Crypto

Explainer: What makes a crypto asset a security in the US?

What did the Ripple judge say?

US District Judge Analisa Torres in New York found some digital token sales by Ripple did not violate the law as alleged by US Securities and Exchange Commission. The SEC sued Ripple for conducting an unregistered offering of $1.3 billion in XRP between 2013 and 2020. Torres ruled that Ripple’s sales on public exchanges to retail investors were not offers of securities under the law because purchasers did not have a reasonable expectation of profit tied to Ripple’s efforts.

Those sales were “blind bid/ask transactions,” she said, in which buyers “could not have known if their payments of money went to Ripple, or any other seller of XRP.”

It was the biggest win for a cryptocurrency company in a case brought by the SEC. The regulator got a partial victory because Torres also ruled that Ripple violated securities laws when it sold XRP directly to sophisticated investors such as hedge funds.

Discover the stories of your interest

What has the SEC been alleging?

The regulator has brought more than 100 enforcement actions against crypto companies, claiming digital assets are securities. The biggest case was brought this year. The SEC said Coinbase, the largest US cryptocurrency platform, allowed users to trade at least 13 crypto assets that should have been registered as securities, including tokens such as Solana, Cardano and Polygon. Coinbase denied the allegation.

Industry players have insisted that most cryptocurrencies – which operate on a database shared across a network of computers, known as a blockchain – do not fit the US legal definition of securities. They say the SEC has been vague and inconsistent and have called for new regulations or laws.

What is a ‘security’ under US law?

To SEC’s contends crypto assets are securities, citing a US Supreme Court case from 1946 dealing with investors in Florida orange groves owned by the W. J. Howey Co.

The court ruled that “an investment of money in a common enterprise with profits to come solely from the efforts of others,” is a kind of security called an investment contract.

The SEC had jurisdiction to seek to prevent Howey from selling to out-of-state investors fractional land interests with a contract to provide profit from the harvest, the court said.

Securities, unlike assets such as commodities, are strictly regulated and require detailed disclosures to inform investors of potential risks.

What have other judges said?

Many of the SEC’s crypto-related cases have ended in settlements, with companies paying fines and agreeing to follow US law or exiting the US market.

Before the Ripple decision, judges in the few cases decided in court agreed with the SEC that specific crypto assets were securities.

Those rulings said developers’ statements tying the value of their digital assets to efforts to grow or maintain the associated blockchain systems showed investor profits depended on the “efforts of others.”

Courts have also decided that investors in those assets participated in a “common enterprise” because the funds they spent were pooled by the token issuer and used to develop relevant systems.

What about Bitcoin?

Bitcoin is not considered a security because its anonymous and open-source origins mean investor profits are not dependent on the efforts of developers or managers, said Carol Goforth, a law professor at the University of Arkansas.

Some blockchain projects have tried to fund their operations in two stages, by offering securities under SEC regulations and later giving or selling those investors cryptocurrency after building a functional blockchain.

Goforth said the developers hoped that approach would remove the “common enterprise” element, but she added the SEC has never clarified what it would take to convert a security to a non-security.

Crypto

Trump Declared Over $600 Million in Income From Cryptocurrency and Business – Reuters

US President Donald Trump has released his financial statement. According to the document, he received over $600 million in income from cryptocurrencies, golf clubs, licensing and other businesses. This was reported by Reuters, writes UNN.

Details

The financial declaration was signed on June 13 and did not contain information about the period it covers. At the same time, some data in the declaration suggest that it was until the end of December 2024, which excludes most of the money raised by the Trump family’s cryptocurrency ventures.

According to the publication’s calculations, Trump declared assets worth at least $1.6 billion in total.

He previously stated that he had transferred his businesses to a trust managed by his children, but the published data indicate that income from these sources still goes to the president, which has led to accusations of conflicts of interest.

Some of Trump’s businesses in areas such as cryptocurrency are benefiting from changes in US policy under his leadership and have become a source of criticism, Reuters writes.

One meme coin issued by the president earlier this year – $TRUMP brought in approximately $320 million in commissions, although it is not publicly known how this amount was distributed between the Trump-controlled organization and its partners.

The feud between Trump and Musk caused Tesla’s stock to crash, with a market value drop of $150 billion.

