Crypto

A challenging macro backdrop could dampen bitcoin’s upside in the third quarter

Representations of cryptocurrency Bitcoin are seen in this illustration, August 10, 2022. REUTERS/Dado Ruvic/Illustration

Dado Ruvic | Reuters

It seems like bitcoin has a good setup for the new quarter, with major institutions signaling confidence in both the future of crypto and even in its U.S. regulators at the end of the month. Don’t get too carried away though – crypto is still part of the broader market, which remains in a challenging macro environment.

The third quarter is historically the weakest for bitcoin. The average third-quarter gain going back to 2014 is just 4.67%, according to CoinGecko, and it’s posted a positive third quarter for only four of the nine in its lifetime.

Bitcoin historical quarterly performance since Q4 2013

| Q1 | Q2 | Q3 | Q4 | |

|---|---|---|---|---|

| Average return | 6.88% | 36.47% | 4.67% | 93.38% |

| Number of positive periods | 4 of 10 | 6 of 9 | 4 of 9 | 6 of 10 |

Source: CoinGecko

Before the recent rush of applications to launch U.S. spot bitcoin ETFs injected new optimism in the crypto market, it was a frustrating second quarter for traders. Between the end of the banking crisis in May and the BlackRock bitcoin ETF filing on June 15, regulatory pressure weighed heavily on sentiment and bitcoin traded sideways. That lull could come back in the next three months as industry drivers wrestle with macro drivers.

“It’s clear that [the Fed] is not fully comfortable yet with the direction of headline inflation numbers,” Christopher Ferraro, president and chief investment officer of Galaxy Digital, told CNBC. “So while they pause rate hikes, they’re in no way yet committing to a permanent pause or even a rate decline.”

Read more in CNBC Pro’s Quarterly Investment Guide

The Federal Reserve left interest rates unchanged at the conclusion of its June meeting, but said two more could be coming later this year. Some on Wall Street are anticipating the Fed will move in July and September. Powell has said the FOMC hasn’t decided if a new hike is likely to take place in July.

“You see every day disparate and sometimes orthogonal data points coming out around is the economy growing? Is it shrinking? Are we headed for recession, are we not?” Ferraro added. “It’s a very uncertain macro environment, which will make this not a one direction move for any asset class, let alone bitcoin.”

Cantor Fitzgerald’s Elliot Han said while bitcoin has finally reclaimed the $30,000 level, it failed to maintain it for several weeks as the macro challenges are “currently dampening upside for crypto.”

Regulation and ETFs

Beyond the macro backdrop, it’s clear developments in U.S. regulation and ETF applications will continue to be the main themes in the third quarter. The rush of efforts to get approval for a spot bitcoin ETF came at the height of the Securities and Exchange Commissions’ hostility toward crypto and many hope institutions like BlackRock, Fidelity and Invesco – which filed for a bitcoin ETF with Galaxy in June – can force some change. It could take a while, however.

“From a timing perspective, I think it’s largely unknown” when a decision on an ETF could come, Ferraro said. “But … all these institutions have real concerted efforts and likely would not have put the effort in motion now if there wasn’t a strong belief that the market and the regulators, in particular the SEC, were ready to allow regulated products.”

“Given all of the regulatory uncertainty and the court cases that are going on … it’s actually an opportune time for the regulators to allow regulated products into the market and help clear out some of the concern or lack of clarity,” he added.

The rest of the world

While that uncertainty continues in the U.S., other parts of the world are taking a friendlier stance toward the industry. U.K. regulators have developed a “Regulatory Sandbox” to allow crypto companies to test new innovations, continental Europe has an established exchange-traded products market for crypto, and Hong Kong has been clear and vocal about its desire to become a crypto hub for the world.

“There’s still a disparity in the treatment of crypto in the U.S. and the rest of the world,” Han said. “The question is will the U.S. follow suit or continue with its litigious approach?”

There’s a growing number of U.S. companies that are no longer willing to wait for regulatory clarity as the price of bitcoin ticks higher, he added – and many are expecting a big price surge in the spring they won’t want to miss.

Bitcoin is up more than 80% YTD

“Some are looking to move their headquarters, or at the least establish large offices, in crypto friendly jurisdictions,” Han added. “One U.S. crypto company we know is now even seriously contemplating its public listing in London or Hong Kong and we’re also seeing more U.S. crypto companies looking to create offshore offerings” like Ripple and Coinbase.

While Ferraro and others remain upbeat about the future of crypto and unworried that regulators will eventually find an appropriate path forward for American crypto businesses, it could end up being too little too late.

“I am optimistic we will get it right,” Ferraro said. “I am fearful that the U.S. will take its time and while that happens, sticky capital and sticky intellectual capital gets formed elsewhere in the world, and then it’s hard to undo.”

