Crypto

Elon Musk deep fakes promote new cryptocurrency scam

Cryptocurrency scammers are utilizing deep faux movies of Elon Musk and different outstanding cryptocurrency advocates to advertise a BitVex buying and selling platform rip-off that steals deposited foreign money.

This faux BitVex cryptocurrency buying and selling platform claims to be owned by Elon Musk, who created the positioning to permit everybody to earn as much as 30% returns on their crypto deposits.

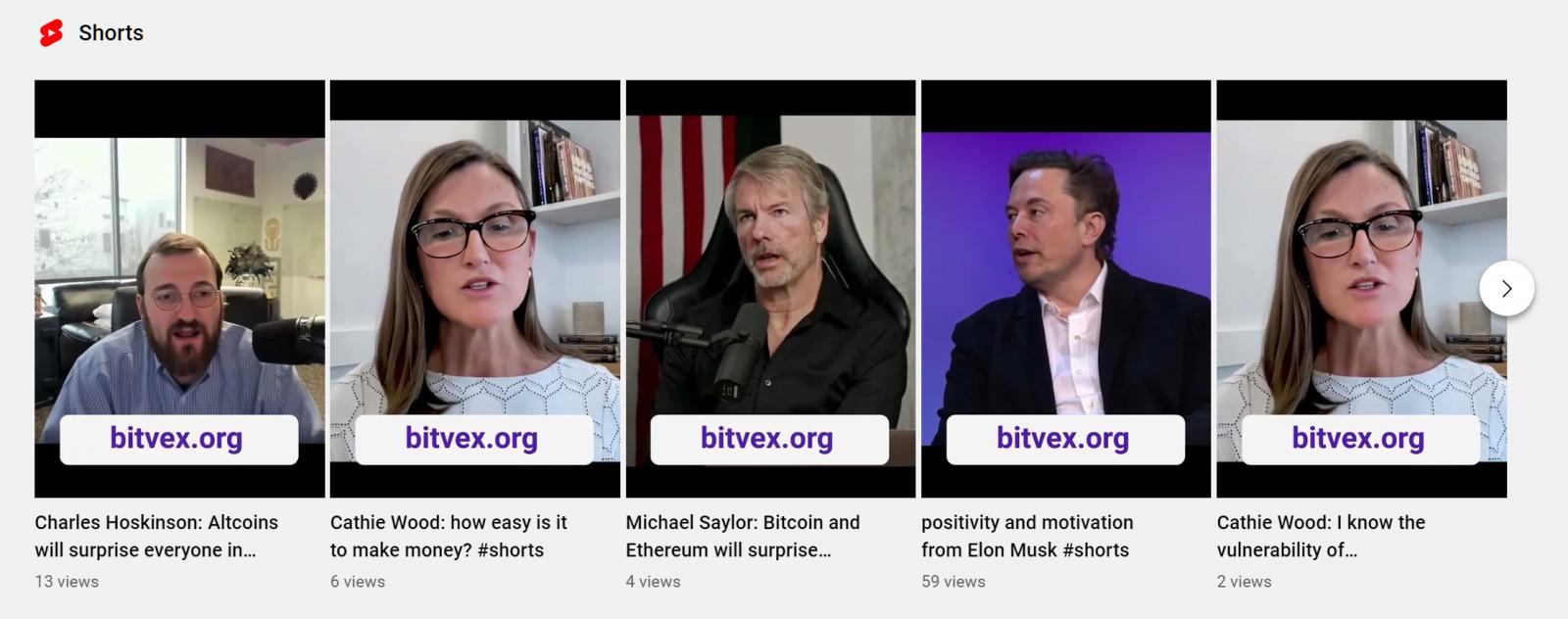

This rip-off marketing campaign began earlier this month with menace actors creating or hacking current YouTube accounts to host deep faux movies of Elon Musk, Cathie Wooden, Brad Garlinghouse, Michael Saylor, and Charles Hoskinson.

These movies are authentic interviews modified with deep faux know-how to make use of the particular person’s voice in a script offered by the menace actors.

