The performance of Bitcoin (BTC -0.53%) this year has been nothing short of extraordinary. It’s now up about 46% since the election on Nov. 5, and 146% year to date. Best of all, Bitcoin recently broke through the $100,000 price level to hit another all-time high just north of $108,000.

But what if I told you that there is another top cryptocurrency that is up more than 120% since the election, and 430% year to date? And that this cryptocurrency also just set a new all-time high? That cryptocurrency is Sui (SUI -3.69%), which now ranks 14th among all cryptocurrencies with a $13 billion market cap.

What is Sui and why haven’t I heard of it before?

If you’ve never heard of Sui, that’s understandable. The cryptocurrency only launched in May 2023, just as the market was emerging from the crypto winter of 2022. So, in many ways, its launch flew under the radar of investors. There were bigger issues to consider. The industry was still coping with the aftermath of the collapse and scandal of crypto exchange FTX in November 2022, and nobody was very interested in hearing about another new cryptocurrency launch.

But fast-forward to August 2024. That’s when 21Shares — the company that partnered with Cathie Wood’s Ark Invest on the launch of spot exchange-traded funds (ETFs) for Bitcoin and Ethereum (ETH -0.79%) — released a research report on Sui, detailing all of its unique characteristics. For example, it described how a new technical upgrade suddenly made Sui faster than any other top blockchain by a substantial margin. It pointed out how Sui was rapidly growing in terms of total value locked (TVL), which is a key metric showing the relative strength of a particular blockchain.

Image source: Getty Images.

The title of the report (“Is Sui a Solana (SOL -0.00%) Killer?”) was very provocative, at least for crypto investors. It suggested that Sui had the technological chops to take on Solana, which now ranks as the fifth-largest cryptocurrency. For several years now, Solana has been positioned as the next Ethereum, so Sui being tabbed as a potential Solana killer is a big deal. In fact, 21Shares suggested that there might be a $68 billion market opportunity for Sui if it was able to take on Solana and win.

How high can Sui go in 2025?

My primary concern right now with Sui is that it may be overheating. Just like Bitcoin, it is smashing through all-time high after all-time high. Right now, Sui is trading at about $4.50 after briefly testing the $5 price level. From the perspective of crypto traders, $5 presents the same psychological price barrier for Sui that $100,000 did for Bitcoin. It took Bitcoin a while to break through the $100,000 level, so Sui may not be able to break through the $5 price level by the end of this year.

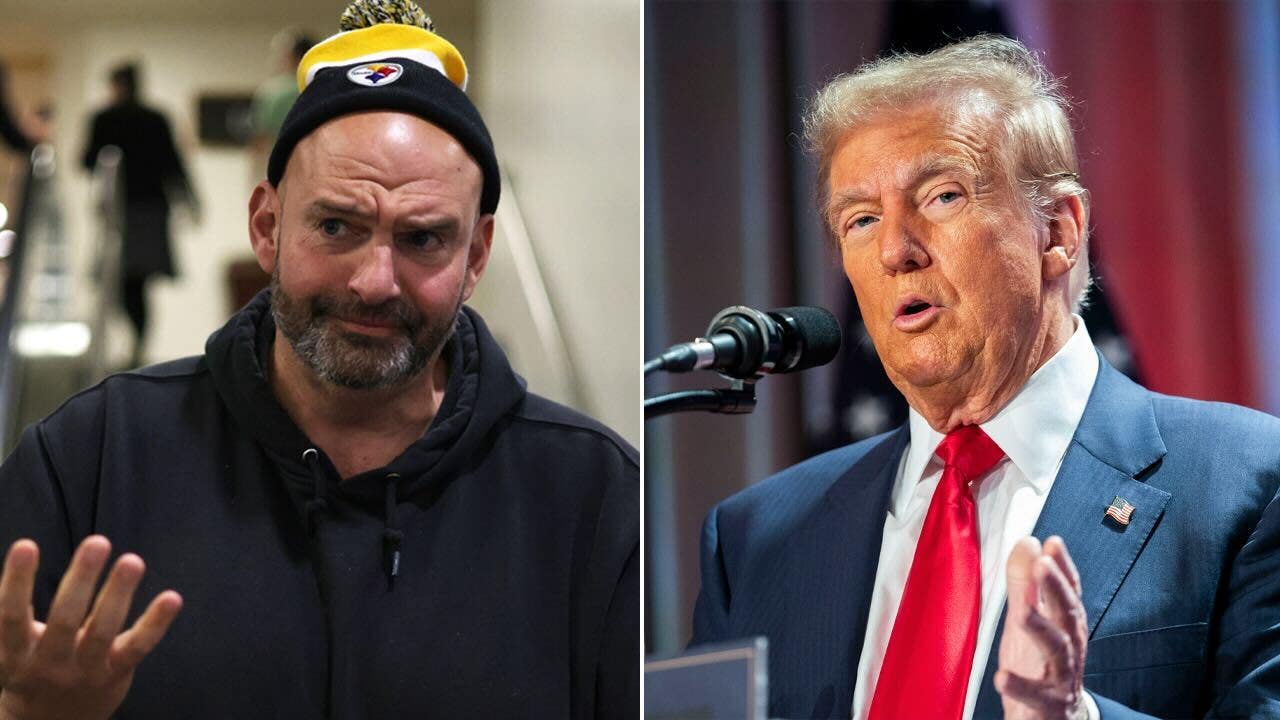

But, in 2025, watch out. Just take a look at this comparison chart of Bitcoin and Sui since the presidential election. That leads me to think that the market is very bullish on Sui’s prospects under the Trump administration.

Bitcoin / U.S. dollar chart by TradingView

Moreover, consider the trading volume that Sui is now seeing on Coinbase Global (COIN 1.75%). Sui has become one of the 10 most popular cryptocurrencies on the platform in terms of 24-hour trading activity. Granted, the trading volume in Sui is nowhere near that of Bitcoin or Ethereum. But there’s more activity in Sui than in popular cryptocurrencies such as Chainlink, Litecoin, Cardano, Shiba Inu, and Avalanche.

Best of all, Sui has a major new product launch coming in 2025. It’s a $599 handheld gaming device that is currently available for pre-order online. If that product launch is a success, then it could be off to the races for Sui. It could easily double in price to hit the $10 price level.

This cryptocurrency could soar even higher if it ever realizes its full potential as the next Ethereum. Imagine if you had invested in Ethereum just 18 months after its launch. Most likely, you’d be a crypto millionaire by now. In December 2016, Ethereum was trading around $5, which is roughly where Sui is trading right now. Today, Ethereum trades for about $3,400.

That said, I can’t emphasize enough how speculative Sui is. It is still a baby in crypto terms. It has only been around for 18 months, and it can be difficult to get good data and reliable information about it. So, do your due diligence before investing in Sui, and keep your expectations in check. An investment opportunity like Ethereum might only come around once in a lifetime, so it’s asking a lot for it to happen with Sui as well.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/F3KZCGARO5ON7HLU2DYHX4L2YU.jpg)

![[Analysis] “Cryptocurrency Holders Surge Over the Past Two Years” [Analysis] “Cryptocurrency Holders Surge Over the Past Two Years”](https://media.bloomingbit.io/prod/news/0eb0e2f0-759d-451b-9469-9e34bbdfbd33.webp)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)