06.06.25, 09:15 • 3708 views

In addition to the meme coin commissions, the Trump family earned more than $400 million from World Liberty Financial, a decentralized financial company. In his declarations, Trump indicated $57.35 million from the sale of World Liberty tokens.

The American president’s fortune also includes a significant stake in Trump Media&Technology Group (DJT.O), which owns the Truth Social social network, the report said.

In addition to assets and income from his business projects, Trump declared at least $12 million in income in the form of interest and dividends from passive investments totaling at least $211 million, according to Reuters calculations.

Trump’s three golf resorts in Jupiter, Doral and West Palm Beach, and a private members’ club in Mar-a-Lago, brought Trump at least another $217.7 million in income. Trump National Doral, a large golf center in the Miami area, was the Trump family’s largest source of income – $110.4 million.

Trump also received royalties from various deals – $1.3 million from Greenwood Bible, the “only Bible officially endorsed by Lee Greenwood and President Trump”, and $2.8 million from Trump Watches, $2.5 million from Trump Sneakers and Fragrances.

According to Reuters, the declaration often only indicates ranges of asset and income values, and the lower limit was used for calculations, so the real value of Trump’s assets and income is most likely even higher.

Trump changed his approach to deportations: raids on farms, hotels and restaurants have been stopped – NYT14.06.25, 10:18 • 2808 views

Crypto

Kevin O’Leary Explains Which Cryptocurrency Is a Smarter Bet: Bitcoin or Ethereum

The cryptocurrency market offers hundreds of different investment options, but two of them control most of the action: bitcoin and ethereum. As recently as last year, the combined market cap of both platforms made up more than 70% of the global crypto market, according to U.S. News & World Report.

Advertisement: High Yield Savings Offers

Powered by Money.com – Yahoo may earn commission from the links above.

Read Next: 13 Cheap Cryptocurrencies With the Highest Potential Upside for You

Check Out: 5 Types of Cars Retirees Should Stay Away From Buying

So which is a better bet for investors? During a recent interview with CoinDesk, businessman and “Shark Tank” star Kevin O’Leary suggested his preference.

Also see five reasons you need at least one bitcoin.

O’Leary shared during the interview that his preference is bitcoin. “If you want exposure to crypto volatility, it’s bitcoin,” O’Leary said. “There’s a lot of people that say, ‘I don’t need anything else … I’ll just buy bitcoin.’ And they haven’t been wrong … I think it’ll be very hard to dethrone it.”

As for ethereum, O’Leary spent much of his time bemoaning its lack of speed and efficiency.

“Goodness, ETH is slow,” he said. “I’m sorry, but it’s slow, and I think a lot of people know that. And the more transactions get piled on it, it doesn’t get any better.”

Learn More: Coinbase Fees: Full Breakdown of How To Minimize Costs

O’Leary has plenty of company in backing bitcoin over ethereum.

Part of bitcoin’s allure is that it has become a dominant crypto force in both size and name recognition. It has grown so big that it recently leapfrogged Google parent Alphabet to rank as world’s sixth-largest asset by market cap, The Market Periodical reported.

From a pure investment standpoint, bitcoin has definitely been the better bet recently. Its price is up about 12% in 2025 as of June 13 and has gained about 56% over the past year. In contrast, ethereum’s price is down about 23% in 2025 and has lost more than 27% over the past year.

If you’re new to crypto, it’s important to understand the differences between bitcoin and ethereum, because it’s not an apples-to-apples comparison.

As U.S. News reported, bitcoin’s network uses a proof-of-work verification system. Ethereum, on the other hand, uses a proof-of-stake system, which U.S. News called “less energy-intensive.” Additionally, the main purpose of bitcoin is to serve as a digital currency that’s an alternative to other currencies, while ethereum is a platform that runs smart contracts, U.S. News explained.

According to VanEck, a New York-based investment management firm, both bitcoin and ethereum have seen their prices fluctuate significantly over the years. Despite that, VanEck noted that bitcoin has been the outperformer, remaining more stable than ethereum.