An instance of one of many rip-off movies could be seen beneath, the place Elon promotes the brand new rip-off website and says he invested $50 million into the platform.

Nevertheless, for those who look rigorously, you will note that the deep faux synchronizes the particular person’s speaking to the menace actor’s script, which is so foolish as to be comical.

How do we all know it is a rip-off?

Whereas it’s apparent that the interviews have been altered to simulate Elon Musk’s voice to advertise the BitVex buying and selling platform, quite a few different clues present that it is a rip-off.

Many YouTube channels selling this buying and selling platform have been hacked to all of a sudden present YouTube movies or YouTube Shorts that promote the BitVex buying and selling website.

For instance, a YouTube channel that displayed gaming movies in Arabic all of a sudden started exhibiting a collection of YouTube Shorts that promoted the BitVex rip-off. As well as, BleepingComputer has discovered dozens of different YouTube channels hijacked equally to advertise this rip-off.

Source: BleepingComputer

When you go to the BitVex buying and selling website itself, it turns into extra obvious that it is a rip-off.

For instance, the positioning claims that Elon Musk is the CEO of the buying and selling platform and comprises endorsements from Ark Make investments’s Cathie Wooden and Binance CEO Changpeng Zhao.

Source: BleepingComputer

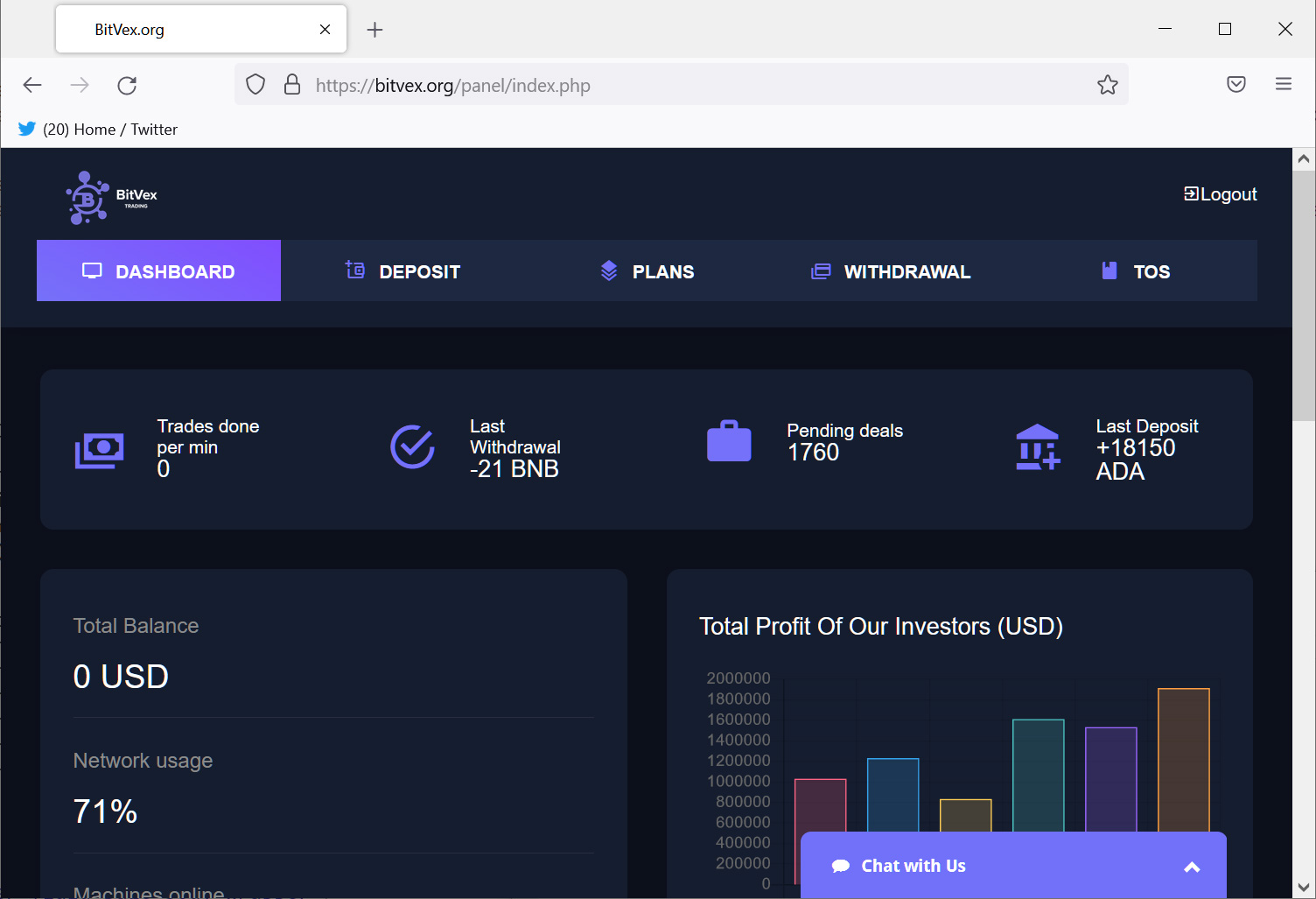

To make use of the BitVex platform, customers should register an account at bitvex[.]org or bitvex[.]web to entry the funding platform.

When you log in, the positioning will show a dashboard the place you may deposit varied cryptocurrencies, choose an funding plan, or withdraw your earnings.

Like virtually all cryptocurrency scams, the dashboard will show latest withdrawals of varied cryptocurrencies to make the positioning seem authentic, as proven beneath.

