Crypto

Cryptocurrency: Top 3 Ethereum ERC20 Coins To Watch This Week

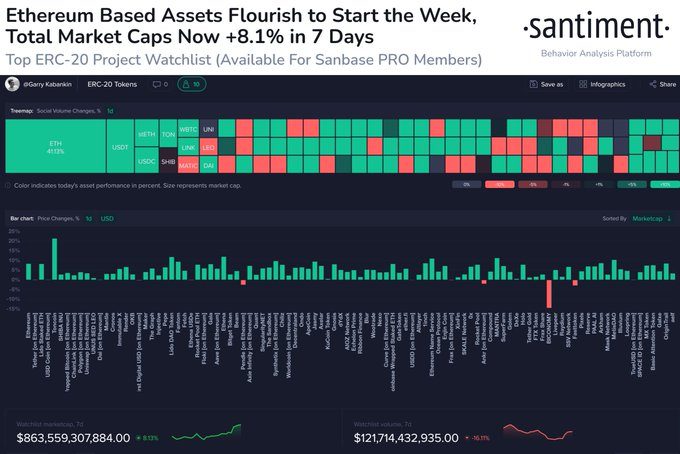

According to data from Santiment, a leading cryptocurrency analytics platform, the Ethereum ERC20 sector has grown by an impressive 8.1% over the past week. The analyst attributed this growth to Ethereum’s robust start to the week.

Among the top performers in the ERC20 space are Toncoin (TON), Lido DAO (LDO), and Ethena (ENA).

Also read: Cryptocurrency: 3 Coins You Should Buy For The Bull Run

Top 3 Ethereum ERC-20 tokens that could surge this week

Toncoin, currently ranked 9th by market capitalization, has surged by 21% in the past week, with a 24-hour trading volume of $684,541,908. The token’s price has fluctuated between $6.40 and $7.08 over the past 24 hours.

Lido DAO, a decentralized finance (DeFi) protocol built on the Ethereum blockchain, has also seen significant growth. With a market cap of $2,375,216,008, LDO has risen by 12% in the past week and currently ranks 51st among cryptocurrencies. The token’s 24-hour trading volume stands at $103,867,581, with its price ranging from $2.62 to $2.98.

Ethena has recorded a 12% increase in the past week, with a market cap of $1,988,578,965, placing it in the 57th position. The token’s 24-hour trading volume has reached $1,094,141,125, and its price has oscillated between $1.20 and $1.40.

Also read: Can Solana (SOL) Reclaim $200 This Week?

Several factors, including the growing popularity of decentralized finance applications and the increasing adoption of Ethereum as a platform for building blockchain-based solutions, contribute to the strong performance of these ERC20 tokens. As more investors recognize the potential of these tokens, the ERC20 sector is likely to continue its upward trajectory.

However, it is essential to note that the cryptocurrency market remains highly speculative and subject to rapid changes. Investors and traders should conduct thorough research and exercise caution when investing in any digital asset, including ERC20 tokens.

Crypto

'Dogecoin Killer' Shiba Inu Burn Rate Spikes 800%, Crypto Market Rallies As Sentiment Soars And More: This Week In Cryptocurrency

The week was a rollercoaster ride for the cryptocurrency market. The crypto world was buzzing with news, from Shiba Inu’s surging burn rate to speculation of certain altcoins becoming irrelevant. Major cryptocurrencies like Bitcoin BTC/USD, Ethereum ETH/USD, and Dogecoin DOGE/USD ended April with heavy losses, but the market sentiment soared as the new week began. Let’s dive into the details.

‘Dogecoin Killer’ Shiba Inu Burn Rate Spikes 800%

Shiba Inu experienced a resurgence in its burn rates, with an 800% surge and millions of coins burned in recent transactions prompting positive market sentiment and an increase in prices. Read the full article here.

Altcoins’ Fate: Strong Performers or Irrelevant?

Pseudonymous crypto trader “Cold Blooded Shiller” questions whether the market is beginning to phase out certain altcoins in favor of stronger performers and Bitcoin. He notes that while Bitcoin’s strength is undeniable, there’s an interesting separation among altcoins. Meme coins like Dogwifhat, Pepe, and Floki Inu have seen significant gains, but will they maintain their momentum? Read the full article here.

See Also: Bitcoin, Ethereum, Dogecoin Rally, As Market Sentiment Soars On Macro Data: ‘Above $67,000 We Fly Like A

Heavy Losses for Bitcoin, Ethereum, Dogecoin in April

April ended on a sour note for major cryptocurrencies. Bitcoin, Ethereum, and Dogecoin closed the month with losses of 16%, 19%, and 40%, respectively. The new Hong Kong Bitcoin ETFs, contrary to bullish expectations, may turn out to be a “complete failure,” according to finance and crypto newsletter, WhaleWire. Read the full article here.

