Crypto

Cryptocurrency hardware wallets may not be as secure as you think

For any crypto holder, storing funds safely is a serious concern that requires analysis and planning. {Hardware} crypto wallets are typically considered being probably the most safe selection amongst cryptocurrency buyers. This doesn’t imply, nonetheless, that these wallets are resistant to fraud.

{Hardware} pockets producer Ledger spoke out towards safety vulnerabilities present in Coinkite and Shapeshift wallets, exhibiting how their merchandise might be attacked. Within the occasion that somebody bought their palms on the bodily pockets, they could be capable of work out the PIN. Though these threats have been rapidly addressed by the businesses, there are nonetheless different methods for dangerous actors to realize entry to consumer funds.

An information breach at Mailchimp not too long ago uncovered an electronic mail listing of customers belonging to a different firm. The e-mail advertising and marketing service has subsequently been sued by one of many customers. A lawsuit filed by Alan Levinson alleges he misplaced $82,000 attributable to negligently saved knowledge.

The same phishing rip-off focusing on Trezor customers was detected by the CoinLoan anti-fraud crew. Hackers hooked up a hyperlink to a counterfeit model of the Trezor web site to an electronic mail acquired by a member of the CoinLoan crew. The aim was to steal the seed phrase and entry customers’ wallets. This safety concern was promptly addressed, saving many Trezor pockets customers from shedding their funds. Nonetheless, this case emphasizes the significance of coping with all attainable safety threats in relation to {hardware} crypto wallets.

What’s a {hardware} pockets?

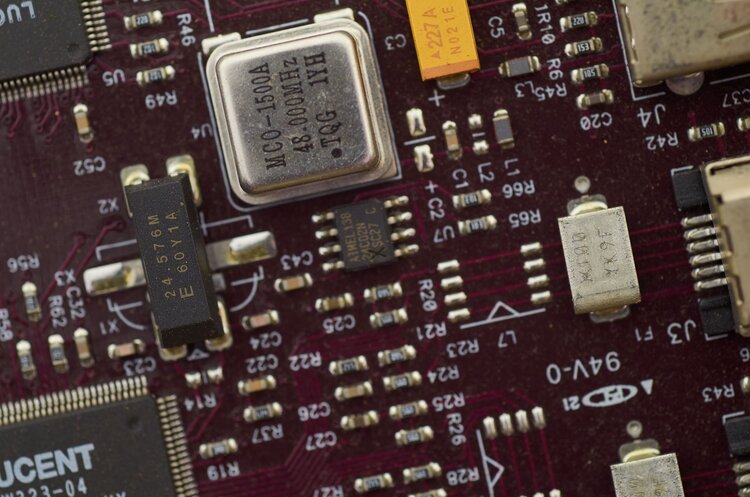

First, let’s work out what a {hardware} crypto pockets is. Not like digital wallets, {hardware} wallets are bodily units, very like USB thumb drives. Personal keys are saved offline, making them inaccessible to on-line threats. Direct knowledge communication with the pc on the {hardware} eliminates the danger of the weak software program. This manner, personal keys can solely be used and saved on the machine and are by no means saved on a pc or on-line, making them resistant to viruses and on-line hacks.

The downsides to utilizing {hardware} wallets embrace preliminary prices which might be greater than common digital pockets software program. Gadgets from main producers like Trezor and Ledger price anyplace between $50 and $1,200. For customers to make use of their {hardware} safely, they need to additionally know learn how to configure it. Funds could be accessed by malicious events if the pockets is dealt with improperly. In an effort to achieve entry to delicate knowledge akin to PIN codes or personal keys saved in a bodily {hardware} pockets, hackers could use the next strategies.

Doable vulnerabilities

Facet-channel assault

A side-channel assault makes use of an oscilloscope, a sort of digital check machine. It measures the ability consumption after which compares its conduct to random PIN codes. Analyzing the measurements of every PIN digit helps construct a database that may then be used with a script to guess the digits one after the other. This vulnerability was detected in some Trezor {hardware} and has since been mounted.

