Crypto

Cryptocurrency exchange Bybit plans to cut 30% of workforce: CEO Ben Zhou

Cryptocurrency alternate Bybit is planning to chop its workforce by 30 per cent amid a continued bear market within the asset class, co-founder and Chief Govt Officer Ben Zhou mentioned.

The strikes are a part of an ongoing reorganisation geared toward refocusing efforts, and reductions might be throughout the board, Zhou mentioned Sunday, including the precedence is to make sure enterprise operations are unaffected and shopper property stay secure.

He cited crypto costs trending decrease and the struggles of firms akin to bankrupt crypto lender BlockFi and embattled crypto brokerage Genesis as indicators “to inform us that we’re getting into into a fair colder winter than we had anticipated from each business and market views.” Bybit is ranked within the prime 10 crypto bourse by each CoinMarketCap and CoinGecko utilizing measures together with quantity and confidence within the reported volumes, is the most recent in a string of exchanges to announce job cuts.

Friends like Crypto.com and Kraken have additionally decreased their workforce because the business contends with depressed costs and decrease volumes. “It’s vital to make sure Bybit has the fitting construction in place to navigate the market slowdown and is nimble sufficient to grab the various alternatives forward,” Zhou mentioned. “Robust instances demand powerful selections.”

In a weblog publish dated Thursday, Zhou had mentioned that “Bybit is right here for the long term,” and famous the alternate secured the largest-ever crypto sponsorship with the Method One 2021 and 2022 world champions, Oracle Crimson Bull Racing.

“We ended the season on a excessive, with the primary blue-chip NFT on a F1 race automotive,” and launched a $100 million establishment assist fund, he added.

Crypto

Senate to try again to advance crypto bill after Democratic opposition tanked first vote

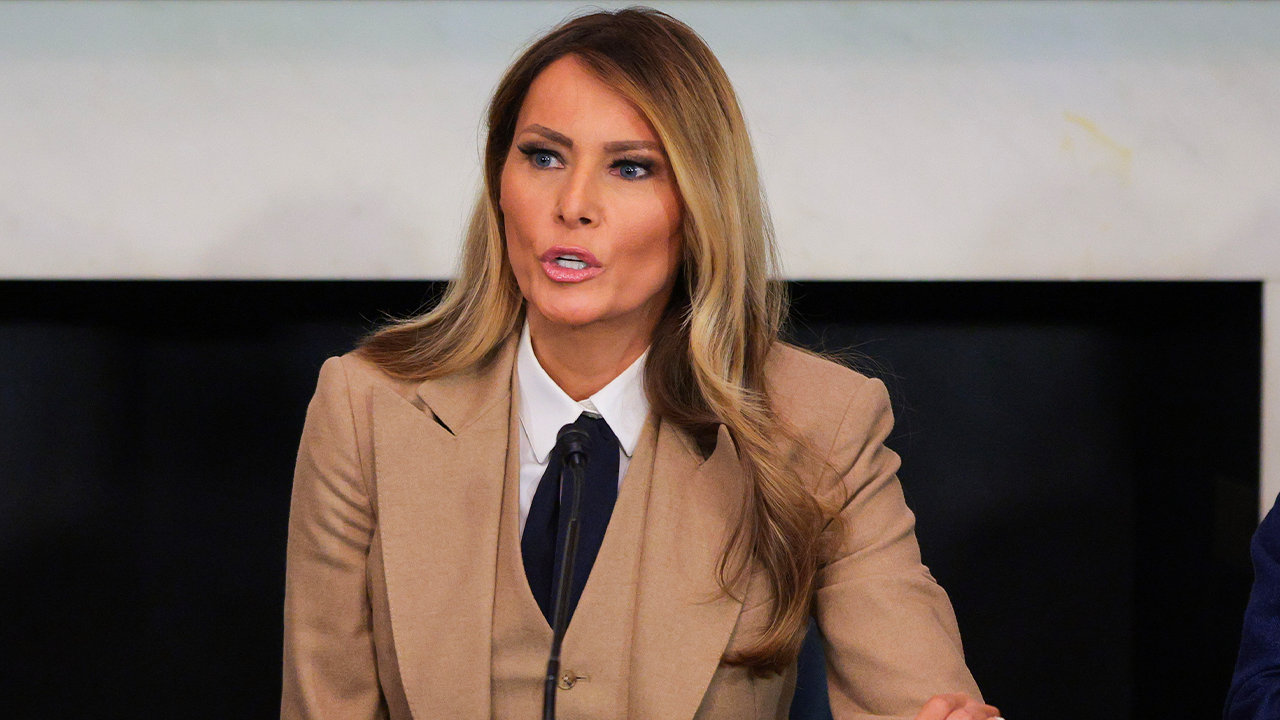

Washington — The Senate is expected to take a key procedural vote Monday evening on a crypto regulation bill after Democratic opposition tanked an initial attempt to advance the measure earlier this month amid concern over ties between the digital asset industry and the Trump family.