Crypto

Trump Declared Over $600 Million in Income From Cryptocurrency and Business – Reuters

US President Donald Trump has released his financial statement. According to the document, he received over $600 million in income from cryptocurrencies, golf clubs, licensing and other businesses. This was reported by Reuters, writes UNN.

Details

The financial declaration was signed on June 13 and did not contain information about the period it covers. At the same time, some data in the declaration suggest that it was until the end of December 2024, which excludes most of the money raised by the Trump family’s cryptocurrency ventures.

According to the publication’s calculations, Trump declared assets worth at least $1.6 billion in total.

He previously stated that he had transferred his businesses to a trust managed by his children, but the published data indicate that income from these sources still goes to the president, which has led to accusations of conflicts of interest.

Some of Trump’s businesses in areas such as cryptocurrency are benefiting from changes in US policy under his leadership and have become a source of criticism, Reuters writes.

One meme coin issued by the president earlier this year – $TRUMP brought in approximately $320 million in commissions, although it is not publicly known how this amount was distributed between the Trump-controlled organization and its partners.

The feud between Trump and Musk caused Tesla’s stock to crash, with a market value drop of $150 billion.

06.06.25, 09:15 • 3708 views

In addition to the meme coin commissions, the Trump family earned more than $400 million from World Liberty Financial, a decentralized financial company. In his declarations, Trump indicated $57.35 million from the sale of World Liberty tokens.

The American president’s fortune also includes a significant stake in Trump Media&Technology Group (DJT.O), which owns the Truth Social social network, the report said.

In addition to assets and income from his business projects, Trump declared at least $12 million in income in the form of interest and dividends from passive investments totaling at least $211 million, according to Reuters calculations.

Trump’s three golf resorts in Jupiter, Doral and West Palm Beach, and a private members’ club in Mar-a-Lago, brought Trump at least another $217.7 million in income. Trump National Doral, a large golf center in the Miami area, was the Trump family’s largest source of income – $110.4 million.

Trump also received royalties from various deals – $1.3 million from Greenwood Bible, the “only Bible officially endorsed by Lee Greenwood and President Trump”, and $2.8 million from Trump Watches, $2.5 million from Trump Sneakers and Fragrances.

According to Reuters, the declaration often only indicates ranges of asset and income values, and the lower limit was used for calculations, so the real value of Trump’s assets and income is most likely even higher.

Trump changed his approach to deportations: raids on farms, hotels and restaurants have been stopped – NYT14.06.25, 10:18 • 2808 views

Crypto

Kevin O’Leary Explains Which Cryptocurrency Is a Smarter Bet: Bitcoin or Ethereum

The cryptocurrency market offers hundreds of different investment options, but two of them control most of the action: bitcoin and ethereum. As recently as last year, the combined market cap of both platforms made up more than 70% of the global crypto market, according to U.S. News & World Report.

Advertisement: High Yield Savings Offers

Powered by Money.com – Yahoo may earn commission from the links above.

Read Next: 13 Cheap Cryptocurrencies With the Highest Potential Upside for You

Check Out: 5 Types of Cars Retirees Should Stay Away From Buying

So which is a better bet for investors? During a recent interview with CoinDesk, businessman and “Shark Tank” star Kevin O’Leary suggested his preference.

Also see five reasons you need at least one bitcoin.

O’Leary shared during the interview that his preference is bitcoin. “If you want exposure to crypto volatility, it’s bitcoin,” O’Leary said. “There’s a lot of people that say, ‘I don’t need anything else … I’ll just buy bitcoin.’ And they haven’t been wrong … I think it’ll be very hard to dethrone it.”

As for ethereum, O’Leary spent much of his time bemoaning its lack of speed and efficiency.

“Goodness, ETH is slow,” he said. “I’m sorry, but it’s slow, and I think a lot of people know that. And the more transactions get piled on it, it doesn’t get any better.”

Learn More: Coinbase Fees: Full Breakdown of How To Minimize Costs

O’Leary has plenty of company in backing bitcoin over ethereum.

Part of bitcoin’s allure is that it has become a dominant crypto force in both size and name recognition. It has grown so big that it recently leapfrogged Google parent Alphabet to rank as world’s sixth-largest asset by market cap, The Market Periodical reported.

From a pure investment standpoint, bitcoin has definitely been the better bet recently. Its price is up about 12% in 2025 as of June 13 and has gained about 56% over the past year. In contrast, ethereum’s price is down about 23% in 2025 and has lost more than 27% over the past year.

If you’re new to crypto, it’s important to understand the differences between bitcoin and ethereum, because it’s not an apples-to-apples comparison.