Software program assaults

Attacking a {Hardware} Safety Module (HSM) can lead to acquiring the cryptographic keys and different knowledge that grants entry to the pockets. The software program that’s contained within the pockets machine is analyzed and reverse-engineered to know how its safety works. This vulnerability in well-liked HSMs was found by the Ledger crew. One of many researchers defined: “The introduced assaults permit retrieving all HSM secrets and techniques remotely, together with cryptographic keys and administrator credentials.”

Voltage glitching

This probably deadly flaw was recognized by Kraken Safety Labs. They came upon that making use of lowered voltage to a microcontroller permits them to learn the chip’s RAM. After the firmware is put in, the chip strikes the cryptographic seed into RAM to guard it, subsequently, granting entry to all of the reminiscence contents.

Finest safety practices

Whereas most recognized vulnerabilities are often mounted by producers, there are likely a number of different methods to hack into present {hardware} pockets units. Step one for customers to guard themselves is to maintain their units in a secure place away from any third-party entry. One other essential rule isn’t sharing delicate info like personal keys, PINs, and restoration seeds with anybody.

The restoration seed could be safeguarded by avoiding typing or storing it on-line, taking footage of it, or some other motion that will compromise it.It’s greatest to easily write it down and retailer it in a secure place. Moreover, it’s essential to solely talk with the pockets utilizing a trusted PC. Any on-line publicity to the PC may result in a vulnerability.

Regardless that a variety of these hacking methods require bodily entry to the machine, there’s additionally a risk of a phishing assault. They might be focused at customers through electronic mail, cell phone, social media, pretend web sites, and prompt messaging apps. This was the e-mail rip-off uncovered and prevented by CoinLoan, saving Trezor customers from falling sufferer to it. On this case, the important thing to making sure pockets safety was not solely customers’ vigilance, but in addition the short response from the CoinLoan fraud detection specialists. As CTO and co-founder Max Sapelov, commented: “This incident does make clear the inherent dangers related to (chilly) non-custodial wallets, together with software program, connections to third-party distributors, and attainable insider leaks. In distinction, custodial wallets akin to CoinLoan typically implement a sequence of checks and holds which forestall fraudsters from a) gaining entry and b) transferring or withdrawing crypto within the occasion of a leak.” Service suppliers and producers ought to at all times be alert to attainable hacks as a way to shield customers who might not be conscious of those vulnerabilities.

Crypto

Should You Forget Bitcoin and Buy Solana Instead? | The Motley Fool

Bitcoin‘s (BTC -0.48%) price hit an all-time high of $103,332 on Dec. 4. Four main catalysts drove it to that point: the approvals of its first spot price ETFs in January; its latest halving in April, which cuts its rewards for mining in half every four years; interest rate cuts; and President-elect Trump’s crypto-friendly policies.

Bitcoin’s price has pulled back to about $97,000 as of this writing, but it remains up more than 120% over the past 12 months. With a market capitalization of $1.93 trillion, it’s the world’s top cryptocurrency and seventh most valuable asset.

Image source: Getty Images.

Bitcoin is still a solid long-term play on the cryptocurrency market, but it might have less upside potential than its smaller coins. Could one of those tokens be Solana (SOL -0.99%), which trades at about $190 with a market cap of $90 billion?

What sets Solana apart from Bitcoin?

Solana’s tokens are validated with the proof of stake (PoS) method, which doesn’t require any tokens to be digitally mined. That approach is faster and more energy efficient than the proof of work (PoW) mining mechanism used by Bitcoin.

PoW blockchains are only used for mining more tokens. PoS blockchains support smart contracts, which can be used to develop decentralized apps (dApps), games, non-fungible tokens (NFTs), and other crypto assets. PoS tokens can also be “staked,” or locked up, on the blockchain for a period of time to earn interest-like rewards.