Source: BleepingComputer

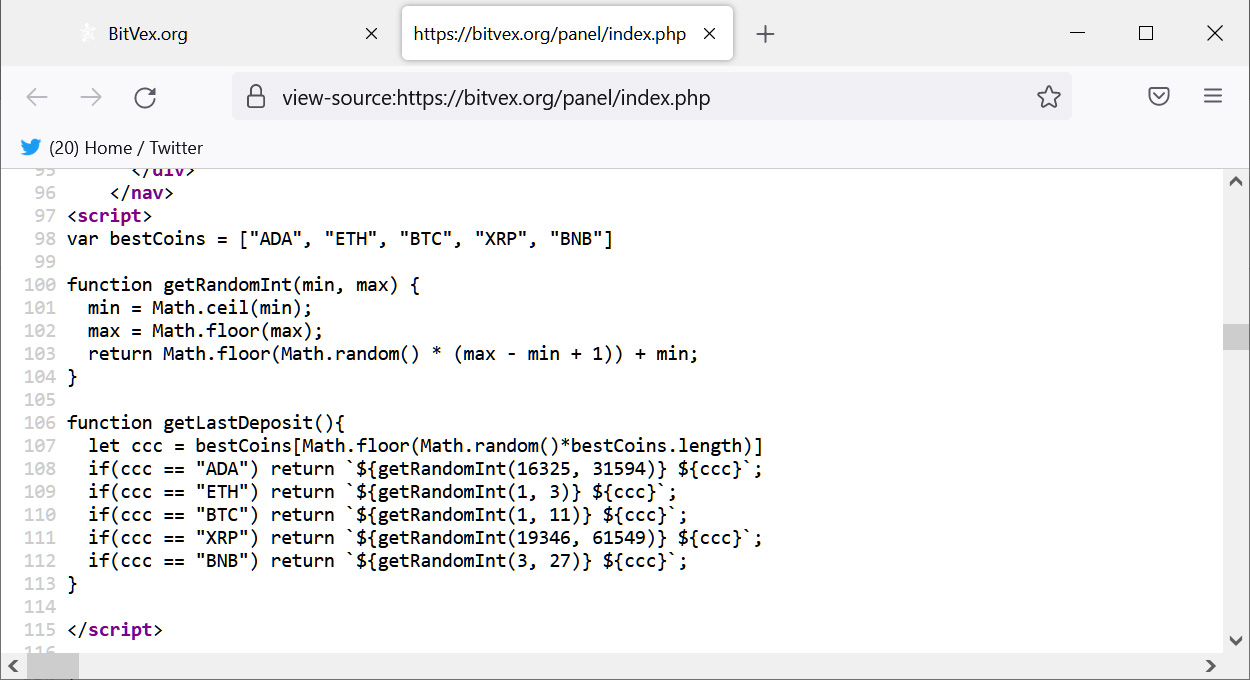

Nevertheless, these withdrawals are created via JavaScript, randomly choosing considered one of 5 totally different cryptocurrencies (Cardano, Ethereum, Bitcoin, Ripple, or Binance Coin) and randomly producing withdrawal quantities. These faux withdrawals are modified randomly on every web page refresh.

Source: BleepingComputer

Fortunately, the rip-off doesn’t seem too profitable, with solely $1,700 deposits to the rip-off’s cryptocurrency addresses seen by BleepingComputer. Nevertheless, these addresses are doubtless rotated, so they might have stolen extra for the reason that rip-off launched.

A few of the cryptocurrency addresses used on this rip-off are listed beneath:

- Bitcoin – 16Ge7LhzpxHTSQLptSe4sptseVwDYU6gpN (Earned $1,280.82)

- Bitcoin Money – qpkrguy6ralp0pux390fr7pz2ugpq90s3uach9m42j

- Ethereum – 0x1087d3584AB80df8d14B4D7d5A2091C3Bb55eF2F

- Tether – TRh8zMBdcEEZdPBC6xkBmkd5SrpkRQEjWK

- Dogecoin – DDu1kVvtd9bc4jQ1uY7EUBBddmzTgjbsav

- Polkadot – 16keizqPvkS3uQ4Cad9vPNoQhbstKNqJtTG1Uk8i6mY8JNTL

Whereas it might be exhausting to consider that folks would fall for these scams, faux cryptocurrency giveaways and funding schemes are recognized to generate tens of millions of {dollars} for menace actors.

In January 2021, a faux Elon Musk crypto giveaway rip-off earned $580k in only one week.

Much more not too long ago, an Ark Make investments-themed rip-off promoted on YouTube stole $1.3 million by simply re-streaming an edited model of an outdated reside panel dialogue on cryptocurrency with Elon Musk, Jack Dorsey, and Cathie Wooden of Ark Make investments.