As U.S. News reported, bitcoin’s network uses a proof-of-work verification system. Ethereum, on the other hand, uses a proof-of-stake system, which U.S. News called “less energy-intensive.” Additionally, the main purpose of bitcoin is to serve as a digital currency that’s an alternative to other currencies, while ethereum is a platform that runs smart contracts, U.S. News explained.

According to VanEck, a New York-based investment management firm, both bitcoin and ethereum have seen their prices fluctuate significantly over the years. Despite that, VanEck noted that bitcoin has been the outperformer, remaining more stable than ethereum.

Crypto

Alchemy Pay Partners With Backed to Integrate xStocks on Its Platform, Pioneering the First Direct Fiat Access to Tokenized Stocks and ETFs – Branded Spotlight Bitcoin News

-

West1 week ago

West1 week agoBattle over Space Command HQ location heats up as lawmakers press new Air Force secretary

-

Technology1 week ago

Technology1 week agoiFixit says the Switch 2 is even harder to repair than the original

-

Business1 week ago

Business1 week agoHow Hard It Is to Make Trade Deals

-

Movie Reviews1 week ago

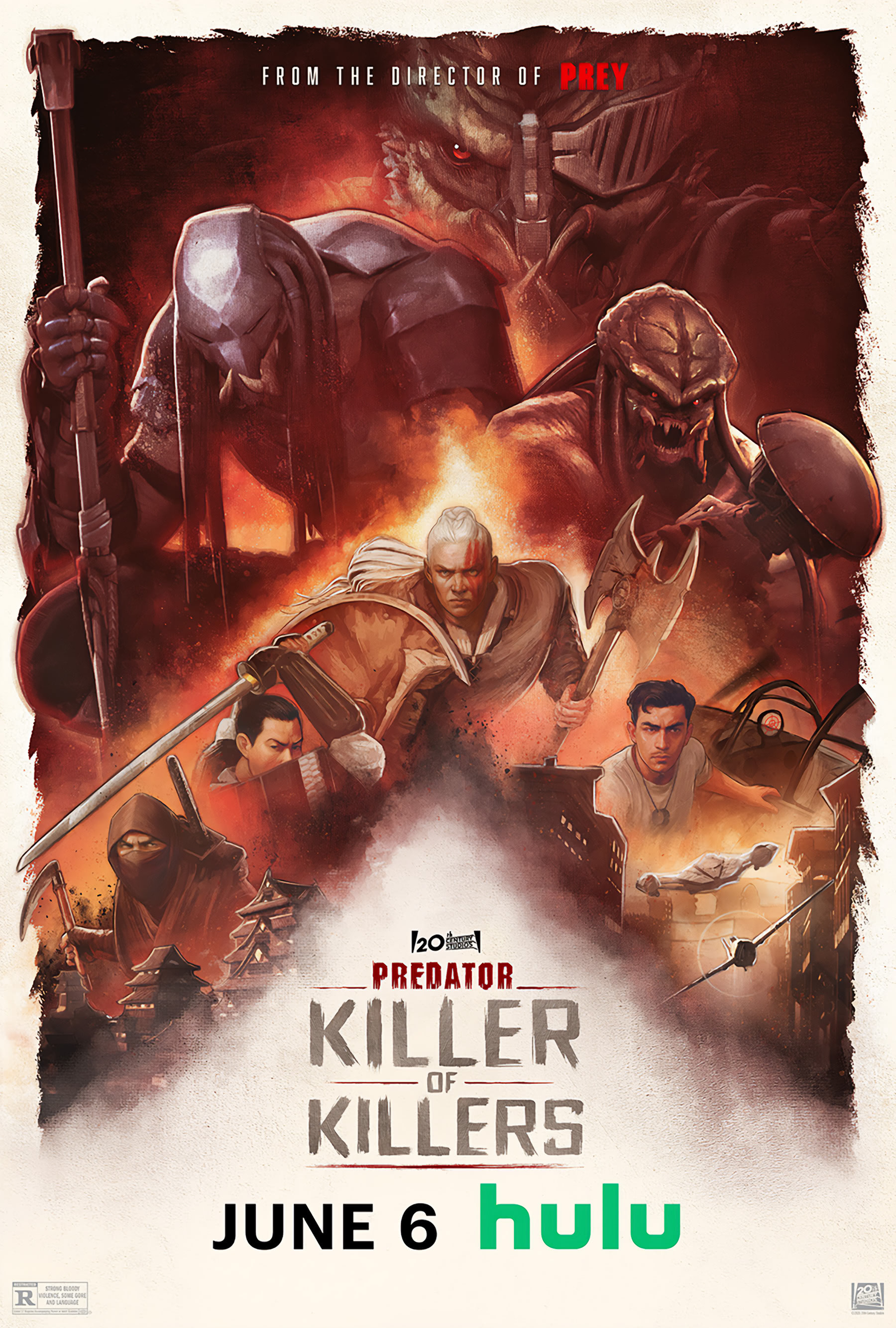

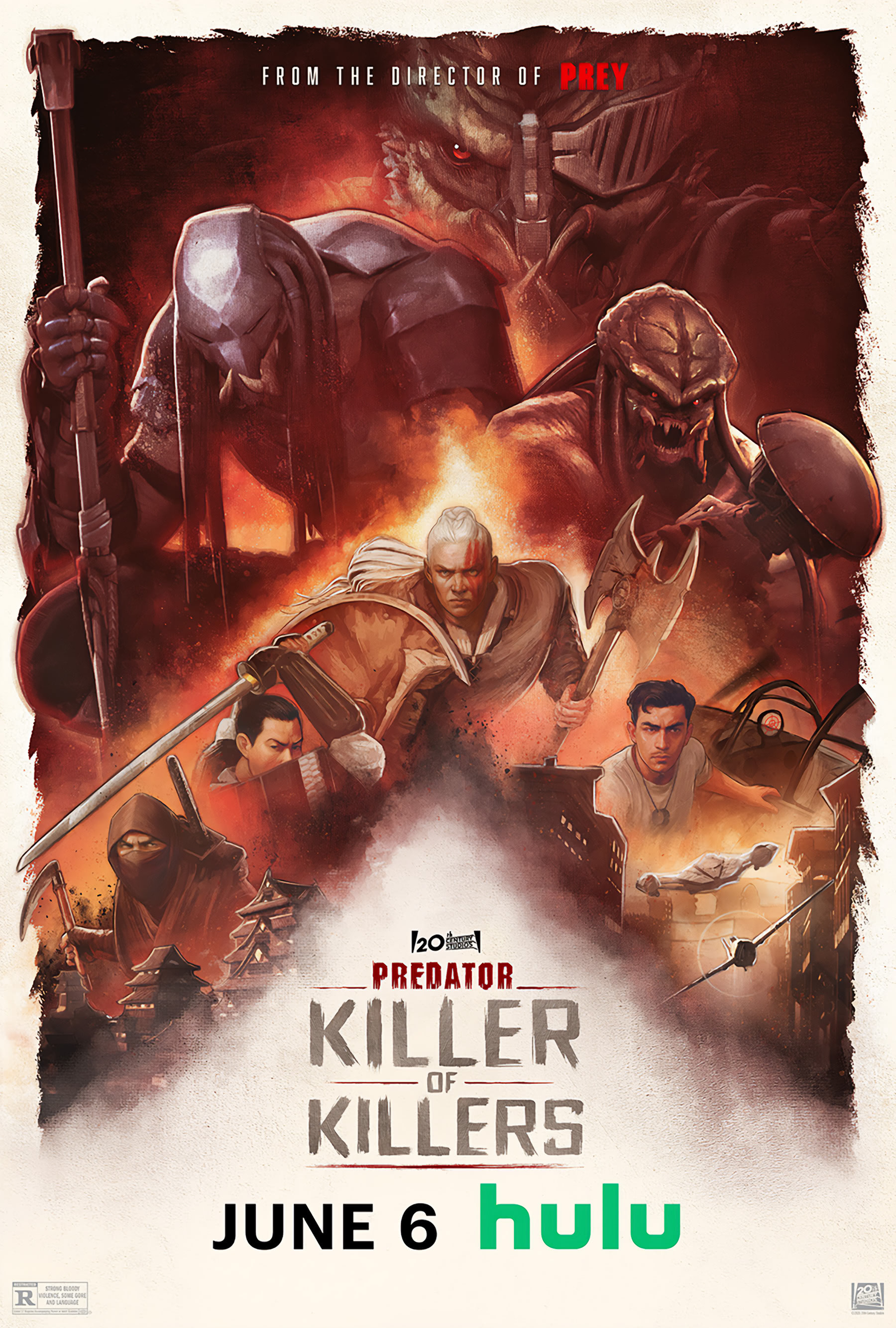

Movie Reviews1 week agoPredator: Killer of Killers (2025) Movie Review | FlickDirect

-

Politics1 week ago

Politics1 week agoA History of Trump and Elon Musk's Relationship in their Own Words

-

World1 week ago

World1 week agoUS-backed GHF group extends closure of Gaza aid sites for second day

-

News1 week ago

News1 week agoAmid Trump, Musk blowup, canceling SpaceX contracts could cripple DoD launch program – Breaking Defense

-

World1 week ago

World1 week agoMost NATO members endorse Trump demand to up defence spending