US President Donald Trump has released his financial statement. According to the document, he received over $600 million in income from cryptocurrencies, golf clubs, licensing and other businesses. This was reported by Reuters, writes UNN.

Details

The financial declaration was signed on June 13 and did not contain information about the period it covers. At the same time, some data in the declaration suggest that it was until the end of December 2024, which excludes most of the money raised by the Trump family’s cryptocurrency ventures.

According to the publication’s calculations, Trump declared assets worth at least $1.6 billion in total.

He previously stated that he had transferred his businesses to a trust managed by his children, but the published data indicate that income from these sources still goes to the president, which has led to accusations of conflicts of interest.

Some of Trump’s businesses in areas such as cryptocurrency are benefiting from changes in US policy under his leadership and have become a source of criticism, Reuters writes.

One meme coin issued by the president earlier this year – $TRUMP brought in approximately $320 million in commissions, although it is not publicly known how this amount was distributed between the Trump-controlled organization and its partners.

The feud between Trump and Musk caused Tesla’s stock to crash, with a market value drop of $150 billion.

06.06.25, 09:15 • 3708 views

In addition to the meme coin commissions, the Trump family earned more than $400 million from World Liberty Financial, a decentralized financial company. In his declarations, Trump indicated $57.35 million from the sale of World Liberty tokens.

The American president’s fortune also includes a significant stake in Trump Media&Technology Group (DJT.O), which owns the Truth Social social network, the report said.

In addition to assets and income from his business projects, Trump declared at least $12 million in income in the form of interest and dividends from passive investments totaling at least $211 million, according to Reuters calculations.

Trump’s three golf resorts in Jupiter, Doral and West Palm Beach, and a private members’ club in Mar-a-Lago, brought Trump at least another $217.7 million in income. Trump National Doral, a large golf center in the Miami area, was the Trump family’s largest source of income – $110.4 million.

Trump also received royalties from various deals – $1.3 million from Greenwood Bible, the “only Bible officially endorsed by Lee Greenwood and President Trump”, and $2.8 million from Trump Watches, $2.5 million from Trump Sneakers and Fragrances.

According to Reuters, the declaration often only indicates ranges of asset and income values, and the lower limit was used for calculations, so the real value of Trump’s assets and income is most likely even higher.

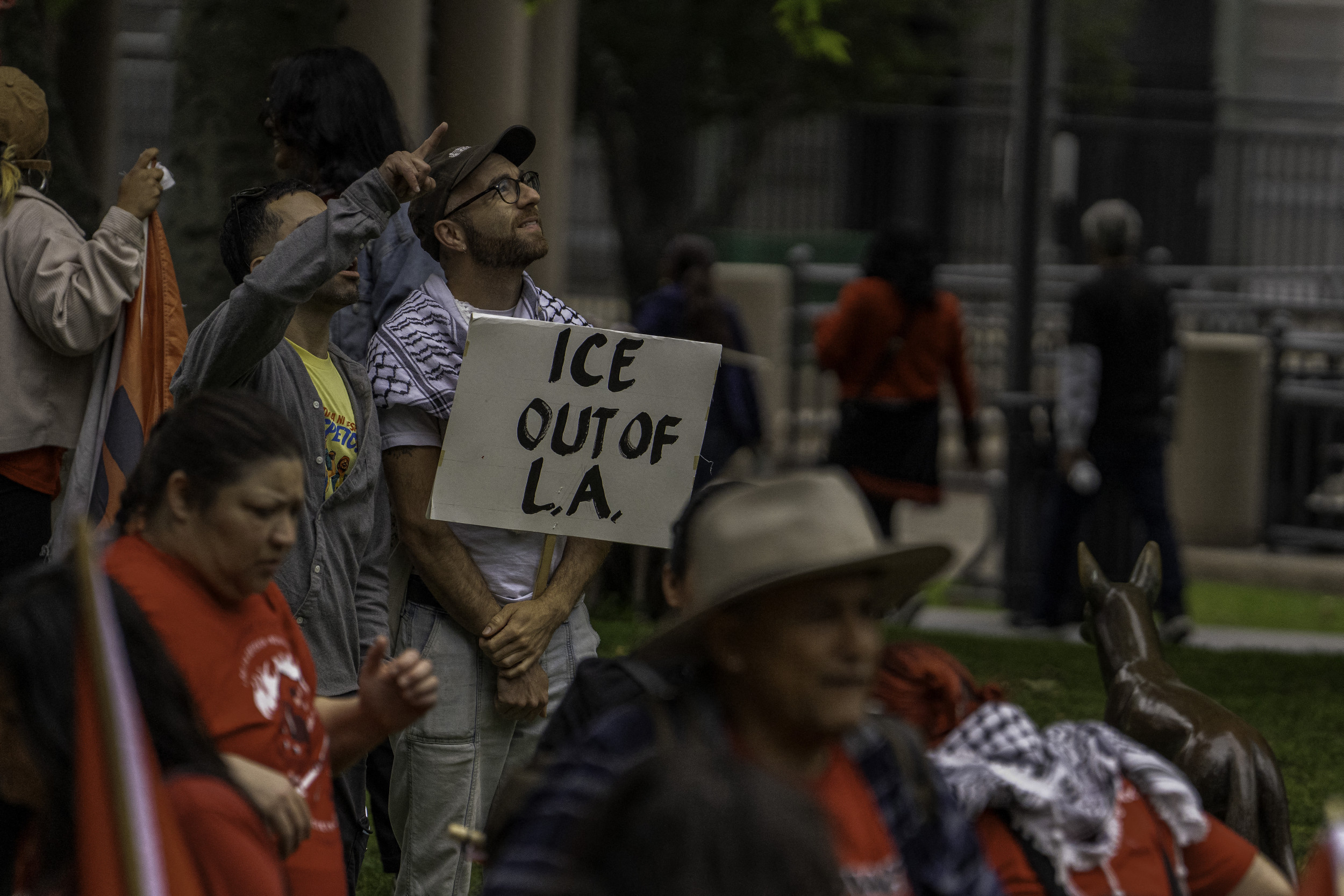

Trump changed his approach to deportations: raids on farms, hotels and restaurants have been stopped – NYT14.06.25, 10:18 • 2808 views