These scams have gotten so pervasive and worthwhile that the FTC launched a report warning that $80 million has been misplaced to cryptocurrency funding scams since October 2020.

Due to this fact, it’s important to acknowledge that just about each crypto giveaway website is a rip-off, particularly these allegedly from Elon Musk, Tesla, SpaceX, Ark Make investments, and Gemini that promise large returns.

When you see emails, tweets, movies, or different messages on social media selling these kinds of giveaways, keep in mind that any cryptocurrency you ship is not going to produce something in return.

Crypto

Should You Forget Bitcoin and Buy Solana Instead? | The Motley Fool

Bitcoin‘s (BTC -0.48%) price hit an all-time high of $103,332 on Dec. 4. Four main catalysts drove it to that point: the approvals of its first spot price ETFs in January; its latest halving in April, which cuts its rewards for mining in half every four years; interest rate cuts; and President-elect Trump’s crypto-friendly policies.

Bitcoin’s price has pulled back to about $97,000 as of this writing, but it remains up more than 120% over the past 12 months. With a market capitalization of $1.93 trillion, it’s the world’s top cryptocurrency and seventh most valuable asset.

Image source: Getty Images.

Bitcoin is still a solid long-term play on the cryptocurrency market, but it might have less upside potential than its smaller coins. Could one of those tokens be Solana (SOL -0.99%), which trades at about $190 with a market cap of $90 billion?

What sets Solana apart from Bitcoin?

Solana’s tokens are validated with the proof of stake (PoS) method, which doesn’t require any tokens to be digitally mined. That approach is faster and more energy efficient than the proof of work (PoW) mining mechanism used by Bitcoin.