Bitcoin’s value is often defined by its scarcity. It has a maximum supply of 21 million tokens, and nearly 20 million of them have already been mined. The last Bitcoin is expected to be mined in 2140, which makes it somewhat comparable to gold or silver.

Solana and other PoS tokens are usually valued by the speed of their blockchains and the growth of their developer ecosystems. Solana has a current supply of nearly 591 million tokens and no maximum supply, but it’s set to reduce its annual inflation rate, currently at 4.83%, by 15% every “epoch year,” which amounts to 450-630 days.

What sets Solana apart from other PoS tokens?

Solana is often overshadowed by Ethereum (ETH -1.34%), the world’s second largest cryptocurrency and top PoS blockchain. Ethereum has its own native token, Ether, but many other smaller PoS tokens, including Shiba Inu, Polygon, and Render, run on its blockchain. It’s easier to directly launch a new token on Ethereum’s blockchain than to build one from scratch, but these tokens are ultimately constrained by Ethereum’s speed limitations.

Solana is a newer PoS blockchain that accelerates its transactions with its own proof-of-history (PoH) mechanism. That upgrade already enables Solana’s blockchain to process transactions roughly 46 times faster than Ethereum, but it’s only achieved less than 2% of its theoretical max speed so far.

Solana’s high-speed blockchain has attracted a lot of developers and partners. It’s been used to develop meme coins such as BONK and WIF, and it powers decentralized exchanges including Jupiter and Orca. It supports stablecoin transactions for Visa, PayPal, and Circle, and it’s integrated its Solana Pay payment protocol into Shopify‘s platform.

Solana even launched its own Android smartphone for Web3 apps, the Saga Phone, in 2023. It’s still a niche gadget, but it sports its own dApps Store as an alternative to Alphabet‘s Google Play Store.

But over the past two years, Solana dealt with network congestion problems, spam transactions, and security failures. One of its top investors was also the failed crypto exchange FTX, which hastily liquidated its tokens at a discount to pay off its creditors. All of those challenges, along with rising interest rates, drove its price below $10 in December 2022.

What’s next for Solana?

Solana’s price has already soared nearly 19 times from its all-time low, but it could head even higher as it resolves its network issues, it laps FTX’s big sale, and interest rates gradually decline. Several big crypto firms, including Grayscale, Bitwise, and VanEck, have also recently filed for the approvals of Solana spot price ETFs.

Those ETF approvals could stabilize Solana’s price while bringing in more retail and institutional investors. They would also probably mark its transition from a smaller altcoin to a “blue chip” cryptocurrency such as Bitcoin and Ether.

But is Solana a viable alternative to Bitcoin?

Solana is an interesting alternative to Ether, but it’s not a viable replacement for Bitcoin yet. Solana might be a good investment if you believe it can keep increasing its speed, expanding its ecosystem, and gaining new ETF approvals. However, it’s still an inflationary token that’s much harder to value than Bitcoin.

It could be smart to invest in both Bitcoin and Solana, but investors should be aware of their differences. Bitcoin can be considered a digital alternative to gold, but Solana’s value will be defined by its transaction speeds and developer appeal.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Leo Sun has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Bitcoin, Ethereum, PayPal, Render Token, Shopify, Solana, and Visa. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal and short December 2024 $70 calls on PayPal. The Motley Fool has a disclosure policy.

Crypto

How Bitcoin and other cryptocurrency made a strong comeback in 2024

)

As the year 2024 ends, here is a look at the performance of cryptocurrency, especially bitcoin, that turned fortune of the investors within days

read more

Crypto was not much known to a common man or small scale investors till the digital currencies in the basket, including the oldest and most-traded – bitcoin, broke all records to touch a new life-time high especially after Donald Trump’s win in the November 5, 2024 US Presidential election.

But before understanding about a strong comeback, let us understand what cryptocurrency is.

