamless token swaps.

A Deep Dive Into the 10 Best Cryptocurrency Coins For 2025

- JetBolt (JBOLT)

JetBolt (JBOLT) is shaking up the crypto world, skyrocketing its way onto traders’ radar as one of the 10 best cryptocurrency coins for 2025 to buy right now. The buzz? Zero gas fees. JetBolt’s game-changing tech, built on the Skale Network, eliminates gas fees entirely, delivering lightning-fast, gas-free transactions that are already turning heads across the crypto space.

This revolutionary feature could also supercharge creativity. Developers can now launch and create dApps, SocialFi platforms, and blockchain gaming ventures without worrying about skyrocketing gas fees holding back innovation.

But that’s not all—JetBolt goes beyond just being another zero-gas token. With an AI-driven crypto tool delivering the latest crypto news and market data straight to its platform, JetBolt is showcasing how blockchain technology and artificial intelligence can go hand-in-hand to add a new functionality to crypto.

Turning it up a notch, JetBolt’s easy-to-earn staking mechanism turns ordinary staking into an electrifying experience. With its sleek, user-friendly Web3 wallet, joining is as effortless as a few clicks. And the twist: staking isn’t just about locking in tokens—it’s about active participation. Engage within the ecosystem and stakers earn even more rewards.

Meanwhile, JetBolt’s presale numbers don’t lie. Over 250 million JBOLT tokens have already been scooped up, with whales diving in to secure their piece of this zero-gas action. In addition, JetBolt’s Alpha Boxes, an exclusive presale perk that boosts batch token purchases by up to 25%, have been flying off the shelves, creating a frenzy that shows no signs of slowing down.

In a world where high gas fees and slow transactions plague most blockchains, JetBolt delivers something truly revolutionary. With every cutting-edge feature thoughtfully designed to resonate with modern and future crypto users, JetBolt quietly sets the bar higher for what blockchain networks can deliver—blending innovation and ease of use into a whole new crypto experience.

- Polkadot (DOT)

Polkadot (DOT) has dropped over 5% in the past week to $6.71 amid $1.23 million in long liquidations. Despite the dip, its advanced parachain technology and expanding ecosystem position Polkadot as a key player in 2025’s multichain future, with crypto analysts targeting $20 soon.

- Ripple (XRP)

Ripple’s (XRP) price holds at $2.34 with a $134.48 billion market cap. Crypto analysts anticipate a $3 breakout, driven by Ripple’s renewed U.S. expansion amid regulatory optimism under Trump. Its focus on blockchain-based CBDC solutions positions XRP as a key player for 2025.

- Ethereum (ETH)

Ethereum (ETH) trades at $3,319.97 following a 10% drop after the Foundation’s 100 ETH sale. Key support stands at $3,061, with resistance at $3,500. Despite short-term bearish momentum, Ethereum’s dominance in DeFi, staking, and upcoming Danksharding upgrade makes it a top contender for 2025.

- Ethena (ENA)

Ethena (ENA) faces bearish momentum, trading at $0.9295 with a $2.81 billion market cap. The Death Cross and oversold RSI signal risks, though possible rebounds could push Ethena toward $1.01.

Meanwhile, Trump’s World Liberty Financial putting in millions in Ethena has fueled bullish sentiment, signaling growing institutional interest. This strategic move could boost ENA’s credibility and adoption, providing holders possible stability and long-term value.

X posts by Panos highlight Trump’s World Liberty Financial purchasing millions of dollars in Ethena (ENA)

In addition, its unique stablecoin protocol expansion strengthens Ethena’s DeFi appeal, further establishing it as one of the top picks for 2025.

- Optimism (OP)

Optimism (OP) trades at $1.79 with a $2.41 billion market cap. Despite recent bearish sentiment, its Bedrock upgrade, reducing transaction costs by 40%, positions Optimism as a key Ethereum Layer 2 solution. Crypto analysts eye $2.20 resistance and possible $3.00 targets for OP.