PoW blockchains are only used for mining more tokens. PoS blockchains support smart contracts, which can be used to develop decentralized apps (dApps), games, non-fungible tokens (NFTs), and other crypto assets. PoS tokens can also be “staked,” or locked up, on the blockchain for a period of time to earn interest-like rewards.

Bitcoin’s value is often defined by its scarcity. It has a maximum supply of 21 million tokens, and nearly 20 million of them have already been mined. The last Bitcoin is expected to be mined in 2140, which makes it somewhat comparable to gold or silver.

Solana and other PoS tokens are usually valued by the speed of their blockchains and the growth of their developer ecosystems. Solana has a current supply of nearly 591 million tokens and no maximum supply, but it’s set to reduce its annual inflation rate, currently at 4.83%, by 15% every “epoch year,” which amounts to 450-630 days.

What sets Solana apart from other PoS tokens?

Solana is often overshadowed by Ethereum (ETH -1.34%), the world’s second largest cryptocurrency and top PoS blockchain. Ethereum has its own native token, Ether, but many other smaller PoS tokens, including Shiba Inu, Polygon, and Render, run on its blockchain. It’s easier to directly launch a new token on Ethereum’s blockchain than to build one from scratch, but these tokens are ultimately constrained by Ethereum’s speed limitations.

Solana is a newer PoS blockchain that accelerates its transactions with its own proof-of-history (PoH) mechanism. That upgrade already enables Solana’s blockchain to process transactions roughly 46 times faster than Ethereum, but it’s only achieved less than 2% of its theoretical max speed so far.

Solana’s high-speed blockchain has attracted a lot of developers and partners. It’s been used to develop meme coins such as BONK and WIF, and it powers decentralized exchanges including Jupiter and Orca. It supports stablecoin transactions for Visa, PayPal, and Circle, and it’s integrated its Solana Pay payment protocol into Shopify‘s platform.

Solana even launched its own Android smartphone for Web3 apps, the Saga Phone, in 2023. It’s still a niche gadget, but it sports its own dApps Store as an alternative to Alphabet‘s Google Play Store.

But over the past two years, Solana dealt with network congestion problems, spam transactions, and security failures. One of its top investors was also the failed crypto exchange FTX, which hastily liquidated its tokens at a discount to pay off its creditors. All of those challenges, along with rising interest rates, drove its price below $10 in December 2022.

What’s next for Solana?

Solana’s price has already soared nearly 19 times from its all-time low, but it could head even higher as it resolves its network issues, it laps FTX’s big sale, and interest rates gradually decline. Several big crypto firms, including Grayscale, Bitwise, and VanEck, have also recently filed for the approvals of Solana spot price ETFs.

Those ETF approvals could stabilize Solana’s price while bringing in more retail and institutional investors. They would also probably mark its transition from a smaller altcoin to a “blue chip” cryptocurrency such as Bitcoin and Ether.

But is Solana a viable alternative to Bitcoin?

Solana is an interesting alternative to Ether, but it’s not a viable replacement for Bitcoin yet. Solana might be a good investment if you believe it can keep increasing its speed, expanding its ecosystem, and gaining new ETF approvals. However, it’s still an inflationary token that’s much harder to value than Bitcoin.

It could be smart to invest in both Bitcoin and Solana, but investors should be aware of their differences. Bitcoin can be considered a digital alternative to gold, but Solana’s value will be defined by its transaction speeds and developer appeal.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Leo Sun has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Bitcoin, Ethereum, PayPal, Render Token, Shopify, Solana, and Visa. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal and short December 2024 $70 calls on PayPal. The Motley Fool has a disclosure policy.

Crypto

How Bitcoin and other cryptocurrency made a strong comeback in 2024

)

As the year 2024 ends, here is a look at the performance of cryptocurrency, especially bitcoin, that turned fortune of the investors within days

read more

Crypto was not much known to a common man or small scale investors till the digital currencies in the basket, including the oldest and most-traded – bitcoin, broke all records to touch a new life-time high especially after Donald Trump’s win in the November 5, 2024 US Presidential election.