Cryptocurrency is a virtual or digital currency and is not in a physical coin or bill based. It can be used to buy goods and services and all the transactions take place online.

Cryptocurrency runs on the system of cryptography.

However, before 2024, crypto was just a fringe sideshow for the investing public. Now, crypto assets like bitcoin can now be owned and traded by Americans like a stock.

What gave more boost to cryptocurrency is the assurance of major legislative changes by the incoming administration in Washington to support the industry.

Investors who were holding bitcoin are up 130 per cent since the beginning of the year as the price of the largest cryptocurrency broke all records and surged past $100,000 following Trump’s triumph in November 2024 presidential elections. As per Coinmarketcap, the market value of all crypto rose by nearly $1.7 trillion.

Another factor that helped crypto surge was the US SEC approving Bitcoin and Ethereum ETFs earlier in the year. Following this financial giants including BlackRock and Fidelity significantly increased their crypto investments.

It was because of this, bitcoin rallied earlier in the year too as it witnessed massive demand from newly launched spot bitcoin exchange-traded funds (ETFs).

Also, enhanced blockchain infrastructure, with improved scalability and security features, attracted a host of new users.

Crypto’s upward movement began around the US Presidential election, when Trump promised to establish a crypto presidential advisory committee to draft robust regulations, enable individuals to mine bitcoin, allow self-custody of digital assets, and reduce government oversight.

He also proposed the idea of a strategic bitcoin reserve to position the US as the dominant “Bitcoin superpower.” The US President also proposed leveraging bitcoin reserves to reduce the US’ national debt.

Most of us associate with bitcoin when we hear about cryptocurrency, however, Pepe – a token inspired by the meme frog – emerged as the top performer with a market capatilisation surpassing $5 billion.

Pepe soared by a staggering 1,570.7 per cent, reaching a market cap of $9 billion.

Similarly, SUI, the native token for the Sui blockchain, posted a remarkable 509 per cent gain. According to Forbes report, Dogecoin, a favorite among meme coin enthusiasts and promoted by Elon Musk, surged 333.1 per cent.

Meme coins including Dogecoin and Shiba Inu were among the major contributors to the expansion of the crypto market in 2024.

After a well performing 2024, market participants are positive about the cryptocurrency prospects for 2025 as the Trump-led administration returns to the White House.

Most of the analysts and experts see bitcoin to reach $200,000 by the end of 2025.

Crypto

China’s new forex rules require banks to tighten scrutiny on crypto trades

The rules, applicable to local banks across mainland China, also require them to track such activities based on the identity of the institutions and individuals involved, source of funds and trading frequency, among other factors.

In addition, banks are required to put in place risk-control measures that cover those entities and restrict provision of certain services to them, the regulator said.

The latest rules reflect how Beijing continues to exercise draconian regulation to root out commercial cryptocurrency activities, such as bitcoin trading and mining, as the digital asset is considered a threat to the country’s financial stability.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png) Technology1 week ago

Technology1 week agoThere’s a reason Metaphor: ReFantanzio’s battle music sounds as cool as it does

-

News1 week ago

News1 week agoFrance’s new premier selects Eric Lombard as finance minister

-

Business6 days ago

Business6 days agoOn a quest for global domination, Chinese EV makers are upending Thailand's auto industry

-

Health3 days ago

Health3 days agoNew Year life lessons from country star: 'Never forget where you came from'

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24982514/Quest_3_dock.jpg) Technology3 days ago

Technology3 days agoMeta’s ‘software update issue’ has been breaking Quest headsets for weeks

-

World7 days ago

World7 days agoPassenger plane crashes in Kazakhstan: Emergencies ministry

-

Politics7 days ago

Politics7 days agoIt's official: Biden signs new law, designates bald eagle as 'national bird'

-

Politics5 days ago

Politics5 days ago'Politics is bad for business.' Why Disney's Bob Iger is trying to avoid hot buttons