Are Dogecoin and Shiba Inu Due for a Bounce?

Despite a turbulent month, traders remain optimistic about Dogecoin and Shiba Inu. Chart analyst Ali Martinez predicts a bullish breakout for Shiba Inu SHIB/USD, while crypto trader YG Crypto analyzes Dogecoin’s recent performance, which saw a dramatic 40% price drop. Read the full article here.

Crypto Market Rallies as Sentiment Soars

Despite the losses in April, the cryptocurrency market started May on a positive note. Major cryptocurrencies are trading higher, with Bitcoin bouncing well above the $60,000 mark. Read the full article here.

Read Next: Dogecoin Is ‘Primed For Higher’ But Pepe Is ‘On A Moon Mission,’ Exclaims Trader

Image: Eivind Pedersen from Pixabay

Engineered by

Benzinga Neuro, Edited by

Anan Ashraf

The GPT-4-based Benzinga Neuro content generation system exploits the

extensive Benzinga Ecosystem, including native data, APIs, and more to

create comprehensive and timely stories for you.

Learn more.

Crypto

Cryptocurrency Price Analysis: SHIB, DOGE, and XRP Face Varied Challenges

Throughout much of the month, the majority of top assets maintained a sideways trajectory. While some experienced marginal upticks, others contended with declines. Let’s delve into the price analysis of Shiba Inu (SHIB), Dogecoin (DOGE), and Ripple (XRP). Shiba Inu (SHIB)Coin Edition’s evaluation of SHIB’s 4-hour chart revealed a bearish signal. Specifically, attention was drawn to the Exponential Moving Average (EMA), where the 20 EMA (yellow) crossed below the 9 EMA (blue)—a phenomenon known as a death cross. Moreover, SHIB’s price lingered beneath these indicators, signaling a diminishing strength for the token. Presently, there’s a prospect of SHIB’s price descending

Crypto

Bitcoin (BTC) User Paid Eye-Watering $100,254 for Single Transaction

A single Bitcoin BTCUSD transaction has caught the attention of many owing to its gas fee size. Blockchain analytics platform Whale Alert confirmed that a fee of 1.5 BTC was paid for a single transaction. This fee is equivalent to $100,254 based on the current market value of the top cryptocurrency. This fee is quite higher than the average transaction cost.

This user paid this enormous fee to have their transfer included in an ordinary Bitcoin block. Some of these transactions have been recorded in the past. In September 2023, a Bitcoin user paid a transaction fee of 19 BTC. This was around the time when Bitcoin price was trading at $26,000, hence, the 19 BTC was equivalent to $509,563.

Then again, in January, another BTC account paid over 4 BTC to have their transfer included in an ordinary Bitcoin block. The transaction was therefore charged with a whopping 1,800,890 sat/vB fee.

Potential reason for high transaction fee

Payment of such exorbitant fees usually raise suspicions as many market observers wonder the circumstances that could have led to it. At press time, Bitcoin’s average transaction fee was at a level of $4.696, up from $3.740 on May 4 and down from $6.696 one year ago. This is also a change of 25.57% from yesterday and -29.86% from one year ago, per data from YChart.

It is worth noting that ordinarily transaction fees can fluctuate due to network congestion. It once reached as high as $60 during the 2017 cryptocurrency boom. Hence, this outrageous transaction fee recently recorded could be a result of a mistake or a misconfiguration in transaction software. It could also be potentially for reasons known only to the transaction initiator or even a possible money laundering scheme.

-

News1 week ago

News1 week agoFirst cargo ship passes through new channel since Baltimore bridge collapse

-

World1 week ago

World1 week agoHaiti Prime Minister Ariel Henry resigns, transitional council takes power

-

World1 week ago

World1 week agoSpanish PM Pedro Sanchez suspends public duties to 'reflect'

-

News1 week ago

News1 week agoAmerican Airlines passenger alleges discrimination over use of first-class restroom

-

Movie Reviews1 week ago

Movie Reviews1 week agoAbigail Movie Review: When pirouettes turn perilous

-

World1 week ago

World1 week agoEU Parliament leaders recall term's highs and lows at last sitting

-

Science1 week ago

Science1 week agoMosquito season is upon us. So why are Southern California officials releasing more of them?

-

Movie Reviews1 week ago

Movie Reviews1 week agoCity Hunter (2024) – Movie Review | Japanese Netflix genre-mix Heaven of Horror