But before understanding about a strong comeback, let us understand what cryptocurrency is.

Cryptocurrency is a virtual or digital currency and is not in a physical coin or bill based. It can be used to buy goods and services and all the transactions take place online.

Cryptocurrency runs on the system of cryptography.

However, before 2024, crypto was just a fringe sideshow for the investing public. Now, crypto assets like bitcoin can now be owned and traded by Americans like a stock.

What gave more boost to cryptocurrency is the assurance of major legislative changes by the incoming administration in Washington to support the industry.

Investors who were holding bitcoin are up 130 per cent since the beginning of the year as the price of the largest cryptocurrency broke all records and surged past $100,000 following Trump’s triumph in November 2024 presidential elections. As per Coinmarketcap, the market value of all crypto rose by nearly $1.7 trillion.

Another factor that helped crypto surge was the US SEC approving Bitcoin and Ethereum ETFs earlier in the year. Following this financial giants including BlackRock and Fidelity significantly increased their crypto investments.

It was because of this, bitcoin rallied earlier in the year too as it witnessed massive demand from newly launched spot bitcoin exchange-traded funds (ETFs).

Also, enhanced blockchain infrastructure, with improved scalability and security features, attracted a host of new users.

Crypto’s upward movement began around the US Presidential election, when Trump promised to establish a crypto presidential advisory committee to draft robust regulations, enable individuals to mine bitcoin, allow self-custody of digital assets, and reduce government oversight.

He also proposed the idea of a strategic bitcoin reserve to position the US as the dominant “Bitcoin superpower.” The US President also proposed leveraging bitcoin reserves to reduce the US’ national debt.

Most of us associate with bitcoin when we hear about cryptocurrency, however, Pepe – a token inspired by the meme frog – emerged as the top performer with a market capatilisation surpassing $5 billion.

Pepe soared by a staggering 1,570.7 per cent, reaching a market cap of $9 billion.

Similarly, SUI, the native token for the Sui blockchain, posted a remarkable 509 per cent gain. According to Forbes report, Dogecoin, a favorite among meme coin enthusiasts and promoted by Elon Musk, surged 333.1 per cent.

Meme coins including Dogecoin and Shiba Inu were among the major contributors to the expansion of the crypto market in 2024.

After a well performing 2024, market participants are positive about the cryptocurrency prospects for 2025 as the Trump-led administration returns to the White House.

Most of the analysts and experts see bitcoin to reach $200,000 by the end of 2025.

Crypto

China’s new forex rules require banks to tighten scrutiny on crypto trades

The rules, applicable to local banks across mainland China, also require them to track such activities based on the identity of the institutions and individuals involved, source of funds and trading frequency, among other factors.

In addition, banks are required to put in place risk-control measures that cover those entities and restrict provision of certain services to them, the regulator said.

The latest rules reflect how Beijing continues to exercise draconian regulation to root out commercial cryptocurrency activities, such as bitcoin trading and mining, as the digital asset is considered a threat to the country’s financial stability.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png) Technology1 week ago

Technology1 week agoThere’s a reason Metaphor: ReFantanzio’s battle music sounds as cool as it does

-

News1 week ago

News1 week agoFrance’s new premier selects Eric Lombard as finance minister

-

Business6 days ago

Business6 days agoOn a quest for global domination, Chinese EV makers are upending Thailand's auto industry

-

Health3 days ago

Health3 days agoNew Year life lessons from country star: 'Never forget where you came from'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg) Technology3 days ago

Technology3 days agoMeta’s ‘software update issue’ has been breaking Quest headsets for weeks

-

World7 days ago

World7 days agoPassenger plane crashes in Kazakhstan: Emergencies ministry

-

Politics7 days ago

Politics7 days agoIt's official: Biden signs new law, designates bald eagle as 'national bird'

-

Politics5 days ago

Politics5 days ago'Politics is bad for business.' Why Disney's Bob Iger is trying to avoid hot buttons