Crypto

Alchemy Pay Partners With Backed to Integrate xStocks on Its Platform, Pioneering the First Direct Fiat Access to Tokenized Stocks and ETFs – Branded Spotlight Bitcoin News

-

West1 week ago

West1 week agoBattle over Space Command HQ location heats up as lawmakers press new Air Force secretary

-

Technology1 week ago

Technology1 week agoiFixit says the Switch 2 is even harder to repair than the original

-

Business1 week ago

Business1 week agoHow Hard It Is to Make Trade Deals

-

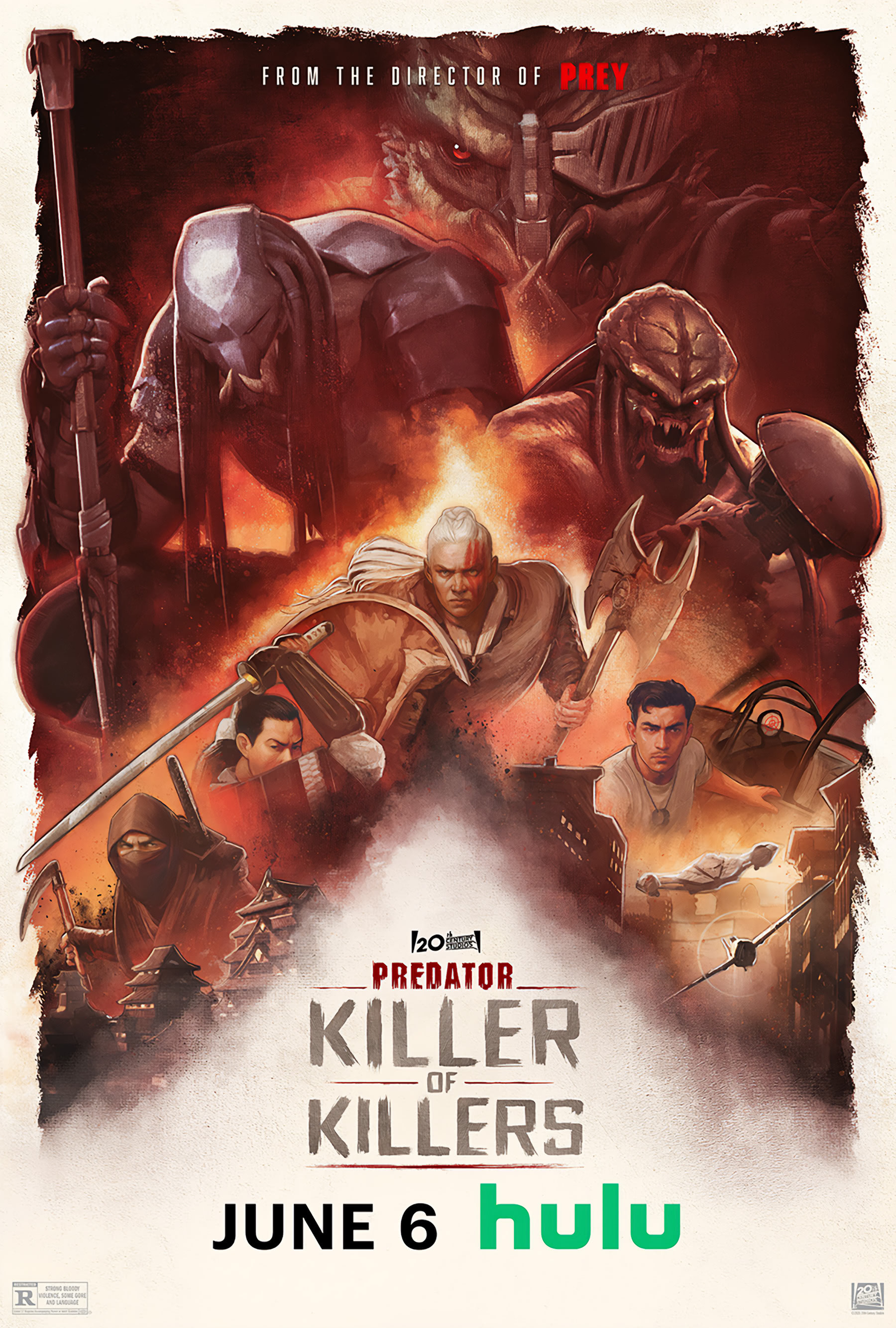

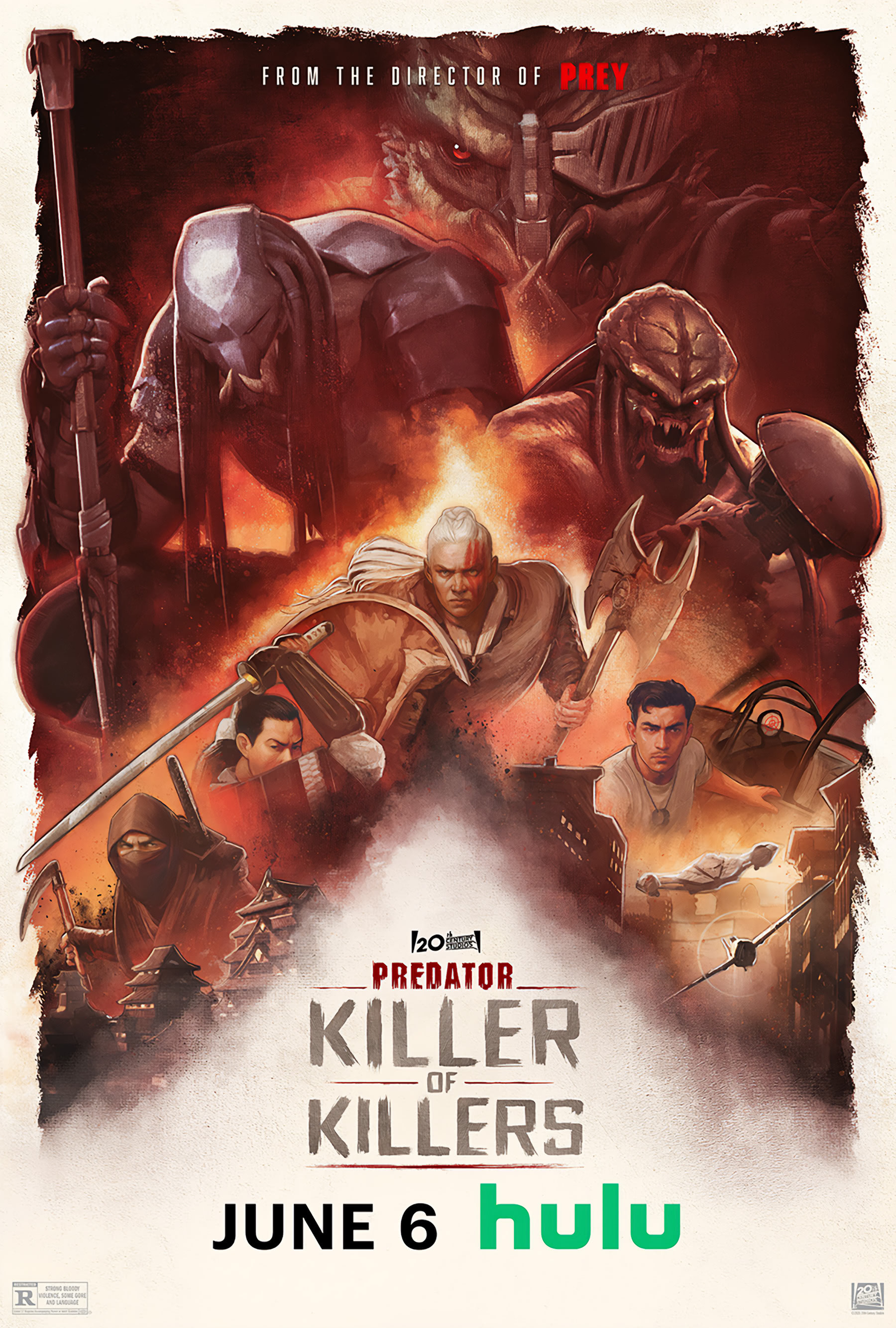

Movie Reviews1 week ago

Movie Reviews1 week agoPredator: Killer of Killers (2025) Movie Review | FlickDirect

-

Politics1 week ago

Politics1 week agoA History of Trump and Elon Musk's Relationship in their Own Words

-

World1 week ago

World1 week agoUS-backed GHF group extends closure of Gaza aid sites for second day

-

World1 week ago

World1 week agoMost NATO members endorse Trump demand to up defence spending

-

News1 week ago

News1 week agoAmid Trump, Musk blowup, canceling SpaceX contracts could cripple DoD launch program – Breaking Defense