The first-of-its-kind legislation, known as the GENIUS Act, would create a regulatory framework for stablecoins — a type of cryptocurrency tied to the value of an asset like the U.S. dollar. After the measure advanced out of the Senate Banking Committee with bipartisan support in March, Senate GOP leadership first brought the measure to the floor earlier this month. But the measure had lost Democratic support in the intervening weeks amid concerns about President Trump and his family’s business ventures involving cryptocurrency.

Senate Majority Leader John Thune said the upper chamber would try again to advance the legislation on Monday, while criticizing Democrats for blocking the measure from moving forward earlier this month, saying “this bill reflects the bipartisan consensus on this issue, and it’s had an open and bipartisan process since the very beginning.”

Thune, a South Dakota Republican, argued that Senate Democrats “inexplicably chose to block this legislation” earlier this month, while adding that “I’m hoping that the second time will be the charm.”

Nathan Posner/Anadolu via Getty Images

Since the failed vote earlier this month, negotiators returned to the table. And ahead of the procedural vote Monday, the measure saw backing from at least one Democrat as Sen. Mark Warner of Virginia advocated for the measure, calling it a “meaningful step forward,” though he added that it’s “not perfect.”

“The stablecoin market has reached nearly $250 billion and the U.S. can’t afford to keep standing on the sidelines,” Warner said in a statement. “We need clear rules of the road to protect consumers, defend national security, and support responsible innovation.”

Still, Warner pointed to concerns he said are shared among many senators about the Trump family’s “use of crypto technologies to evade oversight, hide shady financial dealings, and personally profit at the expense of everyday Americans,” after it was announced earlier this month that an Abu Dhabi-backed firm will invest billions of dollars in a Trump family-linked crypto firm, World Liberty Financial.

Warner said senators “have a duty to shine a light on these abuses,” but he argued “we cannot allow that corruption to blind us to the broader reality: blockchain technology is here to stay.”

Sen. Elizabeth Warren of Massachusetts, the top Democrat on the Senate Banking Committee, has been among the leading voices advocating for adding anti-corruption reforms to the legislation. Warren has outlined a handful of issues with the bill, saying that it puts consumers at risk and enables corruption. In a speech Monday on the Senate floor, Warren said her concerns have not been addressed and urged her colleagues to vote against the updated version.

“While a strong stablecoin bill is the best possible outcome, this weak bill is worse than no bill at all,” Warren said. “A bill that meaningfully strengthens oversight of the stablecoin market is worth enacting. A bill that turbocharges the stablecoin market, while facilitating the president’s corruption and undermining national security, financial stability, and consumer protection is worse than no bill at all.”

Whether the measure can advance in the upper chamber this time around remains to be seen. The measure fell short of the 60 votes necessary to move forward earlier this month, with all Senate Democrats and two Republicans — Sens. Rand Paul of Kentucky and Josh Hawley of Missouri — opposing. Paul has reservations about overregulation, while Hawley voted against the bill in part because it doesn’t prohibit big tech companies from creating their own stablecoins.

Sen. Bill Hagerty of Tennessee, who sponsored the legislation, defended the measure on CNBC’s “Squawk Box” Monday. He outlined that a lack of regulatory framework, which the bill would provide, makes for uncertainty — and results in innovative technology moving offshore. The Tennessee Republicans urged that “this will fix it,” while arguing that the bill has strong bipartisan support.

“We have broad policy agreement, Democrats and Republicans,” Hagerty said. “The question is can we get past the partisan politics and allow us to actually have a victory.”

Crypto

Bitcoin notches record weekly close after highest-ever daily close candle

Bitcoin has notched its highest-ever weekly close as crypto market momentum continues and the cryptocurrency is again nearing its all-time high.

Bitcoin (BTC) has closed at a weekly gain for the past six weeks in a row, and its most recent close at midnight UTC on May 18 was its highest weekly close ever at just below $106,500, according to TradingView.

Its last highest weekly close was in December when it reached $104,400. It later went on to reach an all-time high of $109,358 on Jan. 20, according to TradingView.

Bitcoin is now less than 3% away from its peak price and has gained 2% over the past 24 hours to trade around $104,730 at the time of writing.

Bitcoin also posted its highest-ever close in a 24-hour period on May 18. However, this is not the largest daily gain Bitcoin has made.

“Bitcoin just had its highest daily candle close… ever,” investor Scott Melker posted to X on May 19.

With a daily close above $105,000, “Bitcoin will develop a brand new higher high,” said analyst Rekt Capital.

Bitcoin’s weekly gains over the past six weeks are mirroring its gains in November when it added $30,000 in three of its largest weekly candles ever.

It has added around $12,000 so far in May, climbing from $94,000 to over $106,000 before it pulled back to around $105,400.

Related: BTC price to $116K next? Bitcoin trader sees ‘early week’ all-time high

Additionally, Arete Capital partner “McKenna” said the Coinbase premium had returned, which measures US sentiment by comparing the difference between Coinbase’s BTC/USD pair and Binance’s BTC/USDT equivalent.