- Injective (INJ)

Injective (INJ) is now priced at $21.18 with key support at $22 and resistance near $26. A breakout from its descending channel hints at possible bullish trajectories. Injective’s unique focus on decentralized derivatives trading and cross-chain liquidity positions it among 2025’s top cryptocurrencies.

- Uniswap (UNI)

Uniswap (UNI) struggles with a 0.33% daily dip, trading at $12.99 with a $7.8 billion market cap. Despite bearish trends, its innovative decentralized exchange model and Layer 2 scaling solutions could drive renewed interest, positioning UNI as a top 2025 contender.

- Cardano (ADA)

Cardano (ADA) now trades at $0.9286 with a $32.67 billion market cap. Crypto analysts predict a price range of $1.50 to $2.50 in 2025, depending on key support levels and market sentiment. Cardano’s Hydra upgrade pledges scalability, boosting adoption across decentralized applications.

- Tron (TRX)

Tron (TRX) is holding just a little above key support at $0.245, currently pinned at $0.2463. A possible breakout above $0.2700 could push TRX’s prices toward $0.40. Recent partnerships and its ISO 20022 integration further position Tron as a top blockchain for institutional adoption.

What is the best crypto to buy right now in 2025?

While nothing in crypto is ever guaranteed, JetBolt (JBOLT) stands out as one of the top choices for the best cryptocurrency coins to buy right now. With its zero-gas technology, crypto-earning staking model, and AI-powered functionality, JetBolt is leading the way in redefining user-friendly blockchain experiences. JetBolt’s ongoing presale success—with whales already snapping up over 250 million JBOLT tokens—also signals growing excitement around its ecosystem.

What are the 10 best cryptocurrency coins for 2025?

Based on recent price movements and market insights, here are the top 10 best cryptocurrency coins for 2025:

- Ethereum (ETH)

- Cardano (ADA)

- JetBolt (JBOLT)

- Tron (TRX)

- Polkadot (DOT)

- Ripple (XRP)

- Uniswap (UNI)

- Injective (INJ)

- Optimism (OP)

- Ethena (ENA)

This list of the best cryptocurrencies to buy right now for 2025 include coins with strong ecosystems, utility, and continued development.

In Summary: 10 Best Cryptocurrency Coins to Watch for 2025

Major crypto names like Ethereum (ETH), Ripple’s XRP, Cardano (ADA), and Polkadot (DOT) remain dominant, but breaking news highlights JetBolt’s (JBOLT) presale success and groundbreaking innovations as whale activity surges. Meanwhile, Ethena (ENA), Optimism (OP), Injective (INJ), Uniswap (UNI), and Tron (TRX) also make the list with key developments and strong ecosystems driving interest. Whether through staking rewards, blockchain scalability, or decentralized applications, these cryptocurrency coins deliver unique propositions worth following closely in the coming months.

Explore JetBolt’s game-changing technology and seize the presale excitement by visiting:

JetBolt’s Official Website: https://jetbolt.io/

JetBolt on X: https://x.com/jetboltofficial

Please note that this write-up is not financial advice. Remember that all cryptocurrencies are volatile. Always do your research and consult experts before navigating the unpredictable world of digital assets. No future performance is ever guaranteed, so always exercise caution.

-

Politics1 week ago

Politics1 week agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics1 week ago

Politics1 week agoCarter's judicial picks reshaped the federal bench across the country

-

Politics7 days ago

Politics7 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health6 days ago

Health6 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoSouth Korea extends Boeing 737-800 inspections as Jeju Air wreckage lifted

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg) Technology2 days ago

Technology2 days agoMeta is highlighting a splintering global approach to online speech

-

World1 week ago

World1 week agoWeather warnings as freezing temperatures hit United Kingdom

-

News1 week ago

News1 week agoSeeking to heal the country, Jimmy Carter pardoned men who evaded the Vietnam War draft