The “strength of this bid on a Sunday night feels strange,” they said, adding its “possible someone knows some important news dropping next week.”

Bitcoin’s CAGR cools down

On May 18, analyst Willy Woo dived into Bitcoin’s compound annual growth rate (CAGR), noting that it was trending downward as the network continues to store more capital.

“BTC is now traded as the newest macro asset in 150 years, it’ll continue to absorb capital until it reaches its equilibrium,” he said.

Woo compared it to long-term monetary expansion of 5% and GDP growth of 3%, estimating that Bitcoin’s annual growth rate will be around 8% in around 15 to 20 years when it has settled.

“Until then, enjoy the ride because almost no publicly investable product can match BTC performance long term, even as BTC’s CAGR continues to erode.”

Magazine: Arthur Hayes $1M Bitcoin tip, altcoins ‘powerful rally’ looms: Hodler’s Digest

New regulations threaten the security of the personal data of cryptocurrency users and may expose them to “physical danger,” the platform at the center of last week’s Paris kidnapping attempt has claimed.

“A ticking time bomb,” said Alexandre Stachtchenko, director of strategy at French platform Paymium, referring to the way information must now be collected during cryptocurrency transfers under EU rules.

He did not directly link this to a kidnapping attempt on Tuesday which, according to a police source, targeted the daughter and grandson of Paymium’s chief executive.

“If there is a leak of one of these databases from which I can find out who has money and where they live, then the next day it is on the dark web, and the day after there is someone outside your home,” Stachtchenko said. Data theft is commonplace. On Thursday, the leading cryptocurrency exchange in the United States, Coinbase, said criminals had bribed and duped their way into stealing digital assets from its users, then tried to blackmail the exchange to keep the crime quiet.

Instead of paying up, Coinbase informed US regulators about the theft and made plans to spend between $180 million and $400 million to reimburse victims and handle the situation.

Following the kidnapping attempt, Paymium issued a statement urging authorities to immediately reinforce the protection of companies within the sector, after other similar incidents this year.

Founded in 2011 and presenting itself as a European pioneer of bitcoin trading, Paymium also cited “the highly dangerous aspects of certain financial regulations, either recently adopted or in the making.”

It added, “With the unprecedented organization of massive and sometimes disproportionate collection of personal data, public authorities contribute to putting the physical safety of millions of cryptocurrency holders in France, and more widely in Europe, at risk.” In its sights are rules which came into force at the end of 2024 and which extended the Travel Rule in place for traditional finance transfers to include crypto assets.

The rules now require platforms to gather details about the beneficiary and, in return, transmit certain information about the customer to the receiving institution, including their name and postal address.

Also to be disclosed is the “address” of a customer’s cryptocurrency wallet, which shows details of their account and transactions, said Stachtchenko.

Such sensitive data is sometimes exchanged and stored insecurely by certain players.

Regulatory changes to tighten the rules on the crypto sector aim to “prevent the financial system from being used for corruption, money laundering, drug trafficking” among other criminal activities, said Sarah Compani, a lawyer specializing in digital assets.

Data collection is carried out by parties including banks, insurance companies and crypto-service providers, which are “supervised” and subject to heavy “security obligations, particularly IT and cybersecurity,” said William O’Rorke, a lawyer at cryptocurrency firm ORWL.

In 2027, European anti-money laundering regulations will restrict the use of wallets and cryptocurrencies that allow the holders to remain anonymous.

It follows a French law adopted last month to fight narcotrafficking, which targets anonymization devices such as the cryptocurrency “mixers” used to render funds untraceable.

There are many “legitimate interests” in having such tools however, said cybersecurity expert Renaud Lifchitz. He noted that they are sometimes used by journalists, or by activists opposed to an authoritarian regime which controls the traditional banking system.

The debate is more “political” than “security-related,” argued O’Rorke.

The recent kidnappings and attempted kidnappings can be explained above all by a “somewhat nouveau riche” and “ill-prepared” cryptocurrency sector, he said.

Since 2014, software developer Jameson Lopp has recorded 219 physical attacks targeting cryptocurrency users.

© 2025 AFP

Citation:

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

Best Austin Salads – 15 Food Places For Good Greens! President Trump takes on 'Big Pharma' by signing executive order to lower drug prices Mexico is suing Google over how it’s labeling the Gulf of Mexico As Harvard Battles Trump, Its President Will Take a 25% Pay Cut In-N-Out Burger adds three new California locations to list of 2025 openings DHS says Massachusetts city council member 'incited chaos' as ICE arrested 'violent criminal alien' Why Trump Suddenly Declared Victory Over the Houthi Militia Republicans say they're 'out of the loop' on Trump's $400M Qatari plane dealCrypto

Paris kidnap bid highlights crypto data security risks

Name and address

‘Nouveau riche’

Paris kidnap bid highlights crypto data security risks (2025, May 18)

retrieved 18 May 2025

from https://techxplore.com/news/2025-05-paris-kidnap-highlights-crypto.html

part may be reproduced without the written permission. The content is provided for information purposes only.